Complete List of Unicorn Companies Globally in 2026

Last Updated: December 2025

As of Dec 2025, there are over 1,639 unicorns globally, spanning around 59 countries. This marks a notable increase from previous years, with the number rising significantly since 2022, when there were approximately 1,413.

The U.S. remains a leader, hosting around half of the world’s unicorns (820) and claiming more than 50% of the total count. Notably, the reports show that in 2025, the San Francisco Bay Area remains a key hub, retaining its status as the world’s leading city for unicorn startups.

What is a Unicorn Company?

A privately held startup valued at $1 billion or more is called a unicorn company. Venture capitalist Aileen Lee popularised the term “unicorn” to call privately held companies that achieved this threshold, “unicorn companies”.

Key Characteristics of Unicorn Companies

- Private ownership – They haven’t gone public through an IPO yet

- $1B+ valuation – Based on funding rounds from venture capital or private equity investors

- Usually tech-focused – Though not exclusively, most unicorns are in the technology sector

Examples of companies that were unicorns before going public include Uber, Airbnb, and SpaceX (which remains private). As the startup ecosystem has grown, unicorns have become more common – there are now hundreds worldwide, though they’re still considered significant achievements.

What Features Do Startups Need to Become Unicorns in 2026?

It is not easy for a company to become a unicorn in 2026, startups need to focus on several key features and strategies. Here are the key notable features of a unicorn company:

- Technology Driven: A recent research shows that a majority of the companies that have managed to achieve the unicorn status are software and the rest are either hardware or product & services companies.

- Innovative products and service: It is commonly seen that companies that are the first to do something unique and different achieve unicorn status. They innovate and change the norms, creating a new necessity. Additionally, such companies regularly keep innovating over the lifetime of the company to stay ahead of their competitors.

- Consumer-focused companies: When looked at, around 62% of the unicorn startup companies are customer-focused. Their main aim is to make things easy and simple for the people, being a part of their daily lives. One example is Spotify, they made listening to music from every corner of the world easy.

- Adaptability and Sustainability: These companies stay adaptable and respond swiftly to changing market demands. Emphasize sustainability to attract investment and support.

How Many Unicorn Companies Are There Globally in 2026?

There are over 1600 unicorn companies globally today. With a failure rate of 70-80% of startups within the first five years of operations, achieving a billion-dollar net worth is not an easy task. However, some companies have managed to do so despite the hurdles. The world of venture capital is booming, leading to many startups and companies achieving this threshold.

