Bootstrapping vs Funding: Which is Right for Your Startup

Do you want to try to seek capital for your business or bootstrap it? It’s a classic issue that every entrepreneur has been in. Many individuals have strong opinions about starting and running a business. Every business is unique, so no solution will apply to this subject. Raising money from external sources like investors or VCs is unavoidable for business. Accepting external investor finance can greatly affect how you build and operate your firm therefore, this is a key decision.

Bootstrapping and funding are two common approaches for starting a business, and the choice between two depends on many factors. If you are trying to decide between bootstrapping vs startup funding, this article will help you weigh your options.

Bootstrapping and startup funding

Bootstrapping means starting a business without bringing in any outside investors. In contrast, startup funding involves getting investors into your business. It is vital to understand the decision you will make regarding your business. Both have their own set of advantages and disadvantages, so it is important to consider circumstances carefully before making a decision.

So, let’s begin by understanding bootstrapped vs funded startups in detail.

What is Bootstrapping?

Bootstrapping refers to a business model in which the founder uses resources, loans from family and friends, or the company’s operational earnings to launch and fund its early stages.

“Bootstrapping” stems from the well-known phrase “to pull yourself up using your bootstraps”. If you go the self-funding route, you’ll have to rely on your funds (maybe supported by friends and family) and first sales to get your firm off the ground. Investing time and resources into growing your business can be a thrilling and terrifying adventure.

How does bootstrapping work?

If a founder has enough cash on hand to cover operational and capital expenses for at least a year as the firm grows, and if they anticipate making enough money to cover these costs, they might choose to bootstrap their business. A bootstrapped startup goes through the following phases:

- Beginning – Initially, you’ll need money saved or borrowed/invested from friends. The founder may, for instance, keep their day job and launch the firm simultaneously.

- Customer-funded – The process by which a company maintains operations and finances its expansion using funds provided by consumers or clients.

- The credit phase – The credit stage involves the entrepreneur paying for particular actions, such as recruiting people and updating equipment. During this phase, the company establishes its credit by seeking out loans or venture capital to fund its growth.

