10 Rising VCs reshaping the future of innovation in 2025

Venture capitalists serve as a cornerstone of the startup ecosystem, offering not only critical funding but also invaluable guidance and mentorship to innovative and transformative startups as they scale their operations. Hence, it is an encouraging sign to see a spike in venture capital funding. In 2024, US startups raised $209 billion from venture capitalists, marking the third-highest total in the past two decades.

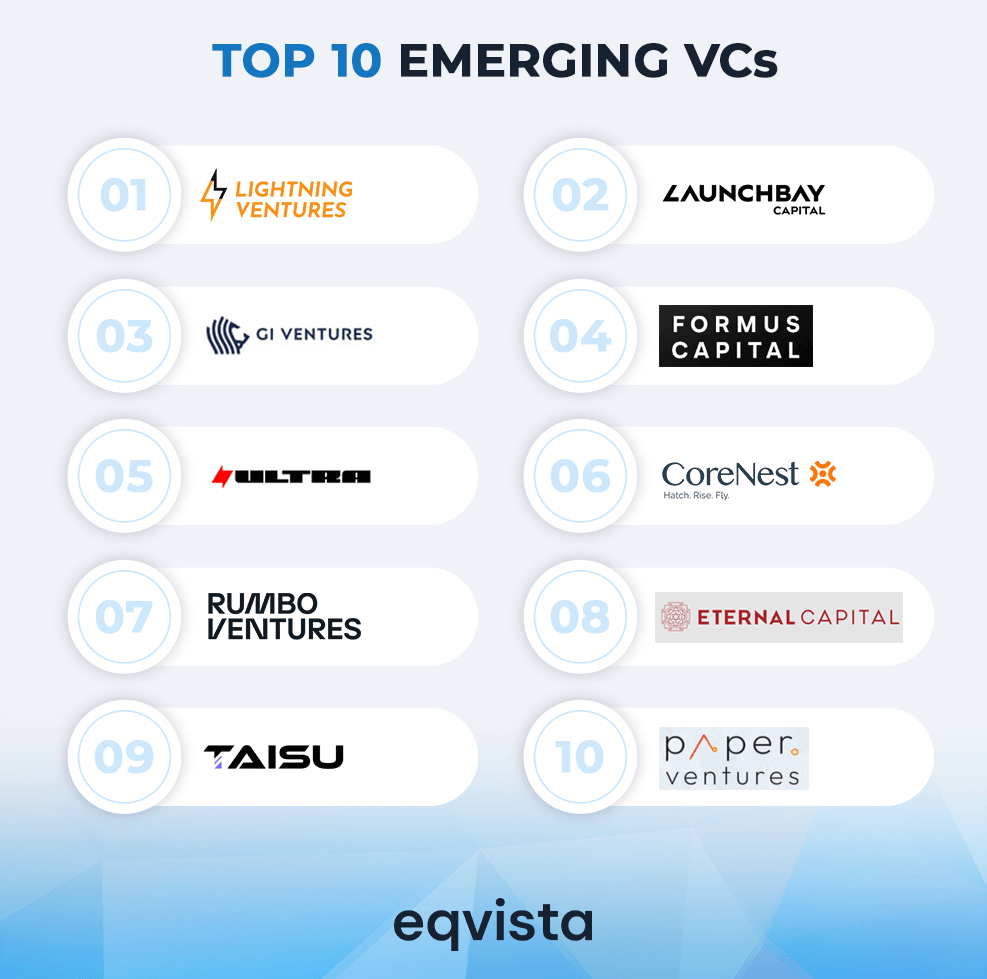

This trend is being backed by a new wave of venture capital firms that are reshaping industries all over the world. From VCs such as Lightning Ventures and Paper Ventures showing conviction in blockchain technologies to ULTRA.VC’s focus on improving quality of life through ethical tech, these firms are introducing a new and diverse set of approaches to venture capital.

In this article, we will take a close look at the top 10 emerging VCs, their investment focus, strategies, and philosophies. Read on to know more!

