Complex securities valuation

Complex securities valuations are required for effective portfolio management, meeting various regulatory requirements, and various other reasons.

When an asset has a unique structure and risk profile, it can be used to execute investing and trading ideas that are too sophisticated to be executed using traditional securities like stocks and bonds.

In The Big Short, the cult-classic movie on the Great Recession, we saw credit default swaps (CDS) used to take short positions on mortgage-backed securities (MBS). CDSs and MBSs are both complex securities. An MBS packs several home loans together and sells them to investors while CDS are structured like insurance against a certain asset. So, in this movie, the CDS holders had to pay a premium until the MBSs failed. Upon failure of MBSs, they received a huge payout.

Even the perfect protagonists of a movie had trouble valuing such securities. In real life, if you do not overcome the difficulties in complex securities valuation, you will make mistakes in financial reporting, regulatory compliance, portfolio management, and investment decision-making.

Why is complex securities valuation required?

Complex securities valuations are required for effective portfolio management, meeting various regulatory requirements, and various other reasons, which we will discuss in this section.

Risk Assessment

Complex securities tend to be very volatile. Because of the complex structure, their values may not always change in a way that makes intuitive sense. Thus, they are considered riskier than traditional assets and require regular valuations for risk assessment.

Regulatory Compliance

If you are providing wealth management services and you provide exposure to complex securities to your investors, you must regularly get independent valuations to meet the disclosure and transparency regulations.

Investment Decision-Making

By regularly assessing the value of your complex securities, you can observe trends and plan your exits, which is a key part of investment decision-making.

Financial reporting

Complex securities can have a huge impact on your profits and ability to repay creditors. Hence, an accurate complex securities valuation is necessary for transparent financial reporting.

Portfolio management

Complex securities offer unique solutions for your portfolio like providing exposure to equity as well as debt of an entity or taking long and short positions on various assets. To effectively balance such pros with the cons of high volatility, you must get a portfolio valuation from someone who can also handle a complex securities valuation.

Complex Securities Valuation Methods

Some complex securities valuation methods are as follows:

Option Pricing Models

Option pricing models like the Black-Scholes model, are commonly used for valuing any security, complex or traditional, that is structured like an option. Simply put, if a security gives you the right but not the option to buy or sell something, it can be likened to an option.

Convertible bonds are a complex security with option-like features since they attract an interest income and can be converted into equity shares.

Example of valuing convertible bonds using the Black-Scholes option pricing method

Assumptions

| Particulars | Amount | Symbol |

|---|---|---|

| Value of the bond itself | $834.79 | B |

| Stock price | $60.00 | S |

| Strike price | $50.00 | K |

| Expiration (in years) | 8 | T |

| Risk-free interest rate | 5% | r |

| Variance | 0.25 | V |

| Annualised dividend yield | 5% | D |

| Conversion rate | 20 | - |

Formula for convertible bond value:

Value of convertible bond = Value of the bond itself + Value of the conversion option

According to NYU Stern, the formula for the conversion option is:

Call option = (N(d1) × S × e-DT – N(d2) × K × e-rT) × Conversion rate

Where N is the normal distribution and,

d1 = ln(S/K) + (r – D + (V/2)) × T / √V × √T

d2 = d1 – √V × √T

When we input the assumptions into this formula, the value of the conversion option will be $453.50 and the total value of the convertible bond will be $1,288.30.

Monte Carlo simulations

Monte Carlo simulations involve running multiple simulations while assigning a different value to the unpredictable variables every time you run a simulation. If the value of complex security depends greatly on a few random variables, you can apply this technique to see how its value will vary over different random variable values.

Example of a convertible bond valuation through Monte Carlo simulations

Assumptions

| Particulars | Amount |

|---|---|

| Face value | $1,000.00 |

| Coupon rate | 5% |

| Time to maturity | 3 years |

| Stock price | $60.00 |

| Conversion ratio | 20 |

| Volatility | 30% |

| Risk-free rate of return | 5% |

| Dividend yield | 5% |

Steps:

1. Simulating stock prices

In this example, we will make 10,000 simulations of the daily stock price over 3 years using the following formula which is based on the Geometric Brownian Motion (GBM) model:

S1 = S0 × e((μ – σ^2/2)t + σW(t))

Here, S1 is the current day’s closing price and S0 is the previous day’s closing price.

μ is the expected continuous annual return of the stock and μ = Risk-free rate of return – Dividend yield

We will replace ‘W(t),’ which is meant to capture the random fluctuations in the stock price, with a normal distribution where the mean is 0 and the variance is 1.

2. Calculating bond values

Once we finish our 10,000 simulations, we will calculate the conversion value by multiplying the simulated stock prices by the conversion ratio. Then, whichever is greater between the conversion value and the face value will be the bond value in that simulation.

3. Discounting the bond values

The bond values will then be discounted using the risk-free rate of return.

4. Calculating the mean

Then, we just need to look at the mean of the convertible bond values, which came out to be $1,158.22.

