Role of Market volatility in the valuation of startups

This article explains why market volatility can reduce startup valuations.

The CBOE Volatility Index (VIX), a measure of market volatility, has recorded some of its highest figures when lockdowns were first enforced in response to COVID-19 and during the Great Financial Crisis of 2008. Rise in this figure often indicates uncertainty regarding the future of businesses, increased investor fear, and potential drops in valuations.

This article explains why market volatility can reduce startup valuations and this could be particularly valuable for entrepreneurs seeking funding, investors evaluating opportunities in uncertain times, and those who need to understand how market conditions influence early-stage company valuations. Read on to learn more!

How does market volatility directly impact startup valuations?

High market volatility can cause inaccurate results in the market-based valuation approach. We primarily use this approach to align startup valuations with current trends; however, if high volatility is one of the trends, the valuations we compute will vary greatly depending on when they were performed.

In this approach, a common method is to find a comparable public company and use its financial multiples to find a startup’s value. If we cannot find a comparable public company, we must compile the valuations and key financial information of similar startups that were involved in mergers and acquisitions, funding rounds, or ones that published their financial performance. Then, we can estimate a market valuation multiple and apply it to find the startup’s value.

Let us see how high volatility can cause high variations in startup valuations by using both these commonly used market-based approach methods. In this example, we shall attempt valuing Beleza Workweek, an enterprise software startup, using the financial multiples of Felicitas Solutions as well as the market valuation multiple established using certain similar companies.

Felicitas Solutions’ financial multiples are as follows.

| Metrics | 28/02/2025 | 21/02/2025 | 14/02/2025 | 07/02/2025 | 31/01/2025 |

|---|---|---|---|---|---|

| Market capitalization (A) | $26,000,000 | $31,200,000 | $23,400,000 | $32,760,000 | $36,691,200 |

| Debt (B) | $1,000,000 | $1,000,000 | $1,000,000 | $1,000,000 | $1,000,000 |

| Cash (C) | $300,000 | $300,000 | $300,000 | $300,000 | $300,000 |

| Enterprise value (D = A +B - C) | $26,700,000 | $31,900,000 | $24,100,000 | $33,460,000 | $37,391,200 |

| Earnings (TTM) (E) | $1,200,000 | $1,200,000 | $1,200,000 | $1,200,000 | $1,200,000 |

| Recurring revenue (TTM) (F = E X 75%) | $900,000 | $900,000 | $900,000 | $900,000 | $900,000 |

| Price-to-recurring revenue (P/RR) (G = A/F) | 28.89 | 34.67 | 26 | 36.4 | 40.77 |

| EV-to-recurring revenue ratio (EV/RR) (H = D/F) | 29.67 | 35.44 | 26.78 | 37.18 | 41.55 |

Note: Price-to-recurring revenue ratio and EV-to-recurring revenue ratio are metrics constructed for this example to more accurately value an enterprise software company.

Now, let us calculate Beleza Workweek’s valuation using the P/RR and EV/RR ratios assuming that its own recurring revenue is $700,000.

| Valuation as per… | 28/02/2025 | 21/02/2025 | 14/02/2025 | 07/02/2025 | 31/01/2025 |

|---|---|---|---|---|---|

| P/RR | $20,222,222.22 | $24,266,666.67 | $18,200,000.00 | $25,480,000.00 | $28,537,600.00 |

| EV/RR | $20,766,666.67 | $24,811,111.11 | $18,744,444.44 | $26,024,444.44 | $29,082,044.44 |

Over the last month, due to market volatility, Felicitas Solutions’ market capitalization ranged from $23.40 million to $32.76 million. As a result, depending on when the valuation was performed, Beleza Workweek’s valuation could range anywhere between $18.20 million to $28.54 million, as per the P/RR multiple.

