Startup Funding: Is Debt or Equity Fundraising Smarter for Startups

If you are an entrepreneur, one of the biggest realizations you must have is that your business idea is only as good as its financial backing. Learning to fund a startup is part of every entrepreneur’s journey. In such a scenario, startup funding has become a specialized skill that entrepreneurs learn very early in the process.

Debt Funding vs Equity Funding for startups

In simple terms, a debt fund is a loan, and an equity fund translates to shares in the company. Each pattern has their share of advantages and disadvantages. It is seen that in its lifecycle, a company needs both these types of funding. But the judgment of applicability between debt vs equity funding is up to the entrepreneur. Let us explore.

What is debt funding?

Debt funding for startups works like personal loans. A certain amount of funds is borrowed from individuals or financial lending institutions, for a limited time, at a fixed interest rate. These funds however are lent in exchange for collateral from the borrower. The relationship between the borrower and the lender is purely transactional. All that matters is good loan repayment terms.

Debt funds can be of any size. But in the context of startup funding, compared to an equity fund, debt funds are chosen for smaller expenses. The simple reason being, debt in any form are a liability. Larger the debt fund, the higher the rates of interest, and the higher the expenses for the company. Since in the early stages, startups try to conserve cash, the decision of debt funding is taken only after careful considerations.

Debt funding for startups is categorized into long term and short term. Long term funds incur higher interest rates. They are required for meeting capital expenses such as the purchase of new equipment, setting up infrastructure, capital required for growth/expansion/diversification, etc. Whereas, short term debt funds are used to manage recurring expenses such as rent, salaries, maintenance, and carry lower interest rates.

Debt funding for startups is provided using certain debt instruments and by select institutions. In case you are borrowing from family or friends, do ensure that the interest rates as per the IRS gift tax are accounted for. On the other hand, the US Small Business Administration works closely with some banks to provide guaranteed loan programs that ensure small businesses receive the necessary funds with ease. The most commonly used debt instruments are:

- Convertible notes – These are one of the quickest modes of obtaining debt funds. Debt funds using convertible notes can be obtained by two simple documents – the convertible note purchase agreement and the promissory note. The former details the terms of investment and the later outlines the amount of investment, its conversion value, and the maturity date. Convertible notes can be as small as $7,000, allowing entrepreneurs a wide berth of financing options for startups.

- KISS & SAFE – KISS & SAFE are standardized legal documents for convertible securities. KISS created by 500 Startups stands for Keep It Simple Security, whereas, SAFE created by Y Combinator stands for Simple Agreement for Future Equity. These documents were created to simplify acquiring seed finance for startups. Most of the startup funding terms are standardized leaving negotiations open mostly for the conversion discount and the valuation cap.

- Venture Debt – This type of debt is provided by specialized institutions like Silicon Valley banks who understand a startup’s limitations with producing asset collaterals. These funds are used as growth capital and if strategically placed can buy a startup valuable time between consecutive equity rounds. Entrepreneurs can plan to achieve certain milestones before equity rounds using these funds which will in turn strengthen their chances to win the equity round.

What is equity funding?

Equity funding for startups, as the name suggests, gives investors rights over company shares in exchange for their investment. Based on the size of the investment, investors will own a percentage in the company profits. Unlike the transactional nature of debt funding, equity funding results in a long term relationship between the investors and the company. Investors become company partners.

Equity funding is provided by angels or venture capitalists. The funding amount is on the higher side as compared to debt funds and typically starts from $250K. However, no interest rates are involved. Equity investors share the risk of failure with startup founders. When the company performs well, they make massive profits within a short period in comparison to traditional investments. While on the other hand, if the company fails, founders do not owe anything to equity investors. This flexibility makes equity funding a lucrative financing option for startups.

Equity funding for startups happens in stages. For a healthy startup, with every round, the value of equity funds raised must increase. Based on the lifecycle of a startup, different activities are undertaken at specific stages and each one requires a different value of funding. Also with their association, Angels and venture capitalists carry their expansive business experience into the new startup. Apart from fundings, this qualitative contribution is a great value-added for growing businesses. After a startup has bootstrapped into the market, these are the four important stages of equity funding:

- Seed fund – This is the first external round of startup funding and ranges between $50K and $2 million. The valuation of a startup post the seed round is between $3 million to $6 million. As the name suggests, this fund is used to plant a ‘seed’ in the startup. The seed fund is mostly provided by Angels, with some exceptions of micro VC firms. Typically these funds are used for the initial market research and new product development. Investors provide seed funds using convertible notes, or in exchange for preferred stock options.

- Series A – Once a startup has created an MVP, Series A funds take the business to the next level. Series A is the stage when VCs enter the scene and funds range between $2 million & $15 million, raising the post-money valuation to $10 million & $15 million. Series A equity funding for startups is used to implement the next stages of a business plan and modify strategies if necessary, scale up or optimize distribution, explore new regional markets, and make up for any shortfall in the plans already in place from the seed round.