Top 10 Rising VCs in 2025

Below we listed out the top 10 rising venture capital firms in 2025, showcasing those that are gaining prominence and influence in the investment landscape.

Lightning Ventures

- Number of investments: 51

Founded in April 2023, Lightning Ventures’ focal point is Bitcoin companies such as Slice, Unchained, DIGTL, and Zaprite. It holds great conviction in Bitcoin’s ability to disrupt global financial systems on account of its high resistance to cyber-attacks and censorship, and its ability to facilitate cross-border transactions.

Lightning Ventures is focusing its investments in startups that will either benefit from the Bitcoin ecosystem or contribute to building infrastructure that supports the Bitcoin ecosystem. Particularly, it intends to support startups that are working toward financial inclusion, enabling fast, low-cost, and scalable Bitcoin transactions, enhancing Bitcoin’s security and privacy, and building decentralized finance (DeFi) applications on top of the Bitcoin protocol stack.

Launchbay Capital

- Number of investments: 43

Launchbay Capital supports tech startups across Europe, the Middle East, and Africa through direct investments via two funds and its investment platform. Through its Early Access Fund, Launchbay Capital invests in late seed and Series A funding rounds of European and Israeli fintech, AI, and software infrastructure startups. It also targets high-liquidity, growth-stage venture-backed startups through its Secondary Growth Fund which has a fixed investment period of 4 years.

Launchbay Capital has also partnered with more than 10 brokers to build a platform where investors can discover private equity opportunities based on recent trade data instead of historical valuations. Through its platform, you can invest in startups such as Stripe, Epic Games, and SpaceX.

GI Ventures

- Number of investments: 31

GI Ventures invests in promising startups from various sectors in collaboration with family offices, corporate investment arms, other venture capital firms, and angel investors. Its initial investments range from $20,000 to $200,000. In addition to access to major private equity investors, the venture capital firm also supports its portfolio companies through mentoring and accelerator programs. It enables portfolio companies to collaborate and leverage synergies. Additionally, it also offers expert guidance on fundraising strategies.

Currently, GI Ventures is focusing on economically viable and scalable startups being built in India’s emerging economic hubs such as Indore, Ahmedabad, Pune, and Jaipur. Their investment rationale is to harness the scalability of innovative startups addressing underserved opportunities.

Formus Capital

- Number of investments: 20

Formus Capital is a venture capital firm that focuses on early-stage tech startups operating in the spheres of artificial intelligence (AI), software, and data infrastructure in the US. It primarily invests in business-to-business (B2B) organizations such as Dill, Letter AI, and Nectar. However, the venture capital firm has also invested in business-to-consumer (B2B) firms such as Arch, Fasset, and River.

Its past investments include Alto Pharmacy, Taptap Send, Deel, Misfits Market, Frontier Car Group, Seso, Kalshi, and Zetwerk.

ULTRA.VC

- Number of investments: 20

By supporting early-stage startups operating in healthtech, community and ethical tech, future of work, education and lifelong learning, and personal and mental well-being, ULTRA.VC aims to make a significant positive impact on people’s quality of life. In addition to acting as a venture capital firm, ULTRA.VC also operates an accelerator program.

To truly support their portfolio startups’ growth objectives, the venture capital firm combines its investment activities with its accelerator program in a way that helps the founders address key pain points such as establishing ideal customer profiles while also helping them focus on mission-critical tasks by taking over bureaucratic tasks.

Some of ULTRA.VC’s recent investments include Addie, CogsAI, Diluu, Evie, Evolve, Expio, and NeverGiveUp.

CoreNest Capital

- Number of investments: 19

Currently, CoreNest Capital is supporting startups from Europe, the Middle East, Africa, and the Gulf Cooperation Council (GCC).

With investments in xAI, OpenAI, Artisan, Pulsara, and Algorized, CoreNest Capital is a stage-agnostic venture capital firm focusing on artificial intelligence (AI), robotics, fintech, gaming, blockchain, innovative consumer, software-as-a-service (SaaS), and social media platform startups.