Observing the impact of market volatility via the market valuation multiple method would be slightly challenging in real-life since it requires performing extensive research into private entities at different points in time. To simulate reality as closely as possible, we will calculate the market valuation multiple with three different sets of companies that will be assumed to have had a liquidity event this month, the previous month, and in the month prior to that.

| February | January | December | ||||||

|---|---|---|---|---|---|---|---|---|

| Company name | Recurring revenue | Valuation | Company name | Recurring revenue | Valuation | Company name | Recurring revenue | Valuation |

| CloudCore Solutions | $500,000 | $6,500,000 | NovaByte Solutions | $400,000 | $3,500,000 | AegisCloud | $1,000,000 | $20,000,000 |

| NexaSoft Systems | $600,000 | $8,400,000 | AgileMind Technologies | $1,000,000 | $3,600,000 | SageSync Solutions | $700,000 | $11,900,000 |

| QuantumEdge Technologies | $600,000 | $7,800,000 | CoreVista Systems | $600,000 | $5,400,000 | InfiniCore Technologies | $900,000 | $18,000,000 |

| StratosSphere Software | $500,000 | $7,000,000 | SkyBridge Software | $1,000,000 | $4,500,000 | NimbleOps Software | $1,000,000 | $18,000,000 |

| ZenithFlow | $800,000 | $9,600,000 | ArdentFlow Technologies | $900,000 | $4,800,000 | AlphaLink Systems | $500,000 | $9,000,000 |

| HyperSync Solutions | $500,000 | $5,000,000 | SummitEdge Solutions | $600,000 | $4,000,000 | TitanX Software | $600,000 | $10,800,000 |

| FusionGrid Technologies | $500,000 | $5,500,000 | NeuralPath Systems | $600,000 | $3,500,000 | ScaleUp Technologies | $1,000,000 | $15,000,000 |

| OmniLogic Systems | $700,000 | $7,000,000 | OptimaWare | $1,000,000 | $7,000,000 | BlueHorizon Systems | $900,000 | $15,300,000 |

| VertexWare | $400,000 | $4,800,000 | CloudCrest Software | $900,000 | $2,800,000 | VortexLogic | $700,000 | $11,200,000 |

| ElevateSoft | $900,000 | $11,700,000 | SynapseLogic Technologies | $700,000 | $9,000,000 | EverNova Software | $1,000,000 | $18,000,000 |

| Total | $6,000,000 | $73,300,000 | Total | $7,700,000 | $48,100,000 | Total | $8,300,000 | $147,200,000 |

| Market valuation multiple | 12.22 | Market valuation multiple | 6.25 | Market valuation multiple | 17.73 | |||

| Beleza Workweek's valuation | $8,551,666.67 | Beleza Workweek's valuation | $4,372,727.27 | Beleza Workweek's valuation | $12,414,457.83 |

Thus, market volatility would result in the market valuation multiple ranging from 6.25 to 17.73 and consequently, Beleza Workweek’s valuation will range from $4.37 million to $12.41 million.

