What Should Founders Consider to Align Business Valuation With Market Expectations?

Jawbone, a wearable tech startup, was incorrectly valued at $3 billion as this valuation didn’t account for market realities like competition from tech giants. As a result, the company had to shut down, much to the dismay of investors and employees. Unfortunately, business valuations that do not align with market conditions are a common occurrence.

Hence, in this article, we discuss the challenges of unrealistic valuations and some best practices, such as leveraging the market-based approach and applying appropriate discounts to ensure precise business valuations that align with market expectations.

Problems caused by unrealistic business valuations

Accurate business valuations go a long way towards fostering trust with stakeholders, funding round success, and tax compliance. Hence, a lack of alignment between business valuations and market conditions is a serious issue that can cause problems such as:

Non-compliance with tax regulations

Fundraising activities are not the only time you will require business valuations. You also need them to establish the taxable income of your employees and service providers from the equity compensation they received. So, by setting an unrealistically low valuation, you would be inviting IRS audits which can lead to penalties and lawsuits.

Disillusionment of investors and employees

Since your business valuation impacts the value of shareholder stakes and the value of equity compensation, employees and investors have vested interests in your growth. However, if you report unrealistic valuation growth, investors and employees may become skeptical. This will ultimately affect the morale of employees and erode the trust of investors.

Fundraising challenges

Investors try to stay away from businesses with unrealistically high valuation asks in funding rounds. They would want assurance regarding your company’s potential to grow significantly beyond the valuation being proposed. However, achieving this becomes challenging when the entry-point valuation is set too high.

How to align business valuations with market conditions?

Some business valuation best practices that ensure alignment with market conditions are:

Applying appropriate discounts

To enable smooth calculations, valuation techniques often make unrealistic assumptions that must later be corrected through discounts. These discount rates must be chosen purposefully to offset any unrealistic assumptions. For instance, the discount rate for acknowledging the decline in the value of money over time is typically chosen based on the expected inflation or the risk-free interest rate.

Similarly, appropriate choices for other discounts also exist.

The discount for lack of marketability (DLOM) is applied to address the lack of liquidity of a private corporation’s shares. To determine an appropriate DLOM, compare the valuation of a similar private company recently involved in an M&A transaction or funding with that of a comparable publicly listed company. Then, after adjusting for scale, we can find the appropriate DLOM from the ratio of the private company’s business valuation to the listed company’s valuation.

The discount for lack of control (DLOC) accounts for the investor’s inability to influence key decisions or operations of a company. DLOC is often used in estate valuations when dividing controlling stakes among multiple heirs.

To estimate an appropriate DLOC, you should investigate the premium offered in acquisitions in comparison to the valuations in minority transactions of similar companies.

