Down round effects on cap table and investor relations

In this article, we will explore what down rounds are, their likelihood in 2025, and their effects on equity structures.

While down rounds are preferable to running out of funds, the down round effects are wide-ranging. These effects extend beyond cap table complications to include future fundraising challenges, decreased employee morale, and strained investor relationships.

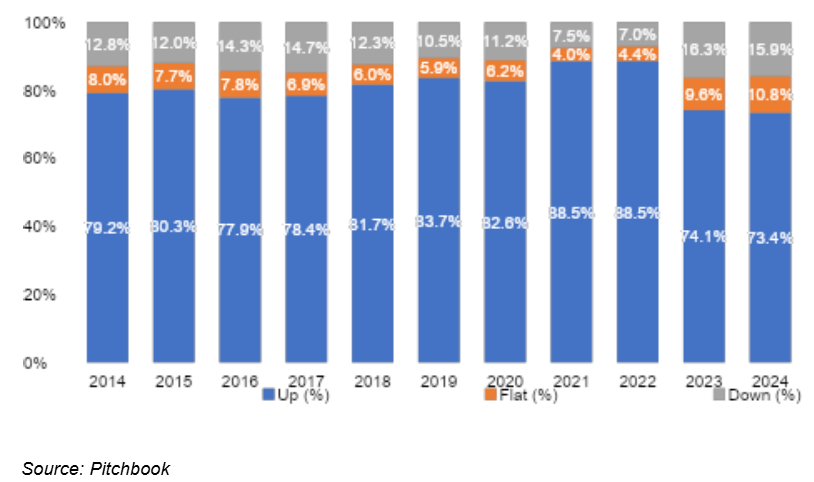

Since 2023, the rate of down rounds has been on the rise, with 15.9% of all funding rounds through Q3 of 2024 resulting in valuation cuts. If these trends continue in 2025, it is important to understand exactly how a down round can impact a startup’s ownership structure and investor relations.

Hence, in this article, we will explore what down rounds are, their likelihood in 2025, and their effects on equity structures, including dilution and the increased likelihood of preference shares being issued. Read on to learn more!

What are down rounds and how likely are they in 2025?

Down rounds occur when companies raise funding at a lower valuation than their previous round. While down rounds often result from underperformance, they can also be triggered by industry trends and economic conditions.

For instance, according to Pitchbook, 35.8% of all US startup funding rounds were down rounds in 2009 driven by the housing market collapse and the Great Recession. However, 2009’s down round rate pales in comparison to that of 2002 when the 9/11 attacks and Dot Com bubble burst caused the down round rate to rise to 58.5%.

At present, we are witnessing spikes in down rounds. From 2017 to 2022, the down round rate fell from 14.7% to 7.0%. However, the down round rates have climbed to 16.3% in 2023 and 15.9% through Q3 of 2024.

The trend of rising down rounds is likely to continue in 2025 due to excessive valuations secured by startups in the zero-interest-rate period of 2020-22, a reality check for AI startups, and decreased investor appetite.

Impact of down rounds on the cap table and investor relations

The dilution and decline in share price resulting from down rounds can prompt a range of reactions from stakeholders, leading to potential complications in the cap table. In the following sections, we will discuss some complications to be expected after a down round.

High dilution

Higher-than-expected dilution is the most immediate impact of a down round. Let us understand this with an example. Suppose Nimbuzz Cloud, a cloud computing startup, needs to raise $4 million in its Series B round.

Some key details about Nimbuzz Cloud are as follows:

- Valuation in Series A – $25 million

- Expected valuation in Series B – $30 million

- Actual valuation in Series B – $20 million

Cloud’s pre-money cap table is as follows.

| Equity holder | Number of units | Value of stake | Ownership percentage |

|---|---|---|---|

| Founder | 800,000 | $20,000,000 | 80% |

| Investor A | 100,000 | $2,500,000 | 10% |

| Investor B | 100,000 | $2,500,000 | 10% |

| Total | 1,000,000 | $25,000,000 | 100% |

Now, let us examine the excess dilution caused by the down round.

| Equity holder | Down round | Up round | Fall in ownership percentage due to down round |

||||

|---|---|---|---|---|---|---|---|

| Number of units | Value of stake | Ownership percentage | Number of units | Value of stake | Ownership percentage | ||

| Founder | 800,000 | $12,800,000 | 64% | 800,000 | $20,800,000 | 69.33% | 5.33% |

| Investor A | 100,000 | $1,600,000 | 8% | 100,000 | $2,600,000 | 8.67% | 0.67% |

| Investor B | 100,000 | $1,600,000 | 8% | 100,000 | $2,600,000 | 8.67% | 0.67% |

| Incoming investor | 250,000 | $4,000,000 | 20% | 153,846 | $4,000,000 | 13.33% | -6.67% |

| Total | 1,250,000 | $20,000,000 | 100% | 1,153,846 | $30,000,000 | 100% | N.A. |

Observe how every shareholder’s ownership percentage falls in the down round except the incoming investor.