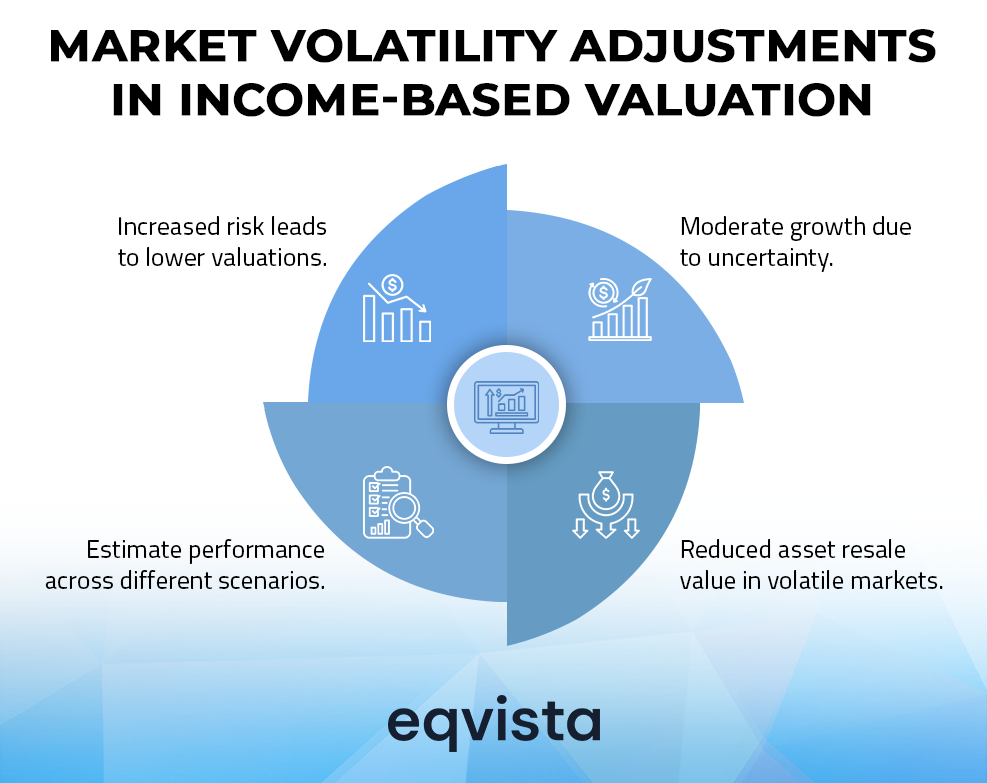

What kind of adjustments does market volatility warrant in the income-based approach?

In periods of high market volatility, some adjustments you may need to make to discounted cash flow (DCF) models or any other method coming under the income-based valuation approach are as follows:

High discount rate

The discount rate is a function of the risk-free rate and the expected compensation for the perceived risk in an investment. In volatile markets, since the risk is also high, investors will ask for a higher compensation. This is the primary reason why valuations tend to fall in volatile markets. In the sub-sections that follow, it will become clearer as to why volatile markets increase risks for investors.

Scenario analysis

Market volatility is often the result of phenomena such as major supply shocks, macroeconomic uncertainty, and industry-wide disruptions. Basically, uncertainty in a factor that we would normally assume to remain constant often causes market volatility.

To get more accurate results, you must identify the key drivers of volatility and their potential future values. Based on this, you will need to estimate your startup’s financial performance in different scenarios. Then, if possible, you should calculate the probability-weighted average valuation in all scenarios to account for market volatility.

Conservative growth projections

In volatile markets, planning and executing strategies that aggressively pursue growth can be challenging simply because accurate and precise predictions are difficult to make. There would be a wide range of possibilities for customer demand and preference trends, raw material prices, and technological advancements. As a result, companies must apply generalized strategies which can also lead to a moderate amount of growth.

Lower terminal value

The resale value of any assets and the market price of any intellectual property amassed by the conclusion of the expected lifecycle will be low when markets are volatile. If the factors causing market volatility persist, the value of such assets will decline faster than in normal conditions.

After all, such assets cannot be expected to create value years later in a market where commercial viability is declining. Hence, businesses will struggle to recover significant value from asset liquidation or IP sales at the end of their lifecycle and thus, we must assume a low terminal value.

Eqvista – Deciphering value, unlocking growth!

Volatile markets can be an effective opportunity to pull ahead of competitors if a startup’s founders make sound decisions that result in lower burn rates, higher customer retention, higher employee retention, and business models that can flexibly adapt to price variations.

From an investor’s perspective, identifying the right opportunity in volatile markets requires insights into macroeconomic trends, industry resilience, company fundamentals, risk-reward tradeoffs, and cash flow stability. Eqvista’s comprehensive and detailed valuation reports can supplement investment decision-making by deciphering business valuations in even the most treacherous markets. Contact us to learn more!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!