An Introduction to the Private Equity Secondary Market

In this article, we will have an in-depth look into the types of secondary transactions and private equity secondary markets.

A secondary market is a marketplace where investors can exchange company shares. It implies that stock transactions between investors are unrestricted and independent of the issuing firm. Transactions involving an investor purchasing a current interest or asset from primary private equity fund investors, also called limited partners (LPs), are called private equity secondaries. Depending on the requirements of the relevant stakeholders, these transactions can be organized in various ways. What is private equity? How does it work? In this article, we will have an in-depth look into the types of secondary transactions and the types of secondary markets and private equity secondary markets.

Private equity secondary market

The private equity secondary market is the buying and selling of pre-existing investor commitments to private equity and other alternative investment funds (also known as private equity secondaries or secondaries). The transfer of interests in hedge funds and private equity funds may be more complex and time-consuming due to the need for established trading venues for these interests.

What is private equity?

Investment partnerships that acquire and run businesses before selling them are known as private equity. Private equity firms manage these investment funds on behalf of accredited and institutional investors. Private equity firms may invest in such buyouts as a consortium or may fully acquire private or public enterprises. They often don’t own shares of businesses that continue to be traded on stock exchanges. Private equity is frequently bundled with venture capital and hedge funds as an alternative investment. Such assets are restricted to institutions and high-net-worth people because investors in this asset class typically need to devote significant funds over the years.

Contrary to venture capital, most private equity firms and funds invest in established businesses instead of startups. Before quitting the investment years later, they manage their portfolio firms to boost or extract value. The private equity sector has expanded quickly due to more significant allocations to alternative investments and relatively positive returns on private equity funds since 2000. Private equity buyouts reached a record-high $1.1 trillion in 2021, doubling from 2020. When stock markets are soaring and interest rates are low, private equity investing tends to become more lucrative and well-liked, less so when those cyclical elements become unfavorable.

How does private equity work?

The private equity fund is private money that finances a long-term investment strategy in an unprofitable company. Since the 1980s, investment management firms that specialized in the leveraged purchase of financially unstable enterprises have been rebranded as “private equity funds” by the financial press. In a private equity investment, operations are carried on as follows:

- An investment manager uses investor cash to finance purchases for hedge funds, pension funds, university endowments, and wealthy individuals.

- It restructures the target firm to sell at a rate higher than its purchase value to get a more significant return on stock invested, typically by slashing costs for quick, increased profits.

- The investment manager uses debt financing as leverage to purchase a target company. As a result, there’s a slight increase in the target company’s value, such as a 30% increase in the asset’s price and a potential 100% return on the equity invested. This is ensured if the private equity used to purchase the target company was a 30% down payment and 70% financed debt. In addition, interest payments made on debt are tax deductible since debt financing lowers business taxes, which boosts investor profits.

- Private equity firms put working money into start-up businesses and add value by lowering costs and balancing the financial interests of private equity shareholders with those of corporate management, who typically offer innovative products and services. A significant portion of the target company’s income is given to the shareholders while reinvesting a smaller amount in the business (i.e., the employees and the production equipment). When a private equity firm purchases a start-up company, the investors may behave like venture capitalists and improve the target company’s goods and services to gain a larger market share. Additionally, when a private equity firm acquires a sizable target company, the new corporate management (the private equity investors) may need to improve employee morale, leading to lower-quality products.

- Leveraged buyouts, distressed securities, venture capital, growth capital, and mezzanine capital are primary investment strategies in private equity financing. Contrary to venture capital and growth capital investments, which give investors working capital to a start-up company without majority control of the company, in a typical leveraged buyout transaction, a private equity firm purchases enough stock (shares of ownership) to give them majority control of a mature company.

Pros and cons of private equity

There are a few benefits to funding or investing in a private equity firm, including:

- Increases working capital for the company – While raising funds for a start-up or established business is difficult, private equity firms can offer the financial boost required to assist a start-up or struggling company.

- Avoids using traditional forms of financing – Private equity valuations are unaffected by the open market. To survive, a business that receives money from private investors only needs to go through a bank and take on the risk of high-interest loans.

- Provides more freedom for expansion – Businesses that get financing from organizations like venture capital firms may do so earlier in their development, allowing them to test various growth methods as they build their company.

