How can Pharma R&D Companies manage a 409a valuation?

Let us understand all this better and see how these companies can be valued using the specific valuation methods for pharma companies.

Getting the valuation for pharma or medical device companies is not the same as getting the value of other companies. And there are many reasons for that. In fact, the traditional business considerations are compounded by patent law and FDA approval processes when evaluating the investment potential of pharmaceutical companies. Moreover, the life cycle of prescription drugs is really short. This means that there is a high-margin revenue falling to zero mostly overnight when the drug expires. And these things just make it tough to get the 409a valuation for Pharma or medical device companies easily.

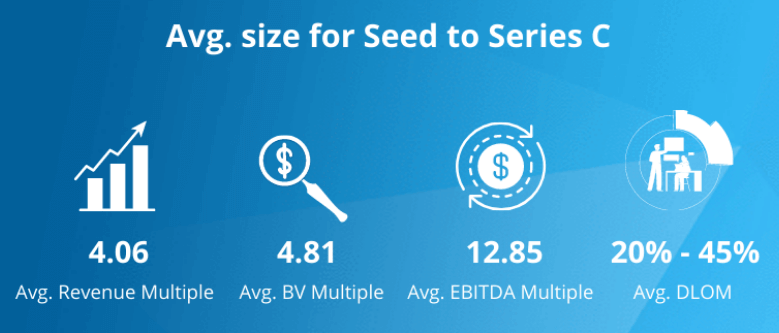

Pharma R&D company 409a valuations by the numbers

Here is a summary of the 409a valuations for Pharma companies performed by Eqvista. These average figures were obtained from the public markets, private markets, and our 409a valuations.

*Most 409a valuations for pharma companies do not use EBITDA multiples

409a Valuation for Pharma R&D Companies

If you are trying to start a biotech, medical device or a pharma company, then you should know that these companies are very different from normal businesses. There can be no revenue in the company, and the company can still be worth billions.

Pharma R&D industry introduction

The pharmaceutical industry has always been on top, and it is because we all need medicines. And the US pharmaceutical industry has companies that engage in researching, developing, manufacturing and marketing drugs for human or veterinary use (NAICS 3254). The industry has both generic drugs and brand names, with several companies specializing in each type. To explain further, the brand names are patent protected formulations that are marketed under a specific brand name of the company that owns the patent.

On the other hand, generic drugs are administered in place of the branded drugs as soon as the formulation’s patent expires and other companies can now produce the same drug. In the US, brand name pharmaceuticals manufacturing generates about 80% of the total drug revenue over the past decade. And generic drugs generate the rest of the drug revenues. In terms of growth revenue, the generic drugs have been growing faster than the brand name ones. There are some generic drugs and brand name drugs that are approved for over-the-counter (OTC) sale without a prescription.

Why Do Pharma R&D Companies Need 409a Valuation?

Unlike other companies, getting the 409A valuation for pharma companies is important mostly when it comes to it being sold, for exiting, or even for going public. If you are about to get into an M&A deal then, you will want to know the value of your pharma company. And since drug development is expensive, it is obvious that the value of the business would be high. Getting the value of how much all the investment and work is important. This also gives us a brief idea of how much the industry is valued.

Moreover, having a pharma company means that you will have employees too. What if you decide to incentivize them with stock options? Well in this case, you need to get the 409A valuation as per the IRS. It is vital to get it if you do not want to get in trouble and pay hefty fines. So, there are many reasons as to why you might need the valuation for pharma companies. But with this, just remember to get the right company to value your business as not everyone can do it.

Common Valuation Methods

Even though there is no single right way to get the 409a valuation for Pharma companies, there are some methods that are used the most. These valuation methods for pharma companies include:

#1 Discounted Cash Flow (DCF)

DCF is a common method that is used for many kinds of companies to get their value. It is an attempt to figure out the value of the business today based on the projections of how much value it would create in the future. So, to be clear, it determines the current value of expected future cash flows by way of a discount rate. In fact, this method is a great way to confirm the FMV (fair market value) that is obtained by analysts. However, it can be tricky if not done by the right professionals.

