What are the main benefits of early exercising stock options?

If the company’s stock price will rise substantially, letting employees exercise their options early can be a huge benefit.

Early exercise allows employees to purchase their stock options before vesting date, provided their employer’s plan permits it, and the board has approved such provisions.

While early exercise can provide tax advantages and allow participation in company growth from an earlier date, it also involves significant risks, including paying cash upfront for unvested shares that may be subject to company repurchase rights.

This article examines how exercising stock options early can offer tax benefits, maximize potential financial gains, and align personal and company interests while also highlighting the associated risks and the importance of careful planning.

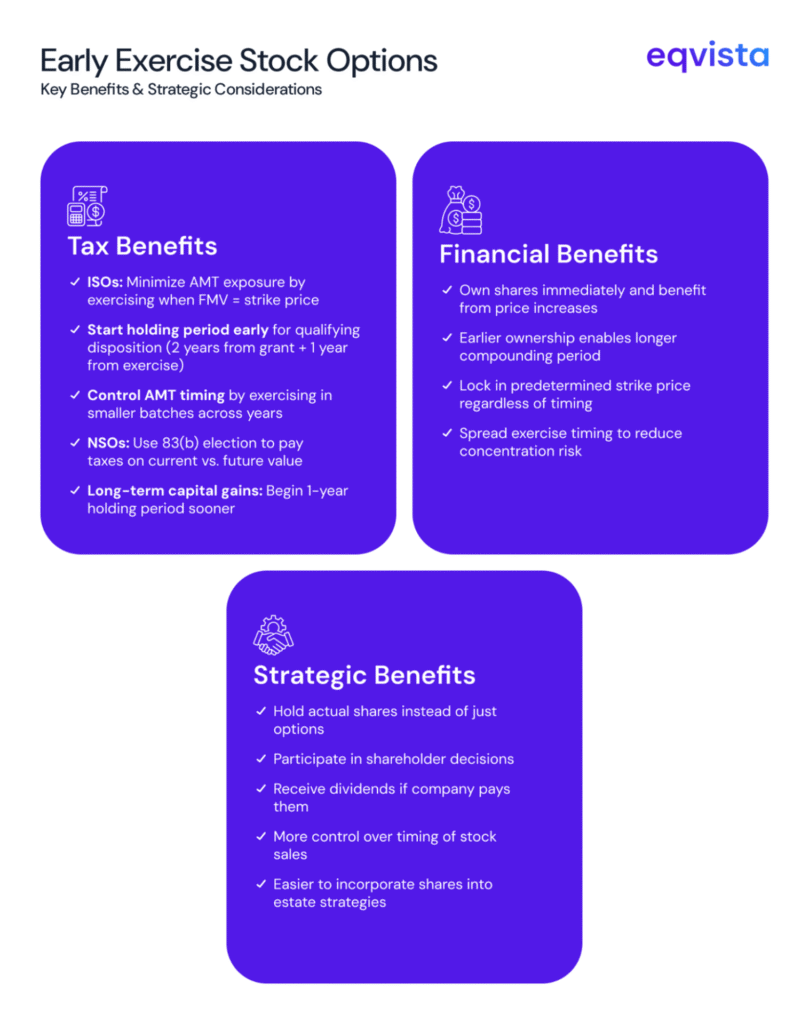

Main Benefits of Early Exercising Stock Options

If the company’s stock price will rise substantially, letting employees exercise their options early can be a huge benefit. There are other significant benefits of early exercising stock options.

Tax Advantages

One of the most important benefits of early exercising stock options is the tax advantage. ISOs (Incentive Stock Options) can be more tax-friendly than NSOs (Non-Qualified Stock Options).

When exercising ISOs, the bargain element (the difference between the exercise price and stock market value) does not have to be included in the income of a taxable year, which is relevant for regular taxation. This implies that exercising ISOs will not incur income tax liability unless the stock value exercise price exceeds the market rate.

Nevertheless, this practice may also have adverse tax consequences, such as triggering AMT. This is because the bargain element is characterized as AMT income, and, e.g., with deferred compensation, a plan distributes a maximum amount every year. Therefore, you can plan ahead in the year and decide how many ISOs to exercise to reduce the AMT effects.

If you exercise 2,500 ISO options when the FMV is $2 and exercise price is $1, you won’t owe ordinary income tax at the time of exercise. However, the $2,500 bargain element (2,500 × ($2-$1)) must be included in your AMT calculation. If you exercise when FMV equals the exercise price, there’s no bargain element, so no AMT or ordinary income tax impact.

With NSOs, if there’s no bargain element (FMV equals exercise price), there’s no tax at exercise. However, if a bargain element exists, it’s taxed as ordinary income at your highest tax bracket.

For example, exercising 2,500 NSOs when FMV is $2 and exercise price is $1 creates a $2,500 bargain element taxed as ordinary income.

Note: The 83(b) election only applies if you EARLY EXERCISE NSOs before they vest. For regular NSO exercises after vesting, no 83(b) election is needed or applicable.

Financial Gains

Let us discuss the benefits of early exercising a share option.

- Lock in exercise price – Early exercise allows you to purchase shares at the fixed exercise price before potential stock price increases, though you pay the same exercise price regardless of timing.

- Higher potential gain – If the stock appreciates after early exercise, you benefit from the full appreciation above your exercise price.

