Stock Option Taxation

In this piece, we will discuss stock option taxation, the different types of stock options, and all the details pertinent to an employee stock option plan.

Stock options are a way companies—especially startups—compensate employees by giving them the right to buy company stock at a fixed price, regardless of what the market price becomes in the future. This creates the potential for significant profit if the company’s value increases.

Stock option taxation is a critical consideration for founders, impacting multiple aspects of their business and personal finances. It is a powerful tool to attract and retain valuable employees without depleting precious cash reserves.

What is a Stock Option?

Stock Option taxation is a form of equity compensation that refers to the tax rules and regulations applied to stock options, allowing employees to purchase company shares at a predetermined price.

Stock options are a renowned form of alternative compensation used by thousands of companies (especially startups) in their employee packages. It is a great way to land talented, highly skilled employees at lower than market salaries in exchange for a potentially massive payday down the line. For founders, understanding tax implications is essential for managing stock options and optimizing tax implications. Moreover, equity plans influence company finances and employee satisfaction.

Types of Stock Option

Stock options are primarily categorized into two types based on their tax treatment and usage: Incentive Stock Options (ISOs) and Non-Qualified Stock Options (NSOs). Incentive Stock Options (ISOs) and Non-Qualified Stock Options (NSOs) differ significantly in terms of eligibility, tax treatment, and regulatory requirements.

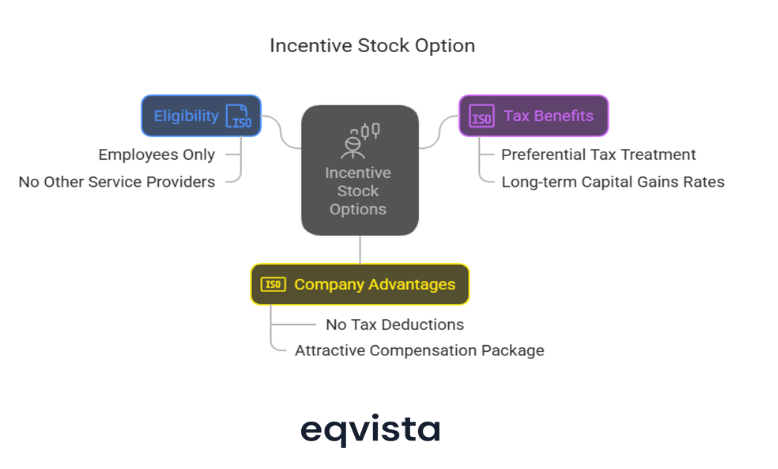

ISO or Incentive Stock Option

Companies mostly give incentive stock options to executives. ISOs can only be given to employees in the company, and cannot be issued to any other service provider. Because of this, these types of options give preferential tax treatment in the form of long-term capital gains rates. With ISOs, employees don’t have to pay tax for exercising their options and the company that offers it doesn’t have to face deductions either.

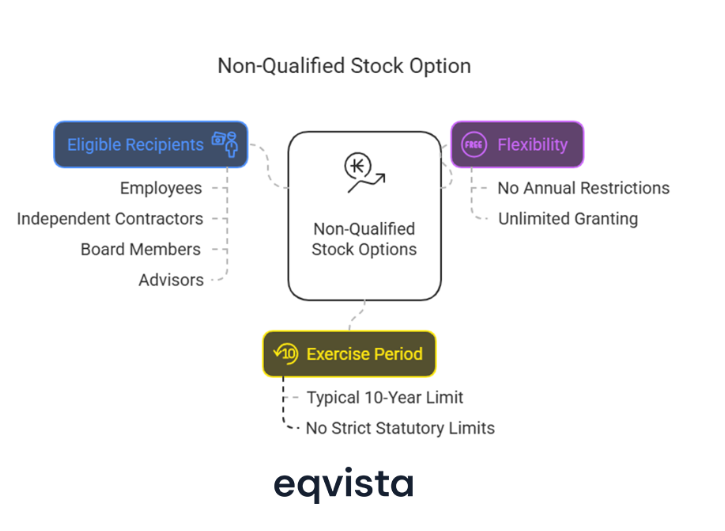

NSO or Non-Qualified Stock Option

Non-qualified stock options are arguably the most popular option. This type of stock options can be issued to any type of service provider for the company, and is not limited to the company employees. Therefore the company can issue it to advisors, lawyers, investors, founders, employees, and others. Unlike Incentive stock options, the federal government does not offer NQSOs special tax treatment.

How Stock Options Are Taxed?

Stock options are taxed at two primary points: when they are exercised and when the underlying shares are sold. The tax treatment varies depending on the type of stock option. A listed options price is closely connected to the underlying stock’s price movement. If the stock’s price rises or falls, the option, in most cases, moves towards the same direction.

Key Takeaways

- ISOs: Favorable tax treatment with potential for long-term capital gains if held long enough but may trigger AMT.

- NSOs: Less favorable tax treatment occurs with ordinary income tax at exercise and capital gains tax at sale.

The taxation of stock options follows a two-step process:

- When you exercise the option (buy the shares)

- When you sell the shares you acquired

The tax treatment depends on the type of stock options.

Taxation at Exercise

- Incentive Stock Options (ISOs): When exercising ISOs, there’s generally no regular income tax due. However, the difference between the exercise price and FMV of the shares at exercise is considered for AMT.

