SaaS Valuations: 7 Metrics Every SaaS Company Should Know

When it comes to analyzing and selling their SaaS business, many companies struggle. This unique SaaS business strategy makes the SaaS valuation extremely different from that of traditional enterprises. There are many variables and multiples to consider when it comes to SaaS companies; this article will help you understand them all.

SaaS Company Valuation

SaaS companies can be difficult to value if you don’t understand all the terminologies and elements involved. A SaaS company’s value can be determined by examining the following factors.

Overview of SaaS companies

Servers, databases, and software developed by SaaS companies are accessible via the internet, most commonly through web browsers. The software can be accessed from a wide range of devices.

Examples of SaaS companies

The most popular alternative is Software as a Service (SaaS), which is also known as cloud application services in the cloud industry. Internet-based software as a service (SaaS) allows customers to access programs hosted by a third-party provider. SaaS applications run entirely in your web browser thus there is no need for any additional software to be downloaded or installed on your end users’ computers.

Some well-known SaaS examples are:

- Google Workspace (formerly GSuite)

- GoToMeeting

- Cisco WebEx

- SAP Concur

- Salesforce

- Dropbox

How does SaaS company valuation work?

The process of valuing a SaaS company can be complicated, but a well-established company can serve as a useful starting point. If comparable businesses are available, a valuation specialist can use market, cost, or income valuation methodologies to assess a company’s financials and other criteria.

Software as a service (SaaS) company valuations is unique. Because many SaaS companies are startups with little or no revenue history, valuation experts have to adapt their approach. Public business valuations, mergers, and acquisitions are driving SaaS value multiples to record highs. Tools like profit and revenue multiples might help evaluate private SaaS valuations. However, a company’s stage, business strategy, and capacity to keep consumers can all have a big impact on the money it brings in.

7 important metrics that are driving SaaS company’s valuation

The financial structures of SaaS enterprises are frequently more sophisticated than those of traditional corporations. Why? Because software-as-a-service companies are more likely to rely on steady growth than SaaS companies are. This means that if you’re in the software industry and you’re growing at less than 20 percent yearly, you’re almost certain to fail within the first few years of business. Because only 15% of high-growth SaaS companies (those who made it through the first few years) can maintain steady growth, it’s a hard reality. Listed below are the 7 important saas company valuation metrics.

Annual Recurring Revenue (ARR) & Monthly Recurring Revenue (MRR)

The total annual subscription revenue is known as the Annual Recurring Revenue (ARR). It’s common practice to define annual recurring revenue, or ARR, as the difference between total revenue generated from new business and total revenue generated from upgrades and downgrades. Even though it isn’t a GAAP metric, every SaaS company uses it as a revenue equivalent.

For Example, An annual recurring revenue of $12,000 is generated if a consumer signs up for a service and pays $12,000 for a one-year renewal agreement. Annual Recurring Revenue (ARR) would be zero if a consumer paid $10,000 for a service with no contract. For example, if a customer pays $1,000 each month for a monthly renewal agreement service, then the customer’s Annual Recurring Revenue (ARR) would be $12,000 per year.

All subscription revenue, reported as a monthly total, is referred to as Monthly Recurring Revenue (MRR). A company’s monthly recurring revenue (MRR) is the sum of all new and upgraded subscriptions, minus downgrades (or contractions) and cancellations. Even though it isn’t a GAAP metric, every SaaS company uses it as a revenue equivalent.

For Example, MRR = $1500 if 10 clients each pay $150 per month. For an MRR of $1700, you’d need seven customers paying $200 per month and three customers paying $100.

The rule of 40

This is an excellent way to gauge their revenue growth and profitability (revenue growth plus EBITDA margin) for SaaS companies. When it comes to growth and profit, there is often a trade-off. Trying to find an investor or making a sale puts management teams in a perpetual state of conflict both within and externally. The concept is not necessarily binary, and not everyone sees the world in the same way.

This is when a person’s ability to assess a product’s worth comes into play. Over 100 percent year-over-year growth and 50 percent EBITDA margins are considerably different from 15 percent year-over-year growth and negative EBITDA margins, respectively. There’s a wide range of possibilities, but there’s no right or wrong answer when it comes to determining the appropriate growth rate for profitability.

Buyers and investors use this metric to answer these questions concisely and demonstrate to a potential partner that the company has found the proper balance between growth and profit for its products and customers. As a result, companies that exceed the rule of 40 attract a premium over their peers, as their long-term growth and profitability are rewarded with significant valuation upside.

Company Churn Rates

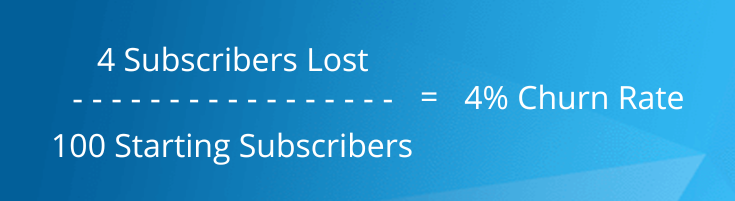

Many elements can be measured in terms of attribution or loss when we talk about churn. Customers, contracts, bookings, contract value, GAAP revenue, and MRR can all be used to measure loss. The ratio or rate is the most common way to express this, although it can also be thought of as a complete number.

This is a widely discussed measure in the SaaS industry, and it is highly subjective. Churn is determined by your company’s particular goals and what your stakeholders find acceptable, regardless of how you measure it. However, this does not negate the importance of observing a few common churn measures.

