Current Ratio by Industry (2025)

Industries have evolved distinct liquidity patterns in the financial ecosystem based on their unique operational demands, cash conversion cycles, and market pressures. A manufacturer stockpiling inventory will present a different financial profile than a subscription-based software company, though both might be equally robust.

Whether you’re an investor seeking stability, or a manager gauging liquidity, understanding the current ratio can illuminate the path to informed financial decisions in a landscape where liquidity can mean the difference between opportunity and crisis.

What is the Current Ratio By Industry?

The current ratio by industry refers to the typical or average current ratio values that are observed within specific business sectors. This financial metric varies significantly across different industries due to their inherent operational and financial characteristics.

It can be found out by dividing a company’s current assets by its current liabilities. It measures a company’s ability to pay short-term obligations within one year.

Industry Grouping Analysis With Current Ratio By Industries

Companies should compare their current ratios primarily within their own industry rather than across sectors. Industries with lower current ratios may need more sophisticated cash management strategies. Extremely high current ratios might indicate inefficient use of capital that could be better deployed for growth.

Industries with low current ratios represent the competitive advantage of favorable supplier credit terms. Financial services’ high ratios show how regulations can impact financial metrics. The wide variation in current industry ratios underscores that optimal working capital management is highly context-dependent.

Check out our most recent data on Current Ratio By Industry in the table below.