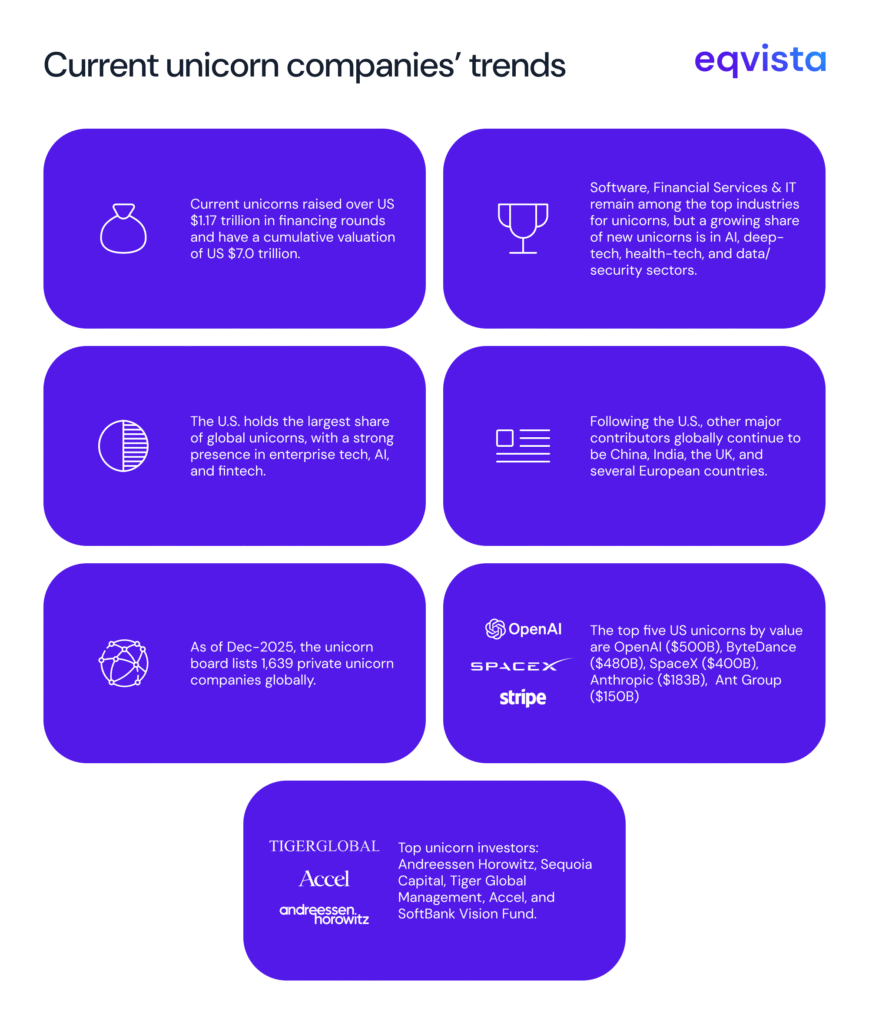

Current Unicorn Companies’ Trends

Explore the latest trends and key insights that are shaping the future of the most valuable unicorn companies. This section highlights the significant emerging trends and industry shifts among the top unicorns by market value as of December 2025.

- Current unicorns raised over US $1.17 trillion in financing rounds and have a cumulative valuation of US $7.0 trillion.

- Software, Financial Services & IT remain among the top industries for unicorns, but a growing share of new unicorns is in AI, deep-tech, health-tech, and data/security sectors.

- The U.S. holds the largest share of global unicorns, with a strong presence in enterprise tech, AI, and fintech.

- Following the U.S., other major contributors globally continue to be China, India, the UK, and several European countries.

- As of Dec-2025, the unicorn board lists 1,639 private unicorn companies globally.

- The top five US unicorns by value are OpenAI ($500B), ByteDance ($480B), SpaceX ($400B), Anthropic ($183B), Ant Group ($150B)

- Top unicorn investors: Andreessen Horowitz, Sequoia Capital, Tiger Global Management, Accel, and SoftBank Vision Fund.

Funding Distribution and Valuation

The highest-funded unicorn companies have collectively raised approximately $136 billion in equity funding. US Companies dominate the list with 7 out of 10 entries, followed by China and India with one company each.

OpenAI has the highest post-money valuation at $157 billion while having raised the third-highest amount of funding ($18B). Ant Group follows closely with a $150 billion valuation and $19 billion in funding. SpaceX has achieved a $137 billion valuation with relatively less funding ($9B) compared to its valuation.

Investment Patterns

Tech unicorn startup companies lead the list, especially in AI (OpenAI, xAI), data (Databricks), and transportation tech (Waymo, Cruise). Corporate investors play a significant role in several companies: Google in Reliance Jio, Alphabet in Waymo, and General Motors in Cruise.

Andreessen Horowitz appears as a lead investor in multiple companies (Databricks, SpaceX, Stripe), showing prominence in high-value investments. Three companies tied at $9B funding (SpaceX, Stripe, and Cruise), showing a common funding threshold for mature tech companies.

Industry Focus

AI and machine learning companies represent a significant portion of the list (OpenAI, xAI, Databricks). Autonomous transportation shows strong investment interest (Waymo, Cruise).

Financial technology maintains strong representation with Ant Group and Stripe. Space technology (SpaceX) continues to attract significant investment despite high capital requirements.

