Expert Tips to Fine-Tune and Fortify Your Startup’s Financial Model

Here are some expert tips that can help you improve startup financial models, fine-tuning financial projections, and fortify financial planning for startups.

Imagine a crystal ball that reveals your startup’s financial journey, guiding you through the twists and turns of entrepreneurship. A startup financial model acts as the quantitative representation of your startup’s objectives, such as the anticipated number of consumers, the anticipated number of employees, and the anticipated increase in profit margins.

In 2023, investors put $31.8 billion into US and Canadian startups, highlighting the need for strong financial models. The number of new businesses is increasing, with over 1.1 million founded in 2022, indicating a growing need for financial modeling services. Over 300 startups have used this service, raising over $505 million in capital.

Whether a visionary founder or an ambitious entrepreneur, a well-crafted financial model is the key to unlocking your startup’s full potential and turning your innovative ideas into tangible success. This article outlines the startup financial model, such as revenue projections, cost structures, cash flow analysis, and scenario planning.

What is the Financial model?

A startup financial model is a tool used in finance that represents an organization’s strategy and goals numerically; this is especially important for startups. It shares and projects data about the company’s income, clients, key performance indicators, expenditures, personnel, and liquid assets.

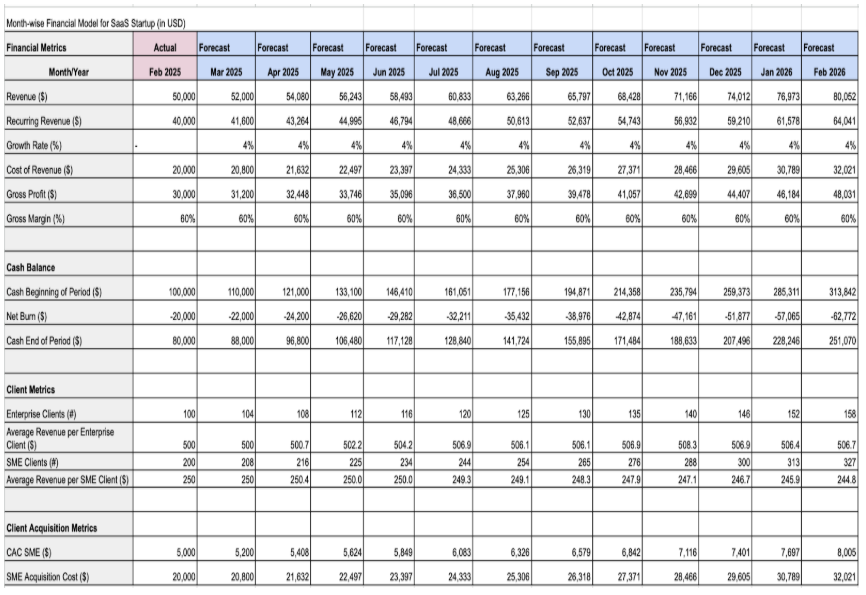

Sample Financial Model For SaaS Startup

In more advanced businesses, this is a budget communicating with departments about expected salaries, significant spending, and overall financial targets.

A startup financial model involves an operating strategy that lays out the startup’s short-term (one to three years) costs and objectives and its long-term (five to ten years) growth potential. The predictions will serve as a means of communication between the company and the VCs when the company is seeking venture capital investment and will also play a significant role in the VCs’ due diligence.

How does the Financial model work?

A financial model in a startup provides a structured framework to forecast and analyze the company’s financial performance over time. It integrates key financial statements—income statement, balance sheet, and cash flow statement—to offer a comprehensive view of the startup’s financial health and future prospects.

It helps make informed decisions about investments, hiring, and resource allocation and identifies potential financial risks and opportunities for improvement. Providing a clear financial roadmap can help attract investors.

Importance of startup financial model

The advantages of financial modeling range from improved decision-making to streamlined compliance as the following:

You may calculate your anticipated financial inflows and expenditures and choose the best possible financing source and amount. Budgets and projections benefit significantly from the use of startup financial models.

