How To Create An ASC 718 Report?

Have you calculated your company’s stock option expenses?

As a part of employee compensation, many companies offer stock options to their employees. The stock option offers employees the right to buy and sell shares from the company’s stock at a specific price. Check out our support article on how to issue options on Eqvista.

The new ASC 718 generates a Stock Option Expense report calculating the total expense from the company’s stock options.

Note: the ASC 718 feature is only available for premium account holders. Kindly upgrade your account to unlock this feature.

Here are the steps to follow:

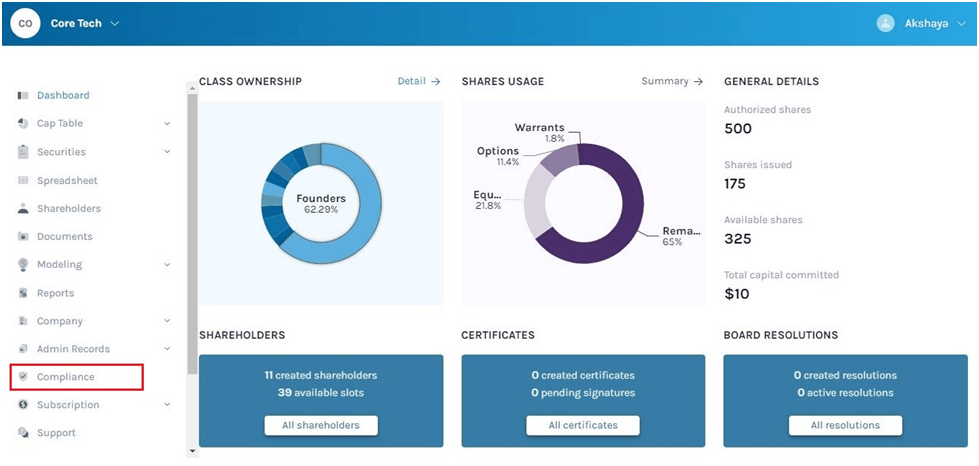

Step 1: Log into your Eqvista account and select the company account to generate the ASC 718 report.

From the dashboard, click on “Compliance” on the left-hand side of the menu.

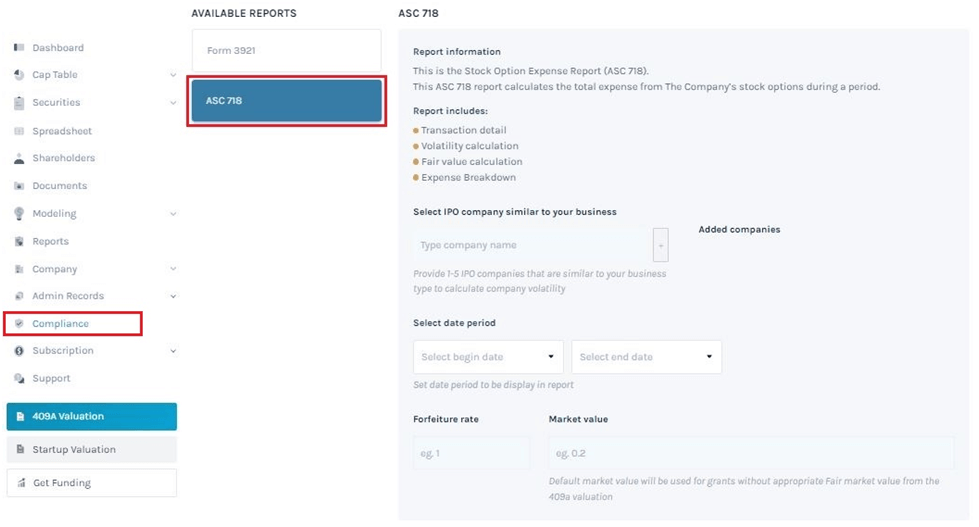

Step 2: Here you will see all the reports available. Click on “ASC 718” to create a report on total expenses from the company’s stock options.

