Disclosures for the ASC 718 report

In this article, we will discuss disclosure requirements for ASC 718.

ASC 718 disclosures reporting is a crucial component of all startups’ financial disclosure for funding. After a Series A or B round of investment, many businesses will start implementing ASC 718 disclosures for reporting for the first time. ASC 718 reporting, therefore, becomes a staple of the whole financial reporting package and acts as a safety net for ensuing financial audits. The ASC 718 disclosures requirements may get quite complex very fast. Therefore it might be helpful to stand back and take a broad view of the procedure. Stock-based compensation reporting is necessary to support the recognition of compensation expenditures. In this article, we will discuss disclosure requirements for ASC 718.

ASC 718 – Stock-based compensation reporting

ASC 718 disclosures are necessary due to the intricate procedures for applying for stock-based compensation. To use the regulations and determine the proper amount of compensation expenditure, it is crucial to have clear and accurate instructions on employee stock ownership plans. Additionally, it establishes the fair market value of stock options before issuance.

What is stock-based compensation?

Stock-based compensation is often used to incentivize employees in the company in addition to their salary and bonuses to match their goals with those of the business’s shareholders. It is paid with equity and is often known as share-based or equity compensation. Stock awards often have a vesting time before they become earned and marketable.

What is ASC 718?

The comprehensive standard known as ASC 718 mandates the accounting of stock-based remuneration. This standard aims to have stock-based compensation values included in financial statements. The government wishes to determine the costs incurred for the equity component of employee remuneration following GAAP reporting guidelines.

What is the ASC 718 disclosure spreadsheet?

The main purpose of ASC 718 disclosure reports is to explain how your financial computations were made. The ASC 718 disclosures for your firm are simply done with Excel spreadsheet files that include the costs and cash flow connected with stock-based compensation at your company. The ASC 718 report mandates the disclosure of the accounting for options and shares and a few associated measures that may be used to forecast future costs and liabilities.

Disclosure of ASC 718 report

In the event of an audit, accurate recording and reporting of the equity compensation expenditure in the financial statements per ASC 718 are required. A corporation must have an accurate valuation of its shares utilizing an option pricing model to be able to achieve this. Let’s examine the standards for ASC 718 disclosures.

Understanding ASC 718-10-50-1 and ASC 718-10-50-2

There are four disclosure goals for stock-based remuneration set out by ASC 718-10-50-1. Users of the financial statements should be able to comprehend the following if a reporting firm has awarded its employee stock-based pay awards:

- The specific and broad terms of any existing stock-based compensation contracts

- The impact of stock-based remuneration on the income statement

- The technique for determining the stock-based compensation awards’ fair market value

- The impact of stock-based remuneration on cash flow

To meet these goals, a reporting organization must provide the minimum data required by ASC 718-10-50-2 in its annual financial reports. The subsections following address the particular needs in further detail. An example also shows disclosures requirements in ASC 718-10-55-134 through ASC 718-10-55-137.