Financial modeling aids in projecting future cash flows, using which you can calculate the worth of a company or a project. It is helpful for businesses that are looking to go public, acquire other firms, or raise financing.

Startup financial models’ use of formulae and functions for automating computations allows for rapid results. It shortens the time it takes to weigh potential outcomes and make a choice.

By examining consumer demand, industry trends, and rival activity, you might find new prospects for business development. Startup financial models can aid in optimizing the cost of capital and resource allocation across projects and markets.

Types of Financial Models

Depending on the parameters used, startup financial models of various sorts provide varying outcomes. Here are five of the most prevalent types.

Three-Statement Model

The model forecasts a corporation’s balance sheet, income statement, and cash flow.

- The income statement details a business’s income, expenditures, and profits over a specific period.

- The balance sheet shows the company’s assets, liabilities, and equity.

- The statement of cash flows details the cash received and paid out by a business.

The assertions are related, and any modifications to one will affect the others.

Three-Statement Model Example

A growing software-as-a-service (SaaS) company wants to forecast its financials for the next year (2025), with the following assumptions:

- Revenue Growth: 25% YoY

- Cost of Goods Sold (COGS): 40% of revenue

- Operating Expenses: 30% of revenue

- Depreciation: 10% increase

- Net Profit Margin: 20%

- CapEx: $15M

- Financing Cash Flow: Increase by $5M

Three-Statement Model Calculations: Income Statement:

| 2024 (Base Year) | 2025 (Projected) | Calculation | |

|---|---|---|---|

| Revenue | $100M | $125M (+25%) | $100M × 1.25 = $125M |

| Cost of Goods Sold (COGS) | ($40M) | ($50M) (+25%) | $125M × 40% = $50M |

| Gross Profit | $60M | $75M | $125M - $50M |

| Operating Expenses | ($30M) | ($37.5M) (+25%) | $125M × 30% = $37.5M |

| Depreciation & Amortization | ($5M) | ($5.5M) (+10%) | $5M × 1.1 = $5.5M |

| Operating Profit (EBIT) | $25M | $32M | $75M - $37.5M - $5.5M |

| Interest Expense | ($3M) | ($3.5M) | Increased due to new debt |

| Pre-Tax Profit (EBT) | $22M | $28.5M | $32M - $3.5M |

| Taxes (25%) | ($5.5M) | ($7.125M) | $28.5M × 25% |

| Net Profit | $16.5M | $21.375M | $28.5M - $7.125M |

Balance Sheet:

| Balance Sheet Items | 2024 (Base Year) | 2025 (Projected) | Calculation |

|---|---|---|---|

| Assets | |||

| Cash & Equivalents | $20.0M | $26.375M | $20M + $21.375M (Net Profit) - $15M (CapEx) |

| Accounts Receivable | $15.0M | $18.75M | $15M × 1.25 |

| Inventory | $25.0M | $31.25M | $25M × 1.25 |

| Property, Plant & Equipment (PP&E) | $50.0M | $59.5M | $50M + $15M (CapEx) - $5.5M (Depreciation) |

| Total Assets | $110.0M | $135.875M | |

| Liabilities | |||

| Accounts Payable | $10.0M | $12.5M | $10M × 1.25 |

| Long-Term Debt | $30.0M | $35.0M | $30M + $5M (New Financing) |

| Total Liabilities | $40.0M | $47.5M | |

| Equity | |||

| Retained Earnings | $50.0M | $71.375M | $50M + $21.375M (Net Profit) |

| Common Stock | $20.0M | $17.0M | |

| Total Equity | $70.0M | $88.375M | |

| Total Liabilities + Equity | $110.0M | $135.875M |

Cash Flow Statement:

| 2024 | 2025 (Projected) | Calculation | |

|---|---|---|---|

| Operating Cash Flow (OCF) | $30M | $37.5M (+25%) | $30M × 1.25 |

| Capital Expenditures (CapEx) | ($10M) | ($15M) (+50%) | $10M × 1.5 |

| Financing Cash Flow | ($5M) | $0M (Net $5M increase) | -$5M + $5M |

| Net Cash Flow | $15M | $22.5M (+50%) |

Discounted Cash Flow

This valuation method anticipates future cash flows to determine the company’s worth. Due to the time value of money, projected cash flows go down to their present value in a discounted cash flow analysis. The model requires you to speculate on the company’s future growth, cash flow, and discount rate.