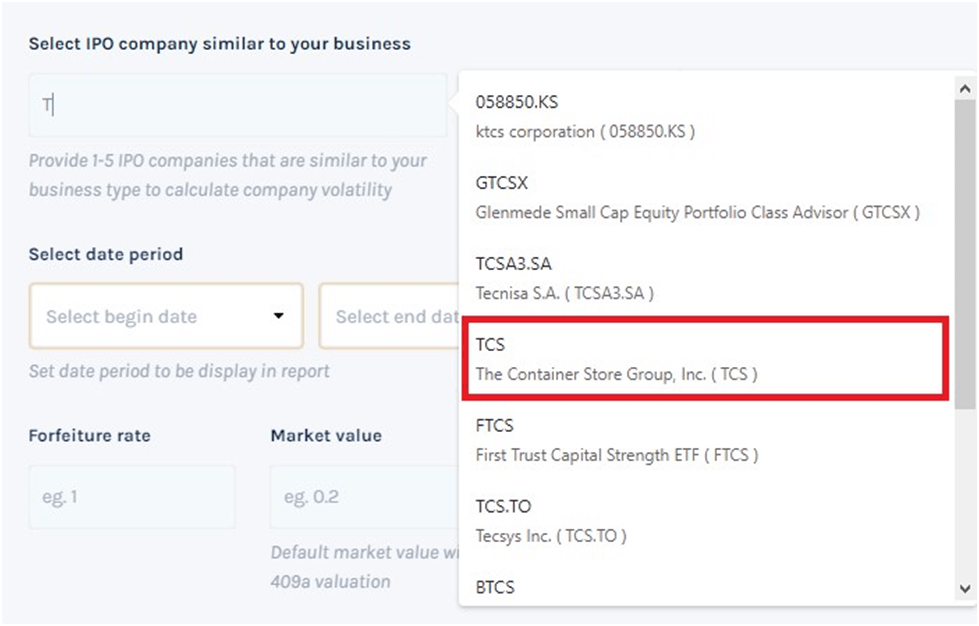

Step 3: Once you do this, you can begin the process of creating a report. You begin by selecting a Public company similar to your business. The API is connected to stock markets around the world. Check out our support article to learn how to search for public companies in ASC 718 report.

In this case, we are going to type the first few letters of the company’s name in the space provided.

After selecting the company name, click “+” to add the company name as shown below.

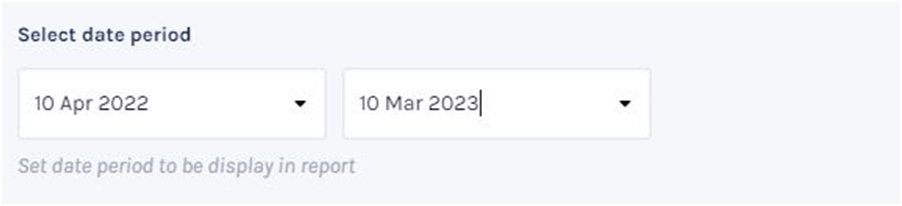

Step 4: Next, select the date period for your company’s expense report. The most common for this is either a calendar year (ie. January 1st to December 31st) or another period if your fiscal year is different (ie. April to March).

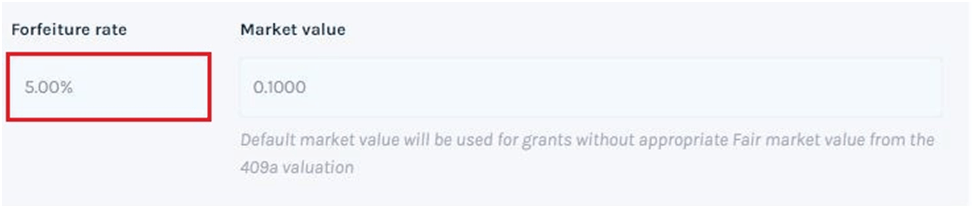

Step 5: After filling in the date, enter the forfeiture rate.

The forfeiture rate is a percentage of stock options that are expected to be forfeited or canceled before they vest and become exercisable. The rate is forfeited shares divided by the granted shares to show the percentage of shares forfeited.

If you have no history or previous data, then an acceptable rate is usually 5% or 10%.

Step 6: Finally, enter the fair market value.

Note: If you do not enter fair market value from 409a valuation, default market value will be used for grants.

After filling in the details, click “Create Report“.

The report gets downloaded and can be viewed in the Excel sheet. Check out our support guide to understand the details of the downloaded form.

For more information on Eqvista’s processes, check out our support articles or contact us today!