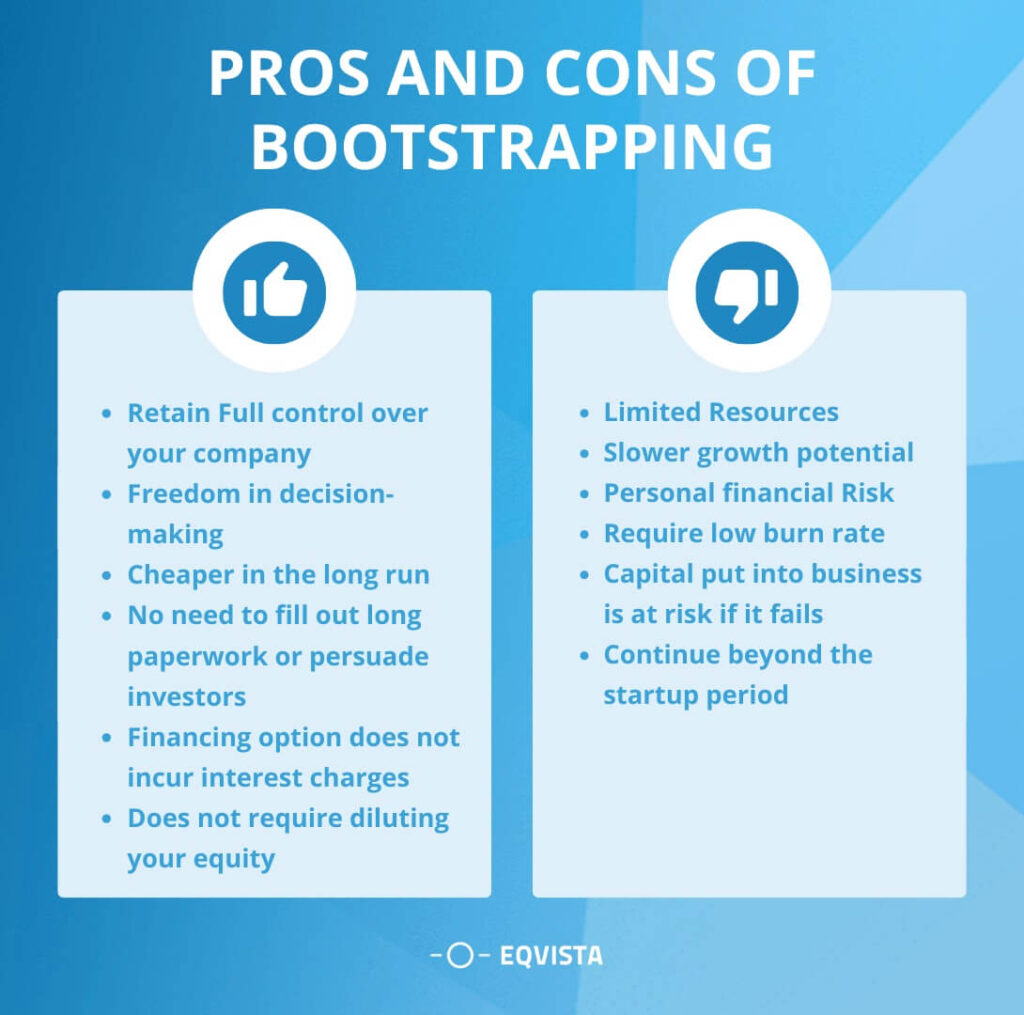

Pros and cons of bootstrapping

Bootstrapping companies seek investment to expand. Marketing, hiring, and product launches require funds. If your firm plans to develop and expand, you must educate yourself on finance. Let’s look at a few pros and cons of Bootstrapping.

Examples of bootstrapped startups

Despite its drawbacks, bootstrapping has been a feature of many successful company founders’ narratives. A large number of startups, including some well-known businesses, are self-funded. This number can reach as high as 80%. Here are two instances of successful businesses that did not rely on investors.

GitHub

GitHub was a bootstrapped startup in the past. Its current owner, Microsoft, valued it at $7.5 billion. The creators of the software development platform self-funded the business for four years before bringing in their first investor. While launching the firm, the founders worked day jobs, worked remotely on GitHub, and paid themselves little (but increasing) wages to support the initiative.GitHub has millions of user developers who can save code in nearly every programming language. The GitHub founders’ estimated net worths are billions.

Spanx

Sara Blakely, inventor of Spanx, is a famous bootstrapper who made her start with $5,000 in her savings. She saved a ton of money by doing everything herself, from creating the prototype and packaging to finishing the patent, rather than looking for investors.

As a result of her hard work, Blakely is now the only owner of Spanx, which has contributed to her net worth of $1 billion.

What is funding?

A company can utilize funding to launch or sustain a new venture. Funding comes in multiple forms. Startups utilize this capital to advertise, expand their firm, and run day-to-day operations.

Finding a traditional lender to partner with might further complicate the already difficult process of raising capital for a company. Financial institutions are picky about who they lend money to. So, they usually look for

- A solid credit score,

- A solid track record of revenue generation,

- A large cash reserve, and

- A high sales volume.

But if you’re looking for startup funding, there are many options besides banks and other conventional lenders.

Types of funding in startups

There is no shortage of legal and financial choices when financing a business. We have outlined a few distinct kinds and how they function below.

- Angel Investors: Angel investors make high-yield investments in businesses. These people usually have a lot of disposable income and aren’t afraid to use it in risky businesses.

- Crowdfunding: Crowdfunding sites have transformed the finance environment for startups. Through this, you may reach a worldwide audience with your company’s idea and supporting details and collect funds from various sources.

- Close Friends and Family: A “friends and family” loan might be an option if you know people willing to lend you money for your business. You should present a detailed payback plan and make a compelling argument for your company because asking for money is never easy.

