What is NAV Reporting and Why Is It Important for Investment Funds?

Inaccurate NAVs can erode investor trust and trigger severe regulatory consequences. Consider the case of Calvert Investment Management (Calvert). The Securities and Exchange Commission (SEC) found that, between 2008 and 2011, Calvert had incorrectly valued certain securities. As a result, performance was misreported, shareholder transactions were executed at incorrect NAVs, and Calvert collected inflated asset-based fees.

To settle these charges, Calvert had to pay a civil penalty of $3.9 million and make a self-administered distribution to affected shareholders.

To help you avoid such dire consequences, in this article, we will introduce you to NAV reporting, its importance, components, challenges, and best practices. Read on to know more!

What is NAV reporting?

As the name suggests, net asset value (NAV) is the difference between the total assets and total liabilities. In case of investment funds, these values are adjusted to reflect the income distributions, shareholder activity, and fund management expenses. Funds are required to report these values at regular intervals. In the case of mutual funds, NAVs are reported at the end of each trading day. However, private equity (PE) and venture capital (VC) funds have relatively relaxed NAV reporting requirements.

Just as share price history forms the basis for interpreting returns from stock market investments, NAVs form the basis for interpreting investment fund returns.

Why is NAV reporting important for fund managers?

The three reasons why NAV reporting is a key consideration for fund managers are as follows:

Investor relations

NAV reporting is the main disclosure required of investment funds and expected by investors. An investor with a well-diversified portfolio will have active investments in multiple funds and across multiple asset classes. Hence, it is not possible for investors to assess the performance of each investment regularly. Instead, investors prefer to study the trends in investment values and investigate accordingly. Delayed NAV disclosures throw off this portfolio management habit of investors and, hence, can make investors anxious.

SEC reporting requirements

NAV forms a crucial element of reports required to be filed with the Securities and Exchange Commission (SEC). Specifically, N-PORT and N-CEN are two forms that most funds need to file. In these forms, funds must disclose the returns and standard deviation of their NAVs in comparison to the index. Furthermore, funds must also report if any payments to shareholders were reprocessed due to errors in NAV calculations.

Tax compliance

Many investment funds are structured as registered investment companies (RICs) to benefit from pass-through taxation. Even if RICs themselves may not pay taxes, they may still need to file, or at least prepare, certain forms to be submitted to the Internal Revenue Service (IRS).

Indirectly, NAV reporting helps investment funds file Form 1099, Form 1042-S, and Form 1120-RIC. These forms are meant to report the interest and dividends paid to shareholders, income paid to foreigners, and the taxable income of the investment company.

Key components of effective NAV reporting

NAV reporting begins with the valuation of assets and recognition of liabilities. However, this process also involves the following key components, whose importance is often understated.

- Accounting for income and expenses – The NAV must be adjusted for income distributions and fund management expenses such as fund manager salary, staff salary, and operating expenses.

- Adjusting for shareholder activity – The NAV can be impacted by shareholder activity such as subscriptions, redemptions, and distributions. Hence, you must create a summary of such activity for the given period and adjust the NAV accordingly.

- Disclosures – You must disclose the fair value hierarchy of the assets, the valuation methodologies, and the data used as inputs to ensure transparency.

- Compliance check – Finally, you must ensure that your methodologies, data sources, and disclosures meet the regulatory requirements and accounting standards.

What challenges do fund managers face with NAV reporting?

Fund managers may face the following challenges while reporting the NAV.

Data accuracy

The value of assets that have an active market can be easily determined. However, the same cannot be said for complex securities that do not have an active market. Their value must be determined based on observable inputs such as the price of underlying assets and macroeconomic variables. The valuation complexity heightens when you must consider unobservable inputs.

So, managers of funds that invest in complex securities often face a lack of accurate, up-to-date data.

Valuation complexity

Traditional valuation methodologies do not offer accurate results when it comes to certain assets, such as derivatives or early-stage startup equity. For such assets, you must utilize alternate valuation methodologies such as option pricing models, the venture capital method, or the comparable company analysis.

In certain cases, you may need to make adjustments to these methods based on the asset’s characteristics. This is only possible if you have a strong understanding of the core principles of these valuation methodologies.

Regulatory compliance

In addition to calculating the NAV, fund managers must also make various disclosures to the investors. Furthermore, the NAV forms a key component of SEC filings for registered investment companies. While NAV itself is not submitted to the IRS, it supports accurate tax reporting through forms submitted to the IRS. To avoid duplication of effort and ensure consistency, fund managers should align their NAV methodologies with both SEC and IRS valuation standards.