Consider the case where you want to know how much a company is worth before deciding whether or not to invest in it. A discounted cash flow (DCF) model helps estimate the company’s future revenue and calculate its current value after discounting for the passage of time.

Discounted Cash Flow Example

A cloud computing startup wants to estimate its current valuation with the use of Discounted Cash Flow (DCF) model.

- Discount Rate (WACC): 10%

- Growth Rate: 10%

- Terminal Growth Rate: 3%

Free Cash Flow Projections:

| Year | FCF ($M) | PV of FCF ($M) @ 10% Discount | Calculation |

|---|---|---|---|

| 2025 | $10 | $9.09 | $10M ÷ (1.10)^1 |

| 2026 | $12 | $9.92 | $12M ÷ (1.10)^2 |

| 2027 | $14 | $10.52 | $14M ÷ (1.10)^3 |

| Terminal Value | $206 | $154.77 | ($14M × 1.03) ÷ (0.10 - 0.03) ÷ (1.10)^3 |

| Enterprise Value | $184.30M | Sum of PVs |

M&A

This category assesses how mergers and acquisitions affect financial outcomes. It considers the cash flows and values of both the target and acquiring corporations, thus its additional name of the merger model. Financial experts might use it to see whether a merger or acquisition makes good business sense.

M&A Example

A large enterprise software provider TechCo is acquiring a smaller data analytics company DataSolutions, to expand its AI capabilities.

- TechCo Market Value: $500M

- DataSolutions Market Value: $200M

- Expected Synergies: $20M

- EBITDA Post-Merger:

| Metric | TechCo Inc. | DataSolutions Ltd. | Merged Entity | Calculation |

|---|---|---|---|---|

| Market Value | $500M | $200M | $720M | $500M + $200M + $20M |

| EBITDA | $50M | $30M | $100M | $50M + $30M + $20M |

| EV/EBITDA | 10x | 6.7x | 7.2x | $720M ÷ $100M |

The model shows that combining these companies creates financial efficiencies, as evidenced by the improved overall earnings profile.

Option Pricing Structure

You can calculate an option’s fair value using an option pricing model, which gives the option holder the right to acquire or dispose of an underlying asset at a predetermined price. It considers the investment’s cost, volatility, expense, and interest rates. Traders and investors use this model to ascertain a model’s fair worth and make trading choices.

Option Pricing Structure Example

An investor would like to find the fair value of a call option on ABC Inc. utilizing the Black-Scholes Model.

- Stock Price (S): $120

- Strike Price (K): $130

- Time to Expiration (T): 6 months (0.5 years)

- Risk-Free Rate (r): 4% (0.04)

- Volatility (σ): 25% (0.25)

| Variable | Value | Formula |

|---|---|---|

| d1 | -0.251 | [ln(120/130) + (0.04 + (0.25²/2)) × 0.5] ÷ (0.25 × √0.05) |

| d2 | -0.428 | d1 - (0.25 × √0.05) |

| Call Option Price | $5.50 | S × N(d1) - K × e^(-rT) × N(d2) |

This pricing example shows how options can be valued as insurance policies against price movements, with the premium reflecting the probability and magnitude of potential outcomes.

Initial Public Offering

This methodology calculates the intrinsic value of a company’s stock upon its first public offering. The company’s finances, development opportunities, and market circumstances are all considered. It’s a helpful tool for underwriters and investors in establishing the first share price.

Initial Public Offering Example

A digital banking startup is preparing for an IPO and wants to determine its initial share price.

