83(b) election – A Complete Guide for Companies

One way startups can save is by utilizing 83(b) election, a way to save on taxes and eliminate any other financial issues for their company.

As an entrepreneur who is granted stock options or restricted stock as part of your compensation package, how do you maximize your financial potential while minimizing tax liabilities? The 83(b) election is a powerful yet often overlooked tool in equity compensation and tax strategy The IRC’s 83(b) option allows startup founders or employees to pay their taxes on the complete FMV (fair market value) of restricted shares at the award date.

This article provides a detailed guide for companies on the 83(b) election, including its benefits, potential risks, and the process for filing.

What is an 83(b) election?

Under the Internal Revenue Code (IRC), 83(b) election is a provision that allows startup founders and employees the option to pay taxes based on the restricted stock’s total fair market value at the time of granting. This provision can save a startup and employees a lot of money and avoid any future tax difficulties when the 83(b) election is submitted within 30 days of receiving the restricted shares, as the possibility of forfeiture is eliminated.

How does 83(b) election work?

Suppose you receive 10,000 shares with a grant price of $1 each. If you file an 83(b) election, you would immediately report $10,000 as ordinary income. If you later sell those shares for $20 each after they vest, your taxable gain would be calculated based on this initial value, leading to lower capital gains taxes compared to being taxed on each vesting date.

When you make an 83(b) election, you ask the IRS to record income and collect income taxes on the acquisition of business shares at the time they are awarded rather than when they vest. When an employee gets a company stock or stock options reward, it is known as the grant date. You can keep up with stock-based compensation along with your taxation plans.

Benefits of 83(b) election

If you hold shares for more than a year before selling them, you’ll benefit from lower long-term capital gains taxes. Filing an 83(b) allows you to begin the holding period clock early, straight after the grant date, allowing you to take advantage of the lower capital gains tax rate.

Because the restricted stock is awarded on a vesting schedule, the employee will have no taxable income on the date it is granted. Any dividends received by the employee as a result of owning restricted shares would be recognized as compensating dividends for tax purposes (i.e., ordinary income tax treatment subject to withholding).

How Form 15620 standardised the section 83(b) election?

IRS Form 15620 is a newly introduced standardized form designed for taxpayers to make a Section 83(b) election on November 7, 2024. Before Form 15620, taxpayers had to draft their election statements based on IRS guidance. The new form provides a consistent format that includes all necessary information, reducing uncertainty about compliance with IRS rules.

Taxpayers can file Form 15620 by mailing it to the IRS service center, where they file their federal income tax return. Although electronic filing is currently unavailable, there are indications that it may be allowed in the future.

You can file 83b elections in 2024 on Eqvista’s application, which lets you track where your form is and keep records for future use. This way, you can ensure you stay compliant and are ready for any tax effects due to your equity compensation.

Factors to consider when filing an 83(b) election

Identifying information about you (name, address, Social Security number). The property awarded (number and kind of shares of which firm), as well as the date received or purchased, any limitations on your shares, and the fair market value of the shares on the date received or acquired.

- Stock value outlook – Generally, if the outlook of the stock is bullish over the vesting period.an 83(b) election should be considered.

- Risk of loss – If the taxpayer later forfeits the equity before it vests (e.g., if employment ends), they are not entitled to a refund of the taxes already paid on the equity’s value.

- Tax Implication – By making the election, you include the FMV of the equity at the time of the grant in your taxable income immediately. This is considered as ordinary income and taxed at your regular income tax rate.

- Capital Gains – By filing an 83(b) election, any future appreciation in stock value will be taxed at long-term capital gains instead of ordinary income rates, provided you hold the shares for more than one year.

- Irrevocability – Once filed, the 83(b) election cannot be undone. Therefore, it’s crucial to consult with a tax advisor to ensure that this strategy aligns with your financial situation and expectations regarding stock appreciation.

Who should file an 83(b) election?

The 83(b) election can be a strategic move for individuals receiving equity compensation, allowing them to potentially minimize their tax liabilities by locking in lower valuations at grant time.

Individuals who should consider filing an 83(b) election include:

- Startup Founders – Founders receiving restricted stock as part of their compensation can benefit significantly from the 83(b) election. By filing, they can lock in a lower tax rate based on the initial valuation rather than facing potentially higher taxes as the stock vests over time.

- Employees with Restricted Stock – Employees who receive restricted stock subject to vesting should evaluate the 83(b) election. If they expect the stock’s value to increase, filing the election allows them to pay taxes on the lower initial value rather than on potentially much higher values at each vesting date.

- Individuals with a Bullish Outlook – Anyone who believes the stock will appreciate significantly over time should consider filing an 83(b) election. This is particularly relevant for those in high-growth industries or startups where rapid valuation increases are expected.

When to file 83(b) election?

If you have the opportunity to exercise your stock options before they vest, you can do so and file an 83(b) election within 30 days of doing so.

This 30-day period includes weekends and holidays. The day you receive your equity is considered “Day 0” in that 30-day period.To meet the deadline, ensure your election is properly mailed within this 30-day window. The deadline will be extended to the next business day if the 30th day falls on an official holiday, Saturday, or Sunday.

The IRS considers timely mailing as timely filing if your mail has a postmark that clearly shows when the U.S. The Postal Service (USPS) obtained possession of your mail.

How to file 83(b) election?

The election is generally considered timely filed if the completed election is placed in a properly addressed and stamped envelope and sent via certified U.S. mail. The certification date is on or before the 30-day deadline.

