The Global Unicorn Landscape in 2025

Long ago, billion-dollar startups were scarce; they deserved their magical nickname: unicorns. Today, these powerful private companies have multiplied across the global economy, transforming from rare curiosities into formidable herds that reshape entire industries.

With more than 1,550 unicorns worldwide in 2025, their distribution tells us a compelling story about where innovation thrives, how capital flows, and which nations are positioning themselves as leaders in the digital age.

As we analyze the unicorns worldwide in 2025, distinct patterns emerge that reveal the state of global innovation, investment trends, and the shifting balance of entrepreneurial power.

Country-by-Country Insights

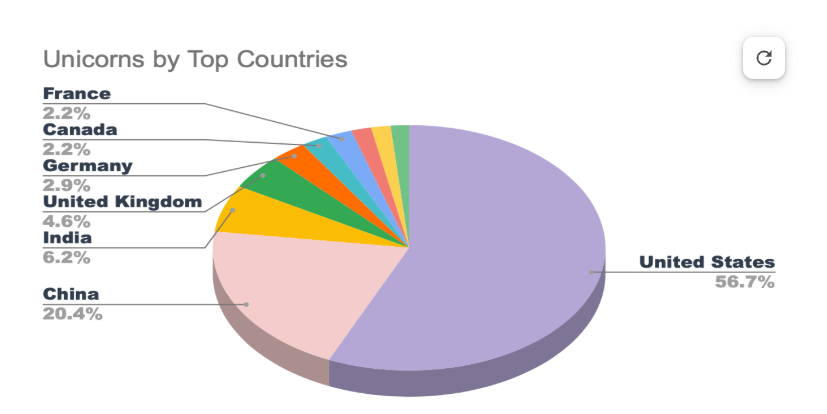

The global distribution of unicorn companies remains heavily concentrated in a handful of countries. Our analysis reveals that out of the 1,550+ unicorn companies identified globally in 2025, almost half can be found in a single country: the United States. The unicorn phenomenon-private startups valued at $1 billion or more continues to reshape the global business landscape in 2025.

| Country | Count of Unicorns |

|---|---|

| United States | 780 |

| China | 281 |

| India | 86 |

| United Kingdom | 64 |

| Germany | 38 |

| France | 30 |

| Canada | 29 |

| Israel | 24 |

| Singapore | 22 |

| South Korea | 21 |

| Brazil | 20 |

| Japan | 16 |

| Australia | 12 |

| Hong Kong | 10 |

| Indonesia | 10 |

| Ireland | 10 |

| Mexico | 10 |

| Switzerland | 9 |

| The Netherlands | 9 |

| Sweden | 8 |

| Norway | 5 |

| Spain | 5 |

| Vietnam | 5 |

| Finland | 4 |

| United Arab Emirates | 4 |

| Belgium | 3 |

| Chile | 3 |

| Italy | 3 |

| Philippines | 3 |

| Thailand | 3 |

| Austria | 2 |

| Cayman Islands | 2 |

| Colombia | 2 |

| Denmark | 2 |

| Estonia | 2 |

| Lithuania | 2 |

| Nigeria | 2 |

| Saudi Arabia | 2 |

| Seychelles | 2 |

| Turkey | 2 |

| Argentina | 1 |

| Bermuda | 1 |

| Croatia | 1 |

| Czech Republic | 1 |

| Ecuador | 1 |

| Egypt | 1 |

| Greece | 1 |

| Liechtenstein | 1 |

| Luxembourg | 1 |

| Malaysia | 1 |

| Malta | 1 |

| Poland | 1 |

| Portugal | 1 |

| Senegal | 1 |

| South Africa | 1 |

| Taiwan | 1 |

| Uzbekistan | 1 |

Top 10 Countries by Unicorn Count

The United States maintains its historical dominance with 783 unicorns, followed by China with 282. Together, these two innovation powerhouses host nearly 77% of the world’s billion-dollar startups. The remaining positions in the top 10 are held by a mix of Asian, European, and North American nations:

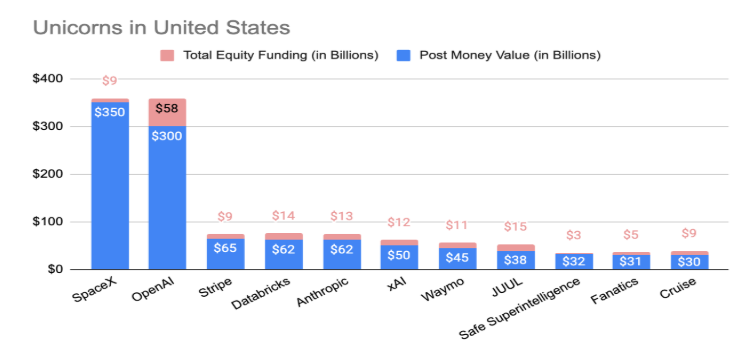

United States: The Future of Unicorns

The United States remains the world leader in the number of unicorns, with hundreds of private companies valued at $1 billion or more. U.S. unicorns account for roughly half of all unicorns globally, reflecting the country’s mature venture capital ecosystem, deep talent pool, and robust startup infrastructure.

