Expense Breakdown Of ASC 718 Report

The section under ASC 718 summarizes the entire expense associated with stock-based compensation. The total expense of the stock options is calculated together with the deferred tax asset during the period.

Note: the ASC 718 feature is only available for premium account holders. Kindly upgrade your account to unlock this feature.

To understand the downloaded ASC 718 report, you must first create a form. Check out our support guide to learn how to create an ASC 718 report on Eqvista.

Here are the steps to follow:

Step 1: Double-click the file to open the ASC 718 report in Excel format that was downloaded. At the bottom of the page, you will see the different sections of the report. Here, click the tab “Expense Breakdown”.

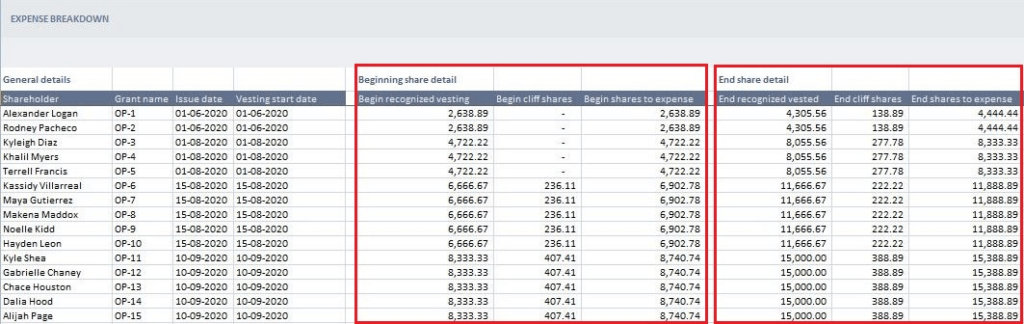

Step 2: The step calculates the total amount of options vested throughout the period, subtracting any cliff shares awarded by not vested during the period, then adding any cliff shares in between the vesting period and the end report date.

- Begin Recognized Vesting: The total amount of vested shares in the grant at the beginning of the period.

- Begin Cliff Shares: Time between end of last vesting period before beginning date and beginning date over shares in period times.

- Begin Share to Expense: Total of the Begin Recognized Vesting + Begin Cliff Shares

- End Recognized Vesting: The total amount of vested shares remaining in the grant at the end of the period.

- End Cliff Shares: Time between end of last vesting period after ending date and ending date over shares in period times.

- End Share Expenses: Total of the End Share Expenses + End Cliff Shares

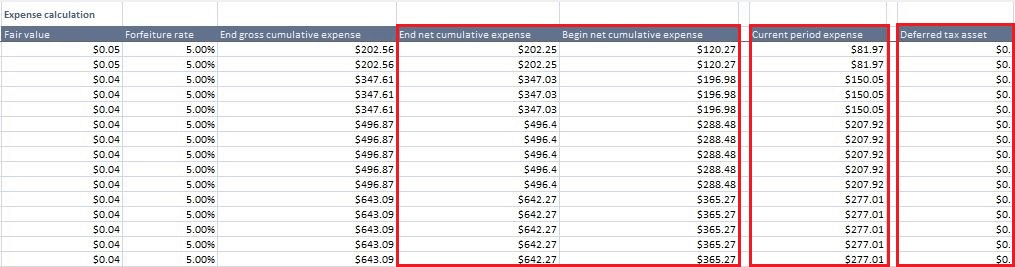

- Fair Value: Fair Value per grant

- Forfeiture Rate: Forfeiture Rate used per grant

- End Gross Cumulative Expensing: End Share Expenses * Fair Value per grant

- End Net Cumulative Expensing: End Gross Cumulative Expensing-(End Cliff Shares* Fair Value * Forfeiture Rate) per grant

- Begin Cumulative expensing: Begin Share to Expense* Fair Value per grant

- Current Period Expensing: End Net Cumulative Expensing- Begin Cumulative Expensing

Further to the section that was discussed above, the other 4 sections—Entries and Disclosures, Transaction Detail, Volatility calculation, and Fair value calculation.

If you want to know more about Eqvista, check out our support articles or contact us today!