NEA Investments Analysis :Top 10 investments in 2024

Founded in 1977 by Chuck Newhall, Frank A. Bonsal, and Richard Kramlich, New Enterprise Associates (NEA) is a stage-agnostic venture capital firm that primarily invests in startups from the sectors of life sciences, digital health, enterprise tech, consumer, and fintech. The firm believes in taking an active role in supporting its portfolio companies. Its support extends beyond just advising on key issues and involves solving problems collaboratively with founders.

Over its rich, nearly five-decade-long history, NEA has seen more than 280 of its portfolio companies reach the IPO stage and more than 99 of its invested companies became billion-dollar businesses. Some of its notable investments include Cloudflare, Coursera, and Plaid.

This article analyzes NEA’s investment data from January 2024 to January 2025, examining funding patterns, sector preferences, and strategic positioning to understand the firm’s vision for technology and healthcare innovation.

Investment Portfolio Overview

NEA’s 2024-2025 investment portfolio shows diversity in funding stages, sectors, and deal sizes. The firm participated in rounds from pre-seed investments to massive billion-dollar financing rounds, showcasing its flexibility and commitment to supporting companies at every growth stage.

| Sr. No | Organization Name | Funding Type | Announced Date (Jan 2024 - Jan 2025) | Money Raised in Round (in USD) |

