Advisor Stock Options: Everything you should know

The shares provided to your business’s advisors when you offer employee shares are known as advisor stock options. Startups offer Advisors advisor shares instead of cash compensation, which is often an appealing proposition. Businesses must consider the advisor’s job when deciding how much to compensate them. However, you should avoid giving your real advisor shares of stock and offer stock options with vesting postulates to purchase shares. Giving advisors stock options with a vesting schedule helps advisors with tax liability, ensures prompt delivery from advisors, and considers the effect of valuation on stock options. To help businesses navigate the issuance of advisor stock options, this article discusses vesting consideration for advisor stock options, how many shares advisors get, and advisor share agreements.

Advisor stock options

Instead of being awarded real shares, advisors are often offered advisor stock options to purchase shares. If the business awards highly valued advisor shares, this helps to avoid a possible tax liability. Stock options are often used to encourage advisers to invest long-term in a company’s growth.

What are advisor stock options?

In exchange for their assistance in expanding the firm, advisors who hold advisor stock options are given advisor shares. They are offered as remuneration to external board members who support investors, the workforce, and the expansion of a business.

As long as they act in the business’s best interests, advisor stock options may be utilized to reward a range of responsibilities. They also provide remuneration without tax restrictions and complicated accounting requirements of stock options.

It is unlikely that advisors who get advisor shares would be obliged to provide businesses with legal or tax advice. They will be required to provide quality information and access networks of connections instead.

Types of stock options advisors get

Equity is distributed as advisor shares in exchange for the advisors’ services. Two popular forms of advisory shares are listed below:

- Restricted stock options – Advisors get this kind of advisor shares in exchange for their knowledge and counsel. A certain amount of shares owned by the advisor may be available on the open market. However, the advisor must consent to refrain from selling more shares than what was previously negotiated. They are limited in terms of how many shares they can sell during that time, to put it simply.

- Non-qualified stock options – Advisors with non-qualified stock options have the right to acquire a certain number of shares in their firm at a predetermined price for a predetermined period.

Difference between restricted stock awards and advisor stock options

Restricted stock awards (RSAs) and stock options are the two major forms of equity remuneration provided to advisors. The main contrast between RSAs and options is one of legality. RSAs are shares purchased in advance, while options are the right to purchase shares that are often provided later.

Who issues advisor stock options in an organization?

The majority of businesses that offer advisory shares are just starting. At the time, the business could not even be much more than a concept. The issuer could also be in the latter stages of the seed capital phase or even later when it is an operational, expanding business.

How does the vesting schedule work for advisor stock options?

Advisor vesting is vital, but it differs from employee vesting. Because firms evolve fast, the seed-stage advisors may not be the same as your Series B and later advisors.

Advisory share agreements sometimes contain a two-year vesting timeline with no cliff and monthly vesting. Because most advisors will provide the majority of their value up front, most businesses avoid vesting schedules that last four years. After two years, you may always decide whether you want to be together.

Some contracts include a three-month cliff that provides the parties time to decide if their partnership will be beneficial and successful. Numerous advisors also agree to a single-trigger acceleration of the vesting schedule, which gives them full ownership of their shares in the case of a specified occurrence. This might be the firm being sold or the working arrangement being ended by the company.

How many stock options to dilute to advisors?

The equity granted to advisors might vary greatly. Whether an advisor receives advisor shares may depend on their experience level and position. It could also be contingent on how long the adviser and business anticipate cooperating.

Advisors may get up to 5% of the business’s total stock. Early startups may sometimes create an advisory board and provide board members advisory stock options as compensation.

Anywhere from 0.25% to 1% of the company’s stock may be paid to single advisors. The precise sum could change depending on how much the advisor advances the business.

For instance, an advisor who shares knowledge at monthly meetings can be paid just 0.25 percent. For this more tangible contribution, an advisor referring a prospect who becomes a significant client may get 1%.