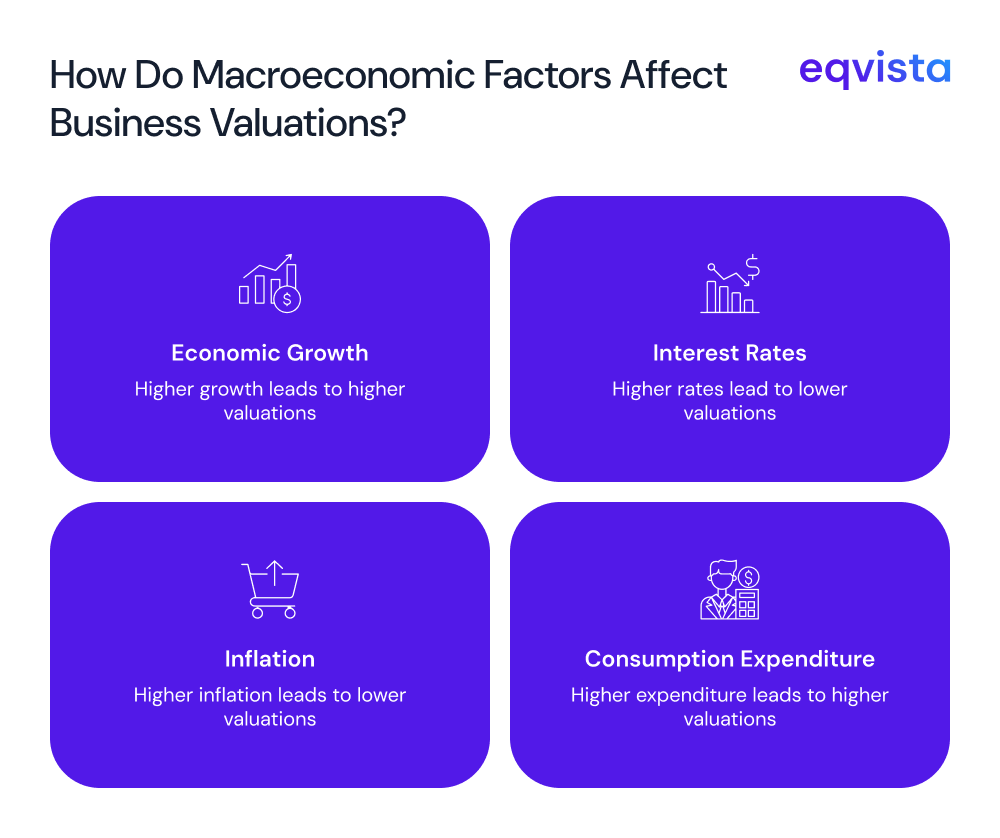

Making adjustments as per macroeconomic conditions

Economic growth rates, interest rates, inflation, consumption expenditure trends, and unemployment rates are factors that influence a company’s valuation. In periods of high economic growth on account of healthy consumption expenditure, we can expect a company’s valuation to increase.

On the other hand, rising interest rates and inflation can significantly disrupt a company’s unit economics, increasing costs and reducing profitability, which can ultimately lead to a sharp decline in its valuations.

When unemployment is high, a company will find it easier to find talent and manage payroll expenses. This would improve the company’s free cash flow to equity and in turn, increase its valuation. Adjusting your business valuation based on such economic factors is an important step in aligning it with market expectations.

Leveraging the market-based valuation approach

The market-based valuation approach ensures that a business valuation is grounded in current market realities by estimating a company’s value based on the valuations at which comparable companies are trading on stock exchanges or are being funded, acquired, or merged.

One of the methods that comes under the market-based valuation approach is the market valuation multiple method. When you compile market valuation multiples for a specific industry, it helps you understand how investors currently evaluate a company’s performance within the context of the prevailing macroeconomic environment. Let us understand this with an example.

Venthero is a company that provides innovative energy-efficient heating, ventilation, and air conditioning (HVAC) solutions and is heading into a Series B funding round. In 2024, it had sales worth $40 million. Now, let us look at the sales and valuations of similar companies that were acquired, funded, or listed in recent times.

| Company | Sales (2024) | Valuation |

|---|---|---|

| Isotherm | $60,000,000 | $200,000,000 |

| CoolSTAR | $80,000,000 | $300,000,000 |

| Exothermic | $30,000,000 | $120,000,000 |

| Mr Cool | $25,000,000 | $140,000,000 |

| GoldilocksHVAC | $45,000,000 | $180,000,000 |

| Total | $240,000,000 | $940,000,000 |

Now, to find the market valuation multiple, we just need to divide the total sales by the total valuation.

Market valuation multiple = $940,000,000 ÷ $240,000,000

= 3.92

This means that investors, after considering all industry trends, macroeconomic conditions, customer preferences, and various other factors, are currently assigning $3.92 of value to HVAC companies for each dollar they earn in sales.

So, Venthero should be valued at = $40 million × 3.92

= $156.67 million

Monitor market sentiment

You must align your business valuation to market sentiments if the market-based valuation approach cannot be used. You must aim to understand investors’ risk appetite, their preferences, and the industry trends. This is a task that requires thorough research, especially on qualitative factors.

You can understand investor risk appetites by analyzing how individuals and institutions allocate funds across asset classes that have differing risk levels.

On the other hand, understanding investor preferences and tracking market trends will require you to monitor financial and industry-related publications, industry reports, market analyses, and reports from reputable business news media outlets. By doing so, you can gain key insights into market dynamics and investor behavior.

Eqvista- Precise insights to unlock your value!

If your business valuation does not align with market expectations, it can lead to non-compliance with tax laws, loss of trust from stakeholders, and fundraising challenges. You can utilize the market-based valuation approach to address these issues.

However, if you cannot use the market-based valuation approach, you must understand the market conditions by researching qualitative factors. This will help you value your business through other approaches.

For instance, when you use the income-based approach, learning about the market conditions will help you select the appropriate discounts based on macroeconomic conditions and private equity market conditions.