For investors and receivers of funds, some drawbacks of private equity include:

- Requires up-front funding – To invest in a private equity firm, you’ll need access to a sizable quantity of funds. It can be expensive to make a profit, whether your goal is to keep a business alive or turn it around (which can take years).

- An extended period may pass before a private equity firm notices a company – Both established businesses and start-ups are responsible for persuading investors to invest in their ventures, which may result in months of consideration or unproductive talks.

- Less control for investors – When an investment firm injects funds into a business, it could be allowed to decide how the company will be managed or structured. Private equity can be challenging for those who have developed their business from the ground up because it requires them to transfer shares and give up some of their control.

Understanding the secondary market

Secondary investments are private equity assets already in existence. These deals could involve buying stakes from current institutional investors and then selling private equity fund shares or portfolios of direct assets in privately held enterprises. Since private equity is designed to be a long-term investment for buy-and-hold investors, it is, by definition, illiquid. Institutional investors, especially those new to the asset class, have access to private equity from earlier eras through secondary investments than they would otherwise have.

The j-curve effect of investing in new private equity funds is reduced by secondaries, which often have a distinct cash flow profile. Even though many significant institutional investors have acquired private equity fund interests through secondary transactions, investments in secondaries are frequently made through third-party fund vehicles with structures akin to funds of funds. Investors in private equity funds can sell their remaining unfunded commitments and the investments they have made in the fund.

Types of secondary transactions

There are two major categories of secondary transactions:

Sales of Fund Interests

This category comprises selling an investor’s interest in a private equity fund or portfolio of interests in several funds through the transfer of the investor’s limited partnership or LLC member ownership interest in the fund. The secondary market allows the selling of almost all private equity funds, including buyouts, growth equity, venture capital, mezzanine, distressed, and real estate.

The investor will usually be released from any outstanding unfunded obligations to the fund and receive some liquidity for the funded investments through the transfer of the fund interest. In addition to conventional cash sales, various structured agreements are used to complete fund interest sales:

- Structured joint ventures include a wide range of negotiated exchanges between the buyer and seller that are ordinarily tailored to their individual requirements. Typically, the buyer and seller reach a more complicated economic arrangement than a direct transfer of cent percent ownership of the fund interest.

- Stapled transactions – When a private equity firm solicits new investments for a fund, it is called a stapled secondary transaction. A secondary buyer makes a new commitment to the new fund that the private equity firm raises by purchasing an interest in an existing fund from an existing investor. During the fundraising phase, private equity firms frequently start these transactions. As the need for primary investments decreased recently, they became less frequent. Several spinout transactions involving captive teams within banking institutions have been finalized.

- Securitization – To issue notes and provide partial liquidity for the seller, a new vehicle (a collateralized-fund-obligation vehicle) receives contributions from investors through fund interests. In most cases, the investor will sell a portion of the leveraged vehicle’s stock. This is also known as a collateralized fund-obligation vehicle.

Sale of Direct Interests

A direct secondary transaction offers the chance to sell the stock before the complete portfolio of companies has been sold.

- Tail-end – The sale of the remaining assets in a private equity fund that is nearing, or has already exceeded, their expected life falls under this category.

- Secondary directs or synthetic secondaries – The sale of portfolios of direct investments in running companies falls under this category rather than the sale of limited partnership interests in investment funds. Historically, these portfolios have been the source of corporate development initiatives or significant financial institutions. Typically, this group can be broken into the following subgroups:

- Secondary direct -It involves the transfer of a captive portfolio of direct investments to a second buyer, who will either handle the investments themselves or find new management for them.

- Synthetic secondary or spinout – A synthetic secondary transaction involves acquiring a stake in a new limited partnership created mainly to hold a portfolio of direct investments by secondary investors.

