Secondary Transactions – Converting Notes Into Shares Using Valuation Method

One of the most significant transactions an investor may make in a company is the conversion of notes into company shares.

Here are the steps to follow:

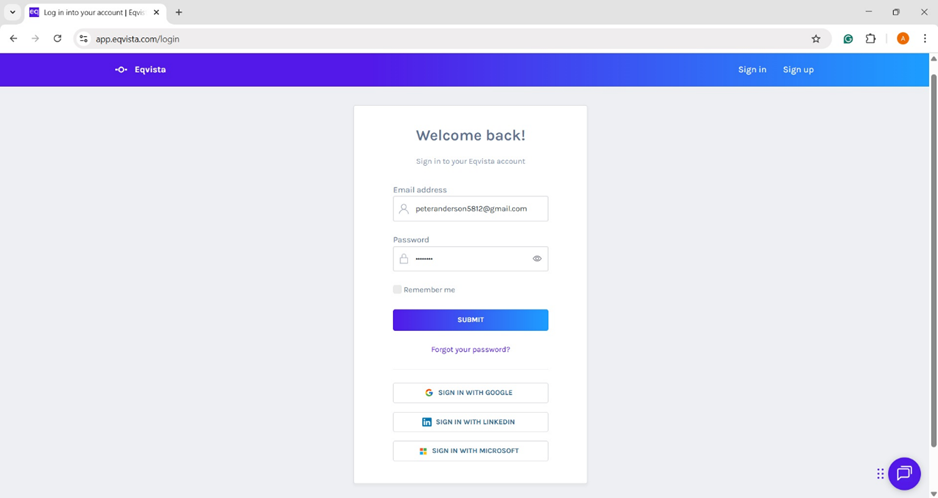

Step 1: Log into your Eqvista account and select your company account.

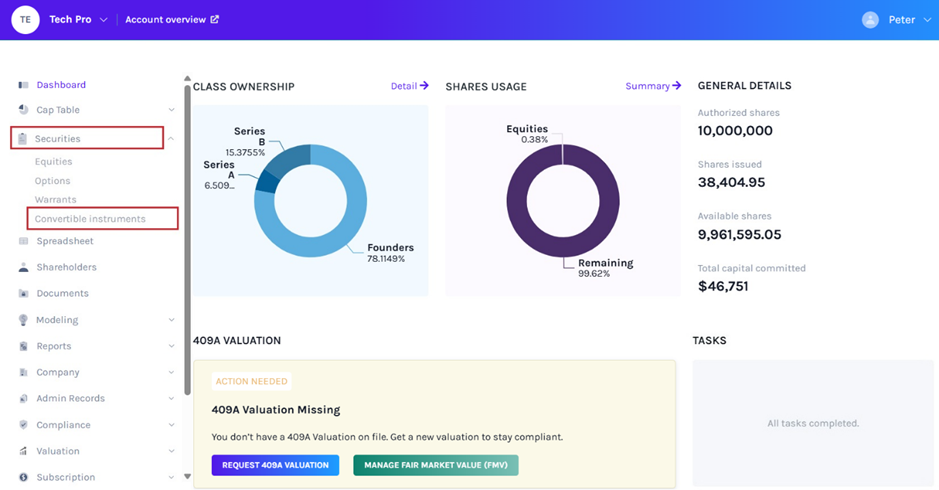

On the dashboard, click “Securities” from the left-hand side and then “Convertible Instruments”.

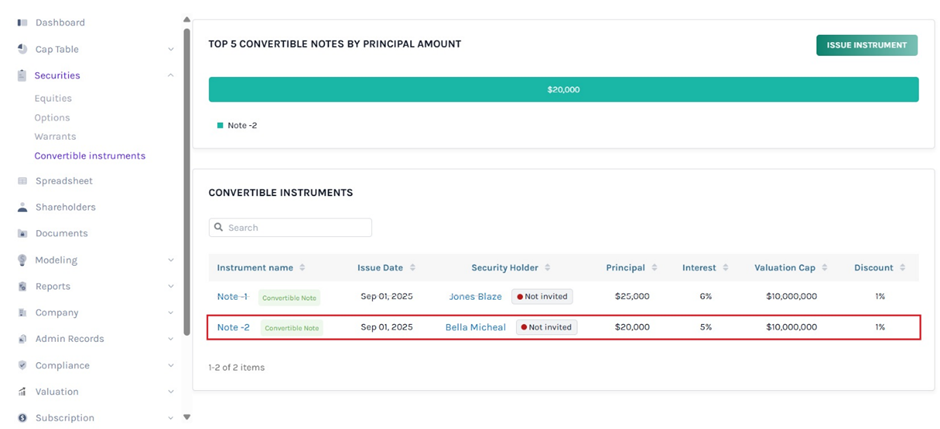

Step 2: Then, you will be directed to the below page and click “Note 2”.

