The Role of Valuations in Tax Planning and Compliance

In this guide, we’ll unpack how accurate valuations can minimize your tax liabilities, ensure compliance, and ultimately, transform your approach to tax optimization.

Tax planning doesn’t have to be a daunting chore. Imagine transforming your approach from reactive compliance to proactive optimization. The key? A deep understanding of business valuation. By unlocking the true worth of your assets, you can navigate complex tax landscapes with confidence, minimize your tax burden, and ultimately, drive greater financial success.

Managing long-term financial goals has always been difficult for many businesses, especially SMBs, which need financial stability. To do this, you will need a precise business valuation in place. The role of valuation in tax planning and compliance is vital as it helps make informed business decisions.

Tax Planning & Compliance: The Valuation Factor

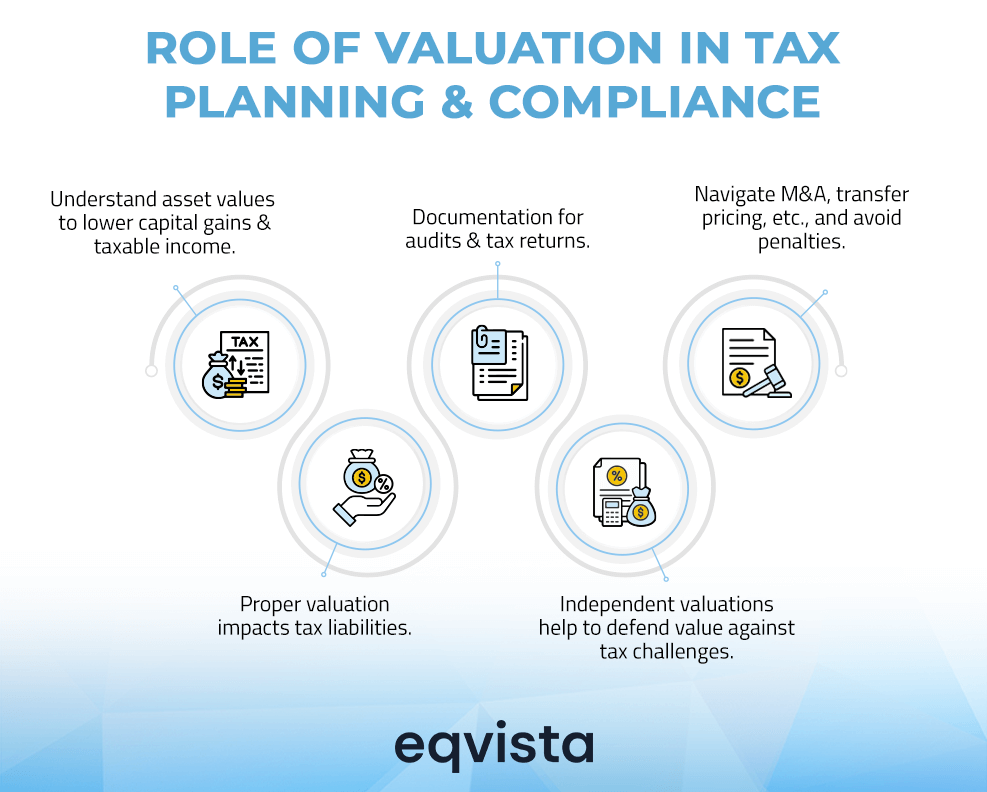

Valuations play a significant role in tax planning and compliance, influencing the calculation of taxes owed in various scenarios, such as estate, gift, and business sales or acquisitions. An accurate business valuation can help your company through the following ways:

Minimizing Tax Liabilities

The business valuation generally includes assessing the company’s assets, such as:

- Property

- Investments

- Intellectual Property

You can ascertain the value of your business and find chances to lower tax payments by doing an in-depth assessment. With the real value of the assets known, taxpayers may consider strategies to reduce their capital gains or taxable income.

Substantiating Tax Positions

If you conduct an accurate business valuation, it helps you with proper documentation. Even during a tax audit, you will be in a better position to provide the necessary proof. Valuing your business will help you in tax planning and compliance and support businesses during tax returns.

