How to calculate capital gain tax on shares in India?

This article will discuss the capital gain tax rate implications of shares in India and how to calculate them.

Salary, rental, and business earnings are all subject to taxation, as most of us are well aware. But what about the money you make when you sell or buy stock? People who work from home and retirees who buy and sell stocks are often confused about how their earnings are taxed. Profit/loss derived from the sale of equity shares falls under the category of “Capital Gain”. This article will discuss the capital gain tax rate implications of shares and how to calculate them.

Capital Gain Tax on Shares in India

A number of factors influence the capital gain tax rate consequences of stock investments, including the type of stock (listed or unlisted) and the length of time that the stockholder has owned it. There are long-term gains and short-term gains associated with stock market investments listed on any of India’s well-known stock exchanges.

Overview on Capital Gain Tax in India

Equity shares, mutual funds, debt instruments, and derivative instruments all form an important part of most investors’ investment portfolios. These investments generate two types of income: dividends or interest income and capital gains or profit when the securities are sold or repurchased.

Hindu Undivided Families (HUF) and individuals in India are taxed at different rates, ranging from zero to 42.7% depending on your income level, with slabs of 5%, 10%, 15%, 20%, 25%, and 30%. Surcharge and cess are also applied to these rates. As a result, it is critical to have a firm grasp of the capital gain tax rate for shares in India.

How does capital gain taxation work?

According to the 2018 Union Budget India CGT rates, the long-term capital gain (LTCG) on the sale of listed securities above Rs. 1 lakh is taxed at 10% and the short-term capital gain (STCG) at 15%. In addition, debt mutual funds are taxed on both long-term and short-term capital gains. The STCGs on debt mutual funds are taxed at the individual’s IT slab rate, whereas the LTCGs on debt mutual funds are taxed at 20% with indexation and 10% without indexation. Indexation can be defined as the adjustment of the purchase price to take inflation into account. Inflation increases the cost of goods and decreases profits as the indexation declines.

Types of capital gain tax

Shareholders can make short-term and long-term capital gains, depending on the value of their investments. LTCG and STCG are discussed in greater detail below, as well as the tax consequences of these gains.

Long term capital gain tax

Investment options that have been held for more than a year at the time of the asset’s sale are eligible for long-term capital gains. It is based on the difference between the sale and purchase prices of assets that have been owned for more than a year. In other words, this profit is the net profit that investors receive when selling this asset.

Listing equity shares are included in qualifying investment options that generate long-term capital gain (LTCG) over a period of 12 months. To be considered a long-term capital asset, an unlisted equity share must have a holding period of at least 24 to 36 months.

Short term capital gain tax

A capital gain is a profit realized through the sale, transfer, or disposition of an investment property or asset. The profit generated from the sale of these properties is referred to as short-term capital gain if the holding period is less than 12 months (in some cases 36 or 24 months).

Short-term investment in equity shares is defined as a period of less than 12 months (or 36 months) in duration. To calculate short-term capital gains, the difference between a share’s purchase price and its sale value is known as its basis. To understand the tax consequences of a share’s gains, it’s important to calculate them.

Implications of Capital gain tax for STCG AND LTCG

People who make short-term capital gains are taxed at 15% under Section 111A of the Income Tax Act, 1961. Long-term capital gains are not taxed up to INR 100,000. The income tax on long-term capital gains over INR 100,000 is 10%, without the benefit of inflation. Section 112A says that the tax rate for long-term capital gains over INR 100,000 is 10%.

On investments made before January 31, 2018, long-term capital gains that accrue before that date are not taxed. This is called “grandfathering”, which means that the investor doesn’t have to pay tax on long-term gains until January 31, 2018. The reason for the grandfathering benefit is that long-term capital gains on the sale of listed securities were tax-free until January 31, 2018. This is why the grandfathering benefit is still in place.

For example, if an individual bought shares on the stock exchange for INR 100 per share in 2016, the price was INR 160 per share on January 31, 2018. If the individual sells the shares for INR 200 on the stock exchange, he will pay long-term capital gains tax on INR 40 (INR 200 – INR 160), even though his actual profit is INR 100.