|---|---|---|---|---|

| 1 | Xaira Therapeutics | Series A | 2024-04-23 | 1000000000 |

| 2 | Clio | Series F | 2024-07-23 | 900000000 |

| 3 | Wonder | Venture - Series Unknown | 2024-03-19 | 700000000 |

| 4 | Cardurion Pharmaceuticals | Series B | 2024-07-16 | 260000000 |

| 5 | World Labs | Venture - Series Unknown | 2024-09-13 | 230000000 |

| 6 | Sakana AI | Series A | 2024-09-04 | 214000000 |

| 7 | Zenas BioPharma | Series C | 2024-05-07 | 200000000 |

| 8 | Avenzo Therapeutics | Series A | 2024-03-26 | 150000000 |

| 9 | Inventiva Pharma | Post-IPO Equity | 2024-10-14 | 126004765 |

| 10 | Together AI | Series A | 2024-03-13 | 106000000 |

| 11 | Magenta Medical | Venture - Series Unknown | 2024-07-23 | 105000000 |

| 12 | Amber Therapeutics | Series A | 2024-06-10 | 101703017 |

| 13 | Regulus Therapeutics | Post-IPO Equity | 2024-03-12 | 100000000 |

| 14 | Orbis Medicines | Series A | 2025-01-06 | 93200023 |

| 15 | Foundry | Series A | 2024-03-21 | 80000000 |

| 16 | Comanche Biopharma | Series B | 2024-01-17 | 75000000 |

| 17 | Perplexity | Series B | 2024-01-04 | 73600000 |

| 18 | Second Front Systems | Series C | 2024-09-13 | 70000000 |

| 19 | Korro Bio | Post-IPO Equity | 2024-04-18 | 70000000 |

| 20 | Brenig Therapeutics | Series A | 2024-07-24 | 65000000 |

| 21 | MBX Biosciences | Series C | 2024-08-05 | 63500000 |

| 22 | Perplexity | Series C | 2024-04-23 | 62700000 |

| 23 | Outrider | Series D | 2024-10-24 | 62000000 |

| 24 | Pathos | Series C | 2024-10-29 | 62000000 |

| 25 | Moximed | Series D | 2024-08-13 | 61000000 |

| 26 | Sana | Series C | 2024-10-30 | 55000000 |

| 27 | 858 Therapeutics | Series B | 2024-09-26 | 50000000 |

| 28 | Twelve Labs | Series A | 2024-06-04 | 50000000 |

| 29 | Metronome | Series B | 2024-01-31 | 43000000 |

| 30 | Inkitt | Series C | 2024-02-27 | 37000000 |

| 31 | ARRIS | Venture - Series Unknown | 2024-04-30 | 34000000 |

| 32 | beehiiv | Series B | 2024-04-30 | 33000000 |

| 33 | SafeBase | Series B | 2024-04-30 | 33000000 |

| 34 | PayZen | Series B | 2024-08-13 | 32000000 |

| 35 | Backflip AI | Series A | 2024-12-19 | 30000000 |

| 36 | Orby AI | Series A | 2024-06-27 | 30000000 |

| 37 | Genmo | Venture - Series Unknown | 2024-02-27 | 30000000 |

| 38 | Genmo | Series A | 2024-10-22 | 28400000 |

| 39 | Anterior | Series A | 2024-06-08 | 20000000 |

| 40 | Lily AI | Series B | 2024-03-14 | 20000000 |

| 41 | DeltaStream | Series A | 2024-09-17 | 15000000 |

| 42 | AI Squared | Series A | 2024-04-17 | 13800000 |

| 43 | Wispr AI | Venture - Series Unknown | 2024-09-30 | 12000000 |

| 44 | Fastino | Pre-Seed | 2024-11-12 | 7000000 |

| 45 | Courtyard | Venture - Series Unknown | 2024-12-23 | 4500000 |

| 46 | In-House Health | Seed | 2024-05-08 | 4000000 |

| 47 | Agree.com | Pre-Seed | 2024-09-05 | 3000000 |

| 48 | Propense.ai | Seed | 2024-03-06 | 3000000 |

| 49 | Faircado | Pre-Seed | 2024-05-28 | 2441541 |

| 50 | Global Predictions | Seed | 2024-08-01 | 2000000 |

| 51 | Avenzo Therapeutics | Series A | 2024-11-18 | - |

| 52 | Ceramic | Seed | 2024-08-14 | - |

Source: Crunchbase

Funding Distribution

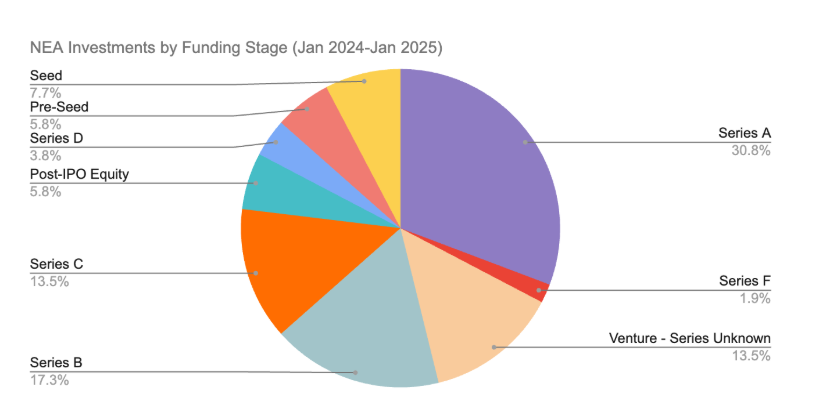

Series A rounds dominated NEA’s investment, accounting for 16 companies (around 30% of total investments). This focus on Series A suggests NEA’s commitment to supporting companies. Series B and C rounds followed with 9 and 7 investments, respectively, while early-stage investments (Pre-Seed and Seed) totaled seven companies. The firm also participated in later-stage financing, including Series D, F, and post-IPO equity rounds, highlighting its full-spectrum investment approach.

Investment Size Distribution

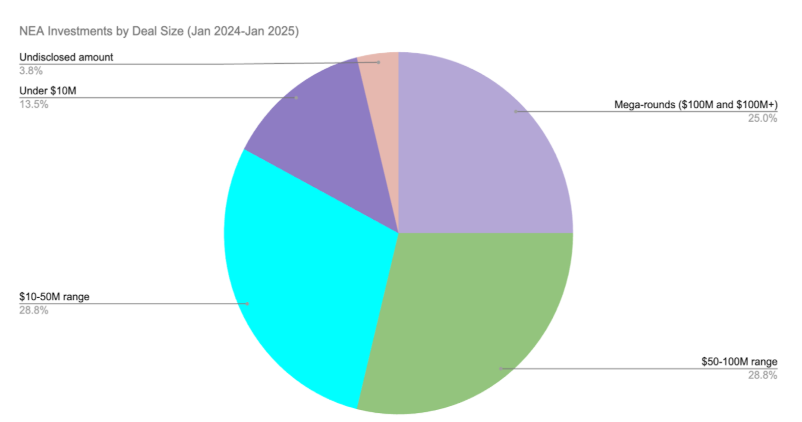

The distribution of investment sizes reveals NEA’s balanced approach to capital allocation:

- Mega-rounds ($100M and $100M+): 13 companies (25%)

- $50-100M range: 15 companies (28.85%)

- $10-50M range: 15 companies (28.85%)

- Under $10M: 7 companies (13.46%)

- Undisclosed amount: 2 company (3.85%)

The largest investment during this period was in Xaira Therapeutics, which raised an extraordinary $1 billion Series A round in April 2024, followed by Clio’s $900 million Series F round in July 2024. These mega-rounds indicate NEA’s confidence in breakthrough technologies and willingness to make substantial bets on market leaders.

