Tips to leverage a business’s unique strengths in valuation

In this article, we will explore strategies that will help you increase the valuation of your startup.

Nearly 50 million startups are launched each year and in 2024, only 43,702 startups secured funding. In such a highly competitive market, startups must differentiate themselves and demonstrate clear investment attractiveness to secure funding.

Venture capitalists enter at an early stage and are looking for high returns in exchange for the risks they take. So, their focus is on unique and disruptive startups. At the same time, the risk exposure prompts VCs to ask if a startup’s unique strength can actually create value.

So, startups must take concrete steps to enhance and emphasize the value of their unique strengths. This approach has borne fruit for many startups. According to a recent study, startups that file for trademarks and patents prior to the seed or early growth stages are more than 10 times more likely to secure funding.

In this article, we will explore other actionable strategies that will help you leverage your startup’s distinct advantages to enhance its valuation. Read on to learn more!

Tips to demonstrate your business’ unique strengths to investors!

In the following sections, we will discuss how you can leverage your startup’s unique strengths to secure a favorable valuation.

Identify your business’ strengths

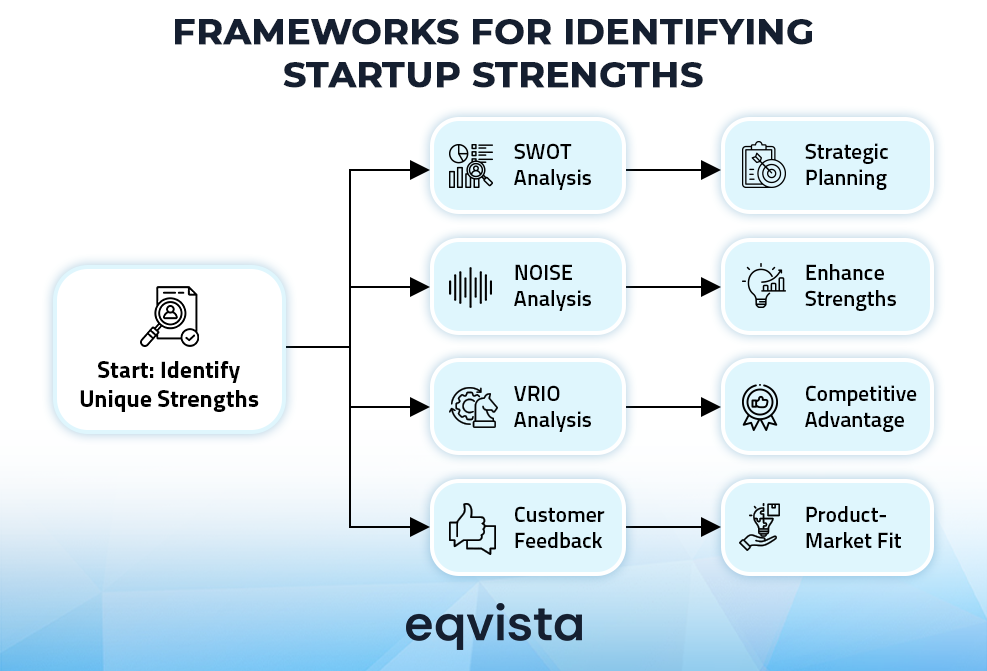

You can identify your startup’s unique strengths by applying the following frameworks:

- SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis – SWOT analysis is a well-known framework for evaluating a company’s caliber and understanding how conducive the current business environment is. This is a highly introspective exercise that is also used to build context for strategic planning.

- NOISE (Needs, Opportunities, Improvements, Strengths, and Exceptions) analysis – The NOISE framework is a more solution-oriented alternative to SWOT analysis. It focuses on identifying unmet user needs, emerging opportunities, areas for improvement, and existing strengths. Additionally, it also helps recognize exceptions to the ‘NOI’ part of NOISE where progress is already being made. Applying this framework can help you identify and enhance your startup’s unique strengths leading up to a funding round.

- VRIO (Value, rarity, inimitability, organization) analysis – The VRIO analysis involves grading a business’s offerings in terms of value creation, rarity, difficulty in imitation, and organizational capability to exploit opportunities. The purpose of this exercise is to gauge the level of competition advantage held by a business.

- Customer feedback – Positive customer feedback is the best proof of product-market fit. However, with the right customer feedback software, you can gain just as much insight from average or negative reviews. These reviews reveal gaps in your offering and highlight the factors that kept customers engaged despite the drawbacks.

Benchmark your business against peers

In funding rounds, especially in saturated spaces, investors will often ask what sets you apart from your peers. If you effectively answer this question, you could secure a premium valuation and improve your chances of securing funds.

