How to Manage Down Rounds Like a Pro?

In the unpredictable business world, knowing how to handle down rounds can make a big difference. It’s commendable that some companies not only survive tough times but actually become stronger. A downround is when a company’s value goes down during a funding round. It’s a tough situation, but if you know how to manage down rounds, what to do and how to do it, you can turn it into an opportunity.

This article focuses on handling down rounds in startups, coping with down-round financing, and navigating down rounds like an expert.

What is a Down Round?

Down Rounds are viewed negatively by a startup and its existing investors since they can signify a company’s perceived worth or performance deterioration.

When a startup’s valuation drops in a later funding round, it undergoes a down round. In other words, the company’s valuation decreases from its last valuation.

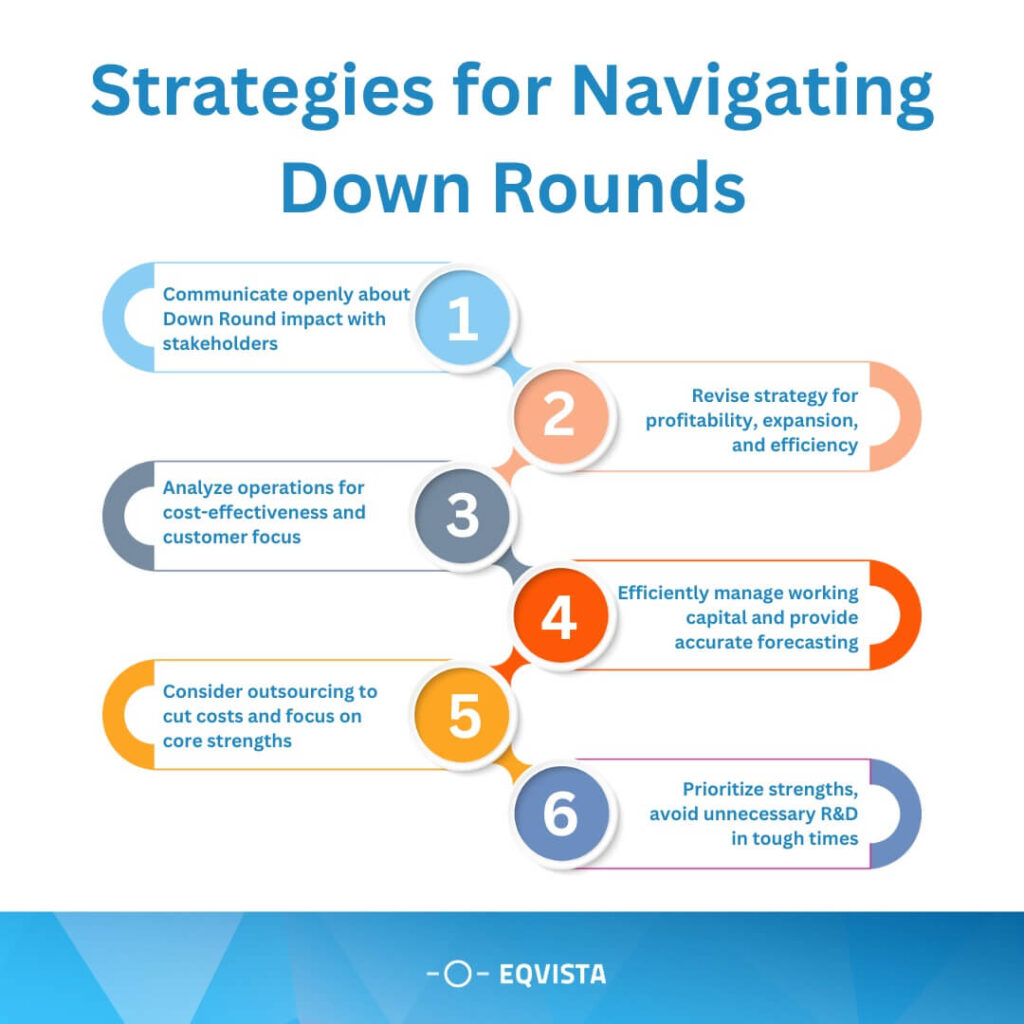

Effective down-round management is essential to preserving investor confidence and your company’s overall health. Managing a down round is challenging but provides an opportunity to display determination. You may navigate a downturn while reducing its long-term impact on your company’s growth potential by applying these tactics and maintaining a proactive and honest approach.

