How do verbal agreements affect investor confidence in a company?

In this article, we will see why verbal agreements undermine investor confidence and discuss some key elements of an investment agreement.

In 2024, the average settlement amount in securities class action litigation was $40.86 million. The first and best thing you can do to avoid such expensive settlements is to craft a comprehensive and fair investment agreement. Verbal agreements, despite good intentions, can prove insufficient due to their ambiguity, high possibility of misinterpretations, and lack of legal enforceability.

To inspire investor confidence, you must offer a solid, legally binding investment agreement that alleviates any foreseeable investor concerns and clears up any possible misunderstandings.

In this article, we will see why verbal agreements undermine investor confidence and discuss some key elements of an investment agreement that safeguard the interests of all parties, build transparency, and foster long-term confidence.

Why do verbal agreements negatively affect investor confidence?

Even when all parties act with good intentions, verbal agreements are extremely difficult to enforce due to the limitations of human memory and the possibility of misinterpretations. To a certain extent, this drawback can be countered by relying on multiple witnesses. Even with multiple witnesses, the passage of time will compromise the accuracy of the witness’s memory of the verbal agreement.

Some of the key drawbacks of verbal agreements that impact investor confidence are as follows.

Vagueness

A verbal agreement may be insufficient to deal with complex scenarios. For instance, a verbal agreement between partners in a partnership firm may only cover the ownership percentage but have blind spots such as profit and loss distribution, payout preferences, and dissolution terms.

In contrast, a written agreement forged through examination and negotiations can cover a vast range of scenarios and ensure fair treatment of all stakeholders in even the scenarios with the lowest probabilities.

Challenging to prove their existence

To avoid keeping their end of the bargaining, the other party can simply deny the existence of a verbal agreement.

For instance, in the Blue v Ashley case, Jeffrey Blue, an investment banker, claimed that he was entitled to an incentive of £15 million from Michael Ashley for playing a key role in doubling the market capitalization of Ashley’s company, Sports Direct International. This claim was contested by Ashley and the court agreed noting that the offer was made as a joke and not more than a pub chat and should not have been taken seriously.

Minimal scope for damages

Even if you were able to prove the existence of a verbal agreement in a court, the compensation awarded may be disproportionately small compared to the severity of the violation of your rights.

How to craft an investment agreement that helps maintain investor confidence?

To make an investment agreement that ensures smooth relations and improves investor confidence, you must understand the needs and concerns of investors.

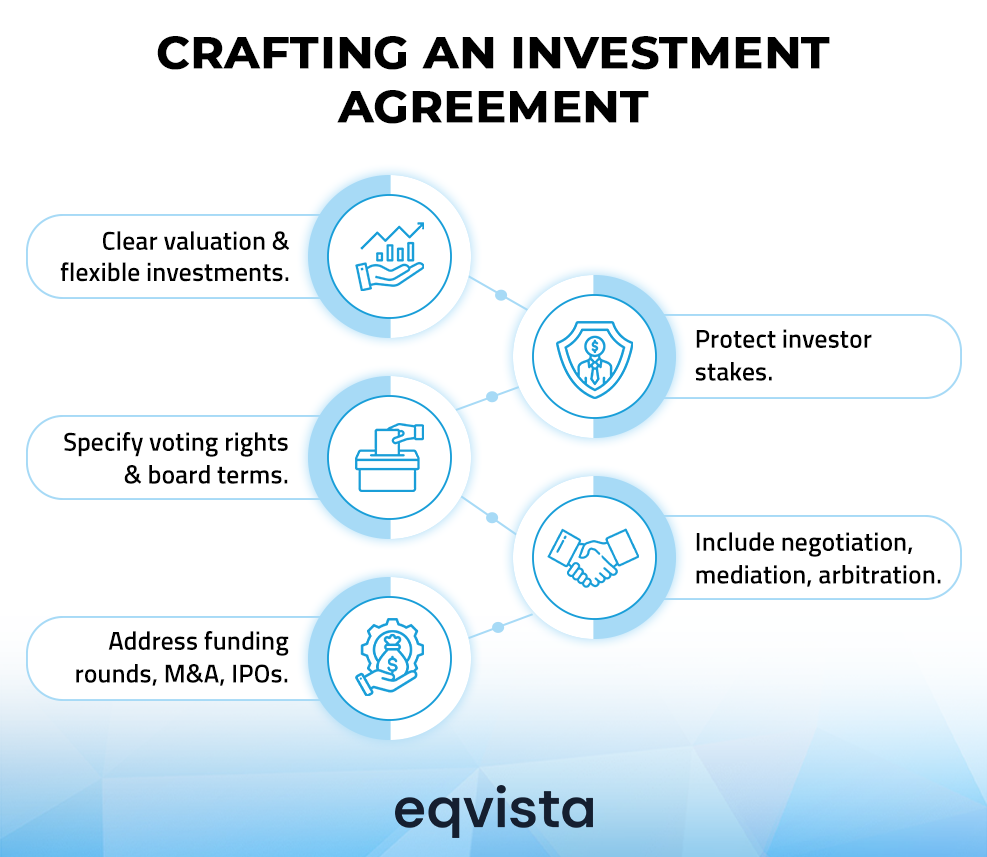

Primarily, we can categorize investors’ needs and concerns into five areas, which are investment terms, governance structure, exit scenarios, anti-dilution rights, and dispute resolution mechanisms.