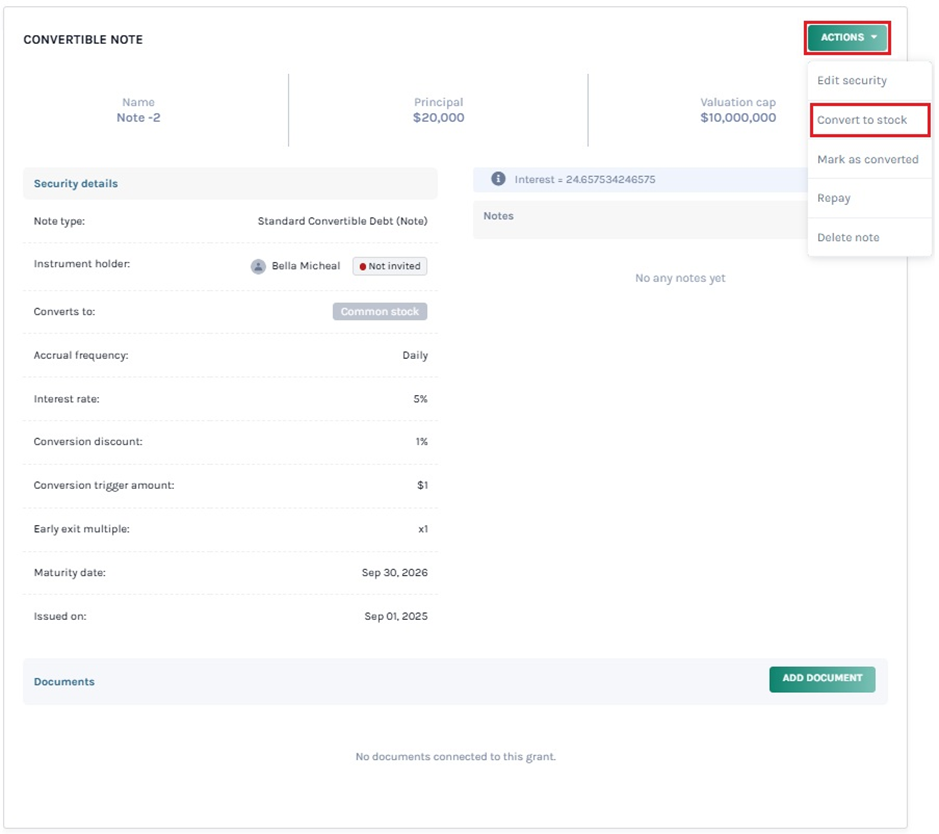

Step 3: Here, you will be able to see the details of “Note 2” and click on “Actions” on the top right-hand side to get the drop-down menu. Then, click on “Convert to Stock”.

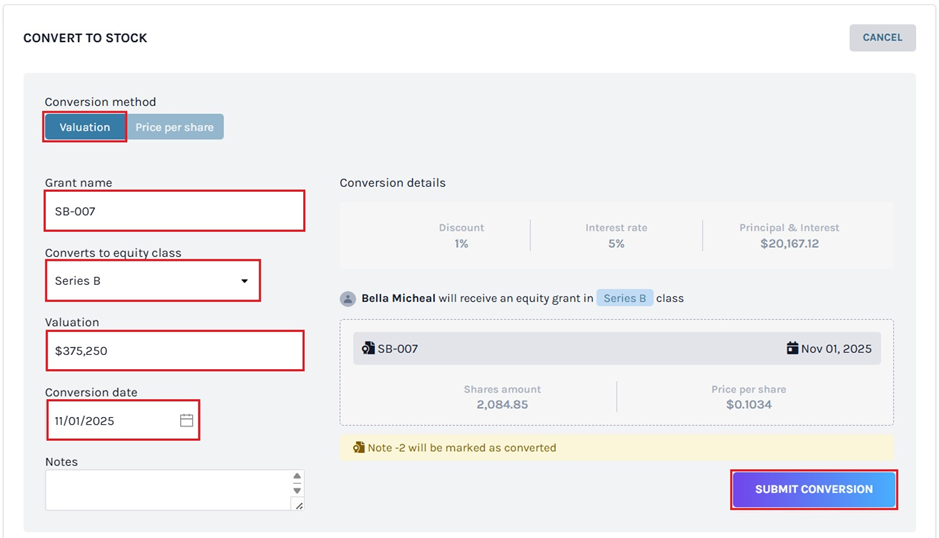

Step 4: By doing this, a new window will appear. The first step is deciding whether it will be Valuation or Price per share.