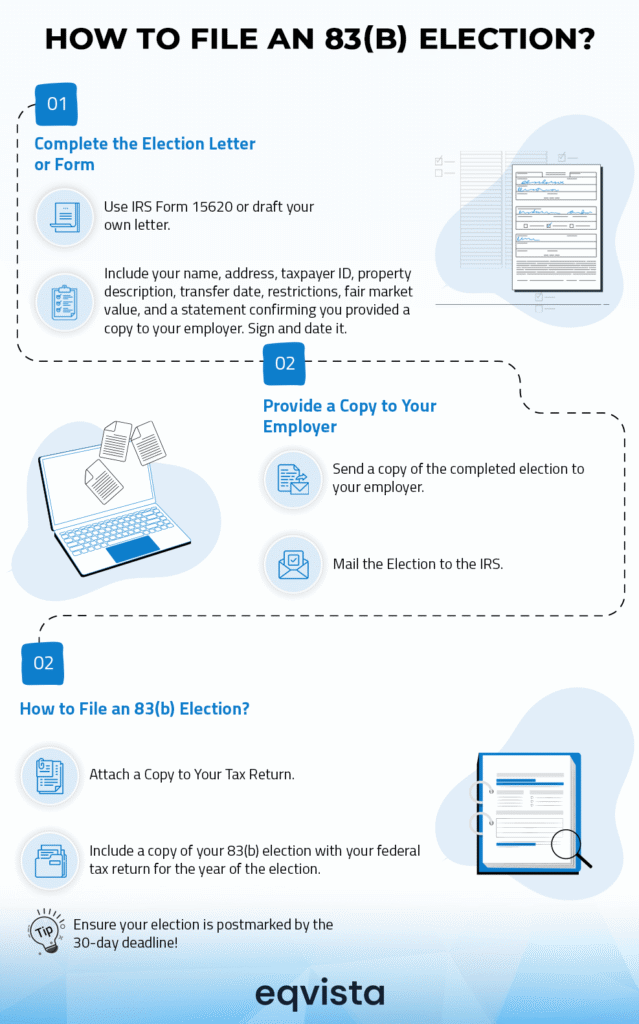

To file an 83(b) election, follow these steps.

1. Complete the Election Letter or Form

You can use the new IRS Form 15620 or draft your own election letter. If using the letter, include:

- Your name, address, and taxpayer identification number

- A description of the property

- The date of transfer and the tax year for which the election is made.

- The nature of any restrictions on the property (such as vesting conditions).

- The fair market value at the time of transfer minus any amount paid for the property.

- A statement confirming you provided a copy to your employer.

- Your signature and date.

2. Provide a Copy to Your Employer

Send a copy of the completed election letter or Form 15620 to your employer or the company that granted you the stock.

3. Mail the Election to the IRS

Send the original election letter or Form 15620 to the IRS office where you file your federal tax returns. This must be done within 30 days of receiving the stock. Use certified mail with a return receipt to ensure proof of timely filing.

4. Attach a Copy to Your Tax Return

Add a copy of your 83(b) election with your federal income tax return for the year in which you made the election, even if it does not result in immediate tax due.

Note: Remember, once filed, an 83(b) election is irrevocable. It’s advisable to consult with a tax professional to ensure this decision aligns with your financial strategy and circumstances.

Eqvista’s platform now makes it easy to file your 83(b) election form. Our Enterprise clients can manage the entire process seamlessly, from creating the form to downloading it. With help of our certified experts you can alleviate the stress and challenges associated with filing an 83(b) election.

FAQs on 83(b) Election

Here are some questions that are commonly asked about 83(b) election:

What happens if you don’t make an 83(b) election?

A missed 83(b) election will impose a financial impact on the organization as well. At each vesting date, the corporation must settle on a valuation for freshly vested shares and appropriately report that amount as compensation. On the plus side, the corporation may usually deduct that sum from its profits.

Who can make an 83(b) election?

An employee or startup founder can opt under IRC 83(b) to pay taxes on the entire fair market value of restricted shares at the time of grant.

What happens when you don’t file an 83(b) election within 30 days?

An 83(b) election permits the tax liability on the complete fair market value of the restricted shares at the time of granting to be paid in advance. Only if the restricted stock’s value rises in the coming years is it helpful. An 83(b) option may also be advantageous if the amount of income disclosed at the time of granting is minor.

Can we revoke an 83(b) election?

No, once the election is made, it is irrevocable. It’s advisable to consult with a tax professional to ensure that you comply with all requirements and maximize potential tax benefits.

Can I file 83(b) elections electronically?

No, 83(b) elections cannot be filed electronically. The election must be submitted in a written format and mailed to the IRS. Electronic filing is expected to be available, but only if taxpayers use Form 15620.

Where do I file IRS form 83(b)

Within 30 days after your award date, mail the completed letter to the IRS. Send your tax return to the IRS Service Center where you filed it—the address for your IRS Service Center may be found here. Send the letter by certified mail and seek a return receipt if possible.

How do I verify that the IRS received my 83(b) election form?

Send the form via USPS Certified Mail with Return Receipt. Keep the stamped receipt as proof of delivery. If you have the Certified Mail receipt, it serves as proof that you filed on time, even if the IRS hasn’t acknowledged it.

Maximize Your Tax Savings – Get Started With Eqvista!

Making an 83(b) election is a strategic decision for individuals receiving restricted stock. This allows them to recognize income based on the fair market value of their shares at the time of grant rather than at vesting. With the introduction of IRS Form 15620, taxpayers now have a standardized method for filing their Section 83(b) elections, simplifying the process significantly.

Eqvista provides services to assist with the filing process to ensure compliance with IRS regulations. With support from certified experts, Eqvista helps users to overcome the complexities of the 83(b)election, and maximize potential tax benefits.

Take control of your tax situation by filing your 83(b) election now. With Eqvista’s expert assistance, you can navigate the process effortlessly.

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!