409A Valuation: Complete Guide for Startups

Understand 409A valuation—what it is, when it’s needed, and why it matters. Ensure compliance and establish fair market value for your business.

In the startup ecosystem, understanding your company’s value is essential—especially through a 409A valuation. This process determines your fair market value (FMV) and forms the foundation of your equity compensation strategy, impacting everyone from employees to future investors.

Key 409A Valuations Takeaways

- A 409A Valuation establishes the fair market value of a private company’s common stock, determined through an independent assessment by a third-party appraiser.

- This valuation is required by IRS code Section 409A for companies offering equity compensation to their employees.

- 409A determines the minimum price (strike price) at which stock options can be granted without tax penalties.

- 409A establishes the common stock value, which is typically discounted from preferred stock (often 10-30%).

- A detailed 409A valuation report provides important evidence for IRS compliance and informs board decisions.

What is a 409A Valuation?

A 409A valuation determines the fair market value (FMV) of a private company, which is essential for setting the exercise price of employee stock options and other equity-based compensation. The FMV represents the market price for a company’s equity when all relevant information is fully disclosed and understood.

To ensure accuracy, 409A valuations must be based on factual data rather than speculation, as speculation often arises from incomplete understanding or insufficient information. Typically conducted by an independent third-party 409A valuation service rather than the owner or the company, this valuation is regulated by the IRS and establishes the strike price for common shares.

This valuation establishes the strike price at which stock options can be granted to employees without triggering tax penalties. This ensures employees can receive equity without incurring immediate tax liabilities. Issuing employee stock options without a valuation can result in significant tax consequences for your employees, including penalties, accrued interest on unpaid taxes, and immediate taxation of vested options.

Why 409A Valuations Matter for Startups?

Getting a 409A valuation allows your business to follow all the tax laws and avoid any of the IRS audit sessions that can cause legal troubles, tax issues and even interfere in the company’s functions if problems arise. Moreover, the need to hire consultants or lawyers to defend your company while the case drags would cost you a lot more.

A good 409A valuation doesn’t just keep you compliant—it’s a powerful tax planning tool. Setting the right fair market value protects both your company and employees from unexpected tax bills. Think of it as prevention rather than paperwork” – Colin Mc Crea, Partner at Eqvista & Head of Analysts

More importantly in these situations, the employees in your company would suffer the most due to the immediate tax issues for them, which is not good for a company putting their employees at risk. It is important to remember that you gave the stock options to your employees to reward them, and not to leave them with a huge penalty with the IRS.

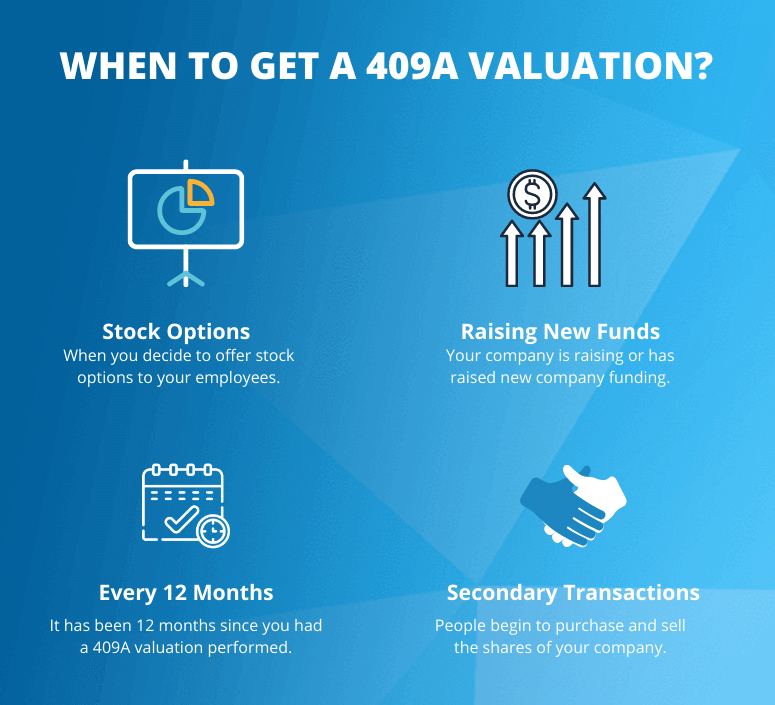

When to Get a 409A Valuation?