- Non-Qualified Stock Options (NSOs): For NSOs, the difference between exercise price and FMV is taxed as ordinary income at exercise. This amount is subject to income tax and payroll taxes like Medicare and FICA.

Taxation at Sale

The tax treatment when selling shares acquired through stock options depends on several factors.

For ISOs

- Qualifying disposition: If shares are held for at least 1 year after exercise and 2 years from the grant date, profits are taxed as long-term capital gains.

- Disqualifying disposition: If shares are sold before meeting the holding periods, the difference between exercise price and FMV at exercise is taxed as ordinary income. Any additional is treated as capital gain.

For NSOs

When NSO shares are sold, any increase in value since exercise is taxed as capital gains. The holding period determines whether it’s short-term or long-term capital gains. Understanding these is crucial for optimizing the tax implications of stock options. It’s always advisable to consult with a tax professional for a strategy tailored to your specific situation.

When to Exercise Stock Options?

Exercise options when they are in the money to maximize value. Align exercising options with your financial needs and goals. Consider the company’s growth prospects when deciding whether to hold or sell shares after exercising options.

Deciding when to exercise stock options involves several key considerations, including the value of the options, your financial situation, and tax implications. Doing so will allow you to exercise your options at your preferred time without compromising your gains.

Here’s a breakdown of the factors to consider.

| Time | Consideration |

|---|---|

| Market Timing | |

| Financial | |

| Tax Optimization | |

| Other factors |

Ensure your options are vested before exercising them. Keep an eye on the company’s stock performance and market conditions. If allowed by your company, early exercise can start the clock for favorable tax treatment. Consult with financial or tax advisors to make informed decisions.

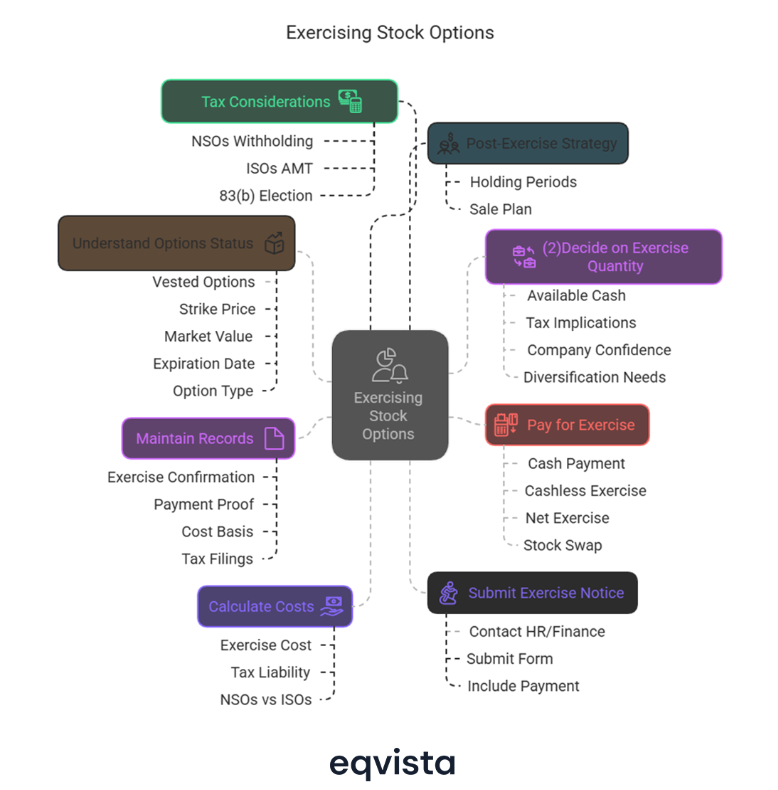

How to Exercise Stock Options?

You can exercise your options as soon as they vest. This also means that you can buy the company stock’s shares. Remember, your options will not be of value unless you exercise them. The price you will need to pay for these options will be present on your contract. So, make sure you read it thoroughly to avoid any confusion later on.

The best thing about exercising stock options is that the price written on the contract remains unchanged. For instance, you spent four years at the same company and you have around 20,000 stock options with a $1 exercise price. To exercise your options, you will have to pay $20,000. After exercising, you will become the owner of the entire stock and you can sell it whenever you please.

Some companies allow early exercise before vesting, which can offer favorable tax treatment but requires using personal funds. Exercising options over time can help manage risk and maximize gains. Many companies trust Eqvista’s equity management to manage and exercise stock options, providing streamlined processes for employees.

Remember, no matter which type of stock option you possess, it comes with an expiration date. It is present in your contract and details other intricacies about your stock option agreement too. Commonly, options tend to expire within ten years from the date the company grants them to the employee.

Take Control of Your Equity Compensation with Eqvista!

As a founder, offering stock options to your team is a powerful way to motivate performance and align interests with the company’s growth. Also understanding the tax implications is crucial for optimizing financial outcomes when dealing with stock options.

Eqvista can help companies manage stock option taxation by providing a complete platform for tracking, issuing, and managing equity compensation, including stock options. We help to navigate the complexities of equity compensation, ensuring that both employees and employers can maximize benefits while minimizing tax liabilities.

Simplify Your Stock Option Taxation Today with Eqvista! Sign Up Now and Maximize Your Benefits!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!