Complying with Tax Regulations

Different company transactions will have different tax rules governing them. The transactions include Mergers & Acquisitions Transfer Pricing or Intra-group Transactions.

The tax authorities require businesses to comply with the applicable requirements in every instance. Is it possible to make sure of this? Yes, a sound business valuation is necessary to follow the law and avoid penalties if you don’t.

Accurate asset valuation

Business valuation involves a thorough analysis of a company’s tangible and intangible assets, which is crucial when it comes to taxes.An accurate valuation ensures that assets are neither over- nor undervalued, which directly impacts tax liabilities.

Defense against scrutiny

An independent business valuation firm provides well-substantiated support for the appropriate value of the firm’s stock. It offers a critical defense if the Internal Revenue Service or other taxing authority challenges the company’s fair market value.

What are the Approaches to Calculate Business Valuation?

In general, there are three approaches to calculating your company’s value.

Income Approach

The basic idea behind the income approach is to calculate the current worth of your company’s potential future income. Valuation experts estimate the company’s future cash flows and discount it back to the current value at an appropriate discount rate. There are two methods to do this. They are:

- Discounted cash flow (DCF) analysis

- Capitalization of earnings

Example for calculation of Income Approach in Business Valuation

Discounted cash flow (DCF) analysis

Consider a prominent hotel chain with steady cash flow and moderate growth. To value this company, we’ll use a 12% discount rate reflecting its risk.

Steps for DCF Valuation:

Forecast Cash Flows – Project future cash flows. Here’s a sample for the next five years:

- Year 1 – $5,000,000

- Year 2 – $5,500,000

- Year 3 – $6,000,000

- Year 4 – $6,500,000

- Year 5 – $7,000,000

Terminal Value – Assume a 2% perpetual growth rate after year 5.

Discount Cash Flows – Discount each year’s cash flow to present value using the 12% discount rate. The present value (PV) of each cash flow can be calculated using the formula:

- PV = Cash Flow / (1 + discount rate)^number of years

The present values of cash flows are:

- Year 1 – $4,464,286

- Year 2 – $4,384,566

- Year 3 – $4,270,681

- Year 4 – $4,130,868

- Year 5 – $3,971,988

Terminal Value – $71,400,000 [$7,000,000 × 1.02 / ( 0.12 – 0.02)]

Discounted Terminal Value – $40,514,277

Total Present Value – Sum the present values of all cash flows and the discounted terminal value. This gives the company a valuation of $61,736,667

Capitalization of Earnings Method

Let’s consider a small company, Draze Ltd, which has the following financial information:

- Average annual net profit for the last three years – $100,000

- Appropriate capitalization rate – 20%

To calculate the business value using the capitalized earnings method, we divide the average annual net profit by the capitalization rate:

Business Value = Average Annual Net / ProfitCapitalisation Rate = $100,000 / 0.20 = $500,000

Draze Ltd’s estimated value is $500,000 based on the capitalized earnings method. This value represents the present value of the company’s future earnings, assuming the current level of profitability continues indefinitely.

Market Approach

Valuers use the market approach to assess similar companies sold or listed on a public exchange. Methods such as:

- Transaction analysis

- The guideline public company method

These techniques assess the company’s position relative to its competitors. Business valuation specialists can assist with tax planning by evaluating pertinent market data and transactions to ascertain the company’s fair market worth.

Example for Market Approach of Business Valuation

Transaction Analysis

Let’s consider a software company called “Techinx” which has strong growth potential. Let’s estimate its value using the Precedent Transaction or Transaction Analysis Method.

First, we need to identify recent mergers and acquisitions involving companies similar to Techinx. Some potentially comparable transactions could include:

- Acquisition of Company A by Acquirer X for $100 million

- Acquisition of Company B by Acquirer Y for $150 million

- Acquisition of Company C by Acquirer Z for $75 million

Second, calculate the valuation multiples:

- Company A – $100 million / $20 million revenue = 5x EV/Revenue

- Company B – $150 million / $10 million EBITDA = 15x EV/EBITDA

- Company C – $75 million / $18.75 million revenue = 4x EV/Revenue

Average of EV/Revenue Multiple = (5+4) / 2 = 4.5x

Apply Multiples to Technix: It has $30 million in revenue and the average EV/Revenue multiple is 4.5x:

- Estimated Value = $30 million revenue x 4.5x EV/Revenue multiple = $135 million

Therefore, based on the Precedent Transaction Method, Techinx could be valued at approximately $135 million.