There isn’t a single specific time when you might need to get the 409A valuation done, but there are a few triggers that would help you understand when it is needed urgently.

- Offering Stock options to employees – This valuation determines the FMV of your company’s common stock, which is necessary for setting the strike price of the stock options. Without this, you risk both the company and the employees receiving the options.

- It has been a year since your last 409A valuation – Annual refresh helps maintain the safe harbor status, which protects the company from potential tax liabilities related to stock options.

- Your company is raising or has raised new funding – Conducting a fresh valuation after a funding round ensures that the strike price for any subsequent stock options aligns with the company’s updated market value.

- Secondary market transactions – These events might affect the company’s valuation, especially if they involve substantial volumes or indicate a shift in market perception. In such cases, a new valuation may be necessary to reflect these changes accurately.

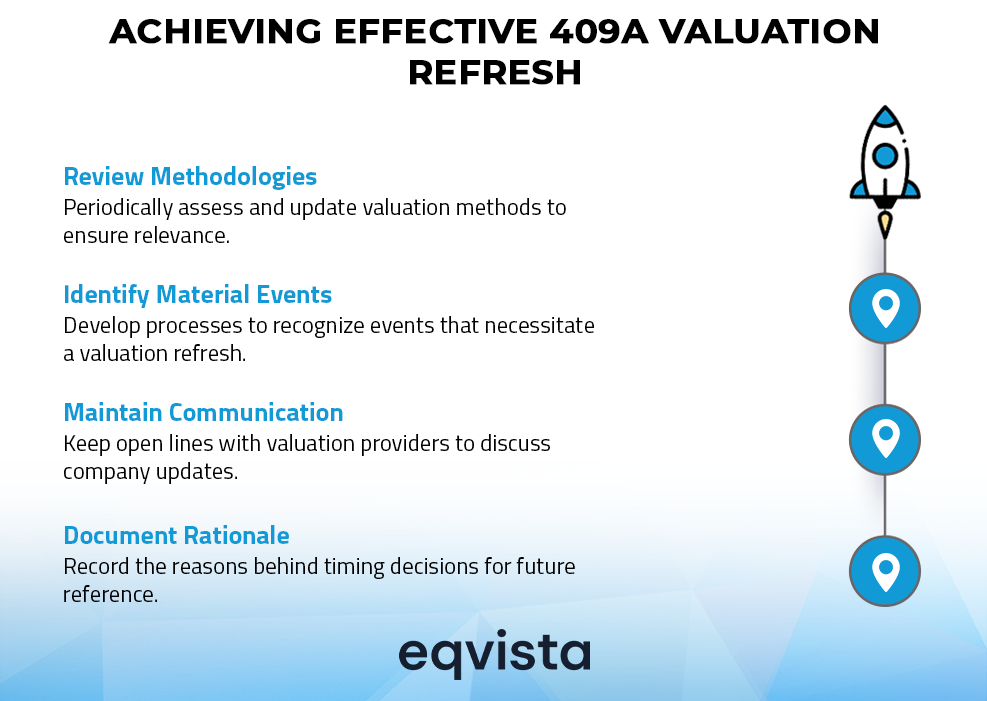

What is a 409A Refresh?

A 409A Refresh is the process of updating a company’s valuation which determines the fair market value of its common stock. This updated valuation ensures the IRS compliance when issuing equity compensation, such as stock options.

According to IRC Section 409A, a 409A valuation provides a 12-month period of safe harbor, this period, you will need to update your valuation in order to “restart” the period of safe harbor for another 12 months.