- Series B – This stage of startup funding is raised when the business is well established, there is an active customer base, and marketing channels are well managed. Usually, the VCs who entered a business in Series A, prefer to lead Series B as well. Series B funds can range anywhere between $7 million and $10 million and expect to reach a post-money valuation of $30 million to $ 60 million. This money helps to expand the business on a global scale, acquire new businesses or IP, for a massive expansion of the specialist team, and to expand the customer base.

- Series C – This round of equity funding for startups is not raised unless any specific need arises. Funding at this stage is provided by later-stage VCs, hedge funds, and investment banks. The requirements usually align with further expansion plans, acquisitions, or new IP. Series C funds run to hundreds of millions.

Pros and Cons of Debt and Equity funding

Now that we have a fair idea about how debt and equity funding works, we must understand that both these methods have their specific pros and cons. Drawing a profitable combination of the two will depend on the entrepreneur’s understanding of the business. What looks like an advantage at one stage can prove catastrophic in the other. Let’s look at some pros and cons of debt vs equity funding:

| PROS OF DEBT FUNDING | CONS OF DEBT FUNDING |

|---|---|

| Investor/lender does not control your company | Interest to be paid monthly. Burden of recurring expense |

| Stable interest rates. Payment cycles can be predicted | Debt reflects negatively on company’s credit score, affecting company valuation for future funding rounds |

| Founders can choose from a range of business loans. Choice available on amount & repayment period | Collateral required as guarantee. Founders tend to part with personal assets |

| Interest amount can be deducted from tax returns | Relationship with lender only in terms of money. No other value add |

| Fixed payment terms. Capital spent & cash flow can be easily monitored | If company fails, assets given as collaterals will be seized |

Thus we see that debt funding for startups though available at short notice, can weigh down on the business owing to its recurring expenses. At the same time, if the company is at a stage where cash flow is well managed, a short dose of debt funds can give it extra support to achieve set milestones.

| PROS OF EQUITY FUNDING | CONS OF EQUITY FUNDING |

|---|---|

| Investors share business risks | Dilution of company ownership |

| No monthly payments | Investors become partners. Participate in company decision making |

| Sufficient cash in bulk to plan long-term | Profits need to be shared with investors |

| No extra interest payments. Weighs less on expenses | Only way to remove equity partners is by buying back their shares at a higher rate than the initial selling price |

| Investors bring in strong industry network/mentorship/future investor contacts | Compared to debt funding, it is difficult to source and obtain. Competitive funding. |

| If company fails, founders do not owe anything to investors | Long-term association with partners, unless shares bought back |

Likewise, while equity funding for startups does not happen overnight, once it does the startup gains not only in funds but massive mentorship as well. Meanwhile, since experienced investors are entering the company as partners, they will have a say in the company’s major decisions. How well a founder handles this situation and plays it to their best advantage is what shapes a promising business.

Debt vs Equity Funding – Which is best for your startup?

In the previous section, we saw some of the upsides and downsides of both debt and equity funding. But on what factors should startup founders base their choice? Not all founders are serial entrepreneurs and making a wrong move with funding decisions can derail startup plans very early in the process. So here are some factors which might help you make this decision:

- Size of funds – In the earlier sections we have briefly discussed the range of funds that can be expected from the varied financing options for startups. Based on your needs and what your company valuation will allow, one can choose between debt and equity funding. Experts believe that debt funds are better for smaller amounts while equity funds are for the larger pile.

- Urgency of funds – How quickly do you need the money? If immediately, a debt fund is the way to go. Business loans are easily available provided all company paperwork is up-to-date. But equity funding for startups is a long process and involves preparations a couple of years in advance.

- Purpose of funds – If cash is all you need, debt funding for startups is the best bet. No other transactions are involved. Neither are the lenders involved in any decision making of the company. But, if you are a growing startup, in need of mentorship and business networks, equity funding is the right way to go. However, you must be ready to share your company with equity partners – profits and decision making power.

Let’s take an example

Consider a bakery ‘Cakes n You’ planning to start two new outlets in the city. Let’s say they need a fresh investment of $30 million.