| Industry | AVERAGE of Current ratios - March, 2025 |

|---|---|

| Advertising/Marketing services | 3.64 |

| Aerospace & defense | 2.78 |

| Agricultural commodities/Milling | 6.97 |

| Air freight/Couriers | 1.77 |

| Airlines | 2.53 |

| Alternative power generation | 1.76 |

| Aluminum | 1.94 |

| Apparel/Footwear | 6.30 |

| Apparel/Footwear retail | 1.60 |

| Auto parts: OEM | 2.25 |

| Automotive aftermarket | 2.46 |

| Beverages: alcoholic | 2.31 |

| Beverages: non-alcoholic | 1.80 |

| Biotechnology | 8.07 |

| Broadcasting | 2.15 |

| Building products | 2.10 |

| Cable/Satellite TV | 1.45 |

| Casinos/Gaming | 1.36 |

| Catalog/Specialty distribution | 1.57 |

| Chemicals: agricultural | 4.57 |

| Chemicals: major diversified | 2.47 |

| Chemicals: specialty | 4.37 |

| Coal | 4.72 |

| Commercial printing/Forms | 2.65 |

| Computer communications | 3.17 |

| Computer peripherals | 2.43 |

| Computer processing hardware | 4.30 |

| Construction materials | 2.96 |

| Consumer sundries | 1.91 |

| Containers/Packaging | 1.56 |

| Contract drilling | 1.62 |

| Data processing services | 2.82 |

| Department stores | 1.57 |

| Discount stores | 1.11 |

| Drugstore chains | 2.14 |

| Electric utilities | 1.65 |

| Electrical products | 9.40 |

| Electronic components | 2.96 |

| Electronic equipment/Instruments | 3.68 |

| Electronic production equipment | 4.17 |

| Electronics distributors | 3.04 |

| Electronics/Appliance stores | 2.42 |

| Electronics/Appliances | 3.47 |

| Engineering & construction | 1.83 |

| Environmental services | 2.10 |

| Finance/Rental/Leasing | 3.71 |

| Financial conglomerates | 12.97 |

| Financial publishing/Services | 1.27 |

| Food distributors | 1.75 |

| Food retail | 1.21 |

| Food: major diversified | 2.92 |

| Food: meat/fish/dairy | 2.35 |

| Food: specialty/candy | 2.09 |

| Forest products | 8.35 |

| Gas distributors | 1.61 |

| Home furnishings | 2.28 |

| Home improvement chains | 2.09 |

| Homebuilding | 4.70 |

| Hospital/Nursing management | 1.94 |

| Hotels/Resorts/Cruise lines | 1.37 |

| Household/Personal care | 1.96 |

| Industrial conglomerates | 2.54 |

| Industrial machinery | 4.31 |

| Industrial specialties | 2.79 |

| Information technology services | 4.29 |

| Insurance brokers/Services | 10.41 |

| Integrated oil | 3.09 |

| Internet retail | 2.29 |

| Internet software/Services | 2.98 |

| Investment banks/Brokers | 18.74 |

| Investment managers | 6.28 |

| Investment trusts/Mutual funds | 29.95 |

| Life/Health insurance | 7.16 |

| Major banks | 17.06 |

| Major telecommunications | 1.32 |

| Managed health care | 3.05 |

| Marine shipping | 7.97 |

| Media conglomerates | 15.22 |

| Medical distributors | 1.76 |

| Medical specialties | 3.98 |

| Medical/Nursing services | 2.19 |

| Metal fabrication | 3.66 |

| Miscellaneous | 3.07 |

| Miscellaneous commercial services | 9.60 |

| Miscellaneous manufacturing | 2.45 |

| Motor vehicles | 2.31 |

| Movies/Entertainment | 2.79 |

| Multi-line insurance | 8.34 |

| Office equipment/Supplies | 1.91 |

| Oil & gas pipelines | 1.15 |

| Oil & gas production | 3.42 |

| Oil refining/Marketing | 1.42 |

| Oilfield services/Equipment | 2.38 |

| Other consumer services | 2.07 |

| Other consumer specialties | 4.38 |

| Other metals/Minerals | 13.15 |

| Other transportation | 1.93 |

| Packaged software | 7.32 |

| Personnel services | 2.11 |

| Pharmaceuticals: generic | 6.17 |

| Pharmaceuticals: major | 6.37 |

| Pharmaceuticals: other | 5.29 |

| Precious metals | 12.10 |

| Property/Casualty insurance | 4.54 |

| Publishing: books/magazines | 2.81 |

| Publishing: newspapers | 5.63 |

| Pulp & paper | 1.83 |

| Railroads | 1.21 |

| Real estate development | 2.74 |

| Real estate investment trusts | 1.68 |

| Recreational products | 2.83 |

| Regional banks | 14.53 |

| Restaurants | 5.90 |

| Savings banks | 13.70 |

| Semiconductors | 5.26 |

| Services to the health industry | 2.85 |

| Specialty insurance | 3.27 |

| Specialty stores | 2.30 |

| Specialty telecommunications | 3.23 |

| Steel | 3.43 |

| Telecommunications equipment | 3.28 |

| Textiles | 2.40 |

| Tobacco | 2.08 |

| Tools & hardware | 3.28 |

| Trucking | 1.38 |

| Trucks/Construction/Farm machinery | 2.34 |

| Water utilities | 1.72 |

| Wholesale distributors | 2.32 |

| Wireless telecommunications | 1.52 |

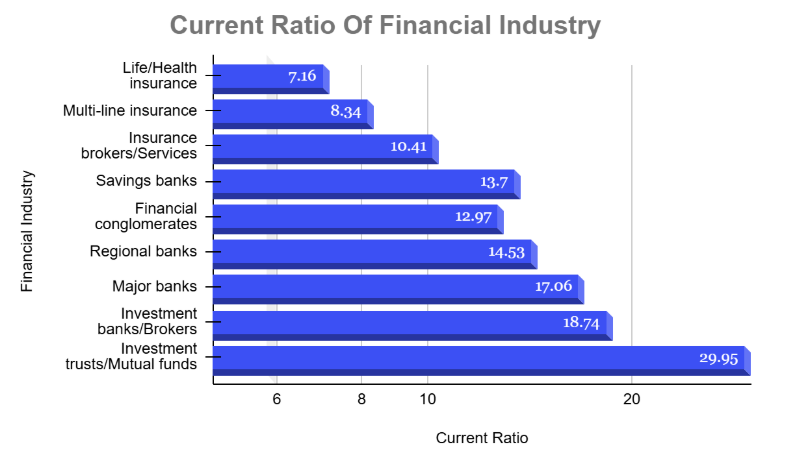

Financial Services

The financial services sector shows remarkably high current ratios compared to other industries:

Key Insight: The exceptionally high current ratios in financial services reflect their business model of maintaining liquid assets to meet regulatory requirements and customer withdrawals. This is not necessarily “better” than lower ratios in other industries, but rather a function of their unique operational requirements.

