2025 QSBS and Capital Gains Reform: What Founders and Investors Need to Know

On 4th July 2025, President Donald Trump signed the One Big Beautiful Bill Act (OBBB) into law. The OBBB has introduced significant tax benefits for investors, including QSBS reforms and an increase in the gift and estate tax exemption limit.

The OBBB also provides numerous benefits to businesses, such as enhanced R&D deductions, introduction of QPP deductions, and reinstatement of bonus depreciation.

In this article, we will unpack all of these tax benefits that have been unlocked for investors and businesses by the OBBB. Read on to know more!

What are QSBS benefits?

Under Section 1202 of the IRC, you can claim up to 100% tax exclusion on capital gains from Qualified Small Business Stock (QSBS) investments. The maximum tax exclusion available under this provision was $10 million or 10x your investment basis. You could qualify for these benefits by holding your QSBS investment for 5 years, provided that you received these shares in a fresh issue in exchange for money, service, or property other than shares.

Another requirement is that QSBS could only be issued by qualified businesses with a gross asset value of up to $50 million. These businesses also needed to ensure that at least 80% of the assets by value were engaged in qualified businesses.

How did the OBBB change QSBS?

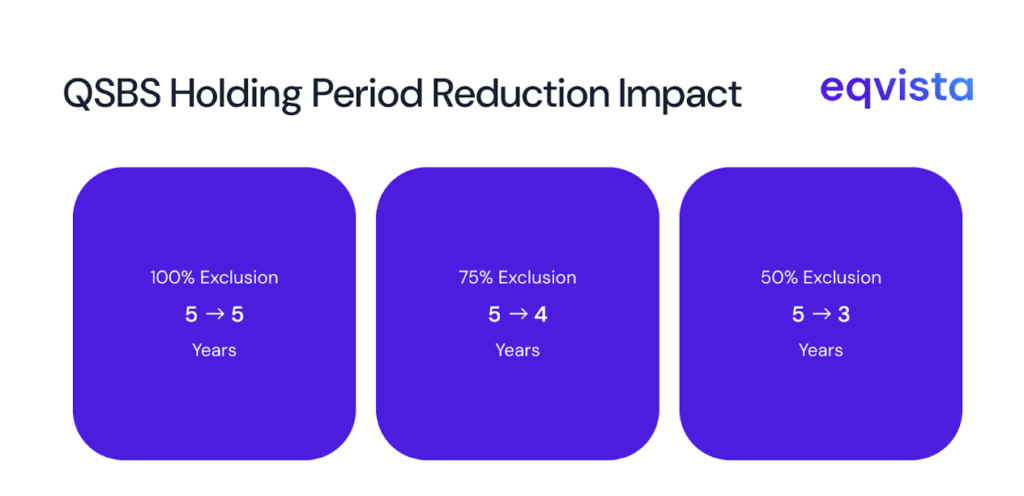

However, with the passage of the One Big Beautiful Bill (OBBB), the minimum holding period for tax exclusion under QSBS has been shortened to 3 years.

The tax exclusion limit has been amended to $15 million (increased from $10 million) or 10x the investment basis, whichever is greater.

The OBBB also expands the scope of QSBS. The maximum gross asset value requirement has been increased from $50 million to $75 million. So, comparatively larger businesses can issue QSBS now.

These key changes are summarized as follows:

| Particulars | Pre-OBBB | Post-OBBB |

|---|---|---|

| Maximum tax exclusion | $10 million or 10x the investment basis | $15 million or 10x the investment basis |

| Maximum gross asset value | $50 million | $75 million |

| 100% tax exclusion | Minimum holding period of 5 years And Investment must be made after 27th September 2010 | Minimum holding period of 5 years |

| 75% tax exclusion | Minimum holding period of 5 years And Investment must be made between 18th February 2009 and 27th September 2010 | Minimum holding period of 4 years |

| 50% tax exclusion | Minimum holding period of 5 years And Investment must be made before 18th February 2009 | Minimum holding period of 3 years |

How does the OBBB impact capital gains tax?

The Tax Cuts and Jobs Act of 2017 had temporarily changed the income brackets for tax on long-term capital gains and qualified dividends. The changes that came into effect in 2018 and were set to expire after 2025 were as follows:

| Tax rate | Tax bracket (Single taxpayers) | |

|---|---|---|

| Pre-TCJA | Post-TCJA | |

| 0% | $0-$38,700 | $0-$38,600 |

| 15% | $38,700-$426,700 | $38,600-$425,800 |

| 20% | Above $426,700 | Above $425,800 |

Note: The tax brackets were subsequently adjusted for inflation.

Since these changes to capital gains tax have been made permanent, investors would continue to pay marginally higher taxes.

