IRS challenges on 409A valuations

In this article, we will explore some of the key techniques and procedures the IRS uses to evaluate and challenge 409A valuations.

409A valuations are the cornerstone of tax compliance when issuing stock-based compensation and inaccuracies can lead to penalties and interests. However, before all this, the Internal Revenue Service (IRS) must successfully challenge your 409A valuation. Understanding how the IRS challenges 409A valuations and the consequences of successful challenges is crucial to tax planning and compliance.

Hence, in this article, we will explore some of the key techniques and procedures the IRS uses to evaluate and challenge 409A valuations. By understanding these methods, you’ll be better prepared to navigate the process and ensure your communications are precise, minimizing the risk of costly errors.

What is an IRS challenge on 409A valuations?

When the Internal Revenue Service (IRS) suspects that you are reporting an inaccurate valuation to reduce the tax liability on stock-based compensation, it may challenge your 409A valuation.

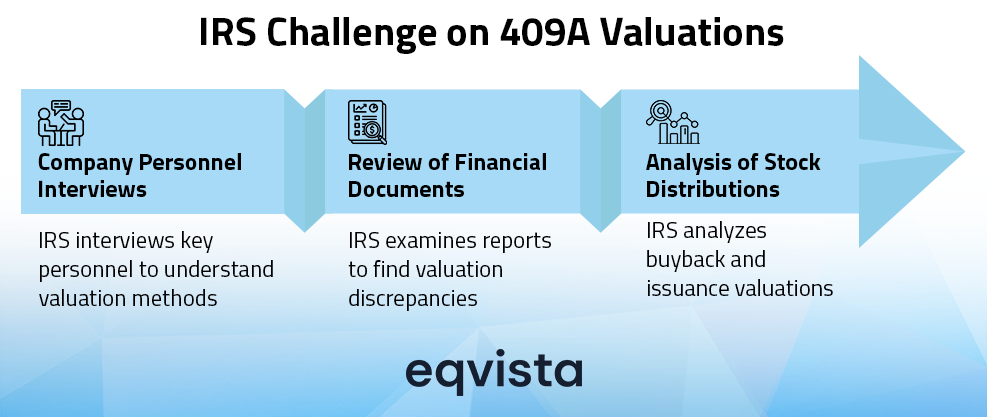

Based on the audit technique guide released by the IRS in March 2024, some of the techniques and procedures that IRS might use to challenge 409A valuations and uncover inaccuracies are as follows:

- Company personnel interviews – To understand the valuation methodology and uncover any oversights, the IRS may hold interviews with personnel knowledgeable about the stock-based compensation plan and your company’s finances, such as your company’s human resources director or Chief Human Resources Officer (CHRO) and its Chief Financial Officer (CFO).

- Review of annual reports, SEC filings and other financial statements – There are two ways in which the IRS could uncover inaccuracies in your 409A valuations. Firstly, they could apply financial modelling similar to your methodology on your financial history and compare the results from your reported 409A valuations.

Secondly, they could check for discrepancies in expense of stock-based compensation as per ASC 718, calculations of payroll taxes, and other accounting entries related to stock-based compensation. - Analysis of distributions – A private company, which does not offer dividends, must buy back its stock-based compensation to provide returns to its employees. By analyzing the buyback history and contrasting it with the company’s 409A valuation history, the IRS may try to find evidence of high valuations being applied on buybacks but low valuation being applied on issuance and vesting of stock-based compensation.

The IRS may also investigate whether a company is deliberately suppressing valuations for both stock issuance and buybacks while consistently applying premiums to buybacks, as this could indicate an attempt to manipulate valuations.

You must note that these are just some of the techniques and procedures that the IRS could use in its challenge of 409A valuations. If necessary, they may choose other techniques.

For instance, in a company whose value is closely tied to its asset portfolio, the IRS may examine the insurance coverage on those assets. If the insurance coverage appears excessive than what should be taken for the reported value of the asset, the IRS may make a more in-depth inquiry into the value of the company’s assets.

