Brand Valuation – Calculating Your Brand’s Worth

Brands can be valued, but the methods and considerations differ greatly from valuing fixed assets.

In today’s fiercely competitive market, where consumer choices are abundant, and brand loyalty can be fleeting, understanding a brand’s true value is more crucial than ever. In 2024, the business technology and services platforms sector experienced a 45% growth in brand value. As of 2023, the e-commerce brand Amazon is one of the highest-valued brands in the US at a valuation of $299.3 billion. In 2025, the world’s top 500 brands grew their brand value by 10%, reaching nearly $9.5 trillion.

Whether you’re looking to attract investors, enter new markets, or refine your marketing strategies, a robust brand valuation can be a game-changer. It equips companies with the knowledge to make informed decisions, harnessing the power of their brand as a strategic asset.

This article provides information and insights into brand valuation, including its relevance, methodologies, and application.

What is brand valuation?

Brand valuation is the process of determining the economic worth of a brand by considering its tangible and intangible assets. It provides stakeholders with a clear view of a brand’s performance and its impact on overall business success. As businesses strive to differentiate themselves, effective brand valuation offers insights into a brand’s current worth and its potential for growth and resilience in the face of challenges.

Brand valuation involves calculating a brand’s financial worth or determining the price a third party would be willing to invest in, access, or license that brand. To make an informed decision, you must consider:

- The brand’s present and future worth

- Stage of development

- Current brand velocity (up or down)

Before 2005, when companies calculated their brand’s value, they only considered physical things like equipment and buildings. However, since the International Financial Reporting Standards (IFRS) were updated in 2005, they also include intangible assets like brands and patents in their financial statements.

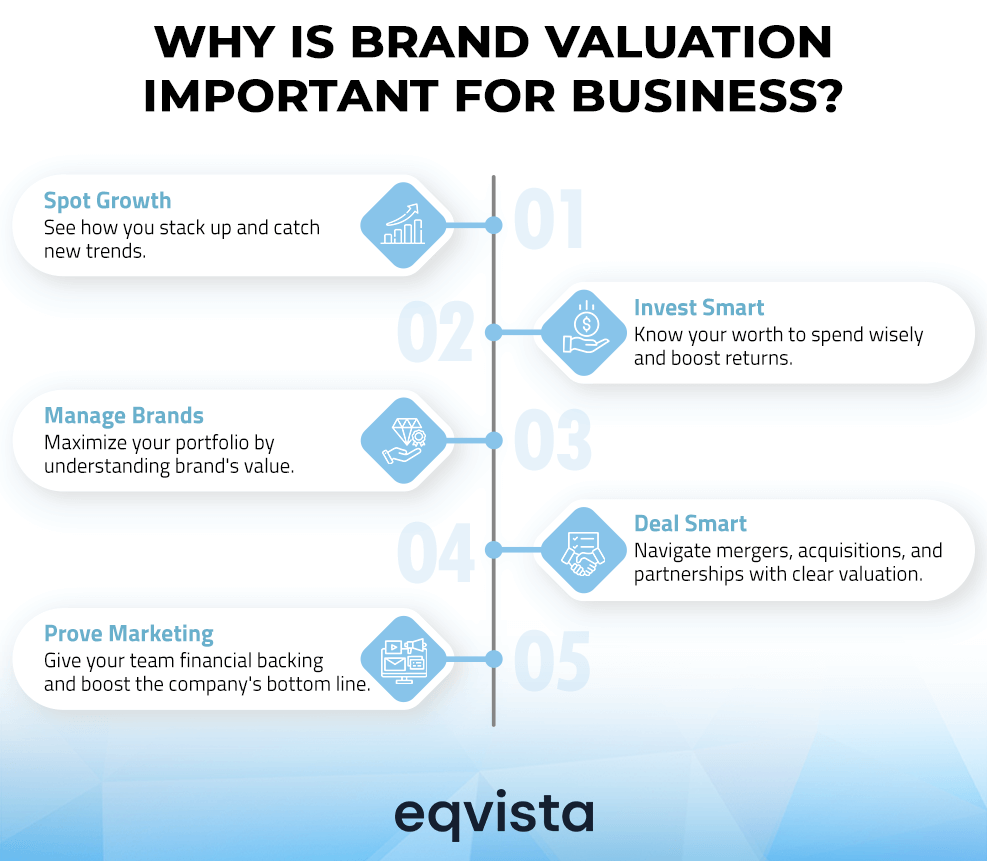

Why is brand valuation important for business?