- Grants & Loans: Grants, which are effectively free funds, can help you start, run, and grow your business. Startup grants are accessible through the application process and do not require repayment.Borrowing money is a long-term commitment, unlike grants. You can get startup loans from financial institutions like banks. You’ll need a well-written business plan, but the specifics may vary depending on the lender.

- Venture capitalists: Initial investors known as venture capitalists (VCs) stand to gain from the success of new businesses. They usually apply to be co-founders or serve on the board of directors. You need to show that your firm can develop over the long run to attract venture capital investments.

Pros and cons of startup funding

To understand the better option between bootstrapping vs startup funding, you must weigh their pros and cons. Let’s discuss why and why not startup funding is a good option.

Example of successfully funded startups

Here are a few startups that raised enough startup funding through external finance.

Uber

Uber’s ride-hailing network is a model of a firm that has achieved financial success. Travis Kalanick and Garrett Camp founded Uber in 2009 to revolutionize taxi service. But it didn’t happen suddenly.

Various sources contributed to Uber’s first funding, including angel investors, VC firms, and strategic alliances. Using their enormous networks and proposing their innovative idea, the founders raised $1.5 million. As Uber grew and showed its scalability, investment rounds increased.

Warby Parker

Warby Parker, a 2010 direct-to-consumer eyeglasses firm, is a notable startup that raised funds while revolutionizing an industry. With a focus on creating a good social effect, the firm set out to offer fashionable eyeglasses at reasonable prices.

Warby Parker’s crowdfunding effort collected $2,500, confirming the idea and demonstrating community engagement. With this seed money, the company’s founders were able to design and market their first line of frames.

Bootstrapping vs Startup Funding- Key Differences

Here are the ultimate differences between bootstrapped vs funded startups.

| Aspect | Bootstrapping | Startup Funding |

|---|---|---|

| Source of Capital | Self-funding; reliance on personal savings or revenue | External funding from investors, venture capitalists, etc. |

| Speed of Growth | Typically slower growth due to limited resources | Potential for rapid growth with access to significant capital |

| Risk and Debt | Lower risk, no debt incurred | Higher risk due to financial obligations and potential debt |

| Flexibility and Adaptability | Greater flexibility in decision-making and strategy | May face constraints due to investor expectations and agreements |

| Ownership Stake | Sole ownership or shared among co-founders | Investors often acquire equity stakes in exchange for funding |

