Employee stock options and 409A valuations

This article will explain all you need to know about stock options and 409A valuations, along with what makes them important.

A lot of companies issue employee stock options to get the best talent in their company and retain them for longer.

When startups offer equity compensation, they go through a critical relationship between company valuation and employee rewards. Employee stock options allow staff to purchase shares at set prices, creating alignment with company success without depleting cash reserves. However, these options require a 409A valuation to establish the minimum legal price—or “strike price”—at which options can be granted.

The relationship between employee stock options and 409A valuation is fundamental to understanding the landscape of equity compensation in the private sector.

The article aims to help entrepreneurs to make informed decisions regarding stock option grants, exercising options, and understanding the broader financial impact of 409A valuations on equity compensation plans.

Stock options and 409A valuations

Stock options are a form of equity compensation offered to the employees in the company. It is important for the employees to pay the exercise price to get the benefit of the option. Once the employee exercises the option, they get the stock in the company and can sell it or hold onto it for later.

Now, before a company can offer stock options, it has to be set at the right price as per IRS standards. For this, the company has to get the 409A valuation done. Section 409A of the Internal Revenue Code governs the taxation of deferred compensation. However, some stock options that satisfy certain conditions are considered to be “stock rights”, that are excludable from section 409A, rather than “deferred compensation” subject to section 409A.

Why do companies need 409A valuations for their stock option programs?

A 409A valuation is an appraisal of your company’s common stock and it’s essential if you want to give your staff stock options. Companies need 409A valuations for their stock option programs to comply with tax regulations and protect the company and employees from tax penalties.

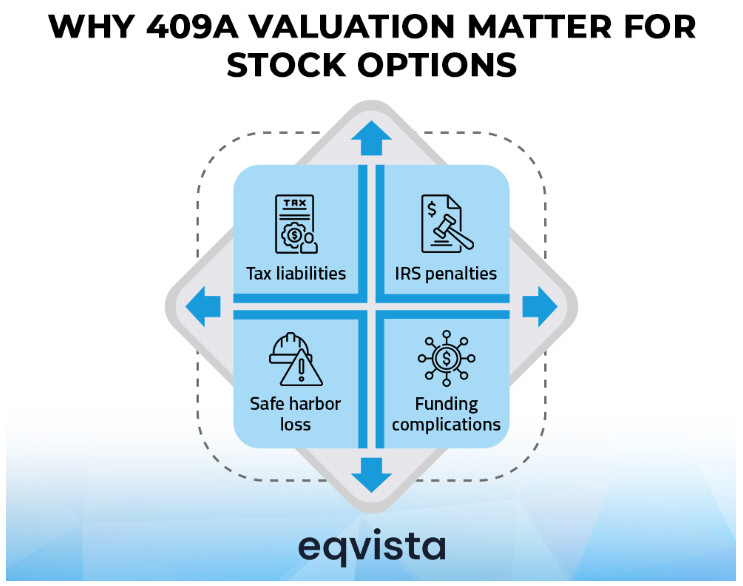

Without a valid 409A valuation, companies risk:

- Employees facing immediate tax liabilities instead of deferring taxes until exercise

- Significant IRS penalties (additional 20% tax plus interest penalties)

- Loss of safe harbor protection during potential IRS audits

- Complications during future funding rounds or acquisitions

Beyond compliance, these valuations provide transparency to employees about their compensation’s potential value and demonstrate proper corporate governance to investors and acquirers. Companies typically perform these valuations annually or after significant business events that could impact company value.

For startups, maintaining proper 409A documentation is essential for attracting talent with equity compensation while ensuring regulatory compliance throughout the company’s growth journey.

Ways to get 409A valuation for Stock Options

This is something that early-stage companies and founders must keep in mind if they want to avoid having to pay tax fines to the IRS. Find a credible 409A valuation source if you’re an early-stage company issuing options and want to take advantage of the safe harbor. Before you can issue your first common stock option, you must complete your 409A valuation.