Define the investment terms

The purpose of an investment agreement is to establish terms of exchange for the startup’s equity interest and the investor’s funds. To prevent potential disputes, it would be wise to clearly mention the valuation approach used along with the underlying assumptions and supporting data in the appendix.

Since startups have a greater need to secure funds than larger corporations, you must provide greater flexibility to prospective investors. So, instead of accepting only lump sum investments, you may need to allow for investments made over a certain period. If you take this route, you must define the investment schedule in the investment agreement.

Explain the governance structure

Specialist investors prefer investing in a handful of companies and taking an active role in managing their portfolio companies. Such investors have prior experience in building and scaling companies in the same sector as their portfolio companies. In contrast, some investors invest in several companies and thus, cannot take an active role in managing their portfolio companies.

To accommodate varying types of investors, startups must issue different kinds of equity interests. Specialist investors may prefer receiving common stocks since these carry voting rights while other investors may want preference shares that do not carry voting rights but provide more security over returns.

Additionally, specialist investors may seek board membership. However, granting indefinite board seats may not be practical. Instead, board membership could be structured to expire upon meeting specific performance metrics, the next funding round, an IPO or acquisition, or after a fixed term.

Hence, in an investment agreement, you must specify the voting rights and terms of board membership.

Address exit scenarios

Among all asset classes, private equity carries the highest level of risk, and startups are considered the riskiest section of this asset class since more than 2/3rds of all startups never deliver a positive return to investors. Hence, startup investors would want to cover all exit scenarios.

The earliest exit opportunity for startup investors is often the next funding round where they may prefer to have their stakes bought out by incoming investors. However, this can cause difficulties in securing funds if the incoming investors have a low investment appetite. To balance your needs with the needs of investors, you must negotiate the facilitation of partial stake sales rather than full exits.

Mergers and acquisitions (M&A) are the next most probable exit opportunity. Here, too, you may need to facilitate partial stake sales. In the case of IPOs, you may not need to offer any kind of support since investors could simply sell their shares in an open market, however, investors may ask to include their shares in the offer-for-sale (OFS). Finally, you must address the payout preferences in case of liquidation.

Thus, in an investment agreement, you must specify the extent of tag-along rights, i.e. rights to have stakes bought out by incoming investors, payout preferences in liquidation proceedings, and whether the investor’s shares would be included in the OFS or not.

Anti-dilution rights

Investors may desire anti-dilution rights to maintain the size of their stake in case of down rounds or when there is a possibility of greater profitability in the future. If an investor has received preferred stock, the anti-dilution rights are either full-ratchet or weighted average conversion rights. However, granting the right of first refusal (ROFR) could work to your advantage. At the very least, it will strengthen your future fundraising efforts, which is especially crucial in the event of a down round.

To understand what kinds of anti-dilution rights you must write into the investment agreement, you will need to inquire about the investor’s investment horizon, return expectations, investment appetite, liquidity needs, and future funding participation.

Define dispute resolution mechanism

Disputes between founders and investors, as well as among investors themselves, can arise from differences in opinion regarding company direction, employee stock option plans, executive compensation, payout structures, and valuations in funding rounds and other liquidity events. Hence, investment agreements will always mention alternative dispute resolution (ADR) mechanisms that include negotiation, mediation, arbitration, and conciliation.

In the investment agreement, you must specify who can serve as the third-party responsible for leading the ADR proceedings, the kinds of resolutions that can be enforced, and the process to appeal resolutions.

Eqvista – Bridging perspectives by defining value!

When you craft a written investment agreement after considering the intentions and needs of all parties, it will provide much more utility than a verbal agreement that could be forgotten or may not provide comprehensive protection in the first place. A written agreement fosters investor confidence by reducing uncertainty, demonstrating a commitment to fair governance, and ensuring enforceability.

The primary challenge you must overcome at the start of your relationship with incoming investors is building consensus regarding your startup’s valuation. This is one of the problems Eqvista helps early-stage startups address as part of our valuation services where we value over $2 billion in client assets every month. Contact us to learn more about our investment valuation services!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!