List of Unicorn Companies 2026

There are 1639 unicorn companies globally today. Here is the list of the top 100 unicorn companies:

| Sr. No | Company | Post Money Value | Total Equity Funding | Lead Investors Include | Country |

|---|---|---|---|---|---|

| 1 | OpenAI | $500B | $58B | SoftBank | United States |

| 2 | ByteDance | $480B | $8B | Kohlberg Kravis Roberts Japan, Sequoia Capital | China |

| 3 | SpaceX | $400B | $9B | Andreessen Horowitz | United States |

| 4 | Anthropic | $183B | $26B | Fidelity, ICONIQ Capital | United States |

| 5 | Ant Group | $150B | $19B | GIC, Temasek Holdings | China |

| 6 | Reliance Retail | $101B | $8B | Abu Dhabi Investment Authority | India |

| 7 | Databricks | $100B | $17B | Andreessen Horowitz, Insight Partners | United States |

| 8 | Stripe | $92B | $9B | Andreessen Horowitz, Baillie Gifford | United States |

| 9 | Revolut | $75B | $2B | Woodford Investment Management | United Kingdom |

| 10 | Shein | $66B | $4B | General Atlantic, HSG | China |

| 11 | Reliance Jio | $58B | $20B | India | |

| 12 | xAI | $50B | $18B | SpaceX | United States |

| 13 | Waymo | $45B | $11B | Alphabet | United States |

| 14 | Canva | $42B | $580M | Stack Capital | Australia |

| 15 | Checkout.com | $40B | $2B | Tiger Global Management | United Kingdom |

| 16 | Ripple | $40B | $794M | Brevan Howard Asset Management, Fortress Investment Group | United States |

| 17 | Figure | $39B | $2B | Parkway Venture Capital | United States |

| 18 | JUUL | $38B | $15B | Altria | United States |

| 19 | Ramp | $32B | $2B | Lightspeed Venture Partners | United States |

| 20 | Safe Superintelligence | $32B | $3B | CoreNest Capital | United States |

| 21 | Fanatics | $31B | $5B | Clearlake Capital Group | United States |

| 22 | Anduril Industries | $31B | $6B | Founders Fund | United States |

| 23 | Cruise | $30B | $9B | General Motors | United States |

| 24 | Alibaba Bendi Shenghuo Fuwu Gongsi | $30B | $4B | Alibaba Group, SoftBank Vision Fund | China |

| 25 | Anysphere | $29B | $3B | Accel, Coatue | United States |

| 26 | Scale AI | $29B | $16B | Meta | United States |

| 27 | Yangtze Memory Technologies | $23B | $7B | Wuhu Wenming Quanhong Investment Management | China |

| 28 | Epic Games | $23B | $8B | The Walt Disney Company | United States |

| 29 | BYJU'S | $22B | $5B | Qatar Investment Authority | India |

| 30 | Envision Group | $21B | $2B | GIC, HSG | China |

| 31 | Kraken | $20B | $1B | Citadel Securities, DRW Venture Capital | United States |

| 32 | FNZ | $20B | $4B | CPP Investments, Generation Investment Management | United Kingdom |

| 33 | Perplexity | $20B | $1B | Accel | United States |

| 34 | ChangXin Memory Technologies | $19B | $5B | China | |

| 35 | JD Digits | $18B | $5B | APOFCO, CICC | China |

| 36 | Miro | $18B | $476M | ICONIQ Growth | United States |

| 37 | Deel | $17B | $982M | Andreessen Horowitz, Coatue | United States |

| 38 | Xiaohongshu | $17B | $918M | Temasek Holdings, Tencent | China |

| 39 | Yuanfudao | $17B | $4B | YF Capital | China |

| 40 | Rippling | $17B | $2B | Coatue | United States |

| 41 | Trendyol Group | $17B | $2B | General Atlantic, SoftBank Vision Fund | Turkey |

| 42 | Yinwang Smart Technology | $16B | $3B | Seres Group | China |

| 43 | Discord | $15B | $983M | Dragoneer Investment Group | United States |

| 44 | Genki Forest | $15B | $721M | Temasek Holdings | China |

| 45 | CloudKitchens | $15B | $1B | Saudi Arabia's Public Investment Fund | United States |

| 46 | Bitmain | $15B | $765M | Crimson Ventures | China |

| 47 | Applied Intuition | $15B | $1B | BlackRock, Kleiner Perkins | United States |