- Extended holding period – The early exercise starts the holding period clock earlier, helping you qualify for long-term capital gains rates sooner (1 year for NSOs, 2 years from grant + 1 year from exercise for ISOs).

Reduced Risk of Stock Price Increase

By early exercising your stock options, you could address the risk of an increase in future stock prices in several ways.

- Fixed exercise cost – Your exercise price is fixed regardless of timing, but early exercise allows you to start benefiting from stock appreciation immediately

- Capture full appreciation – By exercising early, you own the shares and benefit from any price appreciation from the exercise date forward.

- Avoid missing gains – If you wait to exercise and the stock appreciates significantly, you miss out on those gains during the waiting period.

Alignment with Company Growth

Early exercising of stock options is one way to establish alignment between employees and the organization’s goal. Employees who hold actual shares rather than options feel further connected to the corporation.

Thus, a sense of financial ownership can increase the level of effort and work loyalty. Since their financial growth is at stake, employees will be more committed and ensure cross-sectional strategies that enhance the firm’s profitability.

Note – Not everyone has the same advantages of exercising early. That depends on one’s readiness to take on risks and present financial status. In most cases, companies that permit early exercise of the option provide education and encourage people to make decisions.

Mitigating Alternative Minimum Tax (AMT) for ISOs

There’s a chance that you could become liable to Alternative Minimum Tax (AMT).

A larger bargain element means a bigger AMT bill. Some people avoid exercising ISOs because of this tax, but that’s not always the best strategy. if you wait to exercise, you might be subject to a higher AMT when the stock price increases.

Here’s an example:

If you exercise and hold shares from 8000 ISOs with a grant price of $2 and a current market price of $40, your bargain element would be:

Bargain element / AMT Income = (Market Price – Grant Price) X Number of Shares

($40 – $2) x 8,000 = $304,000

Assuming an AMT exemption of $88,100,

Taxable AMT income = AMT Income ($304,000) – AMT Exemption ($88,100) = $215,900

Assuming a flat 26% AMT, you will owe:

AMT = Taxable AMT income x Tax Rate

$215,900 x 26% = $56,134

The amount of AMT you owe will be $56,134 when you file your tax return in April of the following year. Given this staggering figure, it’s easy to understand why many people choose not to exercise: the tax implications would be too much to bear specially if the bargain element is higher.

As a result, it could be beneficial to start exercising at the beginning of the calendar year.

Why should you choose Eqvista’s Tax and Equity Services?

Eqvista’s Tax and Equity Consultation Services help founders, employees, and investors manage their equity and taxes effectively. Here’s why you might consider choosing Eqvista:

- Comprehensive Tax Planning – Eqvista’s qualified tax professionals deal with concerns such as Qualified Small Business Stock (QSBS) and early exercise, and issues pertaining to stock options such as vesting. We explain to you applicable tax aspects of equity types, such as RSUs, RSAs, ISOs, NSOs, and phantom stock options. We help you understand AMT tax management and identify short-term and long term developments.

- Equity Management Solutions – At Eqvista, our all-in-one platform for financial management offers cap table management, valuation services, 409A compliance, and simplified IRS filings. This systematic way makes sure no mismatches happen between your equity management and your records.

- Personalized Advisory Services – Eqvista takes a customized approach to each client. Before making any changes we always conduct the assessment of the client’s existing situation in terms of tax and equity. Post-analysis, we offer a strategy to improve the financial status.

More than 15,000 organizations have succeeded with Eqvista’s services in simplifying equity-related operations and managing tax complications. Through Eqvista’s equity tax planning, they’ve saved an average of $5,000+.

Frequently Asked Questions (FAQs)

What is an early exercise of stock options?

If your employer permits early exercise of stock options, you can cash in on your shares before they officially vest. Only a few businesses allow employees to exercise their equity early to promote future tax savings.

How does the 83(b) election work?

The IRS 83(b) Election, if applicable, should be filed within 30 days from the date of the early exercise. This determines your purchase date and taxable value of the asset. That way, you can ensure that your exercise remains tax-efficient and that your asset will hopefully qualify for capital gains treatment in the future.

What are the risks of early exercising stock options?

As with any investing technique, exercising stock options before their expiration date has potential downsides. The exercise of stock options does not necessarily imply an increase in stock value. After exercising your options, you can incur a loss if the stock price drops.

How can I determine if early exercise is right for me?

Decisions regarding early stock option exercise are ultimately up to individual choices, tax and financial circumstances, and risk tolerance. However, you should also consider the terms of your options agreement and the options available to you. The best way to determine if early exercise is right is to consult a tax expert.

Get Expert Consultation From Eqvista!

Early exercising stock options can be smart, but it’s not always simple. You might save on taxes, make more money if the company does well, and feel more connected to your company’s success. Plus, you can lock in a lower stock price and avoid some tricky tax situations.

However, it can get complicated fast. That’s where Eqvista’s Tax and Equity Consultation Services become helpful and maximize the benefits of early exercising stock options. Our team of accredited advisors can help you develop a personalized strategy for early exercise, considering your financial situation and goals.

We can guide you through complex processes like 83(b) elections and help you understand the tax implications of your decisions. Contact Eqvista today for a consultation and start making informed decisions about your stock options.

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!