Among the most typical churn metrics we’ve seen are the following:

- Customers’ (or a Logo) Churn: This is a loss of revenue, plain and simple. There are several different terms for this: customer attrition, customer turnover, customer defection, and customer retention. What you see here is what it appears to be:

- Revenue Churn: Similar to customer churn, revenue churn takes into account the rate of revenue lost over a given period of time. All of your new revenue from that time frame must be taken out before you can begin your analysis.

For instance, During the previous quarter, you brought in $100,000 in revenue, and this quarter you brought in $90,000. Here’s how it works:

- Recurring Revenue (ARR/MRR) Churn: Each month, they look at their recurring revenue (MRR) and calculate their loss (from both canceled and degraded subscribers) using RRC’s proprietary formula. An example of this is:

The revenue churn might look like this if a company had 50 clients in January paying $200 each, and 45 customers in February at the same price:

- 50 x $200 = $10,000MRR in January

- 45 x $200 = $9,000MRR in February

Customer Lifetime Value (CLV)

A customer’s lifetime value (CLV) is calculated by subtracting the entire revenue from all costs. Even while CLV is normally used to estimate the overall worth of a customer, in subscription-based models, it is more like predicting both the revenue and the costs to deliver the client’s pre-tax contribution in the form of the CLV.

Your CLV can be determined easily if you know your churn or renewal rate and average MRR. A CLV report solves the intricacies of precisely tracking churn and renewal rates and automatically generates a report that is easy to understand.

Renewal Rate

The simple explanation for the renewal rate is: It’s the percentage of customers who stay loyal to a company. Customers, revenue, monthly recurring revenue (MRR), and bookings are all factors that can be used to calculate the percentage of customers that will continue to use your service.

While a count-based ratio works best with clients and similar contracts, it fails miserably when applied to a varied group of clients and contracts.

In this example, if Customer 1 pays $100 per year and cancels, whereas Customer 2 pays $1000 and renews, the count ratio is 50%. It’s actually far more valuable to have a high renewal rate.

Revenue Retention

Revenue retention may appear to be the same as customer retention at first glance, but revenue retention is focused on the amount of revenue you maintain from current customers over a specific period of time (regardless of how many customers you lose in that period). Consider these two critical metrics to gauge the health of your company:

- Net Revenue Retention: A company’s Net Revenue Retention (NRR) is the total change in recurring revenue from a group of customers over time. To arrive at this figure, profits from expansions or upsells are added to the total. Monthly (or annual) estimates are possible, and they show if your product is well-suited to the market. This is how you do it:

- Gross Revenue Retention: When it comes to retaining customers, gross revenue retention (GRR) takes an overall look at how well a firm is performing by excluding elements such as upsells, price increases, and organic customer growth. Always equal to or less than your NRR and is always between 0% and 100%. This is how you do it:

Growth rate

It’s important to keep track of how much your revenue is increasing over time. There are several ways to gauge how quickly your firm is gaining momentum and market traction. Your MRR growth rate is one of the finest markers of business expansion when it continues to rise steadily.

Here’s how you do it:

The Monthly Recurring Revenue Growth Rate is the last saas statistic. Calculating MRR Growth Rate can be demonstrated in the following example.

Net MRR for this month was $790,000, while the previous month’s net MRR was $660,000, which means your firm is increasing at a rate of 16.45 percent per month.

If your SaaS growth rate is in the double digits, you’ve found traction with your market, even if there are no actual benchmarks for SaaS growth rates. To put it another way, if you’re growing your MRR by 10% each year or more, you’re in terrific shape.

Things to avoid while doing SaaS company valuation

Errors are common in a business where there is so much uncertainty. Here are some of the most common things to avoid while doing SaaS valuation.

Comparison with the already sold competitors

The idea is to focus on your company’s narrative. The difficulty with comparing yourself to a competition that recently left is that you don’t have all of the facts. You have no way of knowing if that rival undersold their business because they were talked down during tense discussions or if they just happened to be a natural negotiator.

At the end of the day, you simply don’t know everything. While finding comparable scenarios as a benchmark can be useful, it is not the be-all and end-all answer to your SaaS firm valuation. Even if you have a good understanding of some of the finer characteristics, such as the buyer’s persona, you’re unlikely to have a complete picture of what your SaaS is worth due to its unique position in the market.

Comparing with the market

The usage of comparables can aid your decision-making, but they should not be your sole guiding light. Looking at comparable public firms might be discouraging when you see how much higher their valuations are than your own.

In the long run, SaaS companies that have gone public will be more valuable than SaaS companies that remain private. Why? Because anyone can “buy-in” to the business at any moment, only a select few can purchase stock in the private sector.

In addition, these SaaS companies are also very large. They’ve absorbed a large portion of the market share in their niche and have a large pool of financial and human resources at their disposal. These publicly traded SaaS businesses exist in a very different world than the vast majority of their bootstrapped counterparts. The value of a private SaaS can be estimated using publicly available statistics, but keep in mind that the public market giants are much more expensive than the SaaS you’ll discover on the open market.

Choosing the wrong valuation service provider

Like any other business, yours is likely to be valued by various valuation agencies and services. This is a problem because SaaS is very different from traditional internet business models. There are numerous similarities between SaaS companies and other types of businesses, but there are also fundamental differences. As a result of these key distinctions, SaaS enterprises are valued more highly than other types of internet businesses.

Why choose Eqvista for your SaaS Company valuation?

When it comes to managing the ins and outs of SaaS, Eqvista has the expertise to handle everything from how to do a valuation for saas company, revenue recognition, and customer retention to metrics and analytics. We’re here to make sure you have the data you need, when you need it, with the ability to quickly and easily calculate over 100 SaaS financial and analytical KPIs.