How To Calculate Net Asset Value In 2024?

Let’s say an investor evaluates two mutual funds, each with appealing attributes. One fund boasts a robust track record of performance, while the other offers a compelling investment strategy that aligns with the investor’s long-term goals.

The decision seems daunting until the investor considers each fund’s Net asset value.

What is Net Asset Value? This simple yet powerful metric reveals the underlying value of the funds, empowering the investor to choose not just based on past performance or future promises but on the current intrinsic worth of the investments.

This article will explain everything you must know about NAV calculation and things you must consider while dealing in mutual funds.

What is Net asset value?

NAV is a fundamental financial concept, particularly within mutual funds and securities investing and represents the per-share market value of a fund. You can calculate this by dividing the total of all the securities in a fund’s portfolio, minus any liabilities, by the number of shares outstanding. NAV gives investors a clear snapshot of what the fund’s shares are worth on a per-share basis. It reflects the investment’s underlying value and helps.

- Evaluate performance,

- Compare funds, and

- Execute investment strategies effectively.

Role of NAV in mutual funds

In the context of mutual funds or securities investing, NAV plays several critical roles:

- Pricing Mutual Fund Shares: The NAV in mutual funds determines the price at which shares are bought and sold. At the end of each trading day, mutual funds calculate to update the share price. It means that when you invest in a mutual fund, you buy or sell shares based on the calculated amount at the end of the trading day.

- Performance Tracking: Investors use Net asset value to track the performance of a mutual fund over time. By comparing the at different points, they can gauge how well the fund is doing regarding asset management and investment strategy. An increasing NAV over time indicates that the fund’s investments are growing in value, which is a positive sign for investors.

- Asset Allocation Decisions: NAV helps investors make informed decisions about asset allocation. By examining this of various funds, investors can compare the performance and management efficiency of different investment options. This comparison aids in diversifying their investment portfolio to optimize returns and manage risk.

- Exchange-Traded Funds (ETFs): Like mutual funds, ETFs have a daily net asset value calculation. However, ETFs get traded on stock exchanges at market prices that can differ from the NAV. This difference is under close monitoring because it can indicate whether the ETF is trading at a premium or a discount relative to its Net Asset Value, which can influence investment decisions.

Net asset value calculation

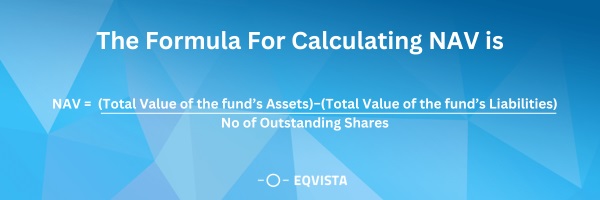

Calculating NAV in mutual funds involves a straightforward formula. Here’s a step-by-step breakdown of the process, followed by an example to illustrate Net Asset Value calculation:

The formula for calculating NAV is:

- Total Assets of the fund include investments in securities, cash and cash equivalents, receivables, and other assets.

- Total Liabilities include money the fund owes, such as pending payments, expenses, and other liabilities.

- Number of Shares Outstanding is the total number of shares currently held by all shareholders.

Steps for Calculation

- Sum up the current market value of all the securities (stocks, bonds, etc.) and cash or cash equivalents in the fund’s portfolio.

- Add up all the fund liabilities, including money owed, pending payments, or other financial obligations.

- Determine the total number of shares currently held by all shareholders.

- Subtract the total liabilities from the total assets to find the net asset value, then divide this by the number of outstanding shares.

Example For Calculating Net Asset Value

Let’s say a mutual fund has the following assets and liabilities:

- Investments in securities: $500,000

- Cash and cash equivalents: $50,000

- Receivables: $10,000

- Other assets: $5,000

- Liabilities (pending payments, expenses, etc.): $15,000

- Number of shares outstanding: 10,000 shares

First, calculate the total assets:

- Total Assets=$500,000+$50,000+$10,000+$5,000=$565,000

Then, subtract the total liabilities from the total assets to find the net assets:

- Net Assets=$565,000−$15,000=$550,000

Finally, divide the net assets by the number of shares outstanding to find the NAV:

- Net asset value = $550,00010,000 = $55

So, the NAV per share of the mutual fund is $55.

Importance of NAV Calculation

The accurate NAV calculation is important in the mutual funds industry for several reasons:

- Indicator of Fund Performance: The accuracy of calculation is crucial for representing the true performance of a mutual fund. An accurate Net Asset Value reflects the fund’s current value and performance, which is crucial for investors’ trust and investment decisions.