Failing to refresh a 409A valuation when required can result in:

- Loss of safe harbor protection

- Potential tax penalties for option holders (up to 20% additional tax plus interest)

- Complications in future financing or exit events

- Increased scrutiny during due diligence processes

Regular and timely 409A valuation refreshes represent an important corporate governance practice that protects both the company and its equity holders.

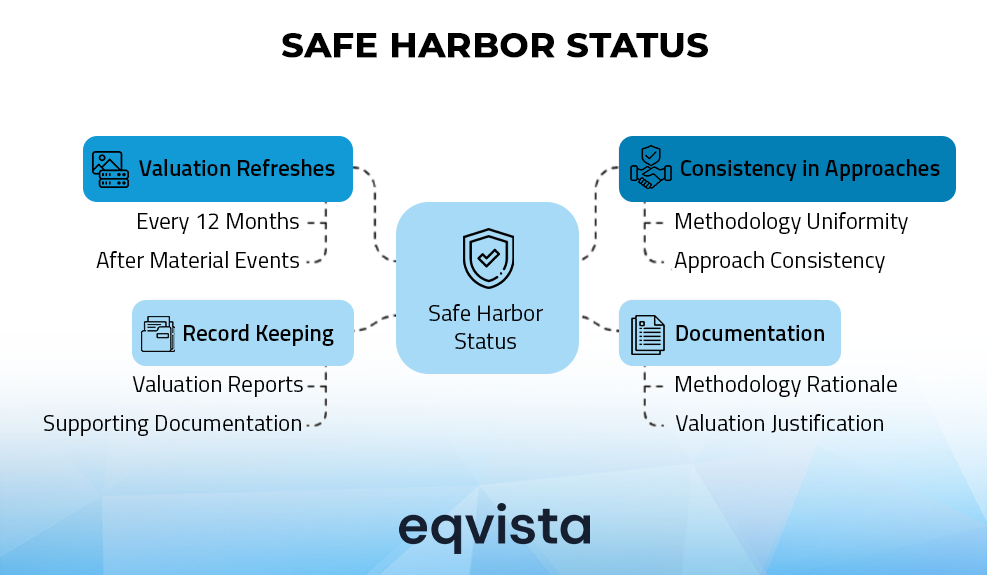

What is a Safe Harbor for Your Company?

A safe harbor of 409A for your company means that you have had the valuation completed in the last 12 months for your company at an acceptable price, which is protected from proving that the FMV is accurate to the IRS. This means that any burden of proof for your valuation would be on the IRS if they choose to audit your company.

Safe harbor protection represents a critical element of the 409A compliance strategy, providing companies with greater confidence in their equity compensation practices while reducing tax risk for all stakeholders.

The IRS recognizes three primary methods to achieve safe harbor status:

- Independent Appraisal Safe Harbor

- Formula Safe Harbor

- Illiquid Startup Safe Harbor

Securing safe harbor status provides several advantages to the company. This shifts the burden of proof to the IRS in case of an audit and reduces the likelihood of successful challenges. Safe harbor provides greater certainty for the company and option recipients. It minimizes potential tax penalties for both the company and its employees.

Failing to achieve Safe Harbor status in a 409A valuation can lead to severe penalties. Working with experienced valuation providers who understand IRS compliance requirements is essential for establishing a defensible valuation that minimizes tax risks for your company and option holders.

Options to Get 409A Valuation for Startups

When selecting a 409A valuation provider, consider their industry experience, methodology, reputation, and defensibility in IRS audits. Practical factors like turnaround time, cost, and additional services like cap table management are also important. Ensure they can support future valuation needs as your company grows.

Independent Valuation Firms

Specialized firms offer comprehensive 409A services with expertise in valuation and private company valuations. These firms typically provide the most defensible valuations with the strongest safe harbor protection.

Software-Enabled Valuation Services

Several platforms offer technology-enabled 409A valuation services that combine software with professional oversight. Eqvista also offers software-based 409A valuation services, which can be more cost-effective but may lack the personalized expertise of traditional providers.

Investment Banks and Financial Advisors

Some investment banks and financial advisory firms provide 409A valuation services, particularly for companies approaching significant financing events or potential exits.