The proportion of equity advisors may be expected to decrease with the firm’s maturity. For instance, a startup gives an advisor attending monthly meetings 0.25% of the company’s stock. With the same advisor, a business that has passed the startup stage and is currently in the growth stage may reduce that to 0.15%.

Does a change in valuation affect advisor stock options?

Entrepreneurs must choose the proper stock options for the company’s advisors while keeping in mind that the company’s valuation will fluctuate with time. You could offer your advisor equity while your company is just forming. But by doing so, you run a significant risk.

Assume, for instance, that you launch a $50 million company and offer your advisor 10% of the shares. You are giving him a $5 million stake in the business. This may have extremely serious tax repercussions. Because of this, the stock is seldom provided to an advisor to a corporation. Instead, such stock is issued as options.

Advisor stock options during different funding stages

Following equity proportions are granted throughout the development phases of financing –

- The C-Suite and important stakeholders get around 8 to 10% ownership.

- The advisor may get between 0.25 and 1% equity, which accounts for actual equity and not just stock options.

The CEO will decide the stock stakes at each step of the funding process. The proportion paid to the important stakeholders and executives currently range from 6 to 10% when the business is prepared to launch. Additional administrators and staff may now receive stock in the following ways:

- Directors and vice presidents may get around 2 to 6% stock in the firm.

- Directors and vice presidents may get around 2 to 6% stock in the firm.

- Employee equity ranges from 2 to 4%.

The first seed round of funding will then happen. The executives’ equity has been reduced somewhere between 3 and 8% at this point. The directors and vice presidents are diluted to between 1 and 3%. Employees get 0.5 to 1%, while managers receive 1 to 2%. The advisor shares are diluted to 0.25% at this stage of the fundraising process.

The acceleration comes next. One of the last funding phases before the business issues its final tranche of equity shares. The executives’ share is progressively diluted in this phase at a rate ranging from 2 to 6%. Now, directors and vice presidents have 0.5 to 1% equity. Employee equity ranges from 0.1 to 0.5%, whereas managers’ equity ranges from 0.25 to 0.75%.

Throughout the firm, these percentages will decline. Although 0.5% may not seem like much, depending on how much the firm is worth, it might be a significant sum of money.

Important considerations for advisor stock options

Here are a few important considerations regarding vesting, tax, and other provisions that businesses and their advisors must pay attention to before issuing advisor stock options.

- Vesting – As discussed above, the vesting schedules for advisor agreements are often shorter than those for founders and workers under an ESOP, being 12 to 24 months. This is because advisors often provide more value in the near term. As your companies develop, they rotate through several advisors appropriate for their level of development. Some advisor contracts include a “clawback” provision in vesting in case the advisor fails to make the anticipated contributions within the predetermined time frame. An alternative to such a clause would be to use a cliff of three to six months to allow for a “test run” to see if the connection is fruitful.

- Tax – Regarding how they are treated tax-wise, options and shares are handled differently. In general, if you get shares in exchange for your services, you may anticipate having an income tax obligation, but options do not create a liability until they are exercised. Before establishing any advisor agreements, we advise seeking tax and accounting guidance.

- Other provisions – The advisor shall concur that the business is properly allocated any intellectual property and other commercials, technical, and financial information that the advisor learns from the firm or acquires while providing his or her services. At the very least, the advisor must be bound by confidentiality clauses. You could include a no-conflict clause and a requirement that the adviser abides by certain corporate rules.

What is an advisor share agreement?

The terms of the equity to be provided to the advisors and their obligations and rights towards the firm or business are covered in the advisor share agreement. All additional information about the advisor’s employment with the firm will be covered in such an agreement.

