Is a 409A Valuation Needed for Convertible Notes or SAFE Notes?

Companies often rely on convertible instruments such as Convertible Notes and SAFEs to raise capital. These instruments provide an efficient way for startups to secure funding without a formal valuation. However, when it comes to issuing stock options companies must comply with IRC Section 409A.

While convertible instruments do not require a 409A valuation, they can influence the company’s overall valuation, especially when new financing rounds are involved.

Understanding the interplay between these financing instruments and 409A valuations is crucial for startups seeking to manage their equity effectively while avoiding potential tax liabilities. In this context, we explore how convertible notes and SAFE notes interact with 409A valuations, highlighting key considerations for companies navigating these complex financial and regulatory landscapes.

Understand Convertible Notes and SAFE Notes

Startup attorneys devised convertible notes to allow businesses to acquire early capital without selling shares for a significant gain in a short period. A convertible note is a debt instrument with several variables and long paperwork. SAFE (simple agreement for future equity) is convertible security, which makes the process of obtaining seed funding simpler and more standard. However, unlike convertible notes, it is not a debt. Therefore, a convertible note contains a rate of interest rate and a rate of maturity, but a SAFE note, on the other hand, does not.

SAFE and convertible notes both change into stock in a future-priced equity round; however, a convertible note may be more complicated in terms of when/if/how it converts. Look at the comparison of convertible and SAFE notes below for a better understanding.

| Convertible Notes | Safe Notes | |

|---|---|---|

| Interest Rates | 2% to 8%. The length of time an investor holds the note affects his or her ownership stake. | No interest rate, since SAFE notes are not debt - The length of time an investor holds the note does not affect his or her ownership stake. |

| Dilution and Valuation Cap | The valuation cap is negotiable in an uncapped convertible note and affects dilution in subsequent financing rounds. | The valuation cap is negotiable in uncapped SAFE Notes and affects subsequent financing rounds. |

| Maturity Date | Convertible notes typically mature 18 to 24 months following the closing date. Subsequent financing rounds typically take place before the maturity date and the notes must be repaid then. | No maturity rates- a benefit over convertible notes as they don’t need to be repaid. |

| Early Exits | In the case of buyouts or IPO, 2x payments are common. However, convertible notes aren't as standardized, so the payouts can be diverse. | SAFE notes give the investor the choice of converting to equity at the value cap or receiving a 1x dividend. Changes to these restrictions can be addressed using a side letter. |

| Structure Difference | Convertible notes are often structured as a single legal arrangement called the Note Purchasing Agreement (NPA), covering convertible note financing and all the terms. Each investor receives a promissory note detailing the date and investment value. | SAFE notes are often stand-alone deals offered to private investors, providing greater fundraising freedom. |

| Terms | Terms include: | Terms include: |

How Convertible Notes affect a 409A Valuation?

Convertible notes are popular among certain businesses since they are simple and affordable to produce. Some investors also favor it since it avoids the challenging topic of evaluating a fledgling firm in its early stages. However, if the notes are not correctly structured, the company can face difficulty securing the following round of funding, and it may result in a skewed value for common shares and stock options.

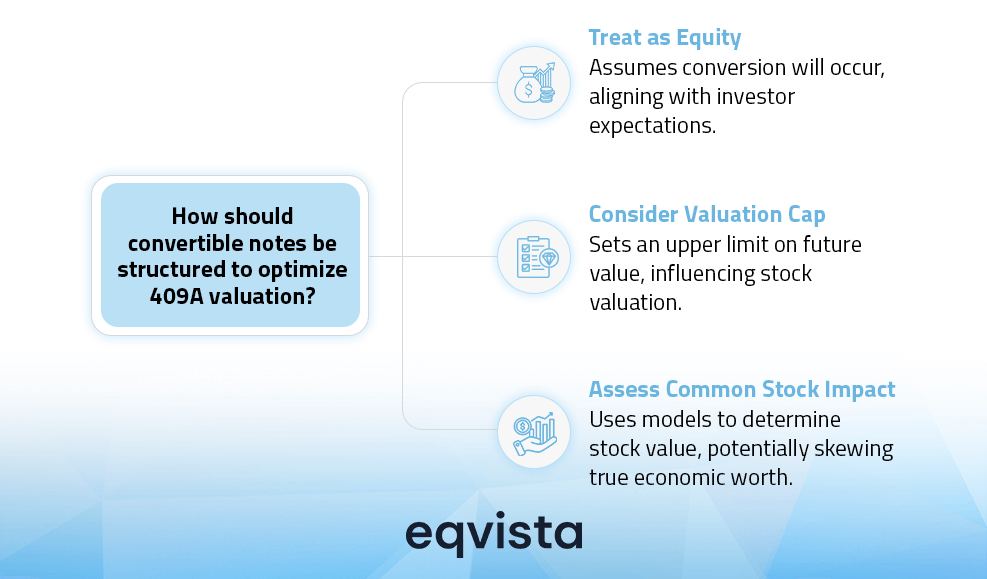

Treatment As Equity

Tax and accounting regulations mandate valuation firms to examine the worth of the company suggested by recent financing. In these cases, convertible notes are treated as equity and not debt in valuation, with an assumption that the note will go through conversion and not repayment. This relates to both the issuing company’s and investors’ anticipation that the note will convert. The sole exception is if a company is sold before raising its Series A round, in which case the acquirer will return the note to secure investor approval.