Guideline Public Company Method

Let’s consider an IT consulting firm, Chronix Ltd., and identify comparable companies:

Comparable Public Companies:

- Company A – Enterprise Value (EV): $1,200,000, EBITDA: $300,000

- Company B – Enterprise Value (EV): $1,600,000, EBITDA: $400,000

- Company C – Enterprise Value (EV): $1,500,000, EBITDA: $375,000

Calculate the EV/EBITDA Multiples and their Average:

- Company A – EV/EBITDA = $1,200,000 / $300,000 = 4.0

- Company B – EV/EBITDA = $1,600,000 / $400,000 = 4.0

- Company C – EV/EBITDA = $1,500,000 / $375,000 = 4.0

Average EV/EBITDA multiple = (4.0 + 4.0 + 4.0) / 3 = 4.0

Now, let’s apply this multiple to Chronix Ltd.:

- Assuming Chronix Ltd. has an EBITDA of $250,000:

- Valuation = Average EV/EBITDA multiple * EBITDA of Chronix Ltd.

- Valuation = 4.0 * $250,000 = $1,000,000

So, valuation of Chronix Ltd. using the Guideline Public Company Method under Market approach is $1,000,000.

Asset Approach

This approach’s foundation is valuing a company’s assets and liabilities. Methods including:

- The liquidation value

- The adjusted net asset approach

The valuator who uses the asset approach subtracts all the assets from the total liabilities to determine the business’s worth. Real estate and manufacturing companies with many assets may find this simple approach helpful.

Example for Asset Approach of Business Valuation

Liquidation Value Method

Let’s consider the assets and liabilities of Grow Ltd.:

Assets (Liquidation Values)

- Property – $400,000 (Book Value: $500,000)

- Equipment – $50,000 (Book Value: $100,000)

- Inventory – $20,000 (Book Value: $20,000)

- Accounts Receivable – $20,000

- Cash – $20,000

- Total Liquidation Assets – $510,000

Liabilities

- Current Liabilities: $50,000 (Accounts Payable: $40,000, Short-term Loans: $10,000)

- Long-term Liabilities: $150,000

- Total Liabilities: $200,000

Liquidation Value Calculation

- Liquidation Value = Total Liquidation Assets – Total Liabilities

- Liquidation Value = $510,000 – $200,000

- Liquidation Value = $310,000

So, the liquidation value of Grow Ltd. is $310,000.

Adjusted Net Asset Value

Consider a small example of a business valuation using the Adjusted Net Asset Value (ANAV) method. Here’s a table showing the book values and adjusted values for the assets and liabilities of Tech Innovators Ltd.:

| Item | Book Value ($) | Adjusted Value ($) | Reason for Adjustment |

|---|---|---|---|

| Assets | |||

| Cash | 30,000 | 30,000 | No adjustment needed |

| Accounts Receivable | 50,000 | 45,000 | Allowance for doubtful accounts |

| Inventory | 70,000 | 65,000 | Adjustment for slow-moving inventory |

| Property, Plant, and Equipment | 200,000 | 250,000 | Adjustment to market value |

| Intangible Assets (patents) | 100,000 | 150,000 | Adjustment to the market value |

| Total Assets | 450,000 | 540,000 | |

| Liabilities | |||

| Current Liabilities | 40,000 | 40,000 | No adjustment needed |

| Long-term Liabilities | 60,000 | 55,000 | Negotiated reduction in liabilities |

| Total Liabilities | 100,000 | 95,000 |

Adjusted Net Asset Value Calculation:

- Adjusted Net Asset Value = Adjusted Total Assets – Adjusted Total Liabilities

- Adjusted Net Asset Value = $540,000 – $95,000

- Adjusted Net Asset Value = $445,000

The adjusted value considers more realistic market values of assets and any potential reductions in liabilities, providing a more accurate valuation of the company’s worth.