To effectively answer this question, you must first identify your direct and indirect competitors based on industry, size, geography, and brand positioning. In the context of funding rounds, you can further shortlist your peers by focusing on firms with ongoing or imminent funding rounds. You could safely exclude firms which have recently closed their funding rounds since you will not be immediately competing with them for funding.

Then, you must compare your financial performance and operational efficiency with your peers. You must pay special attention to metrics such as revenue growth, customer acquisition costs, burn rate, and supply chain resilience.

Pro Tip: Leverage venture capital investment platforms for research

Since you will be looking at private concerns, you may have to get a little creative with your research. To make private equity and startup investments more accessible, certain venture capital players such as Launchbay Capital are building platforms for accredited investors. On these platforms, you can find and evaluate startups with open or upcoming funding rounds.

If you or one of your investors is an accredited investor, sign up to these platforms. This will provide a clearer picture of how your startup stacks up against the competition. The data on these platforms will provide valuable insights and help you refine your pitch.

Adopt driver-based financial modelling

Once you identify your business’s unique strengths using the frameworks we discussed earlier, you should then identify performance indicators that accurately measure these strengths. By making financial forecasts based on these indicators, you can better support your value proposition. This approach benefits startups whose strengths are already reflected in their financial performance and startups still awaiting such results.

If your unique strength is easily reflected in your financial performance, driver-based financial modelling provides data-based context to your growth assumptions. To validate the accuracy of your forecasts, you can highlight the alignment between non-financial indicator estimates and their corresponding financial metrics.

To further strengthen your case, you could showcase the realism of the operational growth described in your non-financial indicator projetions. Some examples of closely related financial and non-financial indicators are as follows.

| Industry | Non-financial indicator | Closely-related financial indicator | Reasoning |

|---|---|---|---|

| E-commerce | Website traffic | Revenue growth | Growth in website traffic drives growth in leads and ultimately drives more conversions. |

| Customer conversion rate | Customer acquisition cost (CAC) | High conversion rate is often the result of a cost-efficient acquisition strategy. | |

| Software-as-a-service (SaaS) | Customer satisfaction score (CSAT) | Customer lifetime value (CLV) | Satisfied customers are likely to spend more and are unlikely to explore other options. |

| Healthcare | Patient satisfaction score | Revenue per patient | Patients satisfied with the care received are likely to trust the healthcare provider again. |

| Staff-to-patient ratio | Operating margins | Salaries paid to clerical staff, nurses, doctors, and lab technicians form a chunk of operating expenses. |

The driver-based model can also prove useful for startups whose unique strengths haven’t yet materialized in positive financial performance. These models can help you accurately estimate timelines to achieve cash flow positivity, up-scaling of operations, and other significant financial milestones. These insights can help you secure a fair valuation based on your progress towards these goals.

Highlight the value of your patent portfolio and brand equity

Startups often overlook or underestimate the value of their intangible assets, particularly brand equity. However, patents and brand loyalty serve as powerful competitive moats. Hence, these assets are critical and unique strengths that differentiate a startup from its peers and thus, can be leveraged to maximize valuations.

Demonstrating brand value

To demonstrate the value of your brand, you must first showcase its recognizableness. If you are a B2C startup, you can collect data about its weekly mentions on social media platforms and the volume of Google searches. On the other hand, in case you are a B2B startup, you can highlight the number of industry partnerships and volume of inbound leads.

Then, using customer testimonials, market share, and customer retention rates, you can validate the reputation and brand value built by your startup.

In the best-case scenario when you become a market leader or capture a niche, you must seize the opportunity to showcase superior brand positioning. In such cases, you should highlight the rapid adoption of newly-launched products, steady demand, product virality, and positive customer reviews. These factors will demonstrate your brand’s ability to generate strong customer interest and foster long-term loyalty.

Quantify the value of patents

Your patent portfolio can create a technological barrier to entry to your customer base. However, quantifying their value is challenging due to extensive research requirements. First, you must estimate the cost of replicating your technology. Then, you must ascertain the total addressable market of the product lines for which this technology is needed or valuable. If you hold long-term patents, you should also estimate cash flows from licensing income.

Typically, due to the research-intensive nature, patent portfolio valuation is entrusted to a credible valuation expert such as Eqvista.

Eqvista – Unlocking your potential by defining its value!

A common theme among the tips discussed in this article was the importance of validating a clear narrative using data-driven insights. To align yourself with this theme and also support your decision-making process, you must adopt a data culture at your startup. This means tracking financial as well as non-financial performance indicators.

Such practices are particularly important if your startup faced setbacks due to market conditions, economic downturns, or was not yet at a stage where its strengths could translate into positive financial performance.

Another factor that can go a long way in securing funding is the credibility of your valuation. At Eqvista, we help startups quantify their unique strengths through comprehensive and data-driven valuations. Our valuation insights will help you approach negotiations with confidence. Contact us today to learn more!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!