#2 Asset based approach

Another common method which is also one of the top valuation methods for pharma companies. This calculates the FMV of the company’s assets and deducts all the liabilities of the company to get the FMV of the equity of the company, which is considered to be the value of the company. The approach is also known as the cost-based approach in many cases. It is because the value of the business is equal to the cost of obtaining its physical assets. Although it is a method considered for the valuation of pharma companies it is not used much since its value is more closely related to intangible assets, cash flows and R&D expenditure.

#3 Income approach

This method is also another common one used for many companies and is most applicable for the companies that face constant and predictable growth in earnings. These companies should have an established record of operations. The value of the business through this method is equal to the cash flow projections for the next year which is then divided by the capitalization rate, which is the appropriate discount rate less than the predicted growth rate.

#4 Market approach

This is another one of the valuation methods for pharma companies that uses the market indications of value based on metrics from guideline publicly traded and/or privately held pharma companies. The financial parameters of the transactions in the public and private companies, like the EV/EBITDA, P/S, and P/E can be used to generate the valuation multiples that are used to calculate the final business value.

How do we get the 409a valuation for Pharma companies?

When Eqvista values a pharmaceutical company, there are some performance metrics that are considered. They are used to benchmark their performance against other companies in the industry:

- R&D spending (past cost)

- Sales

- Operating Profit Margin

- Average development cost per product

- Percent of sales of the recently released products

- Number of clinical trial products

- Number of major regulatory approvals received

- Operating free cash flow as percentage of sales

A lot of the pharma companies are publicly traded ones. And thanks to this, there is a lot of financial data availability. This makes it possible to compare the subject company to the industry benchmarks and apply industry multiples. Nonetheless, when valuing a pharma company, it is vital to use multiples and benchmarks based on the companies that are similar to the subject company. Also, we ensure that we are aware of the multiples of certain public companies that cannot completely reflect the operations of the company in question.

In this case, we also look into the data of the private pharma companies, especially their transactions that are used as a benchmark for the valuation. Eqvista reviews the information about the company’s purchases in the industry. Along with this, we also look at the size and scope of the companies that have been sold and bought. All these parameters are used and the value of the pharma company is determined.

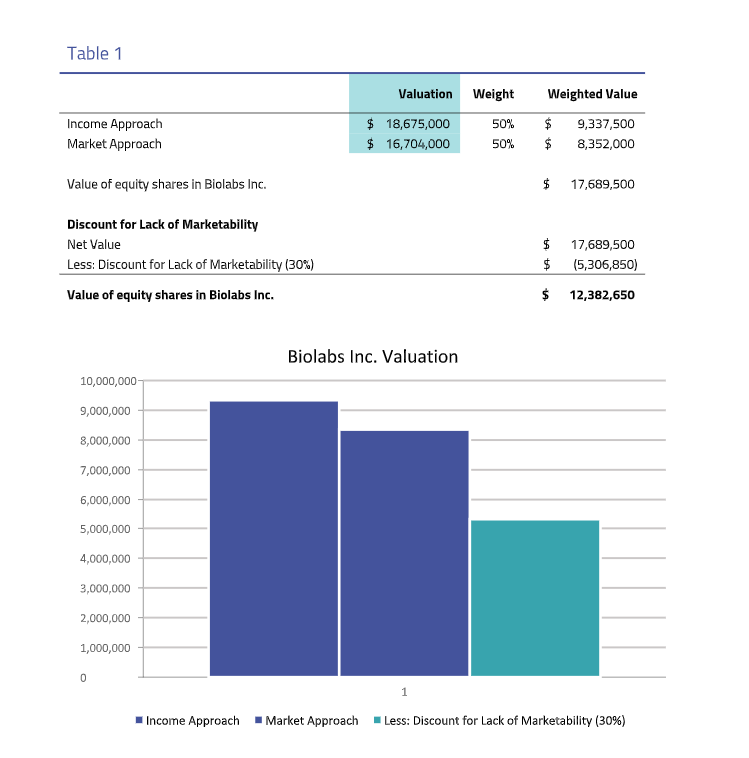

Here is a sample of our 409a valuation report of an example Pharma R&D company:

Why choose Eqvista for Pharma or Medical Device Company 409a Valuation?

R&d Pharma companies are very different from the other companies and this just makes them tough to value. Eqvista has a team who are certified to offer the 409A valuation for pharma or other medical device companies. We have provided valuations for pharma companies for a long time now that are both accurate and IRS-defensible. To get your company valued by us, contact us today to begin the discussion!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!