Despite its intangible nature, a company’s brand can be reliably assessed and monitored, making it just as important as any other asset in terms of financial objectives.

Listed below are five reasons in support of the importance of brand valuation:

- Finding Growth Opportunities – You can find growth plans by seeing how your brand compares to those of competitors. Standing out in meaningful ways is more important than just being different. Your brand can grow and develop new ideas more easily if you understand how the market works and what new trends are coming up.

- Justifying and Optimizing Investments – Knowing where to spend your money when you know how much your business is worth is better. It’s not enough to decide whether or not to engage in branding campaigns. You must also choose how much to spend and what sort of return on investment to anticipate.

- Making Smart Portfolio Choices – If your business manages more than one brand, knowing how much each is worth can help you maximize your brand portfolio. In addition to managing the brands, this entails utilizing their connections to improve overall business success.

- Guiding M&A and Strategic Alliances – Deals involving mergers and acquisitions require you to understand how much your business is worth. When it comes to strategic partnerships and licensing possibilities, they help you deal better and make smarter choices.

- Validating Marketing Efforts – When you value a brand, you give your marketing team real numbers to work with, which gives their creative work more weight. Combining financial and marketing improves returns for the company as a whole. Teamwork is easier when everyone knows how brand plans affect money.

Core Components of Brand Value

What makes brand value so important for an organization? There are a few core components you must know in this regard. Here’s a list of the most important ones.

Financial Value

A brand’s capacity to turn a profit and bring in money is the foundation of its financial component. It involves evaluating a brand’s financial effect on an organization’s overall financial success. The most important way to measure a brand’s financial impact is its:

- Market share

- Price increase

- The income per customer

- Lifetime value

These indicators help assess how successfully a brand can attract and retain customers and its capacity to charge higher prices than competitors.

Brand Strength and Equity

Brand power and value are how people feel about a brand and how loyal they are to it. This comprises:

- Consumers’ trust in the brand

- Their perceptions of its quality

- The emotional ties they experience

Strong brand equity leads to client loyalty, which can help a firm weather economic downturns and boost its competitiveness. Brand equity indicates a brand’s overall well-being and capacity to maintain long-term consumer loyalty.

Market Positioning and Competitive Advantage

Market positioning is how people see a brand compared to brands in the same market. Well-positioned brands can successfully explain their unique value propositions, which make them stand out from competitors and appeal to customers. Strategic positioning like this helps build a competitive edge to bring in new customers and keep old ones returning. A brand is likelier to lead its market section if it stands out.

Factors Influencing Brand Valuation

A few important things need consideration when figuring out a brand valuation. Each of these factors affects the brand’s total financial and strategic worth:

Brand Recognition and Awareness

Brand recognition is how customers can distinguish a brand in different settings. Higher brand recognition and exposure greatly increase its value, improving how customers see it and growing its market share.

Using smart marketing techniques that make your brand more visible and well-known to your target group directly raises its value.

Consumer Perception and Loyalty

Consumer perception is very important; it addresses how people feel about a brand’s quality and trustworthiness. Good connections with customers encourage loyalty, which leads to recurring business and good word-of-mouth that improves the company’s reputation.

Providing high-quality products and outstanding customer service is the best way to increase brand equity and create a positive consumer impression.

Market Positioning and Competitive Landscape

What makes a brand valuable is where it stands in the market compared to its competitors. When brands offer unique value ideas or better goods than others, they can get an edge over their competitors. A brand’s place in the market can also be improved by finding and successfully targeting specific groups of customers.

Financial Performance and Revenue Generation

Financial measures like profit margins, sales growth, and return on investment show a brand’s economic influence. Consistent financial success and the ability to generate revenue during different market cycles are important to determining a brand’s worth.

Industry Trends and Economic Outlook

Brand valuation is highly susceptible to macroeconomic conditions and industry-specific changes. For example, brands in industries that are growing quickly or adept at adapting to economic changes may see their values rise.

If you want your brand’s worth to stay high and grow over time, you must keep up with these trends and improve as needed.

How to Calculate Brand Valuation?

An accurate brand valuation considers both tangible and intangible assets. The tangible brand assets include physical components like logos, websites, designs, typography, and color schemes. Intangible brand assets are non-physical components like vision, purpose, brand tone, and customer service. Let’s look at how you can incorporate both into the valuation process.

