What is the role of a valuation expert witness in legal proceedings?

In this article, we will explore how valuation experts ensure fair outcomes in disputes involving asset valuations.

If you follow court proceedings, you must have some notion of the importance of expert testimony in court cases. In many court cases, some facts or events are simply too technical to interpret without the guidance of an expert. The courts lean on the experience, training, and education of these experts to make informed decisions.

Courts can call upon experts from virtually any relevant field such as medicine, forensic science, architecture, and structural engineering to gain clarity regarding important points of contention. Often, expert witnesses help clarify complex financial issues. Valuation experts deliver unbiased opinions in legal proceedings to help the court reconcile claims with facts and reach a just decision. Their role in ensuring fair treatment of all parties cannot be underplayed.

In this article, we will explore how valuation experts ensure fair outcomes in disputes involving asset valuations. Read on to know more!

Why do courts rely on expert witnesses?

When a legal claim is brought to a court, the judge and/or the jury must review all facts relevant to the claim to resolve the matter. The experience and education of the judges equip them with an unparalleled, accurate interpretation of laws, regulations, and various forms of contracts. However, the court may have to lean on an expert witness if key facts of the matter pertain to fields outside the court’s expertise such as medicine, technology, forensic science, engineering, art, and finance.

By calling expert witnesses, courts can separate facts from opinions, and verify their interpretations of the facts to provide a just ruling.

We often associate expert witnesses with criminology or forensic science experts such as Dr. Michael Baden who testified in trials like the OJ Simpson trial and the Kobe Bryant trial. While Dr Baden was a medical sciences expert, courts may call an expert from any field relevant to the case at hand.

When should you call for valuation expert witnesses?

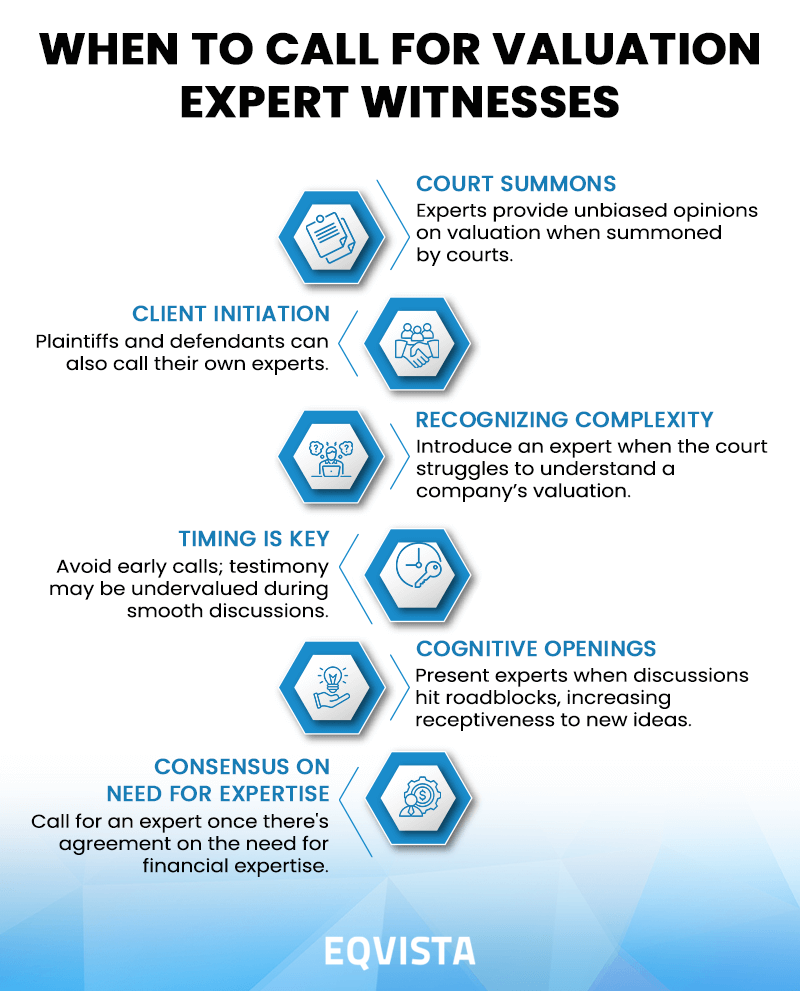

When summoned by courts, valuation experts deliver unbiased opinions on the quality of a valuation methodology, and the accuracy of the valuation. But it’s not just the courts that can call for valuation expert witnesses. A valuation expert witness can also be called upon by plaintiffs and defendants.

In such cases, they must adhere to professional standards of ethical practice while supporting their client’s claims. They must also ensure that their testimony withstands cross-examinations by opposing legal counsel.

Also, the timing of introducing a valuation expert witness is extremely crucial. A valuation expert witness should be called once the court has recognized difficulties in understanding a company’s valuation.

If we over-simplify things, we can reduce a trial to a discussion with an agenda to investigate and rule upon a particular incident. In any discussion, introducing a contrary or new idea is tough when the discussion is moving along a narrative smoothly. At such stages, the group is likely to dismiss or undervalue a plausible solution.