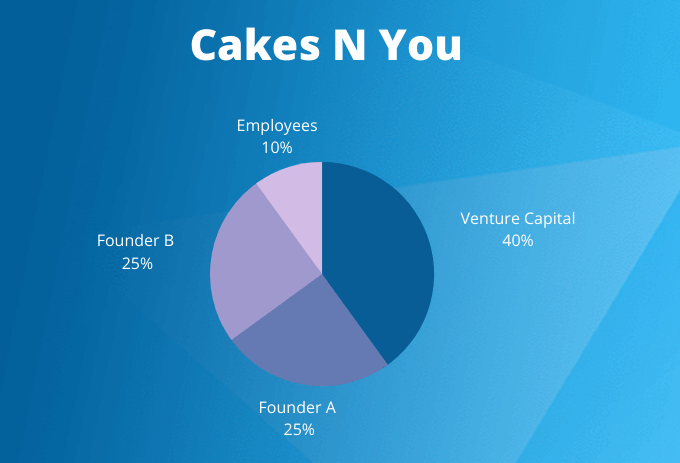

Equity Fundraising

‘Cakes n You’ decides to sell 40% equity to a VC for $30 million, choosing to receive only equity for their funding requirement. After receiving the new investment, the company’s cap table would look like this:

The Venture Capital would take up 40% of the ownership, followed by Founder A and B with 25% a piece, and the remaining 10% left for employees.

Let’s say the company expands well with these new funds and becomes very successful. Later on the company was eventually acquired by Nestle for $70 million. In this scenario Founder A and Founder would leave with a payout of $17.5 million each.

Debt Fundraising

In another scenario, ‘Cakes n You’ decides to get a business loan from a bank for $30 million at 3% interest, to be returned in 5 years. This would be 100% debt fundraising for the company. In this case the founders get to keep their 45% interest in the company intact, but would be burdened with monthly principal and interest payments, which could cause cash flow problems in the business, especially if the company is looking to expand. Using a simple loan calculator, we can see the repayments would be:

| Time | Principal | Interest | Total Paid | Balance |

|---|---|---|---|---|

| Year 1 | $5,168,957 | $760,711 | $5,929,668 | $24,831,043 |

| Year 2 | $5,803,159 | $655,569 | $6,468,729 | $19,027,884 |

| Year 3 | $5,979,668 | $489,060 | $6,468,729 | $13,048,216 |

| Year 4 | $6,161,545 | $307,184 | $6,468,729 | $6,886,671 |

| Year 5 | $6,348,954 | $119,774 | $6,468,729 | $537,716 |

| Year 6 | $537,716 | $1,344 | $539,061 | $0 |

The total interest on the $30 million loan would be $2,343,643, or around 7.81% of the total amount of the loan after 5 years. Let’s say the company still is acquired by Nestle at the beginning of year 3, but at a reduced price of $50 million, as there is uncertainty around the amount of debt the company has on its balance sheet.

In this case, the total remaining debt would be $13,048,216, less the acquisition price of $50 million, leaving around $36,951,784 million left. If founder A and B split this amount based on their 45% ownership, both would receive around $16,628,303 each.

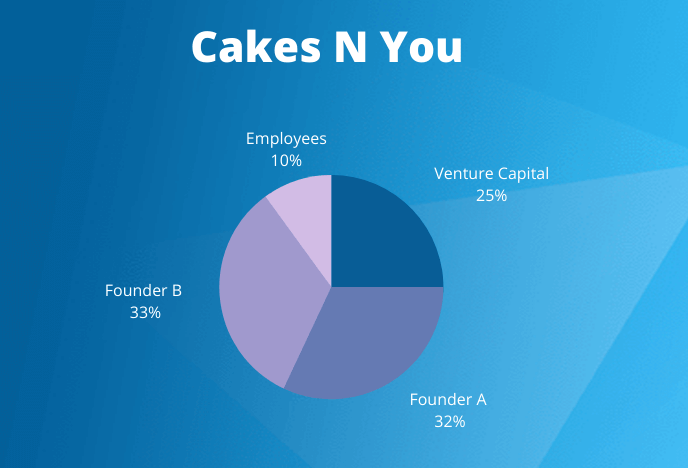

Equity & Debt Fundraising

In the last case, ‘Cakes n You’ decides to use a combination of debt and equity fundraising, and sells 25% equity to a VC for $20 million and gets a business loan from a bank for $10 million at 3% interest, to be returned in 5 years. After receiving the new investment, the company’s cap table would look like this:

In this case the total loan interest payable would be $781,214 based on the calculations in the loan schedule, with a total loan left at the beginning of year 3 of $4,349,405. And if the company is acquired for $60 million, less the loan, $55,650,595 would remain to be split among the shareholders. With having a 32.5% interest for both Founder A and B, each would receive $18,086,443.

In this scenario we can see how having a combination of both equity and debt can be beneficial for the company and have a higher payout for the founders upon exit.

Manage your Startup Equity on Eqvista

Be it debt or equity funds, a startup will get involved in issuing and managing company equity from the very early stages. Apart from fundraising, equity is a good way of hiring new talent as well. Thus to minimize manually issuing and tracking company shares, it is better to rely on sophisticated software such as Eqvista. You can now issue, record, and manage startup equity operations all on one platform. Read more about our services here or to discuss more reach out to us today!