Note: You can also convert to stock using the price per share method by clicking “Price per share”. To learn how to convert to stock using price per share, check out the support article!

In this case, we selected the option “Valuation”. You will need to fill in the details such as the new share name, the security class to convert to, and the valuation along with notes, if needed.

Then, the conversion date will be automatically filled. If the date is not today, then you can edit that as well. As you edit the details, the right-side panel gets updated.

Note: You can see the shares amount after the conversion and the price per share based on the convertible instrument plan.

Once done, you can click on “Submit Conversion”.

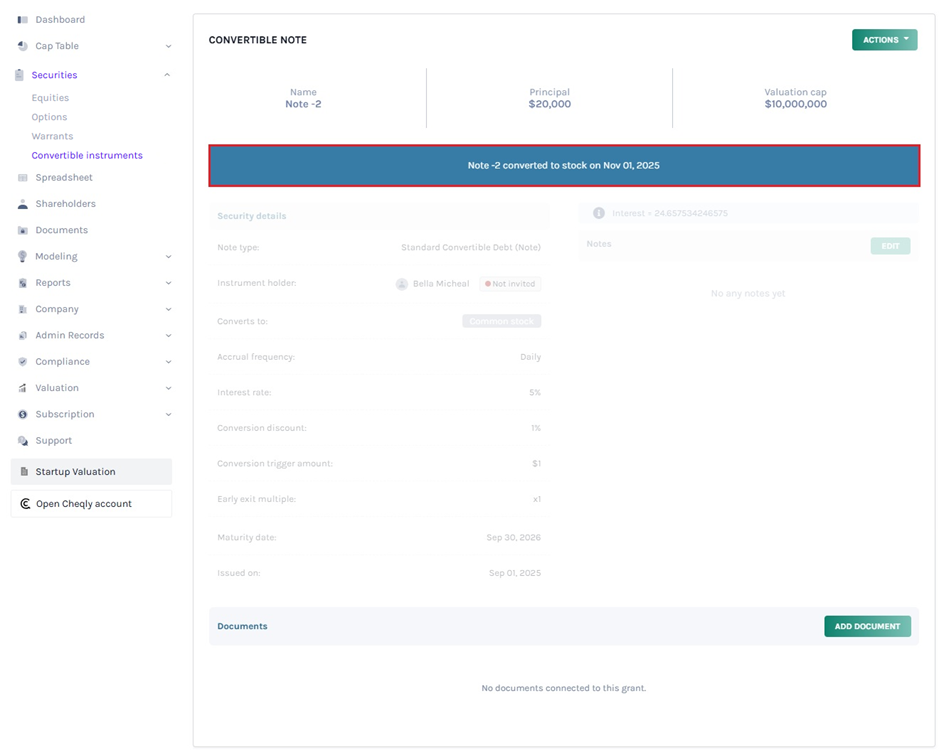

Step 5: Then, you will be redirected to the page where you can see the note is converted to stock.

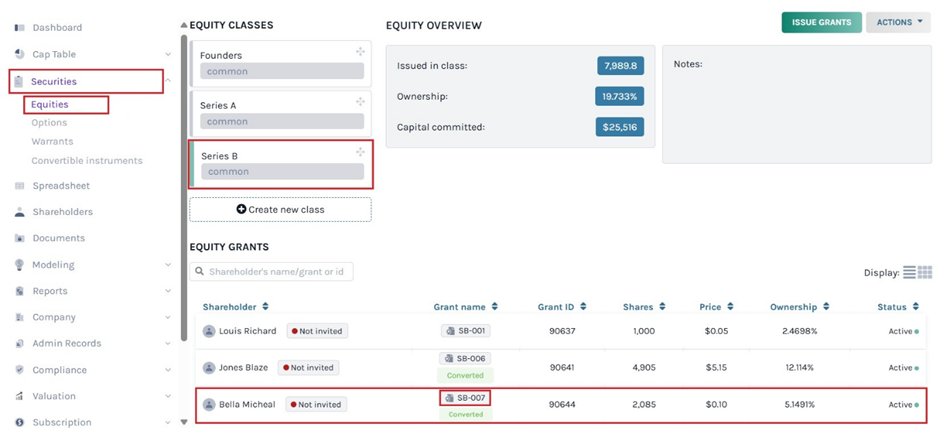

Step 6: If you want to see the new grant details, click on “Securities” and then on “Equities”. Once you get here, click on the “Series B” equity class since the shares were converted to this class.