Here is a basic summary of what a 409A valuation looks like for stock options:

| Type | Basis for Pricing |

|---|---|

| Stock Option Exercise Price | Common Share Price |

| Common Share Price | Typically 20-50% of Preferred Price |

| Preferred Share Price | Price at funding round less DLOM |

Independent Appraisal Method

The easiest option to get a 409A value is to involves independent third-party valuation firms that focus exclusively on 409A valuations. Most companies use specialized third-party valuation firms that focus exclusively on 409A valuations. These firms have expertise in startup valuation methodologies and provide the strongest “safe harbor” protection.

Eqvista is recognized for providing quick and accurate valuations, typically within a few business days. Our team consists of NACVA-certified analysts who ensure compliance with international valuation standards.

Internal Valuation

While possible for public companies, private companies typically cannot perform their 409A valuations and maintain safe harbor protection, except in very early stages with minimal complexity.

Valuation Software

Companies also opt for specialized 409A valuation software. This software streamlines and automates parts of the valuation process, ensures annual updates and resists IRS scrutiny. It also has the advantage of integration with cap table management, provides secure data storage, and provides audit-ready reporting.

Eqvista offers a comprehensive business valuation platform with customizable reports and advanced data analysis tools.

Accounting Firms

Many accounting firms offer 409A valuation services. While potentially more expensive as compared to independent service providers, they may provide integrated services if they’re already handling your company’s financial matters.

409A Violation & Penalties for Non-Compliance

Let us say you still decide to give out stock options to your employees, and in this case, you have to get a 409A valuation done. If you don’t conduct a proper company valuation when issuing these options, you would not be eligible for 409A safe harbor protection. As mentioned above as well, if penalties are handed out, the employees and shareholders would have to pay them, which include:

- All deferred compensation from the current and preceding years becomes taxable immediately

- Accrued interest on the revised taxable amount

- An additional tax of 20 percent on all deferred compensation

Many owners tend to ignore the need to get a 409A valuation due to the high price. But just to be clear, a startup would have to pay a minimum of $1,000 to $3,000 for a 409A valuation. Even though this may be a high amount in the beginning, it is a worthwhile investment to avoid any penalties later on.

Here is an example for 409A Violation and resulting penalties:

Leeway, a pharmaceutical company, is facing a significant issue with an NQDC plan. A research manager, with a $500,000 aggregate plan account balance, received a $50,000 payment from one of the NDQC accounts a year earlier than they elected. This premature payment is a grave 409A violation, as it does not comply with the strict rules around payment timing and distribution triggers under section 409A.

Tax penalties, in this case, is:

- Immediate Income Recognition – Managermust report the full $500,000 plan balance as taxable income for the year of the violation, despite receiving only $50,000 in advance.

- 20% Additional Tax Penalty – The research manager would owe a 20% penalty, which in this case would be $100,000 (20% of $500,000)

- Premium Interest Tax – From the vesting date forward, the research manager would also have to pay a premium interest tax of 1% above the federal underpayment rate on the $50,000 early distribution.

- Potential State Penalties – The research manager may also owe additional state-level penalties depending on the state.

- Amended Tax Filings – The research manager and the company must amend previous tax returns (e.g., Form W-2, 1099, 1040) to account for the 409A violation.

The penalties can be severe, as the entire $500,000 plan balance becomes immediately taxable, even though only $50,000 was distributed early. This highlights the importance of strict 409A compliance for NQDC plans.

Tips to implement stock option policies

Implementing proper stock option policies is crucial to hire and retain talent while ensuring compliance with regulations. Here’s practical guidance on how to establish and manage an effective employee stock option program:

Establish a Clear Equity Compensation Structure

- Define your total option pool size (typically 10-20% of total shares)

- Create standardized equity packages by role/level

- Establish vesting schedules (typically 4-year with 1-year cliff)

- Document approval processes for grants

Obtain a 409A Valuation

- Hire an independent firm to conduct a 409A valuation to determine the FMV of your company’s common stock.