Understanding Down Rounds

The Down Round is risky. A negative cycle can negatively impact the confidence of both investors and employees. Anti-dilution safeguards pose a problem and shift the burden of risk onto the founders and staff. Evaluating the potential consequences and considering alternatives before proceeding with a Down Round is essential.

When a corporation sells new shares or equity-linked securities at a lower price than in the previous financing, anti-dilution provisions come into effect to prevent diluting current investors. These provisions usually involve reducing the instrument’s strike price or increasing the conversion rate, which results in issuing more shares.

What Triggers a Down Round?

A downturn can occur when tech market valuations drop dramatically, reaching as high as 20 times the value in specific industries. This puts many companies that raised capital in 2021 in a difficult situation.

Overfunding too soon is another cause of a downturn, as it leaves little time to achieve significant growth metrics and milestones required to support a strong succeeding round.

Investor disinterest during industry downturns can lower valuations for successful startups. Financial underperformance or issues related to the company, such as high burn rates or disarray in the leadership team, can also result in investors demanding lower valuations.

Market trend

There has been a significant decrease in the value of publicly traded companies last year, which also affected private companies. This is true for companies already overvalued compared to their equivalents in the public sector.

Swedish fintech BNPL company, has seen a massive drop in its valuation, from $45.6B to $6.7B (-85%).OneTrust’s Valuation Slightly Dips to $4.5B (-12%) in Series D Round.San Francisco-based Stripe’s valuation hits to $50B (-47%) in Series I Funding. Ramp’s Valuation Takes a 9% Hit in Series C Round; A Native New Yorker.French Data Science Platform, Dataiku’s Valuation Slides to $3.7B (-20%) in Series D Funding;

Once valued at $11 billion, Pinterest has undergone a significant 60% drop in its valuation before going public. Box, a cloud storage provider, witnessed a 45% reduction in its valuation, going from $2 billion to $1.1 billion before going public in April,2015.

Anti-Dilution Mechanism

When a Down Round financing happens, existing preferred shareholders with Broad-Based Weighted Average anti-dilution protection get compensated. This compensation involves adjusting their initial conversion price, depending on the number of shares and the amount raised during the Down Round.

Issuing more securities at a lower price can lead to a more significant anti-dilution adjustment. The Broad-Based Weighted Average anti-dilution measure can result in reduced percentages for founders and workers, which can negatively impact the company, along with other popular anti-dilution measures such as Full-Ratchet.

The anti-dilution equation:

The anti-dilution equation CPα = CP𝜷*[(A+B)/(A+C)] is used to calculate the conversion price of convertible preferred stock after a dilutive event, such as the issuance of new common stock at a lower price than the conversion price of the convertible preferred stock.

*CPα = Conversion price after downround

*CP𝜷 = Conversion price before downround

*A=FD Capitalization of the company before Downround (including options)

*B= Total consideration received in Downround divided by previous round per share purchase price

*C = Number of shares issued in the Downround

Real-life case study example

Company A is issuing convertible preferred stock to a group of investors at a price per share of $10. The convertible preferred stock has a conversion ratio of 1:1, meaning that each share of convertible preferred stock can be converted into one share of common stock.

After the issuance of the convertible preferred stock, Company A issues new common stock at a price per share of $8. This is a dilutive event for the convertible preferred stock investors, as they can now convert their convertible preferred stock into common stock at a higher price than the price at which the new common stock was issued.

To protect the convertible preferred stock investors, Company A uses an anti-dilution mechanism called a full ratchet. Under a full ratchet, the conversion ratio of the convertible preferred stock is adjusted to the conversion ratio that would have been applied if the convertible preferred stock had been issued on the same day as the new common stock.

In this case, the conversion ratio of the convertible preferred stock would be adjusted to 1.25:1. This means that each share of convertible preferred stock can now be converted into 1.25 shares of common stock.

The following equation shows how the conversion price of the convertible preferred stock is calculated after the dilutive event:

CPα = CP𝜷*[(A+B)/(A+C)]

In this case, the following values would be used in the equation:

*CP𝜷 = $10

*A = 100,000

*B = 100,000

*C = 200,000

Therefore, the new conversion price of the convertible preferred stock would be:

CPα = $10*[(100,000+100,000)/(100,000+200,000)] = $8

This means that each share of convertible preferred stock can now be converted into 1.25 shares of common stock at a price of $8 per share.

Anti-dilution mechanisms are used to protect the interests of investors in venture capital and private equity transactions. These mechanisms are designed to prevent investors from being diluted by the company issuing new shares at a lower price than the price at which the investors invested.