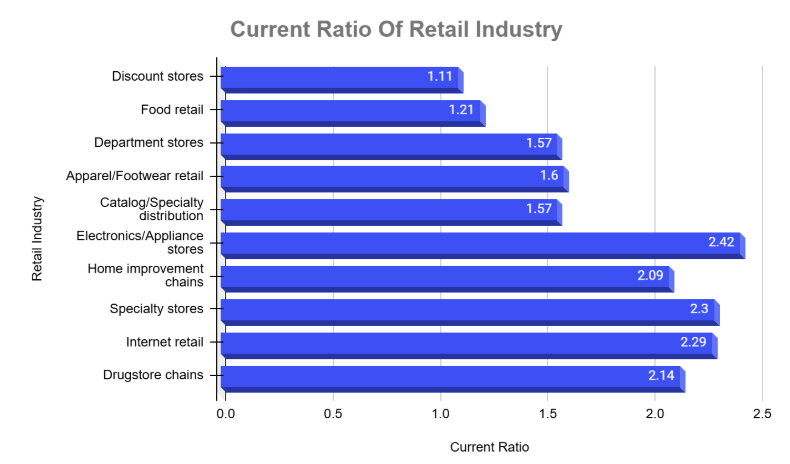

Retail Sector

Retail businesses operate with relatively low current ratios due to their business model of quick inventory turnover:

Key Insight: Retail’s low current ratios reflect an optimized supply chain that minimizes inventory holding while maximizing supplier credit terms.

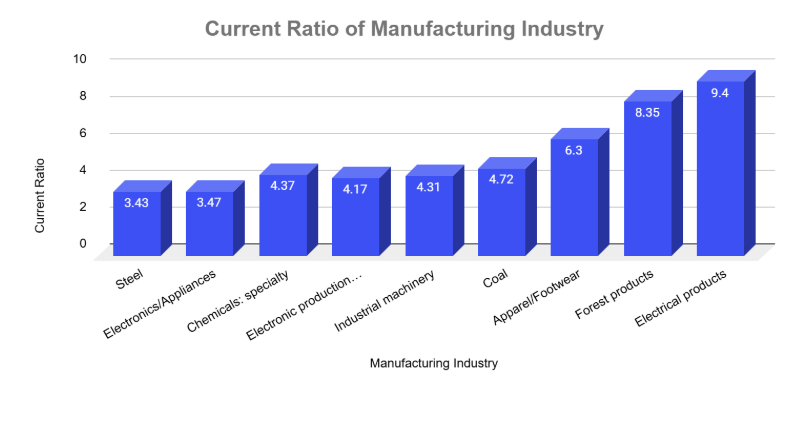

Manufacturing

Manufacturing shows significant variation in current ratios:

Key Insight: Higher value-added manufacturing with longer production cycles tends to maintain higher current ratios, while commodity-like manufacturing operates with lower ratios.

Healthcare

The healthcare sector shows interesting patterns:

Key Insight: Research-intensive healthcare companies maintain higher current ratios to fund long R&D cycles, while service-oriented healthcare businesses operate with lower ratios.

Utilities and Infrastructure

Consistently low current ratios characterize utilities and infrastructure:

Key Insight: These industries feature stable, predictable cash flows and significant fixed assets, allowing them to operate safely with lower current ratios.

How can a company Improve its Current Ratio?

A company can improve its current ratio, which measures its ability to pay short-term liabilities with short-term assets, through several strategies.Increasing current assets can be achieved by enhancing receivables collection and early payment discounts.

Reducing current liabilities involves extending payment terms with suppliers, restructuring short-term debt into long-term liabilities, and controlling unnecessary expenses. Effective asset management includes selling unused assets to reduce debt and using financial software for real-time insights.

Additionally, companies can delay capital purchases, re-amortize term loans, and consider obtaining a line of credit to cover cash flow gaps. By regularly monitoring the current ratio and maintaining sustainable financial practices, businesses can enhance their short-term financial health and become more attractive to investors and creditors.

Maximize your business’s potential with Eqvista’s complete range of financial solutions.

The current ratio is a fundamental financial metric that provides valuable insights into a company. However, its interpretation varies significantly across industries due to differences in operational and financial structures. These variations highlight the importance of benchmarking against industry standards for accurate financial analysis.

Consider using Eqvista’s comprehensive financial tools and services to better understand your company’s financial health and compare it with industry benchmarks. Get started with Eqvista and take your business to the next level!