Best practices for NAV reporting compliance

You can ensure accurate NAV reporting by adhering to the following four best practices:

Classifying items by valuation difficulty

Investment funds must classify assets and liabilities based on the valuation difficulty using the ASC 820 fair value hierarchy, which can be summarized as follows:

- Level 1: Quoted prices in active markets

- Level 2: Valuation based on observable inputs

- Level 3: Valuation based on unobservable inputs

When you diligently apply this hierarchy across your fund’s portfolio, it will be easier for you to identify items that require more attention in NAV reporting. This can be especially useful for funds with complex leverage structures. Such an organized approach can go a long way in reducing delays.

Leveraging automation

The value of certain assets might be easy to determine since they have quoted prices. The same can be said of liabilities such as long-term loans whose values are logged in accounting software. In such cases, utilizing automation may streamline the NAV calculation process. Moreover, this approach also helps sidestep errors borne out of manual entry.

You should also consider leveraging automation in the dissemination of NAV data to investors and regulators to reduce the administrative strain.

Establishing a secure database

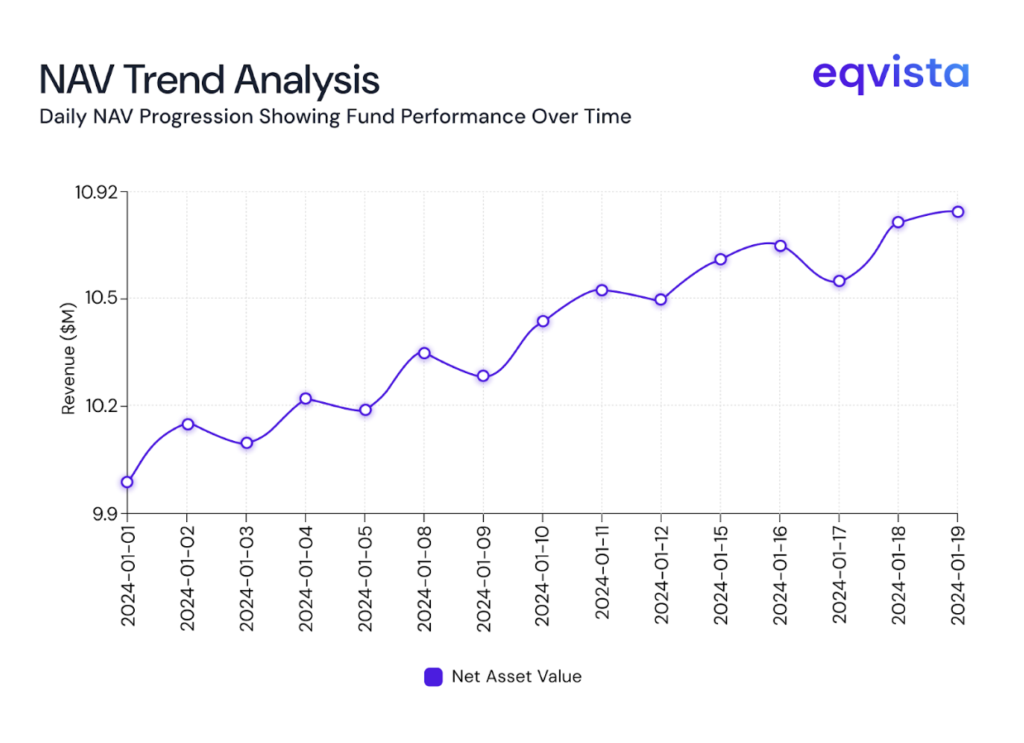

As discussed earlier, you may need to report the return and standard deviation of your NAV in comparison to the index. To make such calculations smoother, you must establish a secure database where NAV values are logged in as soon as they are calculated.

Outlining standard valuation procedures

To expedite NAV reporting, you must outline how you plan to value Level 3 items, which are assets and liabilities whose value depends on unobservable inputs. When your team has a standard valuation procedure, its members would be spared from having to devise the same methodologies in every reporting cycle. Such consistency in valuation principles and parameters also allows for more accurate benchmarking of fund performance.

Delegation

It is highly inefficient to engage every analyst in the NAV reporting process. Overcommitting resources to the NAV calculation can impact the overall fund performance. At actively managed funds, this would distract analysts from searching for investment opportunities and performing due diligence. Hence, there must be a clear delegation of NAV-related responsibilities.

Eqvista- Accuracy delivered with agility!

NAV reporting is more than a mere formality for investment funds. In fact, accurate and timely NAV reporting is the cornerstone of investor relations and compliance with tax and regulatory requirements.

No matter how you delegate NAV reporting responsibilities within your team, resources will inevitably be diverted from core activities such as deal origination. Instead, you should delegate this responsibility to a trusted valuation service provider such as Eqvista. Our extensive experience in venture capital valuations gives us the confidence to deliver cost-effective, timely, and regulation-compliant NAV reporting support.

Every month, our analysts deliver accurate valuations for even the most complex assets without delays. Reach out today to learn how we can strengthen your NAV reporting process.