Challenges of Down Rounds

Down Rounds can be challenging for both the company and its existing investors. Here are some key challenges associated with downrounds:

- Downrounds dilute ownership stakes, reducing control and financial rewards for founders, workers, and early investors.

- The declaration of a downturn has a detrimental influence on firm morale and employee engagement, and it may suggest financial challenges and fewer appealing employment options.

- Downturns may cause havoc on a company’s reputation, potentially leading to mismanagement and impeding fundraising attempts.

- The downturn may violate debt covenants, resulting in financial difficulties, defaults, or insolvency.

- Economic downturns can result in legal disputes between shareholders and management, potentially necessitating renegotiated contractual arrangements.

Implications on Investors and Stakeholders

The anti-dilution protection, pay-to-play, and cramdowns will all harm some of your early backers, including seed investors, advisors who own shares, and common stockholders like founders and workers.

After a downturn, these people’s ownership, influence, and upside will decrease. Each group will experience negative consequences, which are listed below:

- Cramdowns or the triggering of anti-dilution measures can significantly lower the percentage of corporate ownership owned by prior investors.

- With reduced ownership comes a decreased ability to influence business decisions, such as strategic direction, hiring key personnel, and potential exits.

- Investors could lose access or interest. Markdowns and shared class changes can lead to loss of value and preferential rights.

- Issuing new shares below the existing options’ strike price can lead to dilution and lower potential returns. This can cause the options to become “underwater” negatively impacting employee engagement and commitment to the company.

- Due to diminished voting power, common stockholders, including founders and employees who have exercised option rights, may experience unfavorable outcomes such as dilution of majority ownership during a downround, reduced financial benefits, and lower employee morale.

How To Prepare for Down Rounds?

Down Rounds can be challenging for corporations. To navigate this situation, prepare carefully and take deliberate actions. Consider these steps:

- Assess a possible downturn’s origin, market conditions, and corporate performance to estimate its magnitude and impact.

- Analyze financials, communicate accurately with investors, stakeholders, and employees, and consider modifications or pivots.

- Improve operational efficiency by concentrating on core products or services with solid development potential.

- Have a check on financial progress Regular Budget vs. actual

- Improve customer relationships, collaborate with existing investors, seek new investors, and maintain legal compliance.

- Maintain motivation and engagement through maintaining clear communication and team spirit.

Mitigating the Impact of Downrounds

Mitigating the impact of down rounds can be difficult, but there are various ways that companies and investors can use to minimize the negative consequences. Explain the circumstances contributing to the valuation shift and the activities to fix the situation.

Exploring alternative funding sources and options, such as venture debt or strategic partnerships

Exploring alternative funding sources and possibilities beyond standard equity financing can be a sensible method for organizations pursuing funds. Two highlighted routes include strategic partnerships and venture debt.

Venture debt funding focuses on startups and high-growth firms’ growth potential, providing additional capital for expansion, product development, and other projects without diluting stock ownership. Strategic alliances entail partnering with other companies for mutual gain, typically through joint ventures, licensing agreements, co-marketing, or distribution arrangements.

Negotiating terms and conditions with new investors to ensure alignment with the company’s vision

Negotiating terms and conditions with prospective investors to guarantee alignment with the company’s goal is vital in developing a successful and long-term collaboration. Ensure your business’s long-term objectives, vision, and mission are well established before beginning negotiations.

Focusing on operational efficiency and cost optimization to increase runway

Focusing on operational efficiency and cost optimization is a strategic approach many firms take to improve their runway. It refers to the period a company can function with its current cash reserves before obtaining more capital.

A corporation can prolong its runway and build a more sustainable financial position by properly managing costs and optimizing operations.

Alternative to Down Rounds

If the firm doesn’t want to go through downround, there are alternatives that include the following.

- The corporation can lower its burn rate as an alternative to a down round. This action would only be practical if there were operational inefficiencies; otherwise, it would be counterproductive and may slow down the expansion of the business.

- The management may think about bridge finance or short-term funding.

- Re-discuss terms with existing investors.

- Close the business.

Manage your Downround with Eqvista!

Downturn management necessitates a balanced approach highlighting transparency, communication, and strategic decision-making. It is a leadership and adaptability test. You may manage the difficulties of a downturn and prepare your organization for future success by approaching it with a proactive perspective, learning from the experience, and adopting essential changes.

Get professional assistance from Eqvista to get ready for a downturn! For further information, please get in touch with us.