Financial forecasting for startups: Best practices

This article explores five best practices for creating accurate financial forecasts.

Did you know that poor cash flow management is the reason for failure of more than 80% of businesses? This means that startup failure rates, which can be as high as 90%, can actually be minimized by accurate financial forecasting. To the uninitiated, financial forecasting may seem daunting. However, this is an exercise that can help you make better strategic decisions and extend your startup’s runway. It can help you effectively tackle competition, secure investments, and scale operations in a cost-effective manner.

Financial forecasting was once an onerous process, requiring extensive number-crunching and in-depth research. However, advancements in AI, spreadsheet applications, and accounting tools have made it significantly more efficient and accessible.

To further assist you in creating accurate financial forecasts, this article explores five best practices, including understanding key performance metrics, analyzing economic factors, and selecting the right forecasting models.

Best practices for financial forecasting for startups

Five best practices that can help you make accurate financial forecasts as a startup founder are as follows.

Identify your key performance metrics

Forecasting cash flows without understanding the link between operations and performance is like taking a full swing before even knowing who the pitcher is. You might get lucky, but it is nothing more than taking a gamble.

So, when you are creating a financial forecast for your startup, you must identify which performance metric is most closely related to your revenue. To do so, you must track various metrics such as website traffic, user engagement, lead conversion rate, brand awareness, and customer satisfaction score.

You should identify the non-financial metric or metrics that are most closely related to your financial performance. To do so, you can perform exploratory data analysis or use traditional statistical techniques such as regression analysis.

The next step would be to predict the trends in your key non-financial performance metrics. Typically, predicting the trends in these metrics is more intuitive for founders than directly forecasting a financial forecast. Once these trends have been identified, typically, you can use single or multi-variable linear regression to predict the cash flows.

Incorporate economic and industry outlook

Many founders that aim to build a unique business tend to think of their business as an isolated entity. However, you must realize that your startup will not remain unaffected by external factors. These external factors can be categorized into economic, industry, and regulatory factors. In most novel industries, predicting what kind of regulations will be introduced is next to impossible. So, you should concentrate your focus on economic and industry-related factors for the purpose of financial forecasting.

Economic factors such as growth rate, employment rate, gross capital formation, and inflation impact purchasing decisions at an individual as well as corporate level. Typically, the impact of economic factors is felt in the following manner:

Typically, you can perform multivariate regression analysis on economic factors and your financial performance to quantify their relationship. Then, you should compile economic outlooks released by reputable entities such as the World Bank and S&P Global.

Based on these outlooks and the regression equations you formed, you should adjust your financial forecasts. In a similar manner, you can quantify the relationship between industry dynamics and your financial forecasts, and make the appropriate adjustments.

