Are RSUs or Stock Options Better for Startup Employees?

Usually companies offer RSUs (restricted stock units) or stock options such as NSOs and ISOs as equity to employees.

These days the competition to have the best employees for your company is really high, with many firms offering good starting salaries and company benefits. This makes it tough for startups to hire talented staff in the beginning. But there is a way out of this by offering employees with equity compensation.

Employee Compensation

The benefits an employee receives in exchange for a service they provide is employee compensation, eg. in cash, bonus pay, vacations, and others. Generally employee compensation is the largest cost of an organisation. However these days companies are exploring the many different types of employee compensation to grow their business.

Understanding employee stock options

ESOs or employee stock options are the type of equity granted to executives and employees in the company. The company provides derivative options of stock instead of granting stock directly to the employees. These options are in the form of regular call options and the employees are given the right to purchase the stock at a finite time for a specified price. After obtaining the stock, the holder has the option to either hold onto the stock till the future or sell it for a profit. All these details for the ESOs will be written out in the employee stock option agreement.

Often stock options are associated with startups, as this is a way for rewarding early employees when the company grows and eventually goes public. For employees to work towards the greater good and grow the value of the organisation, they are awarded with these incentives. However these options are cancelled if the employee decides to leave the company, and dividend and voting rights are not included in ESOs.

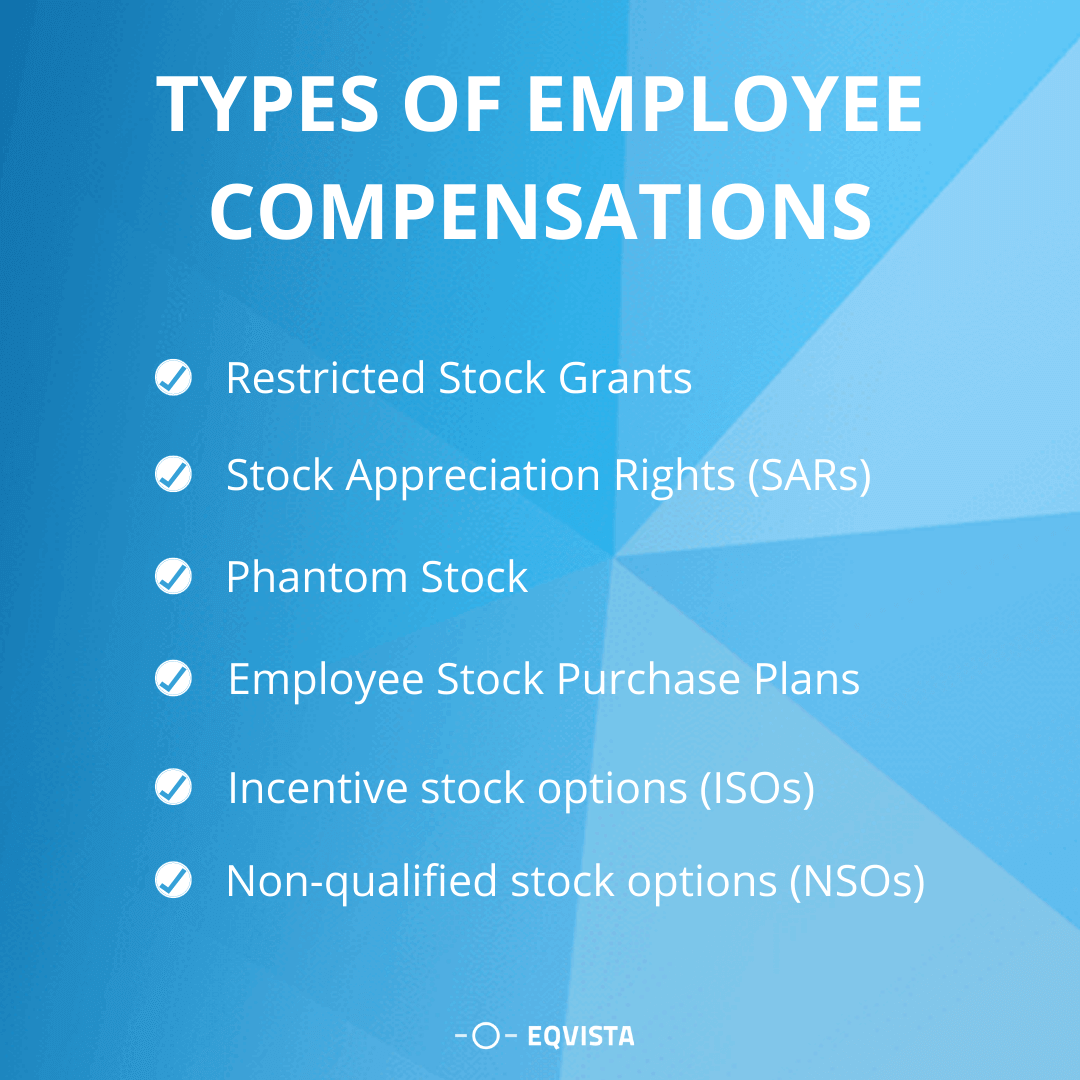

Types of employee compensations

In some or all the employee corporate benefits, equity compensation plans may be included. In the form of stock equity, financial compensation is provided through these plans. A company may offer different types of equity compensation and ESOs is just one of them. The other types may include:

- Restricted Stock Grants: Once a certain criteria is fulfilled, employees are granted the right to acquire shares. Eg. achieving performance goals, working for a defined number of days, etc.