Lattice-based models

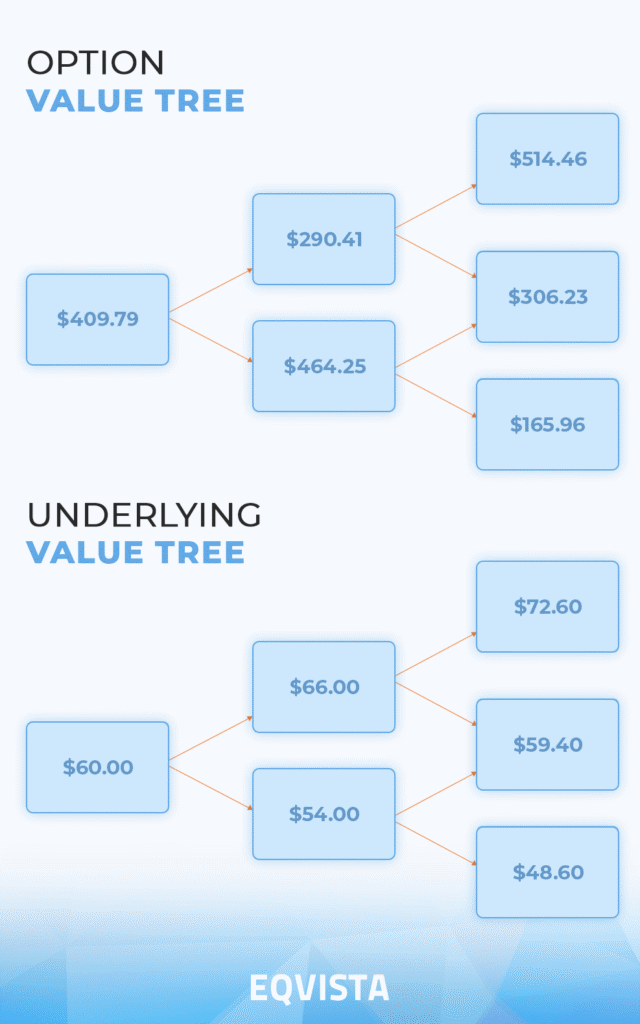

Lattice-based models like binomial trees and trinomial trees value options by calculating various paths of an underlying asset and then calculating option values for each scenario. An advantage of such a model is that you can see the price of a security over a certain period instead of a certain point in time.

Calculation example of lattice-based model

We will make the same assumptions as we did in the ‘Option Pricing Models’ example while changing the maturity to 3 years and using the same formula for calculating the value of the conversion option.

Let us assume that the stock price can move either 10% up or 10% down after every year.

Then, if we calculate the conversion option value for each scenario, we get the following diagram:

| Stock price | Year | Value of conversion option |

|---|---|---|

| $60.00 | 0 | $409.79 |

| $54.00 | 1 | $290.41 |

| $66.00 | 1 | $464.25 |

| $72.60 | 2 | $514.46 |

| $59.40 | 2 | $306.23 |

| $48.60 | 2 | $165.96 |

Challenges in Complex Securities Valuation

Some of the challenges you may experience in valuing complex securities are:

Data Availability and Quality

Complex securities are unique and finding transactions involving similar securities in similar economic and market conditions is next to impossible. So, the market approach to valuation has certain limitations when it comes to complex securities.

Model Complexity and Assumptions

Numerous factors influence complex securities valuation. To capture the impact of all such factors and to deal with the unique structures of complex securities, we must use very sophisticated models which can be difficult to master. Such models also require very accurate assumptions about market and economic conditions, which is difficult to achieve without experience.

Regulatory and Accounting Considerations

Complex securities valuation can play an important role in calculating your tax liability and meeting disclosure requirements through accurate accounting and bookkeeping. However, their complex and unique structure can make it difficult to follow valuation methodology-related regulations and standards set by regulators, tax authorities, and accounting standards boards.

Importance of Engaging Experts in Complex Securities Valuation

Some of the benefits of engaging an expert like Eqvista for complex securities valuation are:

Independence and Objectivity

If you provide exposure to complex securities to your investors, it is a regulatory requirement to report the value of such assets based on an independent valuation. Eqvista is an expert valuation service provider that adheres to the highest ethical and professional standards, ensuring an unbiased and objective valuation that reflects your concerns accurately.

Data-Driven Analysis

A valuation expert will have their own database of complex security valuations which will prove useful in valuing your complex securities. At Eqvista, we provide valuation services of various kinds to more than 15,000 companies which has equipped us with the necessary knowledge for complex security valuations. Rest assured we keep the data private and anonymous.

Risk Management

An experienced valuator can advise you on how to manage the risk arising out of your complex securities. Since we provide a variety of services like startup equity valuations, software valuations, and intellectual property valuations, Eqvista’s team understands the risk profile of different assets and can advise on a variety of asset management matters.

Audit-Defensible Reports

An unbiased report by an experienced valuation expert is crucial to tide over an audit by regulators and tax authorities. Eqvista has assembled a team of valuation experts and accredited tax professionals so that our clients can face audits with peace of mind.

Strategic Decision-Making

At the core of strategic decision-making lies accurately tracking changes in values and risk levels of the asset you hold. Eqvista’s complex security valuation reports assist you in planning your investing journey by explaining expected changes in asset values under various scenarios.

Regulatory Compliance

If you have complex securities on your balance sheet, an unbiased and accurate valuation from an independent valuation expert contributes to regulatory compliance. We, at Eqvista, understand such needs from our experience of providing valuation reports for tax and regulatory compliance.

Rely on Eqvista’s experience for complex security valuations!

Complex securities valuations are important for ensuring regulatory compliance and meeting disclosure requirements. They can also prove valuable for strategic decision-making and portfolio management. Due to their unique nature, such securities can only be valued using advanced methods like Monte Carlo simulations, lattice-based models, and option pricing models.

If you are new to valuing such securities you may face issues due to a lack of relevant data, the complex nature of valuation models, and the numerous regulatory and accounting considerations. So, if you need a helping hand in complex securities valuations, feel free to get in touch with Eqvista!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!