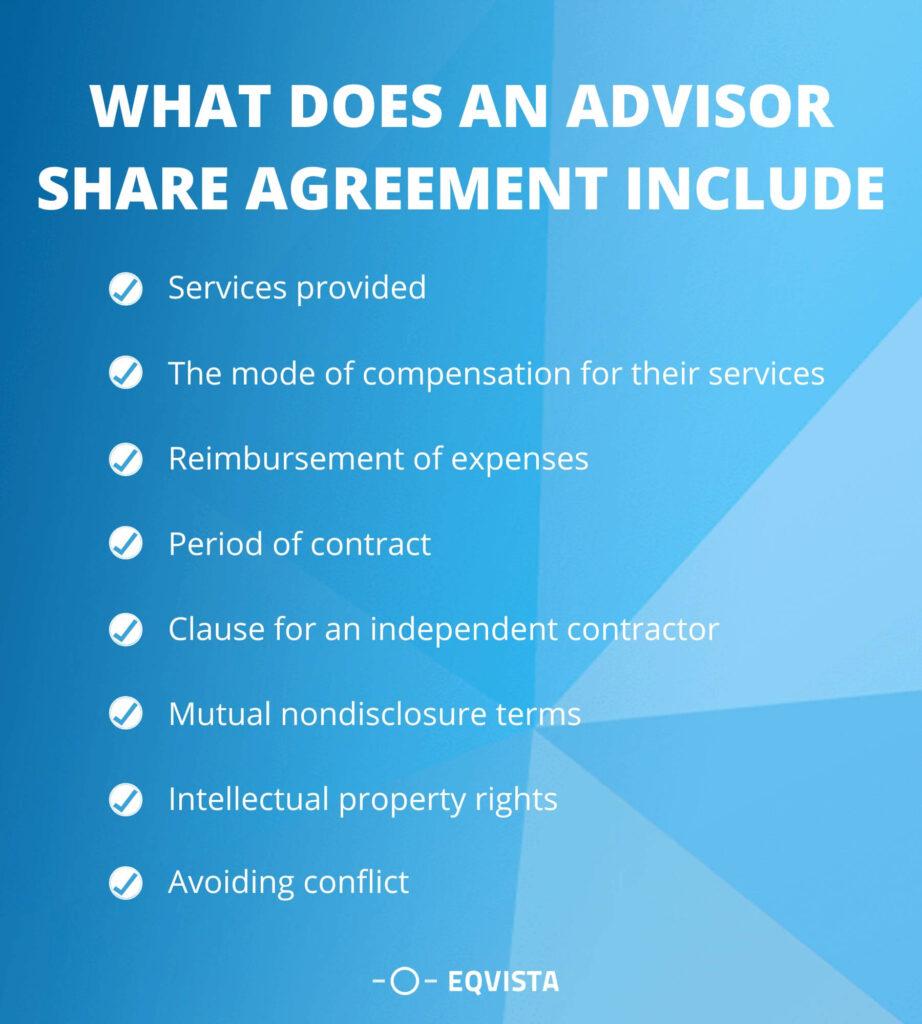

What does an advisor share agreement include?

An advisor share agreement has to have the following components to serve its role effectively:

- Services provided – This can include advice, networking, social proofing, and investments.

- The mode of compensation for their services – This can be through cash, equity stake, or a mix.

- Reimbursement of expenses – This includes what expenses will be reimbursed, how they will be reimbursed, and what the limit is.

- Period of contract – This includes the term with the company and the method of the termination of the agreement.

- Clause for an independent contractor – This is done to establish that the advisor is not a direct employee.

- Mutual nondisclosure terms – This defines confidential information to protect the business and its products.

- Intellectual property rights – This establishes that the advisor doesn’t hold any rights to the business’s intellectual property.

- Avoiding conflict – This establishes that the advisor cannot violate any other obligations while working for the firm and must also inform the business of any competition preventing further issues.

Manage your advisor stock options on Eqvista!

Advisor shares offer profitable investments for business advisors. Before distributing these shares to your corporate advisors, companies should carefully assess the situation. Conflicts of interest may be avoided while maintaining secrecy using advisory shares. They could, however, end up being expensive for a new business. Please don’t hesitate to contact Eqvista for help approaching advisors for a conversion concerning equity. With advisor shares, Eqvista is an expert and can help manage your company.