Valuation Cap Consideration

A typically preferred stock valuation establishes a firm’s and common stock’s tangible present value. However, a convertible note does not give the same unambiguous valuation recommendations. Some notes have a cap value, which indicates an upper limit on the future value that cannot be surpassed. In such circumstances, the cap value must be considered as the value indication.

Impact on common stock value

A Black-Scholes option model must be used to compute an implied value of the firm and the common stock – even though this work will also result in a proposed future value for the common stock. Despite considering a hefty discount for the absence of commercialization and a few other adjustments, the value of common stock and the spot price for future stock option issuance can sometimes be higher than the company’s true economic worth.

409a For Different Types of Debt Instruments

The 409A guidelines don’t prescribe a single approach to debt securities consideration. The approach may differ in 409a for different types of debt instruments and the technique utilized, as well as the information and circumstances of the business.

A 409A valuation is not required to raise capital via a convertible instrument like SAFE, KISS, or convertible notes. However, regardless of your fundraising status, if you intend to provide stock options to important employees, advisers, or others, it is strongly advised that you conduct a 409A valuation.

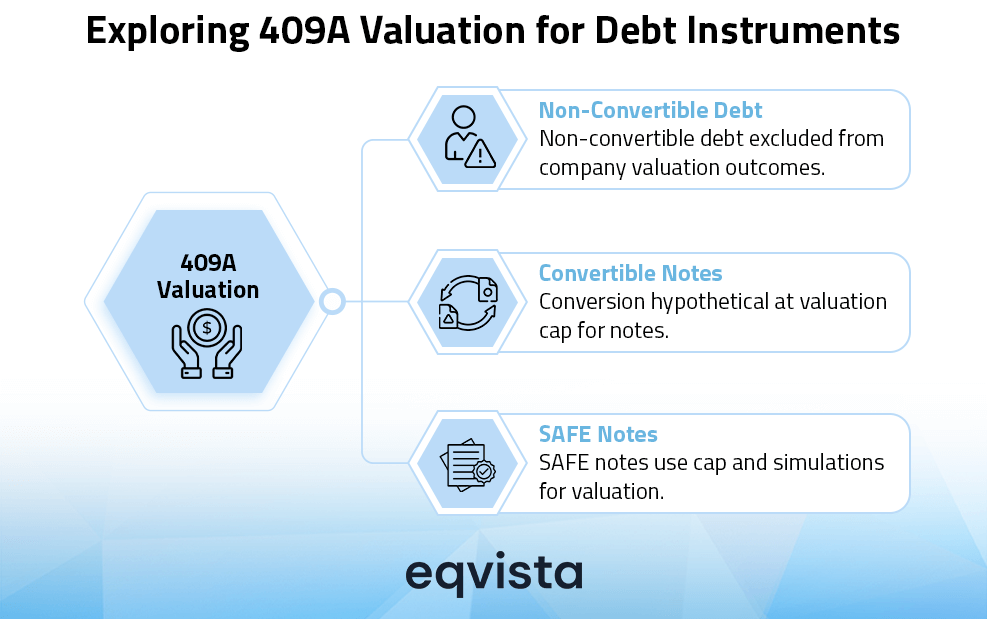

Valuation of Non-Convertible Debt

Only the subject company’s equity is valued in backsolve and backsolves with equity valuation techniques. Consequently, non-convertible debts are not explicitly included in company valuations and don’t affect the valuation’s outcome.

Non-convertible debt is deducted from the total value of the business computed using the applicable technique to get the value to be distributed through the firm’s cap structure under the Guideline Public Company (GPC) or Income (DCF) approach.

Valuation of Convertible Notes and SAFE Notes

A valuation cap on convertible notes gives an indicator of a projected future value. This forecast is regarded as an estimate of the conversion value on the date of valuation. When a convertible note note lacks a valuation cap, the future value is absent, and the convertible debt is classified as non-convertible debt.

For the valuation of convertible securities, valuation partners perform a hypothetical conversion of equities at the value cap of the assigned notes. By considering this conversion to allocated equity, the convertible note’s capacity to earn equity-like returns after repayment is displayed.

Valuation of SAFE notes

SAFE notes include a valuation cap, which serves as an indicator of future value. This cap is crucial for 409A valuations as it provides a basis for estimating the conversion value. Similar to convertible notes, SAFE notes can also dilute the value of existing common stock. This dilution effect must be considered in the 409A valuation process.

For SAFE notes, valuation firms may use Monte Carlo Simulations to account for various potential outcomes and their probabilities. This method helps in estimating the fair value of the SAFE notes.

Get your 409A valuation with Eqvista!

While convertible securities can be beneficial when seeking seed funding, converting them into share ownership and including them in your 409A valuations can be complicated. The convertible and SAFE notes impact on 409A valuations highlights the importance of considering these instruments in determining the FMV of common stock.

Eqvista’s affordable and audit-ready valuation services, starting at $990, offer a reliable safeguard against potential IRS penalties. They allow companies to focus on growth while maintaining compliance with regulatory requirements. Whether through convertible notes or SAFE notes, Eqvista’s NACVA-certified valuation analysts provide the expertise needed to navigate these financial instruments effectively, ensuring that startups can confidently manage their equity offerings.