For more details on the conversion, click on the grant name “SB-007”.

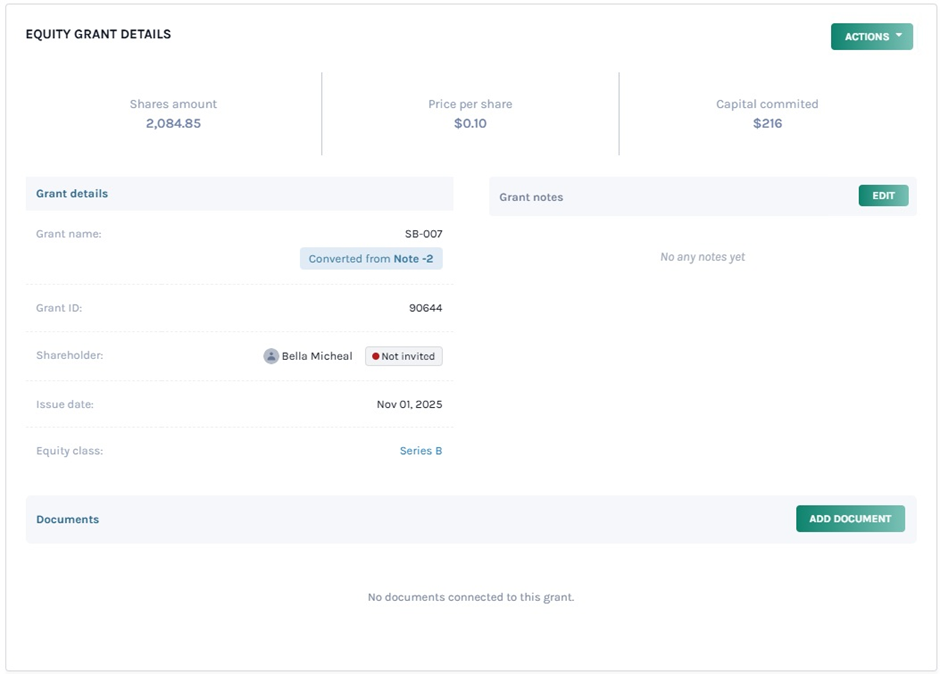

Step 7: When you click, you will be redirected to the page where you can see the details of this conversion.

Note: You can add document to the grant by clicking on “Add Document”. Check out the support article to know more about adding documents to grants.

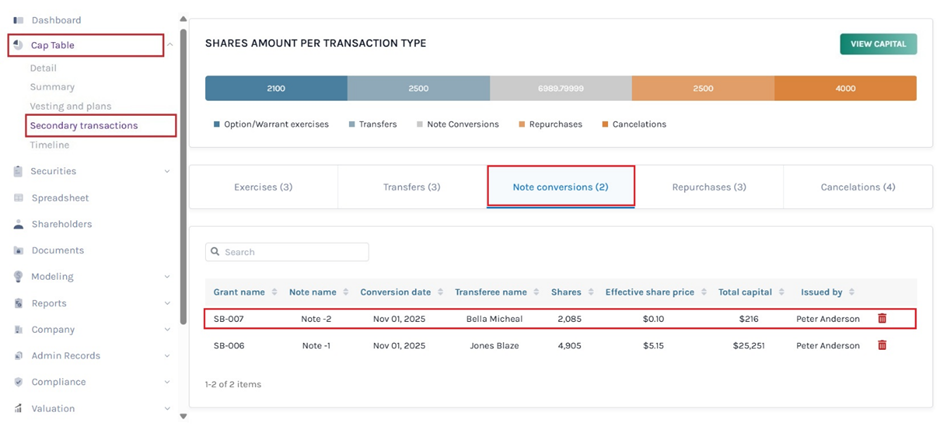

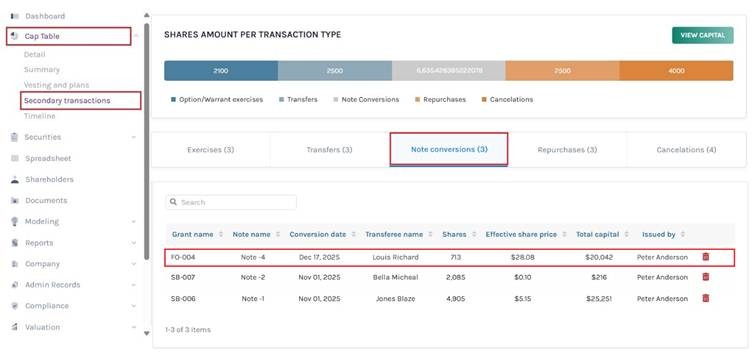

Step 8: The record of the transferred grant can be seen by clicking “Cap Table” on the left-hand side to get a drop-down menu. Then, click on “Secondary Transactions” and you will see all the transactions – Exercises, Transfers, Note conversions, Repurchases, and Cancellations.