After all, higher coverage means higher insurance premiums. The IRS may speculate that the asset values are being misreported and investigate accordingly.

What is the consequence of the IRS challenge on 409A valuations?

Some of the consequences of an IRS challenge on 409A valuations would be.

Audits

In order to find evidence of wrongdoing, the IRS may conduct audits through in-person interviews or by mail. They may choose to hold the interviews at their office, your business locations, or at your accountant or representative’s office. In case of interviews conducted via mail, if the documents requested are too extensive to mail, you can request an in-person interview.

Typically, an IRS audit focuses on tax returns from the last three years. However, if significant errors are discovered, the IRS may extend the review to additional years. Even then, it is unlikely that the audit would go beyond the last six years of tax returns.

Tax liabilities

If the IRS’ challenge proves successful, your employees may face the following unfavorable tax consequences:

- Immediate taxation of vested income – Typically, stock-based compensation vests over a number of years. When the Section 409A is violated, any stock-based compensation that has been vested and does not carry any significant risk of forfeiture will become immediately taxable.

- 20% penalty on unpaid taxes – The taxpayer must pay a penalty equal to 20% of the vested income that just became taxable.

- Higher interest on unpaid taxes – The IRS will charge a higher-than-normal interest rate on the unpaid taxes on the vested income that just became taxable.

Additionally, for underpaying payroll taxes, your company might face severe consequences right from penalties and leading up to jail sentences. The penalty tax amount in this case can go up to 15%.

Legal disputes

Since the employees will face unsavory tax consequences for inaccurate 409A valuations which might be outside their control, they may sue your company for negligence. This can adversely impact your reputation with investors as well as prospective employees.

Furthermore, if you lose such a case, you may end up paying damages to your employees. Such incidents can severely impact your ability to raise funds or attract and retain key talent.

How to minimize the chances of IRS challenges?

Some measures you can take to lower the chances of IRS challenges are as follows.

Accurate recordkeeping

In this context, accurate recordkeeping would mean focusing on two things, which are your financial records and 409A valuation history. You must ensure consistency in values reported for all transactions and assets across various ledgers, journals, and financial documents since any inaccuracies may only make the IRS more suspicious.

Additionally, you should maintain comprehensive records of your 409A valuations, including not only the valuation amounts but also the methodologies used and any updates or changes to those methodologies over time.

Safe harbor provisions

In an audit, it’s far more advantageous to challenge the IRS to prove its case than to be in the position of having to provide evidence that your 409A valuation was accurate. You can do so by qualifying for safe harbor provisions using one of the following valuation methods:

- Illiquid startup presumption – A company which is less than 10 years old and is not expecting to go public in 180 days or be acquired in 90 days qualifies as an illiquid startup. Insiders of such companies who have significant experience in valuing similar companies can perform their 409A valuations. These insiders must record their 409A valuation process in written form.

- Binding formula presumption – A company whose valuation is determined by the same formula in all equity transactions can apply the same formula for 409A valuations.

- Independent appraiser presumption – A company can hire a qualified, independent appraiser to perform its 409A valuation. A key benefit of this method is that you may rely on the testimony of the appraiser to defend yourself in case of an IRS challenge on your 409A valuation.

Eqvista – Ensuring compliance with accuracy!

Whether you can successfully manage an IRS challenge depends on the promptness and quality of your communication and the quality of your records. Once the IRS challenges your valuation, you may regret not having accurate financial statements. Detailed 409A valuation records and valuation methodology records help substantiate your claims. In hindsight, maintaining these records is one of the best things you could have done.

However, to avoid an IRS challenge in the first place, it is important to get 409A valuations after every material event and qualify for safe harbor provisions. The easiest way to do so would be to subscribe for Eqvista’s unlimited 409A valuation packages that start from just $990 annually. Contact us to learn more about our services!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!