Potential Risks of not Incorporating Valuations into Tax Planning and Compliance Strategies

Neglecting the integration of valuations into tax planning and compliance poses immediate financial risks and has long-term implications for legal standing, reputation, and overall business strategy.

- Overpaying Taxes – What if you do not use business valuation for tax planning? We will end up paying more than the actual. There is a chance that we might overestimate the company’s assets and pay higher than necessary.

- Failing to Substantiate Tax Positions – Business valuation is more of a proof that your company’s worth is correct, which supports tax positions for returns. You may not have proper documents during a tax audit without an accurate business valuation, increasing the chances of risk disputes.

- Non-Compliance with Tax Regulations – If you are planning to transfer property or during an M&A, you should have a business valuation comply with the differing tax rules. What happens if you do not do it?

- Non-compliance

- Penalties

- Interest charges and

- Potential legal issues

- Suboptimal Transaction Structuring – You must organize your business transactions to minimize taxes. How do we carry that out? A precise business valuation is the way to lead. You could miss the chance to reduce the tax effects and pay unnecessary taxes if you don’t conduct a business valuation.

- Missed Opportunities to Maximize Tax Attributes – As we know, tax attributes cover:

- Net Operating Losses (NOLs)

- Tax credits or

- Depreciation deduction.

You need to do a business valuation to consider all these. Without this, you may miss the potential opportunity to reduce your taxes.

Seek Professional Assistance for Tax Planning and Compliance

If you plan to have your business valued for tax planning and compliance, seek professional help to make the job easier. The following are the ways through which they can help with your business valuation:

- Expertise and Knowledge – The professionals will have the related knowledge in conducting the business valuation. Valuation experts with years of experience and an in-depth understanding of business valuation concepts.

- Time Savings – A business valuation involves several methodologies and concepts that might be time-consuming.

- Compliance – You will need credible business valuation from certified valuators. NACVA-certified experts with a thorough knowledge of business valuation concepts, giving you credibility to use your valuation report for tax compliance.

Tax Consulting Service of Eqvista

Eqvista offers a comprehensive range of tax planning and compliance services, ensuring that businesses can manage their equity compensation efficiently and comply with all relevant regulations.

Here are some key ways Eqvista can assist you:

- Eqvista’s experts identify potential tax risks and opportunities related to equity compensation and help clients make informed financial decisions about equity taxation.

- The process involves meeting with tax professionals, preparing tax planning for the equity structure, assisting with complex tax considerations, and providing suggestions.

- Eqvista offers filing services for 83(B) elections, Form 3921, Rule 701 compliance, and Qualified Small Business Stock (QSBS) exemptions.

ASC 718 Stock Expensing Compliance

Eqvista helps companies comply with ASC 718 stock expensing rules for equity compensation.

ISO Limits and Rule 701 Compliance

Eqvista ensures companies follow the ISO limits and Rule 701 compliance requirements for equity compensation plans.

Year-End Tax Reporting

- Eqvista oversees year-end annual tax reports, Forms 3921 and 3922, for equity compensation.

- They also handle K-1s for LLCs related to equity.

By leveraging Eqvista’s tax consulting, compliance, and reporting services, businesses can offload their equity compensation tax complexities and focus on growing their operations while remaining compliant with relevant regulations.

Eqvista’s Personalized Tax Solutions for your financial peace!

The first step to complying with legal rules is to get your business valued. A precise business valuation can help you look for opportunities to reduce the company’s tax liability and stay compliant.

Business valuation reports include thorough analyses of multiple factors, so getting them done by a professional can help improve their accuracy. Here is where Eqvista can help you. Our valuation experts can help you better grasp your company’s worth through their expertise working with several companies in different industries.

Eqvista offers personalized tax and Equity consultation services that align with individual business needs. We focus on optimizing savings and fostering financial growth. Our approach includes an initial consultation to understand unique equity and tax requirements, followed by a detailed assessment and strategy development tailored to specific goals. Contact us for tax planning made easy and effective.

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!