Calculation of capital gain tax in India

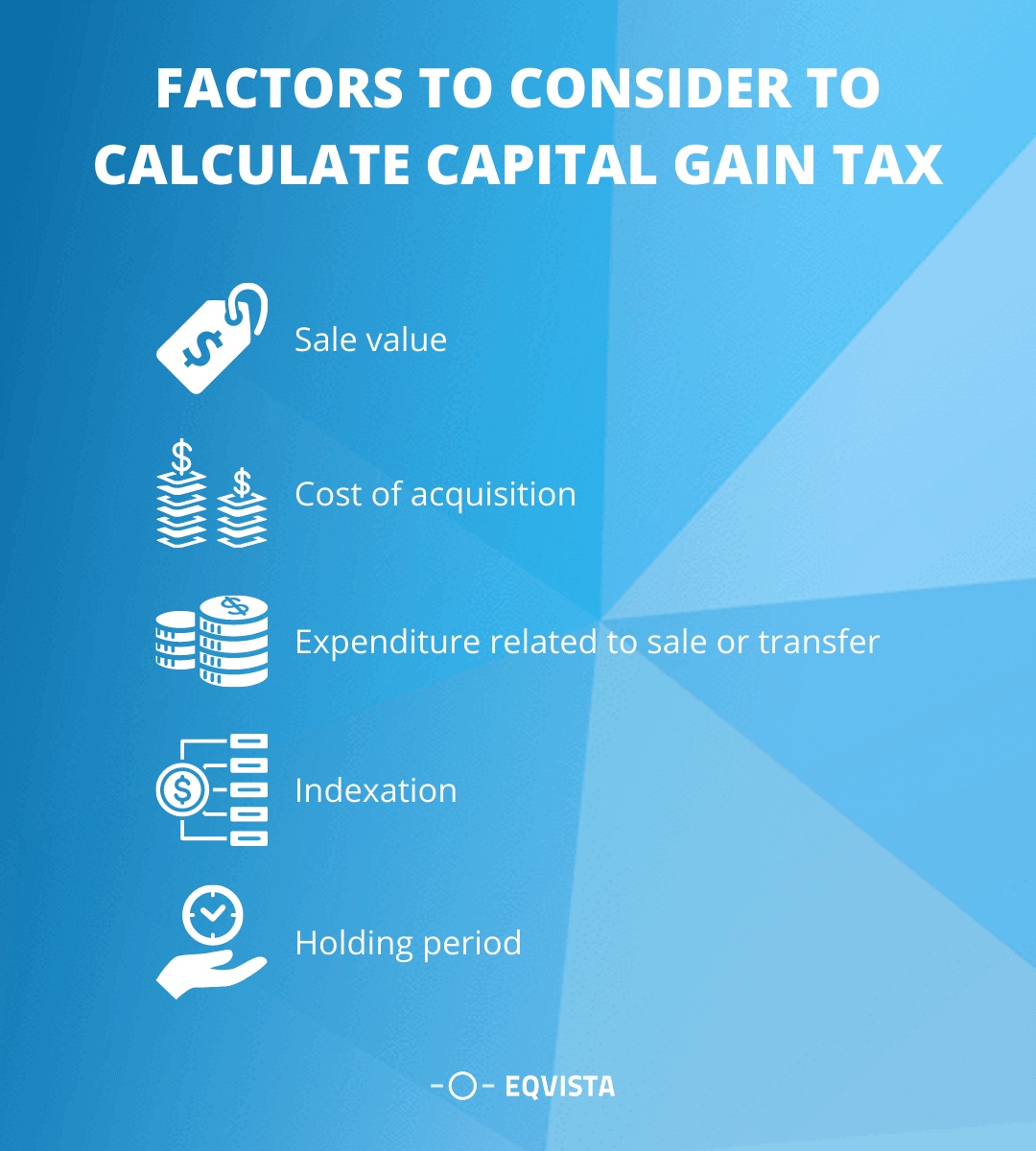

The CST implication and capital gain tax allowance of stock investments are influenced by various factors that are listed below depending upon how long they were held.