In contrast, when a roadblock brings the discussion to a grinding halt, there is a cognitive opening. At this stage, the discomfort of having no plausible solution in sight makes members more receptive to new ideas or opinions of external parties.

Similarly, if a company valuation’s accuracy is one of the points of contention, it is best to call for an expert witness, once there is a general consensus that financial expertise is required to effectively investigate the matter at hand. If a valuation expert witness is called upon too early, the judge or jury may prematurely dismiss or undervalue the valuation expert witness’ testimony. They may dismiss the key valuation insights offered by the expert witness as unnecessary or irrelevant.

How should you counter an opposing valuation expert witness’ testimony?

Some of the strategies that could expose flaws and inaccuracies in an opposing valuation expert witness’ testimony are as follows:

Challenge credibility

It is important to check whether the opposing valuation expert witness has the necessary experience, credentials, and education to actually deliver accurate valuation insights. A valuation witness expert must possess degrees in finance and mathematics and hold certifications such as Chartered Financial Analyst (CFA), Accredited Senior Appraiser (ASA), or Certified Public Accountant (CPA).

Also, the valuation expert witness must have experience in valuing companies from the same geographical region and industry as the one whose valuation is being questioned.

Highlight biases

A valuation expert witness’ testimony can be thrown out if evidence of bias is found. When a valuation expert is hired by someone, they cannot and will not testify against their client’s interests. However, in the pursuit of fulfilling their duty to their clients, the expert may cross ethical boundaries by hiding facts and misrepresenting them. You can take the help of your own valuation expert witness to expose such biased testimonies.

Question methodology

You will find that a company’s valuation figure depends heavily on the valuation methodology used. A company’s valuation when calculated based on its asset values will seldom match the valuations calculated through the income-based approach or the market-based approach. Different methodologies and valuation approaches exist because each of them is applicable or appropriate in situations where the others aren’t.

If you can find evidence that the valuation methodology used by the opposing valuation expert witness was not appropriate, you could get the court to dismiss or at least put less weight on the expert’s valuation insights.

Challenge assumptions

In valuation exercises, it is common to assume certain inputs to narrow down the valuation range. We often make assumptions regarding economic conditions, market growth, and the conditions in closely related industries.

However, the court may not be equipped to identify unrealistic assumptions in your opposing valuation expert witness testimony. In such cases, you can call upon your valuation expert witness to identify the unrealistic assumptions and explain the valuation impact of these assumptions.

How much influence do valuation expert witnesses have over court rulings?

While a valuation expert witness cannot single handedly win you lawsuits, their testimonies can have substantial influence over the outcome. The influence of the valuation expert witness depends on how central is the valuation to the lawsuit. Let us understand this by briefly going over a few scenarios.

Scenario 1 – Allegations of negligence in performing accurate valuation

Allegations of negligence in performing accurate valuations can be made against fund managers whose investment decisions caused significant losses to investors. In such cases, a valuation expert witness’ testimony can help find evidence of negligence on the fund manager’s part. Similarly, the fund manager can employ its valuation expert witness to refute negligence claims.

Similarly, the valuation expert witness’s testimony will be of great importance if a group of employees allege that their employer neglected its duty to perform an accurate valuation to issue equity compensation, resulting in unsavory tax consequences.

Scenario 2 – Allegations of financial fraud

In the case of financial fraud, the damage calculations presented by valuation expert witnesses significantly impact the settlement amounts recommended by courts. But, before settlement amounts are decided, the lawyers must find evidence of financial fraud.

Scenario 3 – Disputes of compensations in M&A transactions

In a startup’s acquisition, minority shareholders may allege that the startup’s intellectual property was severely undervalued, resulting in an unfairly low payout for them.

In such cases, the plaintiff’s legal counsel must prove that the company’s by-laws and shareholders’ agreement do not have drag-along provisions for majority shareholders who were in favor of the deal. Only then will the evidence of undervalued patents, trademarks, and other intellectual properties discovered by the plaintiff’s valuation expert witness be considered.

Eqvista – Precise Valuations That Bolster Legal Strategies!

Valuation experts play a key role in equity litigations as expert witnesses who clarify complex financial issues. A party can prove the accuracy of its asset valuation, substantiate claims of financial damages, and even reach desired settlements if it is backed by the testimony of a credible valuation expert in legal proceedings.

Introducing a valuation expert witness’ testimony once the court has recognized difficulties in valuing an asset can maximize their impact.

A valuation expert witness’ role is not limited to just providing supporting testimonies. A seasoned valuation expert witness can also contribute by countering an opposing witness’ claims by challenging their credibility, highlighting biases, questioning the methodology used, and challenging unrealistic assumptions.

Although a valuation expert witness’ testimony is powerful, it cannot replace sound legal counsel. Ideally, the two should be used in tandem.

If you are involved in a dispute over asset valuations which could snowball into a lawsuit anytime soon, waste no time in hiring Eqvista for equity litigation support. Our team of seasoned analysts has delivered accurate and detailed valuation reports on thousands of corporations and startups. Contact us to know more!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!