How can Healthcare Companies manage a 409a valuation?

Here is a summary of the 409a valuations for healthcare companies performed by Eqvista.

Because of the covid season, healthcare has become an essential industry for people around the world. According to reports, health care will be one of the most booming sectors of the 21st century. But amid all this, new companies in the healthcare sectors are having difficulty growing, as people do not look that keen on investing in novel health care companies. This questions the growth of the new age health technologies and medicines, as they may not get that many funds they need to grow.

Thus, we have come forward with this article which will discuss how one should do healthcare companies’ valuation. We will also put some light on a healthcare company’s 409a valuation.

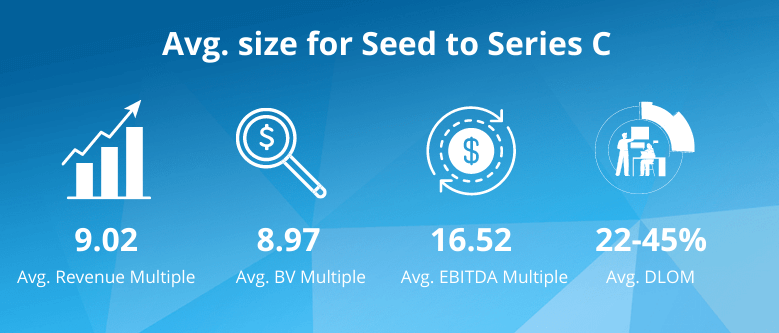

Healthcare Company 409a valuations by the numbers

Here is a summary of the 409a valuations for healthcare companies performed by Eqvista. These average figures were obtained from public markets, private markets, and our 409a valuations.

409a Valuation for Healthcare Companies

It is essential that healthcare companies also get their evaluation done. There are many ways in which one can get a company’s valuation. A 409a valuation is one of the most popular valuations. In the most simple terms, a 409a valuation is a method of analyzing the fair market value of the common stock of a private company by a third party. The name 409a is taken from the US Internal Revenue Code Section 409A. The assessments done by a third party are in the form of written valuation reports and are handed over to the board of directors of the company. And based on these findings, the company determines the share price of their company that they offer to shareholders to purchase.

Healthcare industry introduction

The Healthcare industry comprises several other medical-related sectors such as pharmaceuticals, drugs manufacturing, clinical services, medical equipment manufacturing, medical insurance, and other such sectors directly or indirectly related to health care. Although some of these industries are indirectly related to the field of health care, all of them play a significant role in the diagnosis, treatment, and nursing of sick people.

Why Do Healthcare Companies Need A 409a valuation?

There are several ways to grow. But one of the quickest and shortest ways to succeed is to sell your ideas to others and make them invest in your vision. The 409A valuation is mainly related to this. Now just like every other industry, health care companies and industries also need to grow big. And they want to sell their shares through an IPO. But here, we see an error. People don’t invest in the companies related to healthcare industries as they do in the other sectors.

Now the health company’s valuation process has a significant role in creating this drawback. The valuation and audit process for healthcare-related companies is not the same as for other traditional companies. Usually, healthcare companies’ account books and future assessments are not as solid and tempting to lure strong valuations and big investors. Thus such companies struggle in selling their IPOs.

But just like any other industry, the healthcare industry also needs to grow in both technological advancements and financially. Thus a healthcare industry 409A valuation should be firm. And regardless of all these things, healthcare is the most vital part of an evolving and modernizing society.

Valuation Metrics to Consider in Healthcare Business

The following are significant factors that should be considered while analyzing the valuation metrics of a healthcare business:

Industry competition

Due to the dynamic nature of the healthcare industry, it creates a competitive atmosphere within the industry. Due to which investors find risk and uncertainty while making investments.

Revenue stream

The kinds of revenue stream methods for the healthcare industries play a role too. There are two different kinds of revenue stream methods for healthcare industries.

The first source of revenue stream is the professional component, in other words, work relative value units. But this form of revenue source has stayed the same since the 90s. The other source of revenue stream is ancillary services and technical components. It is a form of supplementary revenue source for professional practice physician owners.

Management

The kind of management the business has plays a crucial role in influencing a healthcare industry valuation. Usually companies with good, well-experienced, and professional individuals as part of their management get a reasonable valuation.

Reimbursement

In the context of health care industries, the reimbursement for the service providers usually comes from third parties. And some of the significant third-party payers are Government agencies, employers, insurance companies, commercial payers, and the patients and their families.

Another major factor that affects the reimbursements of healthcare workers is federal and state government payers, as they set the level of refund, which acts as a benchmark for other reimbursement schemes. And as the reimbursements level keeps on changing, it also causes the perceived risk in healthcare industries.

How do we do the 409A Valuation for Healthcare Companies?

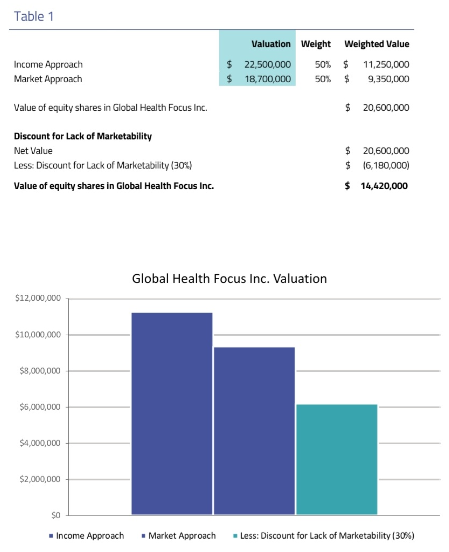

One of the final questions in determining the valuation of a health care industry is what health care industry methods or components should be considered while choosing the valuation. Though one can consider several elements for value determination, the most effective is the Income and Market method. The three main methods that are used are:

- Market Approach – The market-based approach utilizes financial information from publicly traded companies from the same industry and operations, including revenue, net income, EBITDA, etc. These are then used to contrast with for estimating the company’s equity value with a valuation multiple.

- Income Approach – The Income approach is a very straightforward approach, used for companies with a positive cash flow and sufficient revenue. The company’s future forecast of cash flow is then discounted to find the company’s current value (NPV).

- Asset Approach – The asset approach is the least supported 409A business valuation approach and is essentially for very early-stage firms that have not raised any funding and do not have any revenue yet. This method takes the current book value (after adjustments), and finds the value of the company from its balance sheet.

Why choose Eqvista for Healthcare Company 409a Valuation?

So far, you may have an idea of the basics for a healthcare company 409a valuation. Multiple factors have to be taken into consideration when deciding the valuation of a healthcare company. These would include its customer service, history, management, debts and investments, and many more.

For finding the right FMV value, seek the advice of an expert. Eqvista has a team of certified professionals able to conduct a 409A Valuation for your healthcare company.

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!