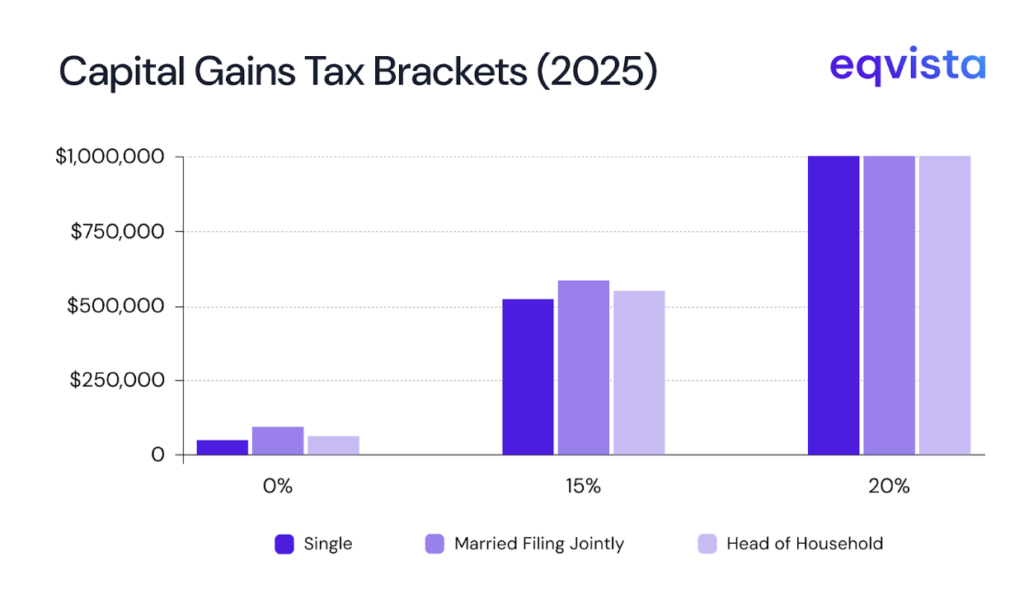

Presently, the long-term capital gains tax brackets are as follows:

| Tax rate | Tax brackets for different taxpayers | |||

|---|---|---|---|---|

| Single | Married and filing separately | Married and filing jointly (or qualifying surviving spouse) | Head of household | |

| 0% | $0-$47,025 | $0-$47,025 | $0-$94,050 | $0-$63,000 |

| 15% | $47,025-$518,900 | $47,025-$291,850 | $94,050-$583,750 | $63,000-$551,350 |

| 20% | Above $518,900 | Above $291,850 | Above $583,750 | Above $551,350 |

How does the OBBB impact estate planning?

The TCJA had essentially doubled the gift and estate tax exclusion limit. But this provision was set to expire at the end of 2025. After various inflation adjustments, the limit stands at $13.99 million in 2025. In 2026, this limit was expected to be halved.

However, with the passage of the OBBB, the limit will be increased to $15 million in 2026. OBBB also allows for inflation adjustments to this limit starting from 2027. As a result, taxpayers do not need to rush their estate planning anymore, even if their estates are larger than about $7 million or the previously expected 2026 limit.

What other benefits does OBBB carry for businesses?

The OBBB brought the following tax benefits for startups, corporations, and business owners:

100% bonus depreciation of qualified personal property placed in service

From 2018 through 2022, the TCJA allowed claiming 100% depreciation on qualified personal property in the year it was placed in service by the business. However, from 2023 onwards, the applicable percentage started dropping, and in 2025, it was slated to drop to 40%. But the OBBB has reinstated the 100% bonus depreciation.

100% deduction of qualified production property

Under the new Section 168(n), the cost of any qualified production property (QPP) can be fully deducted in the year it is placed in service. QPPs must meet the following criteria:

- Non-residential real property

- Integral part of producing a qualified product

- Original use must commence with the taxpayer

- Placed in service in the USA or one of the USA’s territories before 2031

- Construction begins after 19th January 2025 and ends before 2030

- Enhanced research and development (R&D) deductions

Previously, domestic research and development (R&D) expenses had to be capitalized and amortized over five years. The OBBB adds Section 174A, which allows businesses to choose between amortization over five years or immediate deduction in the year in which the costs were incurred.

You must note that this new section does not change the treatment of foreign R&D costs. Such costs must still be capitalized and amortized over 15 years.

Increased business interest deduction

The maximum business interest deduction you can claim is the sum of your interest income, 30% of your adjusted taxable income (ATI), and floor plan financing interest expense. The OBBB removes the deductions for depreciation, amortization, and depletion from ATI calculations. As a result, the maximum business interest deduction has increased.

Enhancement of qualified business income (QBI) deduction

Non-corporate taxpayers can deduct 20% of their qualified business income (QBI) from a partnership, S corporation, or sole proprietorship. This provision, which was introduced by the TCJA, was scheduled to expire at the end of 2025.

Furthermore, QBI deductions phase out with increasing taxable income. In 2025, the QBI deduction phaseout had a lower limit of $197,300 (single) or $394,600 (joint), and an upper limit equaling the lower limit plus $50,000 (single) or $100,000 (joint).

OBBB doesn’t simply make QBI deductions permanent but also enhances them. With the passage of OBBB, the upper limit of the QBI deduction phaseout is expanded to $75,000 over the lower limit for single taxpayers and $150,000 over the lower limit for joint filers.

Furthermore, the OBBB introduced a minimum QBI deduction of $400 for taxpayers who had a minimum QBI of $1,000 from active qualified trades or businesses. The minimum deduction and the minimum QBI condition would be adjusted for inflation.

Increased state and local taxes deduction limit

The OBBB increased the state and local taxes (SALT) deduction limit from $10,000 to $40,000. This deduction limit is phased out with a floor of $10,000 once a taxpayer’s adjusted gross income (AGI) goes beyond $500,000. The deduction limit and its phase-out floor will be adjusted for inflation.

The increase in SALT deduction limit is not permanent and is scheduled to revert to $10,000 in 2030.

Eqvista – Unlocking tax benefits with accuracy!

With the passage of the OBBB, investors and businesses have a great opportunity to unlock extremely lucrative tax savings. However, whether you can truly exploit these opportunities hinges on accurate income reporting and credible business valuations. That’s where Eqvista comes in.

Our accurate and audit-defensible valuation reports are designed to support key tax strategies, including maximizing QSBS benefits. Contact us to know more!