| Company | Valuation ($B) | Total Equity Funding | Sector |

|---|---|---|---|

| SpaceX | $350B | $9B | Aerospace |

| OpenAI | $300B | $58B | Artificial Intelligence |

| Stripe | $65B | $9B | Fintech |

| Databricks | $62B | $14B | Data Analytics |

| Anthropic | $62B | $13B | Artificial Intelligence |

| xAI | $50B | $12B | Artificial Intelligence |

| Waymo | $45B | $11B | Artificial Intelligence |

| JUUL | $38B | $15B | B2C |

| Safe Superintelligence | $32B | $3B | Artificial Intelligence |

| Fanatics | $31B | $5B | eSports, Manufacturing |

| Cruise | $30B | $9B | Automotive, Artificial Intelligence |

U.S. unicorns typically raise larger funding rounds than their counterparts in other countries, often exceeding $1 billion in total equity funding. Many U.S. unicorns reach high valuations quickly, reflecting aggressive scaling and investor confidence.

The United States continues to set the pace for global unicorn creation in 2025, with leadership in fintech, AI, SaaS, and deep tech. U.S. unicorns benefit from unparalleled access to capital, talent, and innovation ecosystems, ensuring their dominance for the foreseeable future.

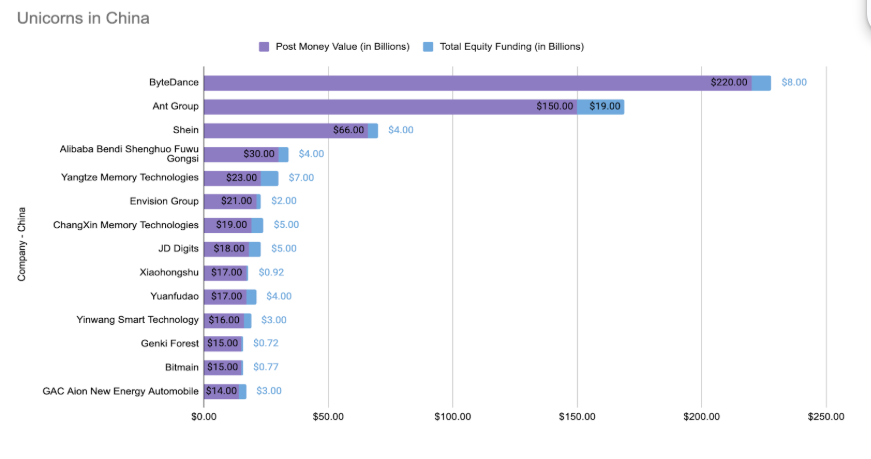

China: The Undisputed Unicorn Powerhouse

China remains the world’s dominant unicorn hub, home to the planet’s most valuable private companies. ByteDance, the parent of TikTok, towers above all with a staggering $220 billion valuation and $8 billion in equity funding. Following closely are Ant Group ($150B, $19B funding) and Shein ($66B, $4B funding), both global leaders in fintech and e-commerce, respectively.

Beyond these giants, China’s unicorn roster is deep and diverse. Major players span sectors from semiconductors (ChangXin Memory Technologies, $19B) to electric vehicles (GAC Aion New Energy Automobile, $14B) and social commerce (Xiaohongshu, $17B). Most have raised billions in equity, showing China’s domestic market and the capital intensity of its leading industries.

Key insights:

- China’s unicorns dominate in valuation and funding, with dozens of companies valued above $5 billion.

- The country’s unicorns are highly diversified, covering AI, hardware, mobility, health tech, and more.

- Several unicorns, such as DJI ($8B, $105M funding), have achieved global impact with relatively lean funding.