- Use this valuation to set the strike price for your stock options.

Develop Legal Documentation

- Draft a comprehensive stock option plan document outlining rules and regulations for option issuance.

- Create a stock option agreement template that explains the terms and conditions of stock grants.

Ensure Compliance and Reporting

- Stay updated on federal, state, and international regulations, especially if offering options in multiple countries.

- Calculate and withhold appropriate taxes and issue required tax forms.

- Maintain accurate records and reporting on exercises, taxes, and employee demographics.

Implementing these practices from the start creates transparency, ensures compliance, and maximizes the motivational impact of your stock option program.

How are employee stock options taxed ?

Employee stock options, also called ESOs, are the kind of equity compensation offered to the employees and executives as compensation commonly used by many companies. Basically, instead of offering the shares directly, the company offers derivative options on the stock. These options come in the form of regular call options and offer the employees the right to purchase the company’s stock at a specified rate for a defined period of time.

Employee stock options are taxed differently depending on the type of option and when specific actions are taken. Two types of employee stock options are Incentive Stock Options (ISOs) and Non-Qualified Stock Options (NSOs), each with distinct tax implications.

Taxation of nonqualified stock options

An employee should remember to exercise their employee stock options based on their own tax decisions. With this said, if they exercise the NSOs in the year where they do not have any other earned income, the person will be paying a lot of payroll taxes than they would be paying otherwise.

- At Grant: No tax implications when options are granted.

- At Exercise: No regular income tax, but the difference between strike price and FMV may trigger Alternative Minimum Tax (AMT).

- At Sale: If held for qualifying periods, the profit is taxed as long-term capital gains; otherwise, some portion is taxed as ordinary income (disqualifying disposition).

Taxation of incentive stock options

ISOs are very different from NSOs, as they are not subject to payroll taxes. However, they are subject to taxes and it is a preference item for AMT (alternative minimum tax) calculations. In fact, when an employee exercises their ISOs, there are a few different tax possibilities.

- At Grant: Generally, there is no tax if granted at fair market value.

- At Exercise: The difference between strike price and FMV is taxed as ordinary income.

- At Sale: Any additional appreciation after exercise is taxed as capital gains (short- or long-term capital gains, depending on the holding period).

Understanding ISO vs NSO is fundamental to granting them correctly.

Example of ISO vs. NSO taxation based on 409A price

BLUESKY Inc. is a fast-rising cloud storage startup known for its AI-powered data security solutions. The company plans to grant stock options (ISO and NSO) to its employees as part of a new incentive compensation plan.

| Scenario 1 | Scenario 2 | ||

|---|---|---|---|

| ISO Options Granted | 50,000 | NSO Options Granted | 50,000 |

| Strike Price (409A Valuation Price) | $0.05 | Strike Price (409A Valuation Price) | $0.05 |

| Sale Price | $4 | Fair Market Value | $4 |

| Taxable Income per Share (Sales Price – Strike Price) | $3.95 | Taxable Income per Share (Fair Market Value at Exercise – Strike Price) | $3.95 |

| Total Taxable Income | $197,500 | Total Taxable Income | $197,500 |

| Capital Gains Tax (15%) | $29,625 | Ordinary Income Tax (Assuming 35%) | $69,125 |

SCENARIO – 1

An employee is granted 50,000 ISO stock options with a strike price of $0.05 (the 409A valuation price) per share. After four years, they sold vested shares at $4 per share.

- For ISOs, the difference between the sale price and the strike price (bargain element or spread) is considered. The difference between the strike price ($0.05) and the sales price ($4), is $3.95 per share for the 50,000 options received. This would give the total amount of $197,500, even if the employee has exercised the options.

- In this case, the gains will be taxed at the long-term capital gains rate i.e.15% (as per US long-term capital gains rate) since the options were held for at least two years from the grant date and more than a year from the exercise date. The capital gains tax will be $29,625.

