How can Saas Companies manage a 409a valuation?

Here is a summary of the 409a valuations for Saas companies performed by Eqvista.

Each business model offers different challenges when you have to get its valuation done. So, when the SaaS model came in, it was challenging too. But the model has been there for a long and there are many who know all about the SaaS metrics and valuation processes, even though the industry is growing at a rapid speed. It is also becoming quite popular amongst many entrepreneurs who are starting new businesses. With this, Eqvista valuers who have worked on the Saas valuation multiples know a lot about how to value such a company.

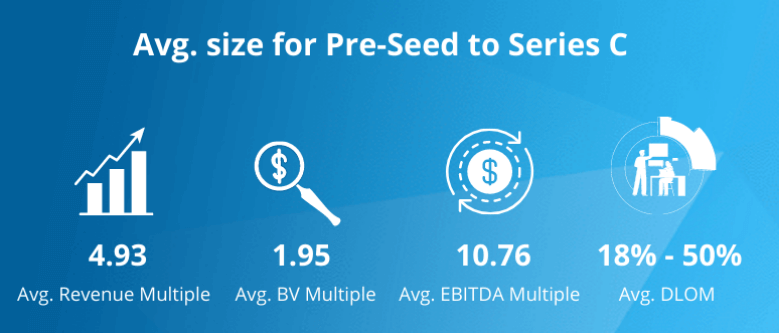

Saas company 409a valuations by the numbers

Here is a summary of the 409a valuations for Saas companies performed by Eqvista. These average figures were obtained from the public markets, private markets, and our 409a valuations.

*Most 409a valuations for Saas companies do not use EBITDA multiples

409a Valuation for SaaS Companies

Saas (Software as a Service) is a growing and unique industry. And when it comes to selling such a company, special considerations have to be made. There are a lot of SaaS valuation multiples that have to be considered when getting a 409A valuation for SaaS companies.

SaaS industry introduction

The rise of the SaaS industry has been captivating the business community at large due to the tremendous growth rate that it has been having for the last 3 decades. At this time, we are entering a new era of this industry where new solutions are being created to address every conceivable business need. SaaS software is used over the internet and is accessible to everyone easily, unlike the traditional software that is deployed “on-premises”. This means that it is installed for a business to use it, while the SaaS software is available for everyone right on the internet.

Why Do SaaS Companies Need 409a Valuation?

409a valuation for SaaS companies is as important as it is for any other company. SaaS companies would also have employees and would also one day go public or exit. For the company to issue stock grants as tax-free events to employees, they would need to know the fair market value of their common stock using IRS regulations. And the 409A is a section under the IRC that has to be followed to get the SaaS business valuation that would also offer the company “Safe harbor” status.

For obtaining 409A safe harbor status, the company has to get an independent valuation provider who offers a 409a valuation for SaaS companies. With this value, you can issue shares to your employees. It also helps you know what the value of your business is in case you want to sell. The SaaS business validation also helps with your exit, IPO, and also in M&A since you will need to know the value of your company in all these events. And for this, you will need a qualified professional to use the SaaS valuation multiples to get your company’s value.

Revenue Metrics to Consider in SaaS Valuation

For every SaaS company out there, there are four key metrics that drive most of the SaaS business valuation calculations. They are:

#1 EBITDA

EBITDA is earnings before interest, taxes, depreciation, and amortization. In this method, the salary of the owner is kept in the equation. But the amortization, depreciation, taxes and interest are all added back to the business income, or they are subtracted from this. All these are added with the profit of the company to get the output. The goal for this is to normalize the income of the business in a way where the tax choices it makes and the way it is financed isn’t a part of the equation. This just gives the investors a much better picture of the financial health of the business.

#2 Seller’s discretionary earnings or SDE

SDE is a calculation that is used for small to medium businesses. This is one of the SaaS valuation multiples that is used since the problem with just evaluating a business based on the profit it earns is not right. This is because the new owner who comes in the business would run it differently. So, by adding the values of how much the owner is paid to the discretionary spending into the profit calculation, the new owner would get a better idea of what they are getting into.