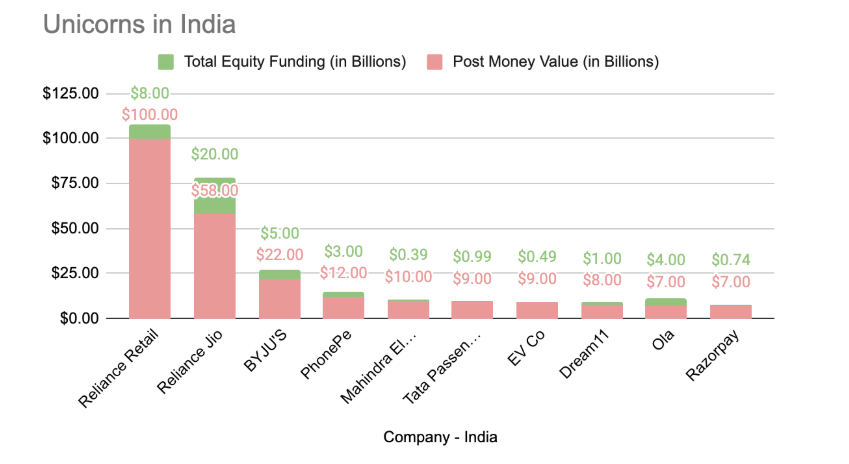

India: Rapid Growth and Sectoral Diversity

India has rapidly established itself as a unicorn powerhouse, producing some of the world’s most valuable startups outside the U.S. and China. Reliance Retail leads with a $100 billion valuation and $8 billion in funding, followed by Reliance Jio ($58B, $20B), and BYJU’S ($22B, $5B), highlighting the strength of India’s retail, telecom, and edtech sectors.

The Indian unicorn ecosystem is marked by diversity:

- Fintech: PhonePe ($12B, $3B funding), Razorpay ($7B, $742M)

- Mobility: Ola ($7B, $4B)

- E-commerce: Snapdeal ($7B, $2B), Meesho ($4B, $1B)

- Edtech: BYJU’S ($22B, $5B), Unacademy ($3B, $789M), Physics Wallah ($3B, $277M)

- SaaS and B2B: OfBusiness ($5B, $746M), Zetwerk ($3B, $754M)

Key insights:

- India’s unicorns are spread across consumer, B2B, and tech sectors.

- Several companies have achieved unicorn status with under $500M in funding, reflecting capital efficiency and strong market fit.

- The country’s unicorns are increasingly attracting global investors.

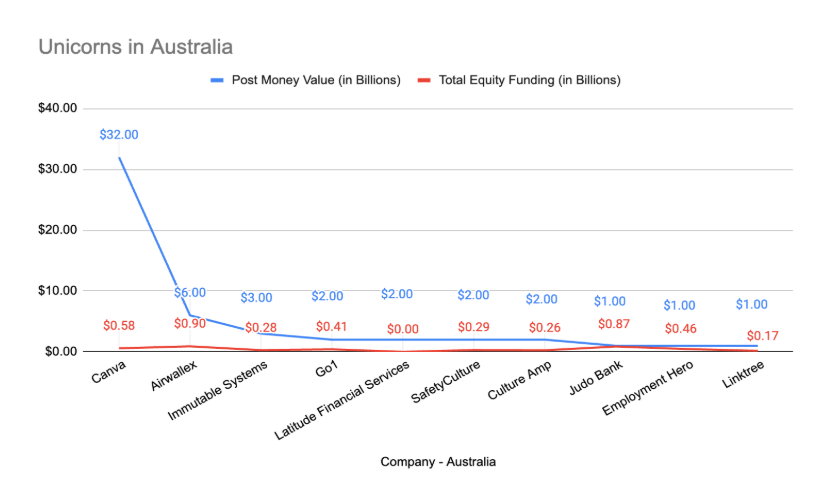

Australia: Lean, High-Value Innovators

Australia’s unicorns are notable for their high valuations relative to funding raised. Canva, the online design platform, is valued at $32 billion with just $580 million in funding-an exceptional ratio that highlights efficient growth and global reach.

Other Australian unicorns include Airwallex ($6B, $902M), Immutable Systems ($3B, $277M), and Culture Amp ($2B, $257M), spanning fintech, web3, and HR tech.

Key insights:

- Australian unicorns excel in SaaS and fintech, often reaching high valuations with modest capital.

- The country’s startup ecosystem is maturing, with a growing roster of billion-dollar companies

Brazil: Latin America’s Unicorn Leader

Brazil stands out as Latin America’s leading unicorn hub. C6 Bank, tops the list at $5 billion with $2 billion in funding. Other major unicorns include Creditas ($5B, $874M), iFood ($5B, $592M), and QuintoAndar ($5B, $755M), showing the strength of fintech, food delivery, and proptech.

Key insights:

- Brazil’s unicorns are concentrated in fintech and digital services, reflecting broader trends in emerging markets.

- Funding rounds are larger, but valuations are generally lower than in the U.S., China, or India.