- The AMT requires the taxpayers who hold an ISO to report the difference in profit between the bargain price paid for a share and the market price when selling it. If one holds an ISO until one year past the exercise date and two years past the grant date, they will have the lower long-term capital gains rate applied to tax the spread from the strike to the market price, and might incur the AMT in this case.

SCENARIO – 2

A contractor is granted 50,000 NSO stock options with a strike price of $0.05 (the 409A valuation price) per share. Since the strike price is higher, the contractor exercised and sold the options in one transaction at $4 per share.

- Similarly, the difference between the sale price and the strike price (bargain element or spread) is considered. The difference between the strike price ($0.05) and the sales price ($4), is $3.95 per share for the 50,000 options received. This would give the total amount of $197,000, even if the employee has exercised the options.

- In this case, the gains will be taxed ordinary income tax i.e. 35% (federal (22%) + state (13%)) since the options were exercised and sold in one transaction. The ordinary income tax will be $69,125.

Tax Difference

- The tax difference would be the difference in tax liability between the two scenarios, assuming the respective tax rate applies.

- In this case, the difference between the capital gains tax ($29,625) and ordinary income tax ($69,125), is ($39,500).

Frequently Asked Questions on 409A Valuation and Employee Stock Options

Many companies use stock options as a way to compensate their employees, but did you know that issuing stock options can affect your 409A valuation? Here is a list of the commonly asked questions on 409A valuations and their effects on stock options and your company.

Are stock options subject to a 409A Valuation?

Stock options can be subject to a 409A valuation, but it depends on the type of stock option and certain conditions. Private companies issuing stock options must conduct a 409A valuation to ensure the exercise price is at or above the fair market value of the stock.

Are stock options considered deferred compensation under section 409A?

Stock options may be considered deferred compensation under Section 409A depending on their structure and compliance with specific conditions. Stock options avoid Section 409A if they are structured as ISOs or NSOs with an FMV-compliant exercise price.

Does 409A apply to employee stock options?

Companies issue stock options to employees as a part of their compensation package. Hence, as per the IRS, before a company issues a stock option, it must comply with the applicable 409A valuation procedures. This is because the strike price or exercise price of stock options is derived from the fair market value of the common stocks of a startup.

What are the benefits of granting employee stock options?

Granting employee stock options helps to align employee and shareholder interests, attract and retain talent, Provide equity-based compensation, Increase employee engagement and productivity, and provide a flexible compensation structure.

How is employee stock options’ fair market value (FMV) determined?

Employee stock option of FMV is established through a 409A valuation process, which sets the exercise price and has major tax implications if done improperly by an independent expert.

How do employee stock options affect a company’s stock price?

Employee stock options do not directly determine a company’s stock price, and they can indirectly influence it by aligning employee and shareholder interests, attracting and retaining talent, and having accounting and tax implications for the company.

Are stock options exempt from 409A?

In general, stock options that fall under incentive stock options (ISOs) must comply with the 409A valuation procedures. However, if the company decides to use non-qualified stock options (NSOs), then it is excludable from section 409A until certain conditions are met. Be sure to connect with Eqvista’s expert to find out which option scheme you should comply with.

Start your 409A Valuation process with Eqvista

From everything we have covered, it is understood that you should have a 409A valuation done on time and by the right firm. This means that you do not just have to find a firm that can do your valuation, but the firm that will offer you the safe harbor status through a 409A valuation.

To guarantee that the safe harbor is provided and that you do not spend a lot on a 409A valuation, Eqvista is a great choice. We offer 409A valuations keeping in mind the IRS regulations without creating a hole in your pocket. In fact, our 409A valuation services start at $990 based on the stage that your company is in. Why so low? Eqvista aims to help companies find an affordable solution for managing their equity compensation, and work to grow with your company.

Additionally, we also offer a great cap table application. So, you can easily have all the shares of your company managed and even get your 409A valuation, all in one place.

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!