Top 10 NEA investments in 2024

In 2024, we saw NEA back various companies across the industries of biotech and AI. Some of NEA’s top investments in this period by funding round size are as follows.

Xaira Therapeutics

- Round: Series A

- Size: $1 billion

Founded by ARCH Venture Partners, Foresite Labs, and Dr David Baker, a Nobel Laureate, Xaira Therapeutics is pioneering AI models to accelerate drug discovery. The company holds a strong conviction in its ability to design new proteins that could effectively target molecular structures that have remained resistant to conventional treatments.

Drug development is traditionally a lengthy and high-risk process, often taking years to yield a viable therapy. However, Xaira Therapeutics believes it can dramatically catalyze this process and pave the way for more effective and timely medical breakthroughs.

In April 2024, Xaira Therapeutics found investors such as ARCH Venture Partners, Foresite Labs, NEA, Lux Capital, Lightspeed Venture Partners, and Sequoia Capital that shared these beliefs and extended a funding of $1 billion in a Series A funding round.

Clio

- Round: Series F

- Size: $900 million

NEA led a $900 million Series F funding round into Clio, a legal practice management tool. Other participants of this funding round were Sixth Street Growth, Tidemark, and Goldman Sachs Asset Management. For 16 years, Clio has been at the forefront of developing cloud-based solutions that are being used by 150,000 legal professionals across more than 130 countries.

Clio plans to use these funds to expand the line of products offered on its platform, and target more sophisticated and high-value customers than its existing user base while also pursuing further geographical expansion. Specifically, these funds will be used to further develop Clio’s integrated legal payments service and AI offerings which already includes Clio Duo, a generative AI solution designed to streamline routine tasks and optimize firm efficiency through data analytics.

Wonder

- Round: Undisclosed

- Size: $700 million

Wonder is a food delivery startup that aims to make great food more accessible by scouting for the best chefs and restaurants in the nation. The startup also operates Blue Apron a meal-kit delivery platform that aims to create a more reliable food distribution system by partnering with farmers and sustainability experts to provide high-quality, sustainably sourced ingredients at better value.

The company has now scrapped its plan to build a nationwide network of food trucks and plans to leverage the new funding to open close to 100 delivery-focused restaurants in New York City.

The company’s CEO, Marc Lore, has disclosed that the funding structure is such that equity will be offered at a potential discount upon achieving certain milestones such as sales or IPO.

Cardurion Pharmaceuticals

- Round: Series B

- Size: $260 million

Founded by physician-scientists, Cardurion Pharmaceuticals is a biotech startup dedicated to addressing cardiovascular diseases that traditional treatments have failed to resolve. The company has developed two novel inhibitor drugs targeting heart failure and multiple cardiovascular conditions.

The $260 million funding from Ascenta Capital, NEA, GV, Blue Owl Healthcare Opportunities, and Bain Capital Life Sciences will support the late-stage clinical trials of these promising treatments. Additionally, Cardurion Pharmaceuticals will utilize these funds to venture into expanding the cardiovascular indications that could be treated through its existing portfolio of drug candidates, catalyze drug discovery, and acquire additional therapeutic assets.

World Labs

- Round: Undisclosed

- Size: $230 million

Founded by the godmother of AI, Fei-Fei Li, World Labs is building large world models (LWMs) that would be capable of reasoning and interacting with the 3D world. It is their conviction that spatially intelligent models are the next step in the evolution of AI that could be beneficial for professionals such as artists, designers, developers, and engineers from various domains as well as creative users. Specifically, the company expects to serve game developers and movie studios.

In December 2024, the company successfully developed an AI model that is capable of building 3D worlds based on 2D images while the next most advanced AI models can only generate 2D images based on text prompts.

