How can Cannabis Companies manage a 409a valuation?

For those who want to grow their businesses and take them to the next level at each step ahead, it is important to get the 409A valuation for cannabis companies.

The Cannabis industry is a unique industry that has recently been booming as states all over the US work towards making it legal. This industry represents the complete marketplace and business culture that comprises startup companies. And most of the cannabis companies that are being created have the aim of “making it today”.

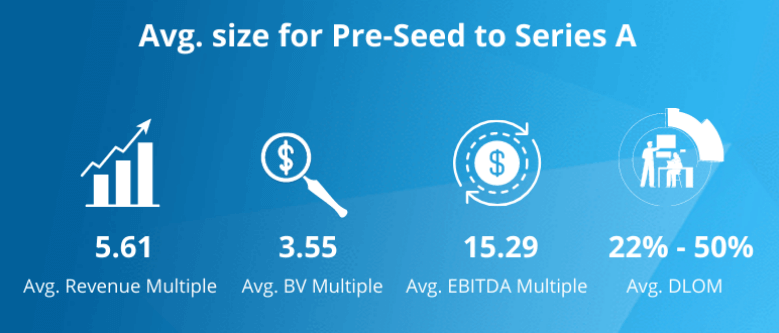

Cannabis company 409a valuations by the numbers

Here is a summary of the 409a valuations for Cannabis companies performed by Eqvista. These average figures were obtained from the public markets, private markets, and our 409a valuations.

*Most 409a valuations for Cannabis companies do not use EBITDA multiples

Why Do Companies in the Cannabis Industry Need a 409a Valuation?

Many states have now legalized cannabis for recreational use and a few have made it legal for medical use. With this, startups are jumping to the opportunity to break into the industry and take advantage. Just like the tobacco and alcohol industry, this industry is also moving towards huge growth. In fact, it is very easy to get investors for this kind of business. And investors like Winklevoss Capital and celebrities like Snoop Dog are funneling large amounts of money into this space. But how do we get to know the worth of all these businesses and the industry? This can only be done through a cannabis business valuation.

Cannabis industry introduction

Cannabis has finally come out of the shadows of being a stoner product and has emerged as a multi-billion dollar industry. It has made its roots in a lot of sectors including agriculture, consumer goods, pharmaceuticals, and healthcare. Public companies that have huge valuations are racing to innovate this in their business, while the established blue-chip companies are partnering or buying marijuana-related businesses to gain access to the industry.

There is a lot of support for the legalization of marijuana. This is also why 15 states have legalized recreational marijuana and 21 states have legalized medical marijuana. Investors are also excited about this and are looking for those who are opening such companies. So, those who are hoping to start a business in this can expect to get investors easily. But just like for any industry, it is important to know all about the ins and outs of the industry before entering it. And once you do, you need to keep a track of the company’s value by getting the 409A valuation for cannabis companies.

Why do Cannabis companies need a 409 valuation?

Obtaining a 409A valuation for your cannabis business is important just like it is for any other business. The reason to get the value can range from incentivizing employees, internal disputes, shareholder buy-out/buy-in, estate tax planning, and financial reporting requirements. For instance, you need to find a way to make pay cuts, but need to pay your employees. So, offering them a reward or compensation through stocks can help. For this, you will need to get the cannabis business valuation done.

Or if you have an internal dispute with one of the shareholders and this leads to a buyout, you will need to find out the value of the shares to buy them back from them. Moreover, if your company is in the middle of an M&A, you will see that the cannabis company valuation is a part of the deal, where both acquirers and investors do their own valuations to get the buying price. The reasons are all the same like it is for any other company and it is as important as well to get the 409A valuation for cannabis companies.

Challenges of valuing a Cannabis company

Although the cannabis industry is still in its infancy, there are some limitations that surround the valuation of marijuana businesses, including but not limited to:

#1 Federal Regulations

Cannabis is still illegal on the federal level. Due to this, many investors and operators consider it risky to invest in such businesses. Moreover, while the federal government allows states to self-regulate the legalization of all forms of cannabis, it is listed as a Schedule 1 drug under the Controlled Substances Act of 1970. This risk makes it a bit difficult for the companies to raise capital at times, and fulfill the demands of expansions.

#2 Taxation

Since cannabis is illegal on a federal level, it is in a limbo state concerning taxes. In this, IRC Sec. 280E states that all the costs have to be considered as non-deductible items when determining taxable burden. These costs do not include the costs for producing, processing, and storage of cannabis. These complex tax filings also present a challenge as there is a limited number of tax professionals who are knowledgeable in this specialized space.

#3 Fewer market data

Market data is also an important factor for the cannabis company valuation and since the industry is still new, the number of companies that can be used to compare is limited. Moreover, the companies that are there are in their growth stages, which results in inaccurate multiples as there is instability associated with young companies.

#4 Revenue forecasting can be complicated

With low market data, the cannabis business valuation will need to rely deeply on the cash flow projections. Because of this and the unknown future of tax burdens, getting the projections in the cannabis industry can be inaccurate than those industries that are much more stable and old.