Accounting Firms

Large accounting firms provide 409A valuation services with the benefit of established reputations and comprehensive financial expertise.

Each option presents different trade-offs between cost, credibility, convenience, and comprehensive service. The optimal choice depends on the company stage, complexity, budget, and risk tolerance regarding potential IRS challenges.

409A Valuation Process

The 409A valuation process is a structured assessment used to determine a private company’s common FMV, for setting the strike price of employee stock options. The process of a 409A valuation begins with data collection and preparation, which is crucial for ensuring an accurate and compliant valuation. Below are the initial steps that kick off the process:

Company Engagement with Valuation Provider

- Select a qualified independent valuation firm

- Share necessary financial documents and company information.

Data Collection

- Financial statements

- Business plans and projections

- Information about fundraising rounds

- Cap table and equity structure details

- Industry/competitor analysis

Valuation Analysis

Valuation specialists apply appropriate methodologies:

- Market approach (comparable company analysis)

- Income approach (discounted cash flow)

- Asset approach (for early-stage companies)

Common Stock Valuation

- Calculate enterprise value

- Determine the value of all equity classes

- Apply appropriate discounts (marketability, liquidation preference)

- Arrive at common stock FMV

Report Issuance

- Detailed valuation report with methodology and findings

- Board approval of the valuation

Finalize and Approve the Valuation

The appraiser provides a detailed report outlining their methodology and conclusions. The company’s board typically reviews and approves this report before issuing stock options.

This process helps valuation to set compliant stock option prices while aligning employee incentives with company growth.

409A Valuation Methods

The Asset Approach, Income Approach, and Market Approach are some of the most common ways through which the valuation of the company is done.

- Market Approach (also called OPM Backsolve) – This method is used when the business has just raised equity funding. As the investors assumedly paid a FMV for the equity, this would be used to get an estimate of the common FMV for the company. The other market-based approaches utilize financial information which includes revenue, net income, EBITDA, etc., from publicly traded companies that are from the same industry and situation. These are then used to compare with for estimating the company’s equity value.

- Income Approach – This is an approach that is very straightforward and it is used for the companies that have a positive cash flow and sufficient revenue.

- Asset Approach – This is the least common and supported 409A valuation approach, and is mostly for the very early stage businesses that have not raised any funding and do not have any revenue yet. Hence, this method is used to just calculate the net asset value to figure out the right value for the business.

What are the 409A Penalties?

The penalties for non-compliance with Section 409A of the Internal Revenue Code are severe and primarily affect the recipients of deferred compensation. These penalties can be severe:

- All deferred compensation becomes immediately taxable to the employee.

- An additional 20% federal tax penalty is applied on top of regular income tax rates.

- An interest penalty based on underpayment rates plus 1% on the underpayment that would have occurred had the compensation been included in income when first deferred.

These penalties apply to various types of deferred compensation arrangements, including excess pension plans, employment contracts, and supplemental executive retirement plans. It’s important to note that these penalties fall on the employee or recipient of the deferred compensation, not the employer.

Employers will be subject to withholding taxes on the vested deferred compensation portion of employees’ earnings if your 409A valuation is found to be non-compliant with the Internal Revenue Code. If employees do not receive their deferred compensation, the IRS will consider it to be included in your taxable year of failure on December 31.

To avoid these severe consequences, companies should regularly review their 409A compliance and take advantage of IRS correction programs if errors are identified within two years of occurrence.

Who Performs the 409A Valuation?

A 409A valuation is typically performed by independent third-party valuation firms specializing in this service. Valuation providers like Eqvista objectively assess a private company’s fair market value, which is required for tax compliance purposes when issuing stock options and other equity compensation.

When choosing a valuation service provider, companies should consider factors such as the firm’s experience in their industry, methodology, reputation, cost, and turnaround time. Accreditations like Accredited Senior Appraiser (“ASA”) from the American Society of Appraisers and the American Institute of Certified Public Accountants (AICPA & NACVA—AICPA), are important for valuation professionals.