| 48 | PhonePe | $15B | $3B | General Atlantic | India |

| 49 | GAC Aion New Energy Automobile | $14B | $3B | China | |

| 50 | Helsing | $14B | $2B | Prima Materia | Germany |

| 51 | Mistral AI | $14B | $3B | ASML | France |

| 52 | OpenSea | $13B | $427M | Coatue, Paradigm | United States |

| 53 | Superhuman (formerly Grammarly) | $13B | $400M | Baillie Gifford, BlackRock | United States |

| 54 | Devoted Health | $13B | $2B | Fearless Ventures, GIC | United States |

| 55 | Celonis | $13B | $2B | Qatar Investment Authority | Germany |

| 56 | GoodLeap | $12B | $0 | United States | |

| 57 | Biosplice Therapeutics | $12B | $778M | aMoon Fund, Eventide | United States |

| 58 | Xingsheng Youxuan | $12B | $5B | Ontario Teachers' Pension Plan | China |

| 59 | Thinking Machines Lab | $12B | $2B | Andreessen Horowitz | United States |

| 60 | Northvolt | $12B | $4B | La Caisse | Sweden |

| 61 | Airtable | $12B | $1B | XN | United States |

| 62 | The Access Group | $12B | $1B | Hg, TA Associates | United Kingdom |

| 63 | Whatnot | $12B | $975M | CapitalG, DST Global | United States |

| 64 | Bending Spoons | $11B | $616M | T. Rowe Price | Italy |

| 65 | Kalshi | $11B | $2B | CapitalG, Paradigm | United States |

| 66 | Oura | $11B | $1B | Fidelity | Finland |

| 67 | Bilt Rewards | $11B | $813M | General Catalyst, GID | United States |

| 68 | Quantinuum | $11B | $900M | NVentures | United States |

| 69 | Colossal Biosciences | $10B | $568M | Mark Walter, Thomas Tull | United States |

| 70 | Notion | $10B | $343M | Coatue, Sequoia Capital | United States |

| 71 | Alchemy | $10B | $564M | C1Fund | United States |

| 72 | Cognition | $10B | $896M | Founders Fund | United States |

| 73 | KuCoin | $10B | $180M | Susquehanna International Group | Seychelles |

| 74 | Crusoe Energy Systems | $10B | $3B | Mubadala Capital, Valor Equity Partners | United States |

| 75 | Digital Currency Group | $10B | $0 | OMERS Ventures | United States |

| 76 | Zuoyebang | $10B | $3B | FountainVest Partners, Tiger Global Management | China |

| 77 | Chehaoduo | $10B | $4B | H Capital Advance, HSG | China |

| 78 | Talkdesk | $10B | $497M | Transpose Platform Management | United States |

| 79 | Thrasio | $10B | $2B | Advent International, Silver Lake | United States |

| 80 | Lalamove | $10B | $2B | Hillhouse Investment, HSG | Hong Kong |

| 81 | Sierra | $10B | $635M | SoftBank Vision Fund | United States |

| 82 | Mercor | $10B | $484M | Felicis | United States |

| 83 | Mahindra Electric Automobile | $10B | $388M | Temasek Holdings | India |

| 84 | Neuralink | $10B | $1B | CoreNest Capital | United States |

| 85 | Gusto | $10B | $746M | Friends & Family Capital | United States |

| 86 | Vercel | $9B | $863M | Accel, GIC | United States |

| 87 | Tata Passenger Electric Mobility | $9B | $989M | TPG Rise Climate Fund | India |

| 88 | N26 | $9B | $2B | Coatue, Third Point Ventures | Germany |

| 89 | Tanium | $9B | $747M | Salesforce Ventures | United States |

| 90 | Yanolja | $9B | $2B | SoftBank Vision Fund | South Korea |

| 91 | Octopus Energy Group | $9B | $3B | CPP Investments | United Kingdom |

| 92 | HeyTea | $9B | $594M | Coatue, Hillhouse Investment | China |

| 93 | Polymarket | $9B | $2B | Intercontinental Exchange | United States |

| 94 | VAST Data | $9B | $381M | Fidelity | United States |

| 95 | Niantic | $9B | $770M | Coatue | United States |

| 96 | EV Co | $9B | $486M | India | |

| 97 | Ping An Healthcare Management | $9B | $1B | SBI Group, SoftBank Vision Fund | China |

| 98 | Gopuff | $9B | $4B | Eldridge Industries, Valor Equity Partners | United States |

| 99 | Personio | $8B | $724M | Greenoaks | Germany |

| 100 | Bolt | $8B | $2B | Fidelity, Sequoia Capital | Estonia |

Data sourced from Crunchbase on December 9, 2025.