- Stock Appreciation Rights (SARs): it gives the right to the increase in the value of a specified number of shares; the increase in value is payable in company stock or in cash.

- Phantom Stock: An amount equal to the specified number of shares is paid in the future in the form of cash. Usually there is no legal transfer of share ownership. If a defined trigger event occurs, the phantom stock may be converted into actual shares.

- Employee Stock Purchase Plans: This plan, usually at a discount, gives the employees an option to buy company shares.

In terms of stock options, there are two main types:

- Incentive stock options (ISOs): also known as qualified or statutory options. Generally they are offered to the top management and key employees, and in many cases they receive preferential tax treatment as gains are treated as long-term capital gain.

- Non-qualified stock options (NSOs): these options are granted to board members, consultants and employees at all stages. It is also known as non-statutory stock options, and gains on these are treated as ordinary income and are treated for the same.

Understanding Restricted stock units

If certain conditions are met, an RSU is a promise from the employer to provide you with the company’s shares (or cash equivalent) in the future on a certain date. For RSUs, to get the stock, you do not have to pay anything, unlike stock options. Instead when you receive the shares, you are only responsible to pay the applicable taxes.

In order for you to qualify for RSUs certain restrictions have to be met. Here are some common ones:

- Milestone-based (e.g. your company must IPO or be acquired)

- Time-based (e.g. you should stay at the company for a certain period of time)

- Combination of the two ( most RSUs are issued at privately held companies with both liquidation and time-basd conditions)

If and when you meet these restrictions, it should be outlined in your RSUs grant and RSUs vesting schedule, and then you receive the shares.

Comparing RSU or Stock Options

RSU or stock options are both valid forms of stock-based compensation. But here are the key differences:

Differences in Settlement

One main difference between restricted stock units and stock options is what happens when the vesting period ends. Once the vesting period ends with stock options, the options become common stock. The employee has the choice to either buy or sell that stock.

On the other hand, an RSU is settled as it is certified in the terms. The employee can ask their employer to defer settling the option for a short time after vesting, thus extending the time to pay off taxes. But in doing so, the employer has to adhere to all the tax laws. RSU or stock options are both good employee compensation incentives.

Some Level of Value

With stock options, the stock option could expire worthless if during the exercise period the market price of the stock stays below the strike price. Why would the holder pay more than the market price to buy the share?

Generally, RSUs on the other hand have some value. Since RSUs are not distributed as stock options where the holder has to purchase the shares, they always have some value being distributed as shares.

Some other differences

One key difference is shareholders rights. The employee receives the full shareholders rights in the case of stock options. Compared to this, employees do not receive full rights in the case of restricted stocks. Both dividend rights and voting rights are provided in stock options, but in the case of restricted stock units, dividends are not paid and voting rights are not provided.

Tax Treatment

Tax treatment between stock options and RSUs is also different. With RSUs when you receive the shares, you are taxed. The amount to be taxed is dependent on the market value of the shares at the time at which you are awarded. Furthermore if you decide to sell the shares and make a gain, it would be taxed at the applicable capital gains rate.

There are two different types of employee stock options. Each of which has a different tax treatment.

- Incentive stock options (ISOs) are not directly taxed. Any profit on the sale of the shares is taxed as short term or long-term capital gains after the option is exercised, depending on the holding period before selling.

- When you exercise options, non-qualified stock options (NSOs) are taxed. The amount to be taxed in that year as ordinary income is the difference between the market price of the stock at the time the options are exercised and the exercise price of the option. It would also be subjected to normal payroll taxes.

RSU vs Stock Options

The primary distinction between Stock Options and RSU is that in stock options, the company grants an employee the right to purchase the company’s share at a predetermined price and date. On the other hand, restricted stock units (RSUs) is a method of granting the company’s shares to its employees in two ways: when the employee meets the specified performance goals, or completes the specified tenure in the company as an employee.

| Point of Difference | Restricted Stock Units | Stock Options |

|---|---|---|

| Definition | Employee compensation that converts to common stock when certain performance or time constraints are met. | A type of compensation in which the employee has the option (but not the obligation) to purchase a certain number of shares of common stock at a predetermined exercise price. |

| Exercise Price | Not applicable. | The stock's the fair market value on the date the option was granted. |

| When are they taxed? | They become vested and liquid as soon as they become vested and liquid. | They can only be used after they have been exercised. |

| How are they taxed? | At standard income tax rates. | Depending on the type of option, at varying rates. |

| Ideal for | Startups that have a current valuation that will most likely not be realized for several years. | Startups in private or early stages that want to incentivize employees to increase the value of their company. |

Are RSUs a better plan for startups?

The answer depends on many financial situations. The employee may be better off with stock options if the company’s shares are increasing in price. The opportunity to purchase the shares at a price below the market price is offered to the employee for the shares.

Additionally, with stock options:

- You have the flexibility to choose when to exercise the option which also allows you to be flexible with the timing of payment of taxes.

- Depending on the terms of the grant, should you leave the company, you should retain the rights to exercise the option.

Generally, RSUs are worth something as compared to stock options, which can be deemed worthless and expire if the stock price is below the strike price.

Conclusion

RSUs and stock options are offered to employees so that the companies can hold on to their special employees. Both of these options are diverse and very different, which is why it is crucial to understand them in detail before you offer them to your employees. Whatever you decide, it is important that you keep track of all the shares in your company. You can use a reliable cap table for this, like Eqvista.

Eqvista can help track and manage the shares in your company easily. It can help you create customized equity plans for employees, set up advanced vesting schedules such as time and milestone based. Check it out here.

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!