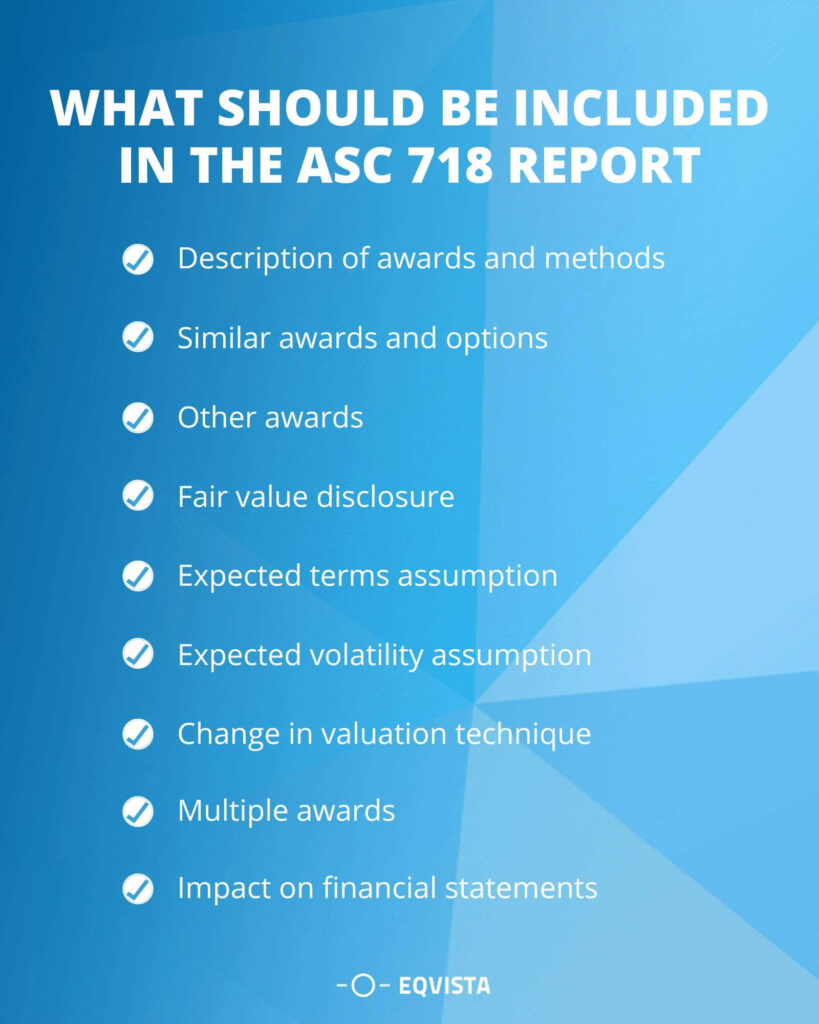

What should be included in the ASC 718 report?

Here are the disclosures requirements that reporting entity must include in ASC 718 disclosures report:

Description of awards and methods

A reporting firm must outline its stock-based awards plans, such as the primary conditions of the awards and any bookkeeping policy decisions. The following information should be disclosed:

- The necessary service and other significant requirements, such as vesting requirements.

- The longest possible contractual term

- The number that may be granted as options or other security instruments.

- The technique used to determine the remuneration cost, such as fair value, intrinsic value, or calculated value.

- The procedure for calculating anticipated forfeitures or, if not explicitly stated elsewhere, for acknowledging forfeitures as they happen.

Additionally, reporting entities must state whether they have chosen to attribute awards based solely on service requirements and a graduated vesting schedule.

Similar awards and options

A reporting company that offers stock options should roll forward operations for the latest income statement. ASC 718-10-50-2(c)(1) disclosures requirement state that the roll forward contains the quantity and weighted-average option price or convertible ratio of the relevant award groups given below:

- Outstanding at the start of the year

- Awarded throughout the year

- Used throughout the year or converted

- Given up through the year.

- Expired

- Outstanding at the year’s conclusion

- At year’s end, exercisable or convertible

ASC 718-10-50-2(e) mandates independent disclosure of the following for awards existing and awards presently exercised or convertible for fully vested awards and awards anticipated to mature as per the most recent balance sheet:

- The quantity

- The weighted average or conversion ratio of the exercise price

- Intrinsic value overall

- Average remaining contractual duration in weight

Other awards

A reporting business should include a roll forward of action for the latest year an income statement is produced if it provides its workers’ rewards apart from options, such as restricted shares. If utilized, the weighted average of fair value on the grant date, calculated value, or intrinsic value should be included in the roll forward for the following groupings of awards:

- Not vested early in the year

- Given during the year

- Vested that year

- Haven’t vested by the end of that year

Fair value disclosure

A reporting organization must disclose:

- The year’s equity awards’ weighted-average grant-date fair value, computed value, or intrinsic value.

- The total intrinsic value of exercised options, converted stock units, stock-based obligations paid, and shares vested.

ASC 718-10-50-2(f) requires a reporting organization to describe the method and important assumptions utilized over the year to determine the fair value or computed value of awards of stock-based compensation, including:

- Expected period

- Rate of volatility

- Dividend forecast

- Risk-free rate

- Estimating post-vesting limitations discount

A reporting company using a valuation approach that incorporates a range of assumptions across the contractual duration of an award (e.g., a lattice model) shall notify the following:

- The range of projected market volatility

- Dividend rates

- Risk-free rates employed

- The weighted-average anticipated volatility and dividend rate

When a reporting business gives comparable awards throughout the year, the guidance must prescribe how to disclose significant assumptions. Some reporting bodies provide a range of essential assumptions, while others provide a weighted average.

Expected terms assumption

An explanation of how the contractual period of the awards was included, the anticipated exercising of the awards, and the anticipated post-vesting termination conduct of the workers should all be included in the disclosing entity’s ASC 718 disclosures of the projected term.