- Revenue: $200M

- Industry Price-to-Sales (P/S) Ratio: 8x

- Shares Issued: 50M

| Metric | Value | Formula |

|---|---|---|

| IPO Valuation | $1.6B | $200M × 8x |

| IPO Price per Share | $32 | $1.6B / 50M |

At this valuation, assuming all shares are new (primary offering), the company would raise approximately $1.6 billion, which has significant implications for its growth strategy and operations.

Expert Tips To Develop a suitable Financial Model for your startup?

The revenue and spending forecasts and the net cash position are the three main components of a business plan that investors and seasoned entrepreneurs want to see.

While some financial plan examples include all three primary financial statements (income statement, cash flow statement, and balance sheet), most instances only include the income statement and a cash flow forecast.

Choosing the Right Financial Model Template

When selecting a financial model template, startups should consider Industry-specific factors, which will allow for more precise forecasting and better decision-making. Pre-built templates provide time savings, defined frameworks, and precise analysis per conventional practices. modeling.

Fine-Tuning Revenue Projections

You can refine revenue predictions by modifying estimations based on market research and consumer feedback. Accurate forecasts must identify primary revenue drivers, including product demand or client segmentation.

Since overestimation may lead to wrong methods and underestimation can restrict development, it’s crucial to establish goals for increasing income that are both reasonable and attainable. Finding that sweet spot improves planning and decision-making credibility.

Optimizing Cost Assumptions

Determining what percentage of expenses are constant vs. what percentage are variable is essential for keeping expenditures in line with sales volume. This specificity allows for a more accurate cost estimate. Refining budget estimates relies heavily on benchmarking against industry norms and competition studies.

Involve people from other departments to get more accurate cost estimates. Adjust your predictions regularly for shifting market circumstances, new technologies, and internal improvements. Examining past information for regularities and tendencies can show how costs have behaved.

Sensitivity Analysis and Scenario Planning

When new companies adopt the following procedures, they gain the capacity to respond to change and make educated choices in the face of uncertainty.

- Analyzing Uncertainty – Conducting a sensitivity analysis and carrying out scenario planning are two of the most critical techniques to use when attempting to evaluate the impact that uncertainties have on financial estimates.

- Preparing for Competitive Conditions – “What-if” assessments assist startups in preparing for several market situations, allowing for the development of proactive strategies.

- Identifying Critical Variables – To be well-prepared for whatever the market throws at them, companies might benefit from doing “what-if” assessments, which simulate alternative futures based on current conditions.

Cash Flow Management and Runway Extension

Startups may prolong their financial runway by cutting costs, improving their cash flow, and growing revenue. These methods help new businesses better deal with their risks and financial difficulties.

For a company to maintain financial stability, exploit opportunities, and reduce risks while pursuing sustainable development, it must have high-quality cash flow management, the ability to extend its runway, and contingency plans.

Involving the Entire Team

To take a comprehensive approach to financial planning, you must get everyone on the team involved. The departments should all work together to provide an accurate startup financial model. Their unique perspectives help us comprehend business dynamics and make more accurate predictions.

Consistent reporting on financial status and open communication among team members promote openness and accountability by aligning plans and objectives. Aligning everyone improves decision-making, coordinates activities, and makes the organization more resilient to change in pursuit of long-term success.

Seeking Professional Advice and Mentorship

Businesses in the early stages of development might greatly benefit from consulting with seasoned professionals in finance and industry. Their observations shed light on the advantages and disadvantages of various financial approaches.

Seeking professional advice and mentorship can enhance a startup’s financial modeling and forecasting capabilities. Mentors can help startups understand financial concepts, which is essential for accurate cash flow projections.

Need help with your Financial Modeling?

Financial modeling is a potent resource for businesses. It’s helpful for strategic planning, budgeting, and managing risks. Investors and other stakeholders may make better decisions to maximize profits and limit risks if startup financial models are accurate and robust.

Eqvista’s financial modeling offers features like waterfall analysis and round modeling to help founders and investors. With Eqvista, you can forecast financial performance, manage share dilution, and plan exit strategies. Get started with Eqvista today —book a call with us now to explore how our tools can transform your business strategy!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!