Top 5 Unicorn Companies in 2026

As of 2025, the global landscape of unicorn companies—privately held startups valued at $1 billion or more—continues to grow and diversify. Companies attain unicorn status driven by investor confidence in their growth potential and disruptive business models. With strategic funding rounds and a focus on innovation, scalability, and market expansion, startups can gallop into the unicorn club.

Open AI

OpenAI is now widely considered to be the most valuable private company in the world (US $500B in 2025). This valuation for its AI models and services shows massive investor confidence. OpenAI’s leadership in generative AI and global demand for AI-driven products and enterprise solutions have put OpenAI at the forefront of the global startup economy.

ByteDance

ByteDance is still a powerhouse in global tech and media, today among the top 3 most-valuable private companies (US $480B as of 2025). Its vast ecosystem of consumer apps, high user engagement and worldwide reach places it in the top of the list of private company valuations.

SpaceX

SpaceX remains the leading private aerospace and space-tech company in the world with an estimated US $400B valuation in 2025. Its reusable rocket technology, satellite internet (Starlink), and ambitious space missions keep it at the forefront of long-term global infrastructure and space economy plans.

Anthropic

Anthropic, an AI-native startup has soared into the upper echelons of valuations of private companies, with an estimated 2025 value of US $183B. This highlights the rising investor appetite for AI infrastructure, tools and enterprise AI solutions beyond “consumer AI” hype.

Ant Group

Ant Group continues legacy of top fintech firm in 2025 Valuation around US $150B. Its listing on the list of top private companies underlines the persistence of the strength of large-scale fintech operations and investor confidence worldwide, particularly from China.

Top 10 Companies’ Total Funding Amounts

Some of the most successful startups get funding from different sources. Funding can come from VCs, angel investors, and other investors looking to invest in promising projects. The following table shows the 10 highest total funding amounts that some companies have received:

| Sr. No | Company | Post Money Value | Total Equity Funding | Lead Investors Include | Country |

|---|---|---|---|---|---|

| 1 | OpenAI | $500B | $58B | SoftBank | United States |

| 2 | Anthropic | $183B | $26B | Fidelity, ICONIQ Capital | United States |

| 3 | Reliance Jio | $58B | $20B | India | |

| 4 | Ant Group | $150B | $19B | GIC, Temasek Holdings | China |

| 5 | xAI | $50B | $18B | SpaceX | United States |

| 6 | Databricks | $100B | $17B | Andreessen Horowitz, Insight Partners | United States |

| 7 | Scale AI | $29B | $16B | Meta | United States |

| 8 | JUUL | $38B | $15B | Altria | United States |

| 9 | Waymo | $45B | $11B | Alphabet | United States |

| 10 | SpaceX | $400B | $9B | Andreessen Horowitz | United States |

How to Become a Unicorn Company?

The evolving innovation landscape has made it more achievable to become a unicorn startup company in 2025. With the right combination of vision, determination, and strategy, today’s startups have the potential to become billion-dollar disruptors in the future. The question is—will your company be the next unicorn? Whether you’re an entrepreneur with a groundbreaking idea or an investor looking for the next big thing, the journey to unicorn status begins now. Are you prepared to make it happen?

Eqvista offers services that benefit companies of all sizes as they navigate growth and operational complexities on their path to becoming the next unicorn. We specialize in providing valuation reports, which are essential for every company seeking to attract investors or prepare for future funding rounds. Eqvista’s cap table management software automates the tracking and management of equity ownership.

Don’t wait any longer! Contact us to discover how our services can help untangle ownership structures and drive growth in today’s dynamic market environment.