Sakana AI

- Round: Series A

- Size: $214 million

A little over a year after launching, Sakana AI reached a valuation of $1.5 billion by securing $214 million from investors such as Nomura Holdings, NEA, Mizuho Financial Group, and Fujitsu. The company aims to democratize AI in Japan by building a world-class AI research lab in Tokyo.

In an energy import-reliant country like Japan, the NVIDIA-backed startup’s approach of building numerous small models instead of training a single large foundational model is seen as a viable strategy to catch up with global AI trends. This approach culminated in Sakana AI creating an evolutionary model merge method where conventional AI models are merged into cost-efficient high-performance models.

Zenas BioPharma

- Round: Series C

- Size: $200 million

Zenas BioPharma was founded by Lonnie Moulder who previously founded Tesaro, an oncology-focused biotech company that was acquired by GlaxoSmithKline, and also served as a venture advisor to NEA. The company aims to be the market leader in the development and commercialization of therapies designed to target and regulate the body’s immune response and inflammatory processes.

The $200 million funding received from investors such as NEA, SR One, Norwest Venture Partners, and Delos Capital would be used for ongoing mid- to late-stage clinical development of obexelimab, Zenas BioPharma’s lead product candidate. In the clinical trials conducted so far, this drug candidate was able to inhibit white blood cells responsible for developing antibodies without depleting them.

Avenzo Therapeutics

- Round: Series A

- Size: $150 million

Avenzo Therapeutics is a biotech startup founded by Athena Countouriotis MD, who previously led Turning Point Therapeutics through its IPO and eventual acquisition, and Dr Mohammad Hirmand who has more than 20 years of biotech clinical development experience. The company aims to improve the standard of care for those afflicted by cancer through its next-generation oncology therapeutics.

The $150 million raised in a Series A round led by NEA, Deep Track Capital, Sofinnova Investments, and Sands Capital would be used to advance the development of a drug meant to treat advanced solid tumors such as the ones seen in breast cancer.

In this funding round, Avenzo Therapeutics also welcomed Dr Jakob Dupont, an executive partner at Sofinnova Investments, as a director. He has more than 20 years of experience in immunology, gynecology, oncology, and other therapeutic areas.

Inventiva Pharma

- Round: Post-IPO equity

- Size: $126 million

NEA, BVF Partners LP, and Samsara BioCapital led a multi-tranche equity financing of up to €348 million into Inventiva Pharma, a listed clinical-stage biopharma company. Currently, the company focuses on developing drugs to treat fibrosis, lysosomal storage disorders, and cancer, and has two clinical-stage candidates.

Inventiva Pharma intends to utilize these funds to investigate the effects of its lead drug candidate, lanifibranor, on patients with MASH (Metabolic dysfunction-Associated Steatohepatitis) in the Phase 3 NATiV3 clinical trial. Thus far, more than 1,100 patients have been randomized in the trial whose patient enrollment is expected to finalize in the first half of 2025.

Together AI

- Round: Series A

- Size: $106 million

Together AI is an end-to-end cloud computing platform designed to develop and deploy generative AI models cost-efficiently and at a production scale. Currently, over 200 generative AI models across the verticals of chat, image, vision, audio, language, code, embeddings, and reranking are using Together AI. Some of its notable clients include Zoom, Quora, DuckDuckGo, and Leonardo.ai.

The $106 million raised in a funding round led by Salesforce will be used to expand offerings which includes the introduction of features to help large enterprises build and deploy generative AI solutions securely across teams using open-source and custom models. The company also plans to increase its capacity to compute internationally.

Eqvista- Empowering innovation through accurate valuation insights!

In 2024, NEA stayed true to its stage-agnostic approach to back innovative companies across AI and biotech sectors right from Series A to post-IPO stages. These companies are focused on enhancing cancer care, addressing unmet medical needs, and driving advancements in AI development. Its new portfolio companies are pursuing novel visions that would catalyze drug discovery, improve the cost and energy efficiency of AI models, and also democratize AI model development.

If you are a biotech company looking to attract investments from pioneering venture capital firms such as NEA, you must establish the potential value of your company through a comprehensive and well-supported valuation report by Eqvista. Contact us to learn more about our services!