Factors to consider to calculate capital gain tax

It is important to know the following terms before learning how to calculate CGT on short-term and long-term capital gains.

Sale value

The amount an assessee receives on the sale of an asset is known as the consideration or sale value. Selling price is used to determine the asset’s value when it’s an equity share.

Cost of acquisition

The following steps are used to calculate the cost acquisition for equity shares purchased prior to February 1, 2018:

- As of January 31, 2018, the fair market value of an investment is the sum of the number of shares bought and their highest price.

- The investment value that is less than or equal to the fair market value is chosen.

- Finally, the share value is compared to the price at which it was bought, and the higher value between them is chosen. This value is how much it costs to buy the thing.

It considered the highest value of the shares that were not traded that day to figure out how much they should be worth.

Expenditure related to sale or transfer

In the course of transferring or selling an asset, one may have to pay for things like registration, brokerage, and other related fees and costs. To calculate STCG and LTCG, if securities transaction tax (STT) is levied on the sale of equity shares, these charges on STT are not included in the computations.

In addition to these, calculating capital gains necessitates familiarity with indexation and asset holding periods. The length of time an investor intends to keep an asset under his or her control is referred to as the “holding period”. Asset acquisition to asset sale dates is included in this calculation.

On the other hand, indexation is the process by which prices are updated to reflect changes in the market inflation rate. Because of this, short-term and long-term capital gains on stocks cannot be calculated using this method.

Indexation

To ensure that long-term capital gains are calculated using the current value of money, indexation incorporates the time value of money (adjusted for inflation) into the calculation of LTCG on shares. It is based on the Cost Inflation Index (CII), with 2001 as the base year used for all indexation purposes.

Holding period

The holding period is determined by the number of months in which the assessee held equity shares. When an asset is purchased, this period begins and ends on the day prior to the transfer of equity.

How to calculate capital gain tax

The STCG and LTCG on shares can be calculated with the help of the following capital gain tax rate calculator formula:

Short term capital gain tax on shares

The following formula can be used to calculate STCG on shares:

The cost of asset improvement is not relevant when calculating short-term capital gains on equity shares. On the other hand, investors should familiarize themselves with the formula above’s additional parameters before calculating their capital gains.

Example of calculation

In December 2017, Mr. Sunil purchased 500 listed equity shares at a price of INR 100 per share and paid INR. 50,000 for them. Following that, he sold the shares for INR 150 per share in May 2018 and made a profit of INR 75,000 after five months. At the time of the transfer of the shares, INR 225 was charged in Brokerage fees at 0.5%.

| Sale value | INR 75,000 |

| (-) Cost of asset acquisition | INR 50,000 |

| (-) Cost of asset improvement | - |

| (-) Expenses incurred in course of sale or transfer of assets | INR 225 |

| Short term capital gains | INR 24,775 |

Sunil’s short-term capital gain from the sale of equity shares is INR 24,775.

Long term capital tax on shares

Following is a standard formula for calculating long-term capital gains under the 1961 Income Tax Act.

Example of calculation

An equity share is purchased for INR 300 on January 1st, 2018, and its fair market value is INR 500 on January 31st, 2019, and the share is sold for INR 750 on April 1st, 2019, following is the LTCG calculation for this share.

On January 31st, 2019, fair market value will be considered the asset’s acquisition cost because the actual acquisition cost was less than the fair market value.

In this case, the long-term capital gain will be INR (750-500) = INR 250. (without considering the other factors like cost of asset improvement, expenses from sale and transfer, etc.)

| Sale Value | INR 750 |

| (-) Indexed cost of acquisition of an asset | INR 500 |

| (-) Indexed cost of asset improvement | - |

| (-) Expenses incurred concerning transfers or sale | - |

| Long term capital gain | INR 250 |

Keep track of your shares and equity with Eqvista!

Investing wisely is essential to both preserving CGT and increasing your wealth. Eqvista can help you with your investment goal, time horizon, risk-reward analysis, and risk-averseness, liquidity, tax incidence, and value buying all play a role in determining which investment instrument is best for you when it comes to investing in publicly traded securities. Contact us for more information on how to manage your equity with us.

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!