Now, let us calculate the dilution in both cases based on the following formula:

Dilution = New shares issued / Total shares after funding round

Dilution calculations

| Type of round | New shares issued | Total shares after round | Dilution percentage |

|---|---|---|---|

| Down round | 250,000 | 1,250,000 | 20.00% |

| Up round | 153,846 | 1,153,846 | 13.33% |

Exercise of anti-dilution rights

In a down round, incoming investors are unlikely to provide any meaningful exits to existing investors. Investors may prefer holding out until the next liquidity event to capture meaningful returns. At the same time, a down round signifies a fall in influence and stake value for existing investors. Hence, existing investors become more likely to exercise their anti-dilution rights in down rounds.

Anti-dilution rights allow for the conversion of preferred shares into common shares on a full ratchet or weighted average basis. In some cases, investors may be awarded the right of first refusal (ROFR) which can provide protection against dilution.

Regardless of which kind of anti-dilution provision is granted and exercised, if investors decide to protect their stake against dilution, it would result in an increase in the number of common shares.

Issuance of preferred shares

Regardless of the circumstances, down rounds provide leverage to incoming investors in negotiations. Even if a startup is likely to perform well a few years after its down round, it cannot survive unless it secures funds through the down round. Thus, to a certain extent, founders must give in to the demands of incoming investors.

However, founders are always wary of excessive reductions in valuation and dilution. Hence, to secure funds while protecting valuations, founders are more likely to issue preferred shares in down rounds than in up rounds or flat rounds. Not only that, incoming investors may ask for other forms of preferential treatment such as:

- Liquidation preferences – Highest priority after creditors in payouts in liquidation proceedings

- Full ratchet anti-dilution protection – Highest-level of anti-dilution protection that applies the lowest share sale price to calculate the conversion ratio

- Board seats – Enhanced influence over company decisions, often used to make the company prioritize greater marketability and financial stability over the founder’s vision for the company

- Redemption rights – Ability to compel the company to repurchase shares at a later date

- Rights of first refusal – Right to purchase additional shares in future rounds to maintain or increase ownership stake

Challenges in future fundraising

A startup that has experienced a down round faces increased scrutiny from potential investors in future rounds. Investors often view this as a signal of heightened risk. Additionally, prospective investors will be wary of preferential rights afforded to those who invested in down rounds as this can create complexities that make it challenging to estimate expected future returns.

In light of the perceived risks, future investors may demand more favorable terms which would further complicate fundraising efforts and ownership structures.

Reduced attractiveness of stock compensation

Due to the fall in share price as well as the preferential treatment afforded to incoming investors, the value of stock compensation would also fall. This can lead to employee dissatisfaction and affect morale. In order to alleviate the friction with employees, you may need to adjust the ratio of deferred stock compensation to cash compensation. However, doing so may not be as straightforward as you think as alteration of stock compensation plans may have significant tax implications.

For instance, incentive stock options (ISOs) attract preferential tax treatment, however, altering them may turn them into non-qualified stock options (NSOs). This may increase the tax liabilities for the employees.

Eqvista – Streamlined equity management for better investor relations!

The down round effects impact cap tables, investor relations, and overall business dynamics, presenting immediate and long-term challenges for startups. Due to the dilution and decreased share price, founders must face increased scrutiny and diminished employee morale.

Furthermore, down rounds also cause future fundraising challenges as down round investors must be provided anti-dilution rights, liquidation preferences, and other forms of preferential rights.

Navigating a down round while maintaining positive investor relations is challenging but necessary for a startup’s survival. It requires careful consideration of the effects of equity structure changes on all stakeholders.

In such a precarious situation, an efficient cap table management software like Eqvista can prove invaluable. Our feature-rich platform helps companies effortlessly maintain transparency and improve investor relations. Contact us to learn more!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!