Classes of Shares (A, B, C)

Classes of shares are essentially a kind of listed stock separated by the amount of voting rights received by the shareholders.

There is a popular belief that publicly traded companies have the same share structure. In corporate ownership, not all shareholders are equal. Some have a greater say in company decisions, while others may enjoy enhanced access to profits or special protections. This differentiation often arises not from the number of shares held, but from the specific category those shares belong to. By creating distinct groups of stock, companies can tailor rights and privileges to meet strategic goals—such as retaining founder control, attracting public investment, or incentivizing employees—without treating every investor identically.

This approach, can be seen in Google and Berkshire Hathaway, allows for a fine balance between ownership and maintaining leadership. As a result, the share structure has each class serve a unique purpose, reflecting the priorities and vision of the company’s architects.

What is a Class of Shares?

A class of shares refers to a specific category of a company’s stock that comes with distinct rights, privileges, and sometimes fee structures. These classes are usually designated by letters such as Class A, Class B, or Class C, and they can differ in several key ways, including voting rights, dividend access, and other shareholder benefits.

For instance, a corporation might resort to issuing ordinary stock after getting only a single vote per share, assigned as a class A shares. It may then further offer executive stock with one hundred votes per share under class B shares.

Features of Class of Shares

The company defines the exact features of each class, which can vary widely; therefore, investors need to understand the specific terms before investing.

- Voting Rights: Classes of shares are essentially a kind of listed stock separated by the amount of voting rights received by the shareholders. For instance, a listed corporation may possess more than one share class, classified as Classes A and B.

- Dividend Access: Some share classes have priority in receiving dividends or a higher claim on company assets in the event of liquidation.

- Ownership and Control: Companies often use multiple share classes to allow founders or key insiders to retain control while raising capital from public investors.

- Fee Structures (for funds): In mutual funds, share classes can also differ by the types of fees charged, such as front-end loads, deferred sales charges, or higher annual fees.

Share Class Types

Companies use share classes to balance the need for raising capital with the desire to retain control, reward specific groups, and tailor shareholder rights. Each class is defined in the company’s charter and can differ in voting rights, dividend access, and other privileges, depending on the company’s specific goals and structure.

Class A Shares

Traditionally, Class A shares come with more voting rights and higher priority for dividends and profits in liquidation, but this is not universal—some companies reverse this structure. Class A shares may be reserved for company insiders or executives or may be publicly traded at a higher price point.

In some tech companies, Class A shares are publicly traded with standard voting rights, while founders control Class B shares with super-voting power.

Class B Shares

Typically considered “common shares” with standard voting rights (often one vote per share) and no special dividend priority. Usually available to the general public and traded on exchanges. In some companies, Class B shares are the super-voting shares held by insiders, while Class A shares are the public shares—so always check the company-specific definitions.

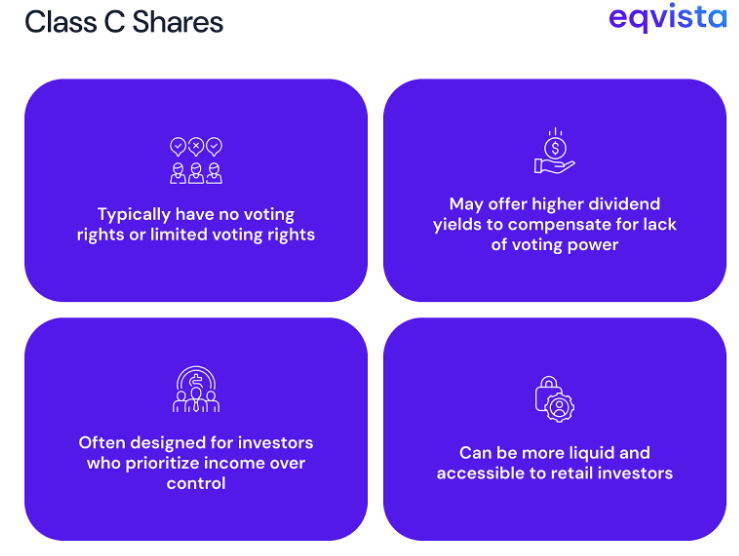

Class C Shares

This class often has little or no voting rights. It may be issued to employees as part of compensation or to public investors with certain restrictions. Generally more accessible and lower-priced, but with fewer shareholder privileges. In some companies (e.g., Alphabet/Google), Class C shares trade publicly but do not carry voting rights.

Key Differences Among Share Classes

Class A, B, and C shares are categories of stock that differ primarily in voting rights, dividend priority, and accessibility. Class A usually has the most privileges, but definitions can vary; Class B is often the standard public share; and Class C typically has the fewest rights, often lacking voting power.

| Feature | Class A shares | Class B shares | Class C Shares |

|---|---|---|---|

| Voting Rights | Typically highest (but not always); may have multiple votes per share. | Usually fewer voting rights than Class A; sometimes one vote per share | Often no voting rights, or very limited |

| Dividend Priority | Often higher priority for dividends and assets | Standard/common share dividend rights | Varies; sometimes similar to B, sometimes restricted |

| Ownership/Access | Sometimes reserved for founders, executives, or insiders; may not be publicly traded | Usually available to the public as common shares | Sometimes given to employees or public with restrictions |

| Convertibility | May be convertible to Class B shares | Rarely convertible to Class A | Varies by company |

| Price | Can be significantly higher than B or C shares | Typically lower than A shares | Often lower-priced; accessible to more investors |

Recording Classes of Shares on Eqvista

If your company has different types of share classes and shareholders, then recording and organizing the details on the cap table should be of utmost importance. Any errors can lead to headaches down the road, as you try to back track on how many shares you issued to whom.

This is where Eqvista comes in. Our advanced equity software management system can help you record all the different classes of shares for your company.

The Summary Page allows you to have an overview of the different classes of shares in the company, and also any options, warrants or convertible notes you may have:

The Eqvista platform also has a detailed page by shareholder to see how much each person owns of your company.

The detailed version also has how many shares each shareholder has per share class, and you can also easily download the cap table to excel.

Interested in different classes of shares for your company?

Understanding the classes of shares is crucial for structuring ownership, managing voting rights, and aligning shareholder interests. Properly organizing and recording can prevent complications and ensures transparency for founders, employees, and investors.

Eqvista provides a comprehensive platform to manage your company’s equity, from issuing and tracking different classes of shares to maintaining an up-to-date cap table. Whether you’re a startup or an established business, Eqvista’s advanced equity management software makes it easy to issue electronic shares, monitor shareholder ownership by class, and generate detailed reports—all in one place. Try Eqvista today and simplify your company’s share structure and cap table management! To know more, reach us today.

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!