It’s important to note that companies should not perform their own 409A valuations internally, as the IRS requires these valuations to be conducted by independent parties to ensure objectivity and compliance with tax regulations.

FAQs

Who needs a 409A Valuation?

Private companies that plan to issue stock options, shares or other equity incentives to employees are required to have a 409A valuation.

Why do Businesses need a 409A Valuation?

The IRS regulation IRC 409A states that stock options cannot be issued for less than their fair market value (FMV). Furthermore, the FMV should ideally be evaluated by a third party who is not affiliated with the company.

How much does a 409A Valuation cost?

409A appraisals are required by the IRS and can cost anywhere from $2,000 to $5,000+ depending on the intricacy of the exercise and the valuation provider. Eqvista provides affordable startup valuations from $990.

How long does a 409A valuation take to complete?

Usually, 2-3 weeks, though it can vary based on company complexity and information availability.

When do pre-revenue startups need a 409A valuation?

Pre-revenue startups need a 409A valuation before issuing stock options, during funding rounds, before IPOs, in M&A events, or to meet annual requirements. Early valuations help ensure compliance, avoid tax issues, and effectively manage equity compensation.

Do All Private Companies require a 409A Valuation?

A 409A valuation is required for private corporations to grant ownership to employees (often a key recruiting tool). Since the value of a private company’s common stock isn’t readily available as it isn’t listed on a public stock exchange, a 409A valuation is required.

Why is a 409A Valuation Important?

Without a proper 409A valuation, companies risk significant tax complications for themselves and their employees, potential legal issues, and may face obstacles during fundraising or exit events.

What factors influence the 409A valuation?

Factors such as company size, revenue, assets, and market conditions influence your valuation. Working closely with a professional valuation expert ensures an accurate assessment by applying appropriate methodologies and interpreting complex financial data.

What methodologies are used in a 409A valuation?

Common approaches include the Market Approach (comparable company analysis), Income Approach (discounted cash flow), and Asset Approach (based on net asset value after liabilities), with adjustments for illiquidity and control factors. The appropriate method is chosen based on the company’s stage, industry sector, and the availability of financial data, ensuring an accurate and defensible valuation.

Can a 409A Valuation be done in-house?

While technically possible, internal valuations don’t provide safe harbor protection. For most companies, the protection from an independent valuation is worth the cost. For companies less than 10 years old, there is a safe harbor that allows them to determine the FMV internally, but most companies prefer to use an independent third -party valuation firm.

How Long Is a 409A Valuation Good For?

Valuations under IRC 409A are valid for a maximum of 12 months after the effective date, or until a “material event” occurs. A material event is something that potentially has an impact on the stock price of a corporation. Qualifying funding is the most typical significant event for the majority of early-stage firms.

How often should a 409A Valuations be Updated?

Generally, 409A valuations are performed annually, which expire after one year. But it may be required after significant events like funding rounds or mergers and acquisitions.

Can the valuation be utilized for both the financial reporting and tax purposes?

Yes, this valuation can often be utilized for both financial reporting and tax purposes, with certain considerations. Many valuation firms now offer these combined services as standard practice, particularly for venture-backed companies.

Is Section 409A Income Taxable?

Section 409A itself doesn’t create taxable income – rather, it governs when and how deferred compensation becomes taxable. This is why companies invest in proper valuations – to ensure their equity compensation doesn’t trigger these negative tax consequences for recipients.

Get Audit-Ready 409A Valuation with Eqvista!

Eqvista is a leading provider of 409A valuations for startups and private companies with in-house of 15 valuators in the team and $1B monthly client asset valuation. Eqvista’s 409A valuations are designed to provide companies with an accurate, audit-ready valuation that protects them from IRS penalties. Our team of NACVA certified valuation analysts have experience working with companies across various sectors.

Eqvista’s 409A valuation services are priced affordably, starting at $990. Take the first step towards safeguarding your company’s future—contact Eqvista today to ensure your startup valuation is in expert hands.

NEED A 409A VALUATION FOR YOUR COMPANY?

Eqvista has got you covered for your 409A valuation needs. Contact us to discuss your case today!