#5 Industry changes are rapid

The growers and direct sales in this industry are in a constant state of change that can be considered volatile. Those who are huge players in the field need to spend a lot on technology, and licenses. They also need to invest time in it to remain relevant, mostly as other states legalize it and new players enter the game.

Cannabis Company Valuation

The cannabis industry is evolving a lot, where new players are entering, states are legalizing it, and technological advancements are taking place. And even though there are risks in this industry, the future growth potential is enormous. Due to this, the cannabis company valuation becomes much more important at each step.

Common valuation methods

Although there are different legal rules for each state, the way a cannabis business is valued is the same. Here are the three common approaches that are used by all the professionals:

- Market Approach – In this approach, the competitors in the same industry with similar structures and sales are considered. The two cannabis valuation method types under this are:

- Guideline company method – In this, we compare the company with similar publicly traded entities.

- Guideline transaction method – In this, we compare the company with similar companies that have been merged or acquired within range of the valuation date.

- Income Approach – In this approach, the value of the company is based on expected future earnings, using the discount rates, net cash flow projections, and terminal values. The two methods used under this are:

- Discounted cash flow – This determines the value of the entity by using projections for the earnings of the firm, and discounts these projections to the present via discount rates.

- Capitalized cash flow – This method is used by reviewing a single cash flow period that is considered to be a reasonable representation of future cash flow periods.

- Asset Approach – In this approach, all the assets are reviewed and the net asset value is obtained by subtracting the value of the liabilities from the assets. There are two methods used under this:

- Net asset value – In this, the assets and liabilities are adjusted for their fair market value and the difference is determined to reach the value of the entity

- Net liquidation value – In this, the current value of all the assets and holdings of the company is considered as the value. It reflects all that the assets are worth if you liquidate it instantly at market price.

How do we do the valuation for Cannabis Companies?

For valuing the companies in the cannabis industry, we cannot just look at the industry. We have to look at the startup business model. The business model will help us find more specific comparables for each company. For instance, for some cannabis companies, tobacco companies like Phillip Morris can be a great comparison. And for the marijuana delivery startups, we use companies like Doordash and Grubhub as comparisons. So, instead of looking at the entire industry, focusing on the niche within it. This helps us in assessing their risk, potential, and more.

The team at Eqvista is certified and has prepared dozens of 409a valuations for cannabis companies. We have access to the cannabis industry information since the industry came into being. In addition to this, Eqvista also helps the companies in addressing their different concerns and opportunities along with offering the best cannabis company valuation.

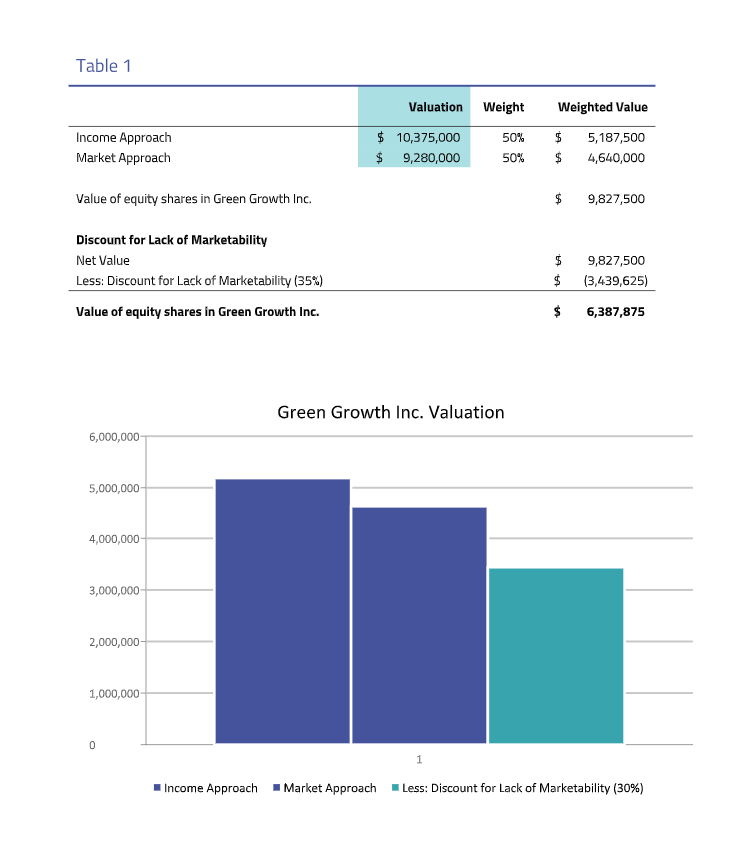

Here is a sample of our 409a valuation report of an example Cannabis company:

Why Do Cannabis Companies Choose Eqvista?

Eqvista is not just an advanced cap table application; we also have a specialized and certified team that offers 409A valuation for cannabis companies. We have successfully been offering the cannabis company valuation services for a long time. The final value is accurate and IRS-defensible as well. Contact us to get your cannabis business valuation performed by our professionals today!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!