The venture capital firm believes that turning innovative visions into reality requires much more than just funding. Hence, CoreNest Capital offers comprehensive support to its portfolio companies extending to technical guidance and operational support. Additionally, the venture capital firm also facilitates mentorship and workshops led by industry trailblazers.

Rumbo Ventures

- Number of investments: 19

Rumbo Ventures believes that global issues such as pollution, climate change, rising energy, and needs, along with increasing integration of global markets and technological advancements are driving the rise of visionary entrepreneurs. These visionaries are poised to redefine industrial systems, revolutionize transportation, transform energy production and transmission, and pioneer carbon emission management solutions.

Hence, Rumbo Ventures invests in startups from the sectors of built environment, climate software and analytics, energy, industry and manufacturing, mobility and transportation, carbon capture, utilization, and storage (CCUS) and restoration, as well as food, agriculture, and land use.

Some of Rumbo Ventures’ investments from its pilot fund include Hoop, Tram, Emeter.ai, Lisus, Einsted, Rye, Woltea, Cellva, and Zero Waste CO.

Eternal Capital

- Number of investments: 18

Eternal Capital is a venture capital firm that focuses on supporting India’s transformative businesses and helping them scale. Currently, it appears to be focusing on investing in seed to series B stages.

Its conviction is that capital has three forms which are financial, social, and intellectual, and only when these three forms of capital converge can a business gain competitive advantages. Hence, Eternal Capital focuses on bringing about this convergence for its portfolio companies.

Thus far, Eternal Capital has invested in startups from the sectors of software-as-a-service (SaaS), drone surveillance, spiritual tech, e-commerce, travel tech, platforms, artificial intelligence (AI), media and communications, health and life sciences, D2C, and financial services.

Taisu Ventures

- Number of investments: 17

Taisu Ventures focuses on Web3 and blockchain startups from seed to early stages. It provides funding in exchange for equity as well as tokens. Unlike Lightning Ventures, Taisu Ventures is chain agnostic. It supports its portfolio companies by providing access to its network of venture partners, advisors, exchanges, market makers, L1 ecosystems, entrepreneurs, engineers, investors, and industry leaders that are spread across the US, Europe, the Middle East, Asia, and Africa.

Currently, its portfolio consists of startups from the verticals of infrastructure, decentralized finance (DeFi), gamefi, and user platforms.

Paper Ventures

- Number of investments: 16

Paper Ventures is an investment firm that supports pioneering startups leveraging blockchain technology to transform the fintech space. Currently investing in startups from Europe, the Middle East, and Africa, Paper Ventures acts as a first-in or initial investor. It was founded by Danish Chaudhry, a financial expert, Oliver Blakey, a professional poker player, and Ivailo Jordanov, a software developer.

Aligned Layer, Camp, Forgotten Playland, Glacis, Holonym, HyveDA, Kiva AI, Limitless Labs, Meth Lab, Monkey Tilt, Naptha AI, Pell Network, QED, Qooverse, Renzo Protocol, Sophon, TAC, and Vanilla Finance are its portfolio companies.

Eqvista- Valuations that propel your vision!

By identifying and supporting startups in transformative sectors, the abovementioned venture capital firms are not only driving technological advancements but also furthering societal progress. With their fresh perspectives and boundless energy, these venture capital firms are uniquely positioned to shape the next wave of market-defining companies while driving exceptional returns for their investors.

These emerging venture capital firms are at the forefront of impactful change such as AI innovation, carbon capture solutions, and financial inclusion.

Moreover, they are revolutionizing private equity itself by introducing innovative solutions to enhance liquidity within this asset class, a long-overdue and critical advancement. Eqvista’s fundraising valuation services will help you craft a compelling pitch that aligns with the priorities of the emerging VCs, ultimately assisting your startup in securing the necessary investments to drive innovation and growth. To know more about our services, contact us!