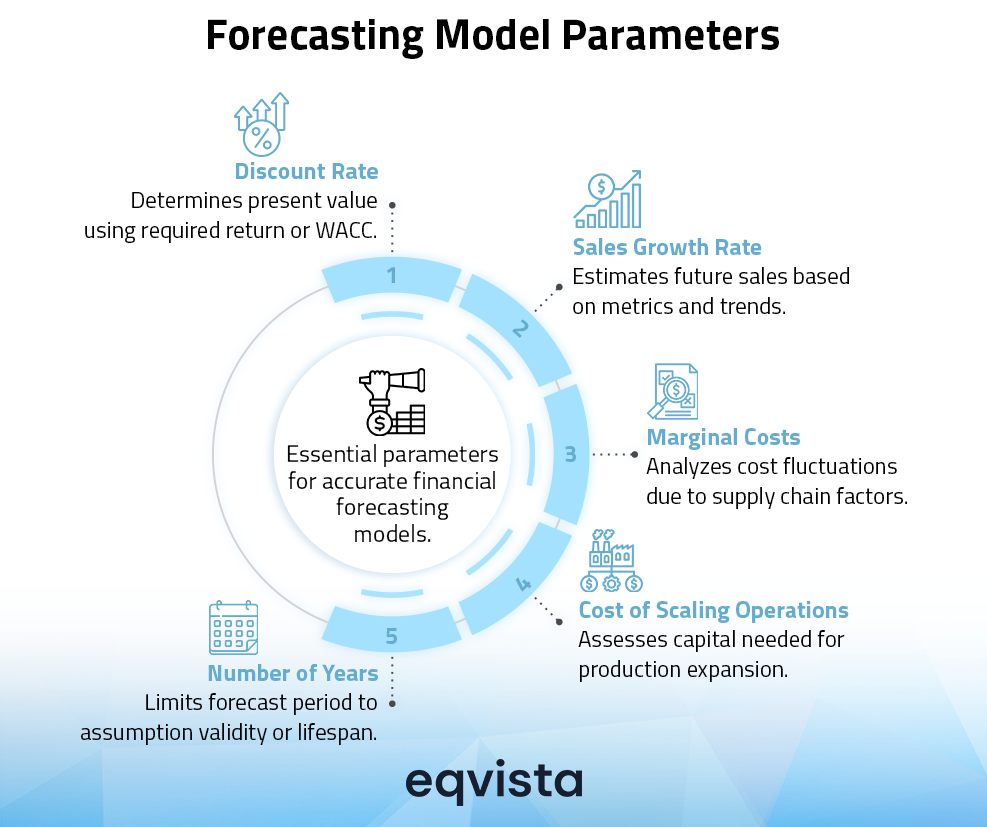

Choose the right financial forecasting model and parameters

Typically, startup founders will choose the discounted cash flow method by default for financial forecasting. However, this might not be the ideal method for a pre-revenue startup. In such cases, driver-based modeling, analysis of unit economics, and scenario-based modeling could be used.

Even after you choose the right forecasting model, to ensure accurate results, you must carefully pick the forecasting parameters.

Consider multiple scenarios

In contrast to established organizations, startups are more susceptible to changes in external conditions. Hence, scenario analysis holds even more importance in the case of startups. In the previous section, we briefly discussed how different supply chain scenarios must be considered to get a deeper understanding of marginal costs.

Similarly, a common practice is to consider different macroeconomic scenarios and sets of industry conditions. Forecasting your financial performance in different industry conditions helps you gain a better understanding of your cash flows. You can gain similar benefits from considering a range of macroeconomic scenarios. This also provides insights into the impact of fluctuations in factors such as borrowing costs and cost of capital.

Depending on the factors you consider, you can either use simple scenario analysis or use techniques such as Monte Carlo simulations. In Monte Carlo simulations, to understand the impact of a continuous variable, we generate random samples based on the variable’s probability distribution. Then, we use these samples to produce financial forecasts. This can help us better estimate or quantify financial performance.

Benchmark end results with market conditions

Apart from financial planning, financial forecasts are also used to find valuations. Hence, incorporating investor sentiments and other market trends is an important aspect of valuation exercises.You can use a market-based valuation approach to align your forecasts with market conditions.

Valuation methods that come under this approach include comparable company method and the market valuation multiple method.

As the name suggests, the comparable company method involves finding a company that mirrors your startup. Then, you must apply its valuation metrics to your financial performance to find your valuation.

To find market valuation multiples, first select companies similar to yours. Then, calculate the ratio of each company’s market value to its financial performance to derive the multiple. Finally, you can apply this multiple to your startup’s financials to find its valuation.

Eqvista – Unlocking value by deciphering trends!

You must note that financial forecasts do not remain reliable forever since the underlying assumptions become outdated. Hence, you must consider financial forecasting as a periodic exercise rather than a one-time thing. This will help you better incorporate market trends and real-time data, and adjust strategies as conditions change.

For accurate valuation reports that aid your strategic planning, help you secure funding and ensure tax compliance while issuing stock-based compensation, consider Eqvista’s expert valuation services. Contact us to learn more!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!