- Residual Value Measurement: NAV provides a snapshot of the fund’s residual value, which is essential for investors to know the worth of their investments. The process involves subtracting the fund’s liabilities from its assets, accurately reflecting at a point in time. Mispricing can lead to investor losses or unfair gains, highlighting the need for precise valuation.

- Secondary Transactions and Pricing: The calculation of NAV impacts secondary transactions and pricing. Zitzewitz revealed that mutual funds often use stale prices to calculate their NAVs, leading to predictable daily returns and opportunities for arbitrage at the expense of long-term shareholders. Accurate and timely calculation is essential to prevent such exploitations and ensure fairness among investors.

- Calculation Basis for Share Price: The Net asset value per share is the basis for mutual fund share transactions. Investors buy and sell mutual fund shares at the NAV per share, making its accurate calculation fundamental for fair trade. It is essential for providing transparency and fairness in the pricing of mutual fund shares.

What are the common errors in NAV calculation?

Accurate NAV calculation is crucial for mutual funds and securities investing, but various factors can lead to errors. Here’s an overview of common mistakes calculation and their potential impacts:

- Human Error: Mistakes made by individuals involved in the NAV calculation process, such as data entry errors or mathematical miscalculations, can lead to inaccuracies in the Net asset value. These errors are often due to oversight or misunderstanding of the calculation process.

- Corporate Actions: Adjustments for corporate actions (e.g., dividends, stock splits) may not have proper accounting in the Net Asset Value calculation. Failure to timely or accurately adjust for these actions can distort the value of the fund’s holdings and, consequently, the NAV.

- Pricing Errors: Accurate pricing of the securities held by a mutual fund is essential for correct calculation. Mispricing of securities, whether due to outdated prices, incorrect application of valuation methods, or reliance on estimated prices in the absence of active market quotes, can lead to errors.

- Lack of Standard Controls: Inconsistencies in applying calculation methodologies or the absence of standard operational procedures for NAV calculation can result in errors. It includes a lack of clarity in handling illiquid securities, derivatives, and other complex instruments.

- Materiality and Impact Assessment: Errors in NAV calculation, depending on their size and nature, can have a material impact on investors. Overstated or understated affect investment decisions, fund performance assessments, and investor returns. The impact assessment involves evaluating the significance of errors and determining the need for correction and disclosure to stakeholders.

What are the consequences of inaccurate Net Asset Value calculation?

Inaccurate NAV calculation can have significant consequences for mutual funds and investment vehicles, affecting various stakeholders, from investors to regulatory bodies.

- Misleading Investors: Inaccurate NAV calculations can lead to investors getting misled about the true value of their investments. It can result in investors making ill-informed decisions, such as buying shares at inflated prices or selling them at undervalued prices, potentially leading to financial losses.

- Regulatory Issues: Mutual funds and investment vehicles are subject to regulatory oversight to ensure fair and transparent operations. Inaccurate Net Asset Value calculations can result in regulatory sanctions, fines, and increased scrutiny for the entities involved. Regulators may also mandate corrective measures to prevent future inaccuracies, potentially leading to higher operational costs for the fund.

- Impact on Share Transactions: The Net asset value prices transactions in mutual fund shares. Suppose the calculation goes wrong. In that case, it directly affects share transactions, potentially leading to investors receiving less value for redemptions or paying more for purchases than they should. It can also result in unintended wealth transfers among investors, with new investors potentially subsidizing existing investors or vice versa.

- Loss of Trust: One of the most significant consequences of inaccurate NAV calculation is the loss of investor trust. Trust is fundamental to the functioning of financial markets, and once eroded, it can be challenging to rebuild. A loss of trust can lead to investors withdrawing their funds, reduced investment inflows, and long-term reputational damage to the fund managers and the investment vehicle.

Use Eqvista For all Your Valuation Needs!

Calculating the NAV requires meticulous attention to the valuation of assets and liabilities, incorporating up-to-date financial data, and adhering to the prevailing accounting standards and regulatory requirements.

For investors, fund managers, and stakeholders alike, understanding the intricacies of NAV calculation is essential for making informed investment decisions and ensuring the integrity of financial markets.

Amidst these complexities, Eqvista stands out as a valuable partner, offering sophisticated valuation services that cater to the needs of modern businesses and investment vehicles. Discover how our cutting-edge valuation services can enhance the accuracy and integrity of your financial reporting. Visit Eqvista today to learn more and take the first step towards streamlined and trustworthy asset valuations.