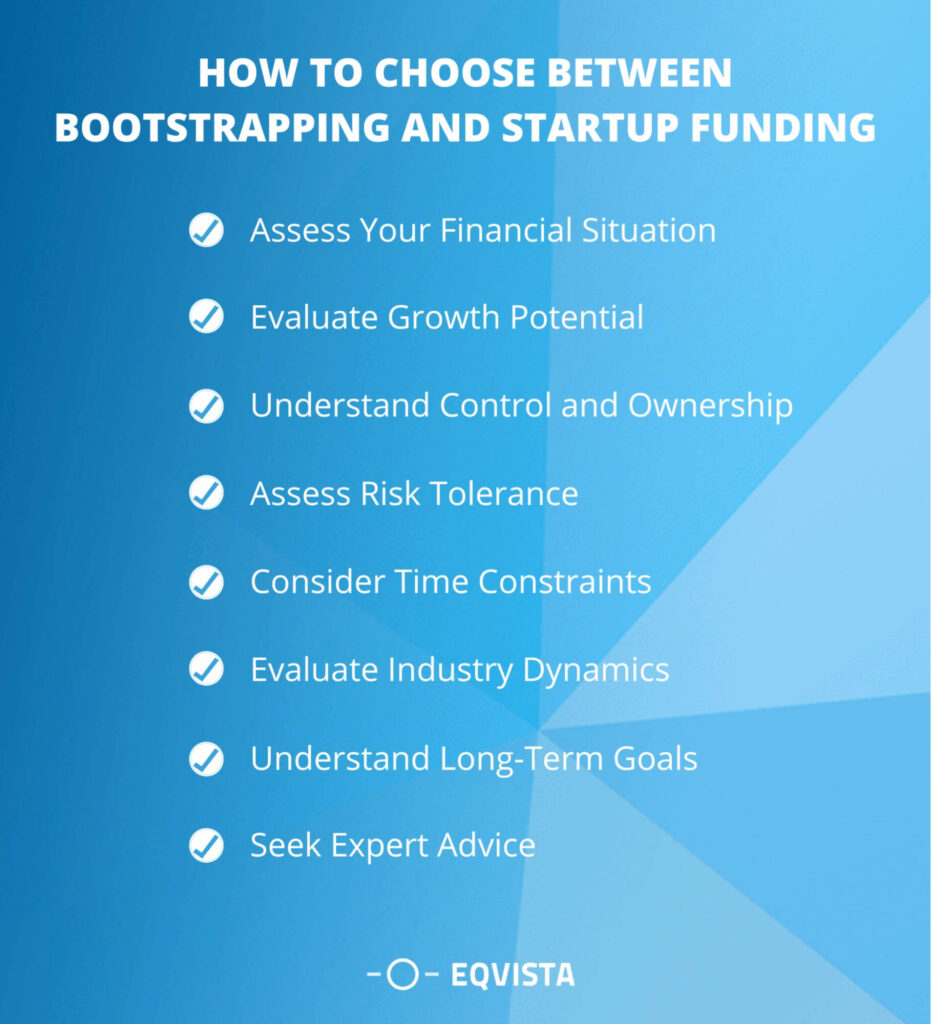

How to choose between bootstrapping and startup funding?

Consider these points when you weigh the pros and downsides of bootstrapping vs startup funding investment for your business:

- Assess Your Financial Situation: Set a plan to understand your situation. What are your savings? What’s your ideal amount to reach your business goals? This evaluation will help you get where you want to be.

- Evaluate Growth Potential: The next step is to identify the specific type of development you seek. Because of the obvious constraints imposed by operating with little capital, the expansion rate will be slower while bootstrapping a business. However, with venture capital , you may expand and acquire momentum far faster.

- Understand Control and Ownership: Next, if you want to know what else bootstrapping a business offers regarding owner control and independence, it’s much more flexible. No one will interrogate you if you delay or accelerate a project, objective, or milestone. However, deadlines become more regulated and strict if you have funding, leaving little space for impromptu adjustments.

- Assess Risk Tolerance: How well can you handle risks? Consider this before setting up your strategy. If you want to take the funding route, prepare to deal with more risks.

- Consider Time Constraints: Bootstrapping may need more time and flexible deadlines to reach your goal. But startup funding will allow you to get there quickly. It also means you can scale your business to expand quickly.

- Evaluate Industry Dynamics: This process requires thorough research on how your industry works, who your competitors are, and your scaling potential. Then, assess which form of capital will help you realize your business potential.

- Understand Long-Term Goals: Consider if you intend to stay in business for a long time or plan to leave your firm in the next several years. Bootstrapping is a great fit if the former is your goal; seeking venture capital to accelerate scaling might be better if the latter is your objective, as most VCs invest with an eye on exiting within three to ten years.

- Seek Expert Advice: Bootstrapping vs startup funding requires a thorough financial analysis. Find mentors, finance experts, or legal authorities to assess your situation. They can conclude your ideal method.

Funding vs Bootstrapping: We help to decide which Is Right for Your Business?

A one-size-fits-all approach to funding does not exist. However, alternate startup funding approaches are essential for many firms. A little loan could get certain businesses off the ground, while others might require large sums of venture capital.

To choose the best source and fully understand the repercussions, startups require an accurate valuation. If you or your company require 409A valuation solutions, Eqvista is happy to assist. We have experience valuing businesses across many different sectors. Our expert staff will utilize time-tested procedures and state-of-the-art research to calculate your company’s value. Would you like assistance? Contact us immediately!