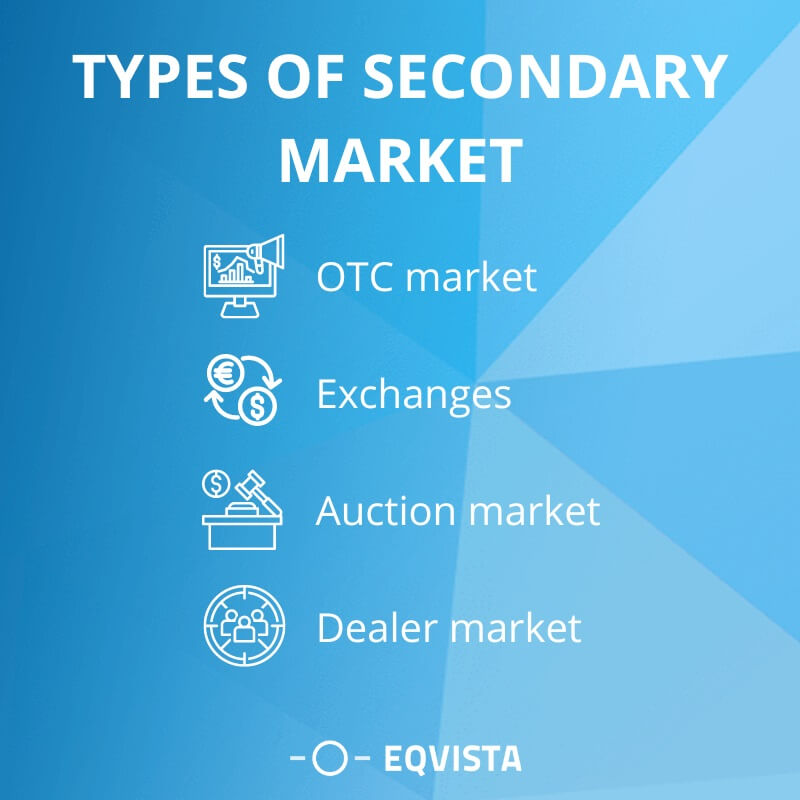

Types of secondary market

Secondary markets can be broadly classified into four types:

- OTC market – Over-the-counter (OTC) securities are traded through a broker-dealer network rather than listed on a significant US exchange. This is typical because many of these securities are held by smaller corporations that do not fit the criteria to be listed on a formal exchange.

- Exchanges – Trading securities, commodities, derivatives, and other financial instruments occur on an exchange. An exchange’s primary duty is to maintain fair and orderly trading and effective pricing information distribution for all securities traded there.

- Auction market – In an auction market, the price is established by the highest amount the buyer is ready to pay (bids) and the lowest amount the seller is willing to accept (offers). One example of an auction market is the New York Stock Exchange (NYSE).

- Dealer market – The rates that several dealers are willing to pay to acquire or sell a particular security are posted in a dealer market. And it is a transparent financial market mechanism.

How does private equity investment work in the secondary market?

Private equity secondaries are deals in which an investor purchases an existing stake or asset from limited partners, the primary investors in private equity funds (LPs). Depending on the requirements of the relevant stakeholders, these transactions can be organized in various ways. Due to their flexibility for LPs who may choose to liquidate or rebalance a portfolio, secondaries have become an increasingly enticing component of the private equity market. In contrast, purchasers of secondaries gain from a shorter duration, a quicker return on investment, discounted access and increased transparency regarding the underlying portfolio of assets.

Risk and important considerations to look for

Investors may reduce exposure to volatility in any market scenario by investing in firms that offer crucial goods and services to secure end markets and robust organizations with successful track records. We put money into single-asset, general partner-led secondaries for our portfolio. As this initial stage is considered the riskiest for private equity investment, we usually target investments with track records beyond three years.

Why is the private equity secondary market gaining popularity?

These days, limited partners who wish to control their liquidity needs or lessen their exposure to future capital calls view the secondary market as a crucial choice. As a result, just like shares in well-performing firms are accessible at the NYSE and NASDAQ exchanges, stakes in well-performing funds are increasingly available for purchase in the secondary market. The secondary market is particularly appealing to buyers while offering sellers a variety of advantages. For investors wishing to enjoy the strong returns of the private equity asset class while preserving shorter hold periods and obtaining quicker pay-outs, purchasing secondary interests flattens the J-curve and is an appealing choice.

Manage your private equity with Eqvista!

It can be challenging for corporations to precisely calculate their equity once a secondary market transaction has started. A cap table comes to aid this challenge by facilitating the recording and maintenance of secondary transactions. Need help with your secondary transactions record keeping? Eqvista provides a new secondary transaction log page, and with that, you may keep track of all secondary transactions, making it easier to include them on your cap table. Contact us today to learn more about recording and maintaining secondary transactions!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!