Canada: Web3, AI, and Cybersecurity

Canada’s unicorns are clustered in cutting-edge sectors. Dapper Labs ($8B, $613M) leads in web3, while 1Password ($7B, $920M) and Cohere ($6B, $935M) dominate cybersecurity and AI, respectively. The country’s unicorns, such as Hopper ($5B, $695M) and Wealthsimple ($4B, $900M), are recognized for innovation and capital efficiency.

Key insights:

- Canada’s unicorns are strong in emerging tech, especially AI and blockchain.

- Several companies have achieved high valuations with less than $1 billion in funding.

Europe: Fintech, SaaS, and Deep Tech

Europe’s unicorn ecosystem is robust and diverse:

- Germany: Celonis ($13B, $2B funding) leads in process mining, with N26 ($9B, $2B) and Personio ($8B, $724M) representing fintech and HR tech.

- France: Back Market, Contentsquare, Doctolib, and Mistral AI are each valued at $6 billion, spanning e-commerce, SaaS, health tech, and AI.

- UK: Revolut ($45B, $2B) Checkout.com ($40B, $2B), and FNZ ($20B, $2B) lead in the Banking and Finance sector.

Key insights:

- European unicorns are often in fintech, SaaS, and AI, with several deep tech standouts.

- Funding levels are generally lower than in the U.S. or China, but valuations remain strong.

Israel: Cybersecurity and Deep Tech

Israel continues to punch above its weight, with unicorns like StarkWare Industries ($8B, $261M), and Moon Active ($5B). The country’s focus is on cybersecurity, blockchain, and enterprise software.

Key insights:

- Israel’s unicorns are highly specialized, with global impact in cybersecurity and blockchain.

- Many reach unicorn status with lean funding, reflecting technical leadership and rapid scaling.

Southeast Asia: Logistics and Fintech on the Rise

Indonesia’s J&T Express is a standout at $20 billion with $5 billion in funding, followed by Traveloka ($3B, $1B) and Akulaku Group ($2B, $638M). The region’s unicorns are primarily in logistics, fintech, and e-commerce, serving massive and growing consumer markets.

Funding Patterns: Capital Intensity vs. Efficiency

The data reveals two distinct funding patterns:

- Capital-Intensive Unicorns: Many Chinese and Indian unicorns have raised billions to scale in large, competitive markets.

- Lean Unicorns: Companies like Canva (Australia) and StarkWare (Israel) have achieved high valuations with relatively modest funding, highlighting efficient growth and strong product-market fit.

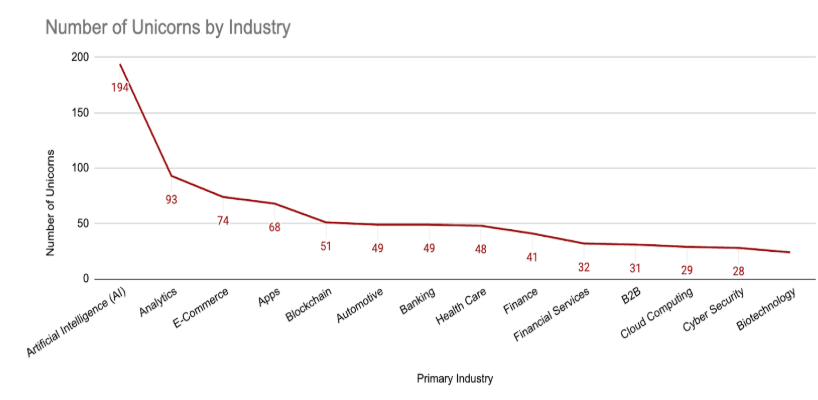

Sectoral Trends

Across all countries, the most common unicorn sectors are:

- AI & Deep Tech: Rapidly growing, especially in North America, Europe and Asia

- Fintech: Present and growing in almost every major unicorn market.

- E-commerce & Marketplaces: Shein, Back Market, and Olist exemplify global and regional e-commerce expansion.

- Web3 & Crypto/Blockchain: Dapper Labs, StarkWare, and Bitmain show continued investor appetite for blockchain.

The Future of Unicorns Is Global

The unicorn landscape in 2025 is more global, diverse, and dynamic than ever. While China, India, and the U.S. remain at the forefront, countries like Australia, Brazil, Canada, Germany, France, Israel, and Indonesia are producing world-class startups with billion-dollar ambitions., AI, Fintech, and digital platforms will continue to drive unicorn creation, but the rise of lean, capital-efficient unicorns signals a new era of innovation and global competition.

As the markets evolve, understanding the characteristics of unicorns is crucial for investors, entrepreneurs, and stakeholders aiming to capitalize on emerging opportunities. Eqvista stands ready to support your journey, offering expert valuation services and cap table management solutions tailored to help startups navigate growth and attract investment.

Contact Eqvista today to unlock your startup’s full potential and accelerate your path to unicorn status.