#3 Revenue Multiples

When we take the valuation of a company from its known data, and determine how the revenue relates to this output, investors can get a proper idea on how much the company without a value is worth using its revenue data. This estimation can be made more accurate by breaking the all the various SaaS company categories and then calculating the revenue multiples for each category based on which fits the SaaS company in question. And with this, a more accurate assessment will be made of that company’s value.

How do we work on the 409A valuation for SaaS companies?

Under the Market Approach, the first question that comes when you want to get the SaaS business valuation done – it is which multiple you should look at from SDE, EBITDA or Revenue. And the next SaaS metrics and valuation that needs to be looked at is the size and growth of the business in question.

SDE is the profit left to the business owner as soon as all the liabilities are deducted. This is used for those companies that are small and demonstrates the true underlying earnings power of the business. Things are different when the company grows. In larger companies, there are more employees. In this situation, all the owner’s compensations and discretionary expenses need to be reflected back into the business to get the true earnings of the company. That is why the EBITDA multiples are used then.

For a lot of businesses, the debate on which SaaS valuation multiples to use stops here. However, the EBITDA that is generated today could be zero and won’t be helpful to get the final value. Why? Well, because the SaaS businesses that are growing are putting back investments to grow, which are all expensed in the current EBITDA. That is where the revenue multiples are considered then. But it is vital to note that this valuation method is entirely based on the growth of the company.

Under the Income Approach, we would look at the Saas company’s forecast and implement the Discounted Cash Flow Method to discount their future earnings into present value. Based on the forecasts, we would make adjustments to a reasonable level in order to implement this DCF method.

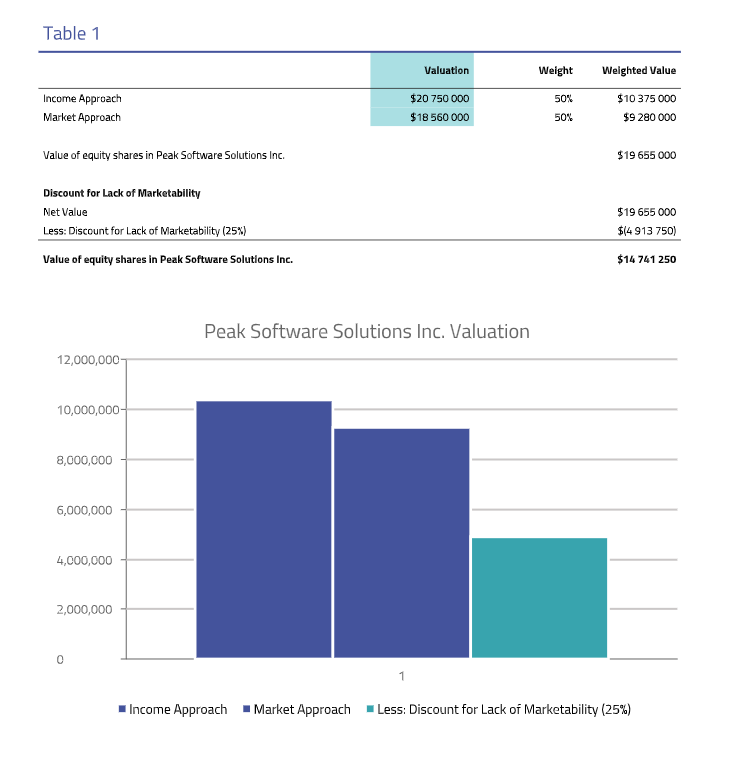

Here is a sample of our 409a valuation report of an example SaaS company:

Why choose Eqvista for SaaS Company 409a Valuation?

With all clear on how Eqvista works on the 409a valuation for SaaS companies, you now know how your company would be valued. Eqvista has had a great track record and has offered SaaS company valuation services since we started. Our platform has every tool that will help your business keep track of all the shares. Check out the application here or contact us to get your SaaS business valuation here!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!