On this page, click on “Conversions” to check if the note is converted.

CONVERSION USING SPREADSHEET

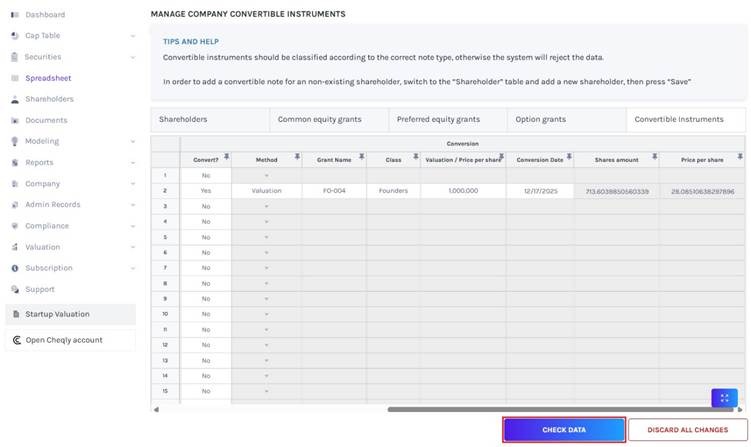

Step 9: Suppose you want to perform conversion using the spreadsheet feature. At the top of the table, click on “Convertible Instruments”. Under the Conversion section, the first one is “Conversion” which provides two options: “Yes” or “No”. Once you select the option, choose the “Method” from the drop-down menu.

In this case, select “Valuation” method, enter the grant name, class, valuation, and conversion date. Based on the valuation entered, the share amount and price per share will be automatically displayed as shown below.

After adding the details, click on “Check Data”. If you want to cancel the process, click “Discard all Changes”.

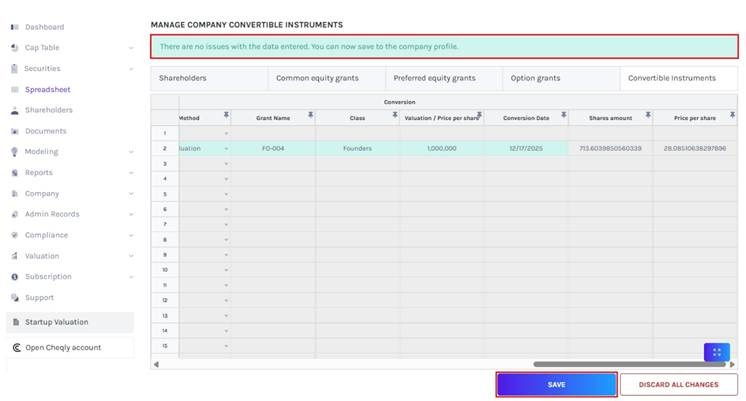

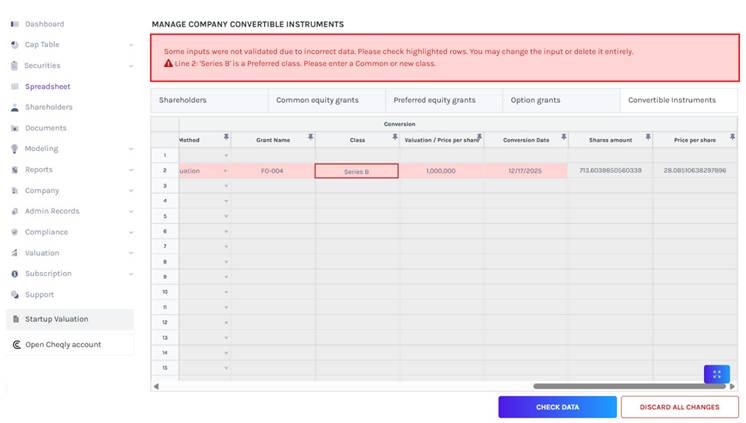

Step 10: Once your details have been checked, a data validation message will appear: either the entered details are correct and you can save them, or some information may be missing or incorrect.

When there are some issues or missing information, the validation message will appear in “Red” along with the details of the issue.

Once the details have been checked, click on “Save”.

Step 11: The record of the conversion can be seen by clicking “Cap Table” on the left side to get a drop-down menu and selecting “Secondary Transactions”. On this page, click on “Conversions” to verify if the grant is converted.

If you want to further understand how to use the Eqvista application, check out our support articles or contact us today!