When estimating the anticipated duration for its “plain-vanilla” alternatives, a reporting entity may adopt the streamlined technique covered in SAB Topic 14 (Section D.2, question 6). If so, the reporting entity must explain why the way was chosen. If not all options were evaluated using the same process, it should be disclosed which options were valued using this method and when it was utilized.

Expected volatility assumption

The ASC 718 disclosures requirements state that you must explain how the predicted volatility assumption arrived. This can involve the timeframes, the composition, and whether the reporting organization employed implied volatility, historical volatility, or a mix of the two.

If there is insufficient data to assess projected volatility, a private corporation may estimate fair value using the calculated-value technique. This would imply using an industrial sector index in place of projected volatility. In this situation, a reporting entity has to make the following disclosures:

- Why estimating predicted volatility is not practical

- The chosen industrial sector index and the justifications for the choice

- The method used to use that index to determine historical volatility

Change in valuation technique

A reporting company can alter option valuation models. Preferability is not necessary for a modification in the option pricing model since it is not a modification in an accounting concept. However, any adjustments to the option-pricing methodology should be disclosed, along with the rationale behind them.

Multiple awards

If different kinds of awards have distinct characteristics, a reporting company that grants stock-based compensation with awards should make separate ASC 718 disclosures for each type of award.

Impact on financial statements

The reporting company must disclose the effect of stock-based remuneration on the financial statements. Every time an income statement is provided, the following disclosures should be made:

- Total compensation expense and accompanying income tax advantage for stock-based compensation awards included in income

- The cost of total compensation is capitalized as part of the asset’s cost

- A description of important changes including those that do not need modification accounting, together with information on the conditions, the number of workers who will be impacted, and the overall increase in compensation costs as a consequence of the modifications

The reporting company must additionally include the total compensation cost associated with unrecognized nonvested awards as of the most recent balance sheet date, together with the weighted average period over which it is anticipated to be recognized.

How to disclose an ASC report?

Please be aware that this list of disclosures is not exhaustive. Depending on your circumstances, your organization’s position may need more or fewer disclosures. You should speak with your accountant if you have any queries. Continue reading to learn about the specific details of your file!

- Document option grants – Start from the beginning to simplify ASC 718 disclosure spreadsheet parsing. The report opens with a chart for option grant disclosures. Option grants are the most important report disclosure. You should include all outstanding shares at the start and conclusion of the period and the activities that changed them. Vesting and exercise metrics complete the disclosures. The number of unsettled options at the start and conclusion of the reporting period differs. Exercises and terminations affect choices.

- Option grants disclosure – Exercises and terminations effect option disclosure. West Coast corporations enable early grant exercise. If your company does that, then the company’s “Exercisable at the end of Period” row will equal “Outstanding at the end of Period”. Option disclosures include more spreadsheet rows than stock disclosures because early exercise options are regarded differently from restricted stock awards (RSAs). Consider future costs in the “Expected to Vest” column. Insider tip: you must disclose the weighted average of the exercise price, weighted by the grant’s shares.

- Calculation of stock grants – The disclosures for stock awards should now be examined once you have thoroughly read the option grant section. Since no exercises are included, the ASC 718 disclosures for RSAs are identical to those for option grants, but the procedure is significantly easier. Only the weighted average grant date fair value is given for stock awards. Now that you’ve completed half of the disclosure process, it’s time to tell the audience about the underlying assumptions used by the Black-Scholes method to calculate the fair value of your company’s option awards. For the weighted average projected term, volatility, rate of interest, and fair value, you should give the range (the low and high numbers). The number of shares awarded may be used to weigh the weighted average.

- Determine the unaccrued expenses – The unaccrued costs or expected future expenses and the corresponding weighted remaining service time are included in this section. These two numbers enable accountants to forecast how many costs may be recognized throughout the next reporting period. The gap between the total and accrued expenses is known as the total unaccrued expense.

Choose Eqvista for your ASC 718 reporting!

It’s critical to include all of your costs in your accounting to prevent overstating your earnings. It might not be easy to appropriately account for alternatives when using a spreadsheet for ASC 718 disclosures. It is challenging to keep up with how accounting guidelines evolve. You can manage your cap table and the costs that accumulate as you grant options with the aid of Eqvista.

Eqvista experts will draft your company’s financial report under GAAP regulations like ASC 718. This implies that you will be able to get a timely financial statement ready for audit. Our team can provide consulting and accounting services for businesses in your sector since we have relevant experience and knowledge. Get in touch with us to learn more about our services for ASC 718 reporting.

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!