Brand valuation Methods and Examples

There are three primary approaches to determining brand worth that take these tangible and intangible assets into account:

Cost Approach

Utilizing the cost method to value a brand, one can determine how much it would cost to create a new brand or grow an existing one. Using concrete figures, this approach calculates the total cost of brand creation by adding up the prices of marketing, trademarks, licensing, design, and more. Although having actual expenditures available for computation is useful, the resultant number may not represent how consumers really see the brand.

Example for Cost Approach

Brand: Athletic shoe brand, “Swift Kicks”

Historical Costs:

- Logo design and brand development: $25,000

- Website creation: $10,000

- Marketing campaigns (first year): $75,000

- Design and development of the first shoe line: $150,000

- Total historical costs: $260,000

Based on the historical cost method, Swift Kicks’ brand value would be approximately: $260,000

Market Approach

The market approach to brand valuation ascertains the brand’s maximum selling price by using its market position as a basis for determining its value. Assessing the brand’s value involves contrasting it with other comparable firm brands. Companies frequently employ this strategy when they are ready for sales.

Example for Market Approach

Scenario:

Forward Inc., an apparel brand, is preparing for a strategic sale. To determine the value for its brand, the company decides to benchmark itself against recent transactions of the similar brands in the same niche of business – StyleHive, ChicTrend, and UrbanElegance.

- StyleHive – transacted at a revenue multiple of 1.5×

- ChicTrend – transacted at a revenue multiple of 1.6×

- UrbanElegance – transacted at a revenue multiple of 1.4×.

Calculation:

- Determine the Average Multiplier: Average Ratio = (1.5 + 1.6 + 1.4) / 3 = 1.5

- Apply the Multiplier: Forward Inc. generated an annual sales of $30 million.

- Using the average ratio: Brand Value = Average Multiple × Annual Revenue = 1.5 × $30million = $45million

Using the brand sale comparison method under the Market Approach, Forward Inc. estimates its brand to be worth approximately $45 million.

Income Approach

Finally, the income method of valuing a brand calculates how much it will earn in the future and uses that number to show its current worth. This method can also help potential investors by focusing on the company’s future growth. Using this technique, you can estimate the brand valuation by looking at the expected revenue, savings, or cash flow associated with the brand.

Example for Income Approach

Scenario:

Consider the case of a SaaS-based company that realizes $5.0 million per year in revenues from its star product. It has a fixed 6% royalty rate against industry licensing deals. A 12% discount rate is considered over a 5-year amortization period along with a tax amortization benefit factor to obtain the final brand value.

Calculation:

| Year | Revenue ($) | Royalty Fee (6%) Before-Tax Royalty Savings ($) | Tax (30%) ($) | After-Tax Royalty Savings ($) | Discount Factor (12%) | Present Value of Savings (12%) ($) |

|---|---|---|---|---|---|---|

| 1 | 5,000,000.00 | 300,000.00 | 90,000.00 | 210,000 | 0.893 | 187,500.00 |

| 2 | 5,000,000.00 | 300,000.00 | 90,000.00 | 210,000 | 0.797 | 167,410.70 |

| 3 | 5,000,000.00 | 300,000.00 | 90,000.00 | 210,000 | 0.712 | 149,473.90 |

| 4 | 5,000,000.00 | 300,000.00 | 90,000.00 | 210,000 | 0.636 | 133,458.80 |

| 5 | 5,000,000.00 | 300,000.00 | 90,000.00 | 210,000 | 0.567 | 119,159.60 |

| Sum of PV | 757,003.00 | |||||

| Tax Amortization Benefit Factor | 1.2 | |||||

| Brand Value | 908,403.60 |

By applying the Royalty Relief Method under the Income Approach, the brand is estimated to be worth approximately $908,404. This valuation reflects the brand’s strength and the cost savings the company enjoys by owning rather than licensing its brand.

Get Expert Valuation from Eqvista!

There is a lot of uncertainty about historical market averages and predictions for the future. This makes it even more important to consider financial factors and contextual and qualitative ones, such as the attributes and risks associated with the assets that support the brand. An expert valuation becomes crucial in this case.

Brand valuation is a crucial aspect of business strategy for making informed decisions about the brand’s future. By leveraging the expertise of valuation professionals, businesses can achieve a more accurate and reliable understanding of their brand’s financial value, which can inform strategic decision-making, support financial reporting requirements, and facilitate transactions involving brand assets.

Feel free to get in touch with any valuation questions.

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!