What Is Included In An ASC 718 Report?

Many companies provide stock options as a part of employee compensation. In the form of a detailed report, the ASC 718 calculates the total expense related to the company’s stock options. Check out our support article on how to create a report on Eqvista.

Note: the ASC 718 feature is only available for premium account holders. Kindly upgrade your account to unlock this feature.

After filling in the details and creating the report, it is automatically downloaded in the form of an Excel sheet. The downloaded ASC 718 report includes:

- Entries and Disclosures

- Transaction Details

- Volatility Calculation

- Fair Value Calculation

- Expense Breakdown

Check out the below section to know in detail about the various sections included in the ASC 718 report.

UNDERSTANDING ASC 718 REPORT

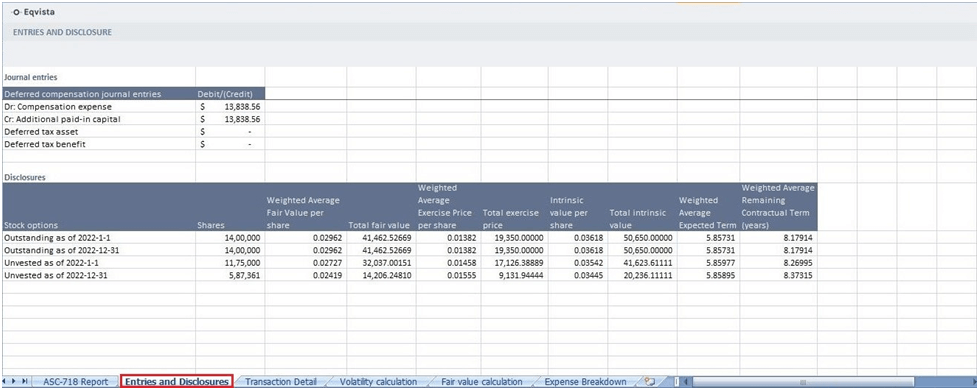

1. Entries and Disclosures

The section refers to the accounting entries and financial statement disclosures related to stock-based compensation. The purpose is to make specific accounting entries and provide detailed disclosures in the financial statements to communicate the impact of stock-based compensation.

The disclosures and entries of the company stock options issued and unvested during the period are mentioned in detail.

Check out the support article to understand entries and disclosures in detail.

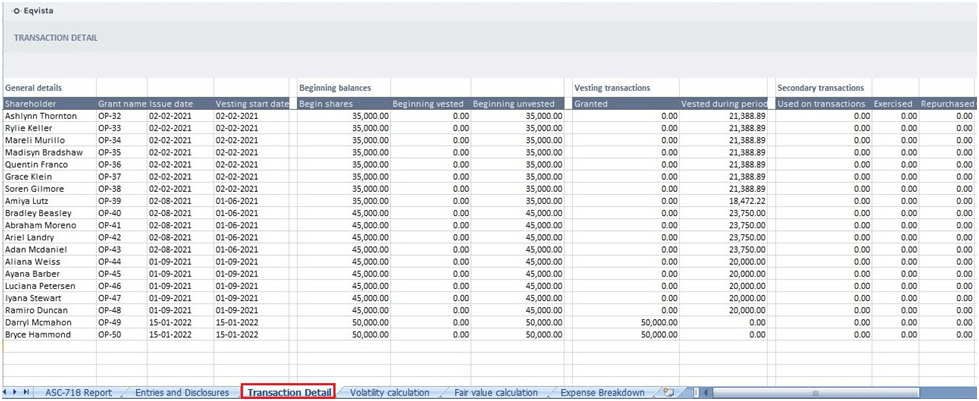

2. Transaction Detail

Typically refers to a section of the report that provides a detailed breakdown of stock-based compensation transactions and their impact on the company’s financial statements.

It provides an overview of the number of options issued during each period, how many options were vested throughout the period, and how many remained unvested at the end of the period which helps in understanding the expenses and calculating volatility.

To know more about transaction details, check out our support article.

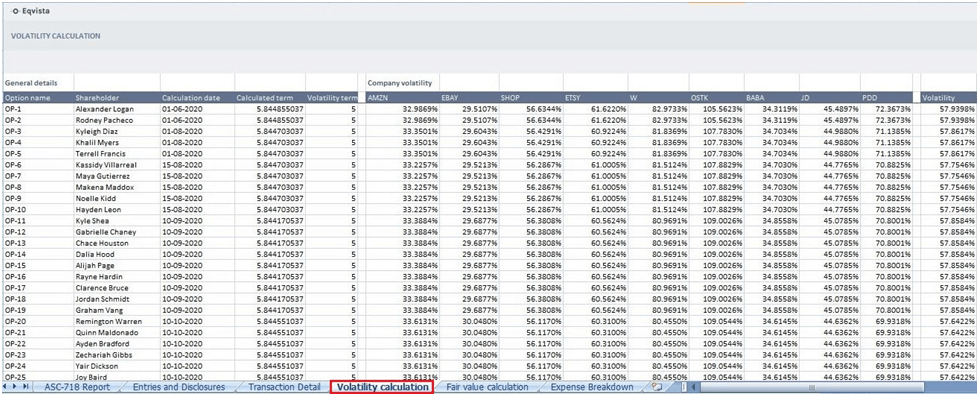

3. Volatility Calculation

The section provides volatility calculation and peer group comparison by comparing the volatility of stocks of similar companies.

The expected volatility of a company’s stock price is a measure of the variability or fluctuations in the stock’s price over a specific period. The volatility of similar companies is taken for comparison for fair market value calculation of the stock options issued over the period.

For a detailed understanding of volatility calculations, refer to our support article.

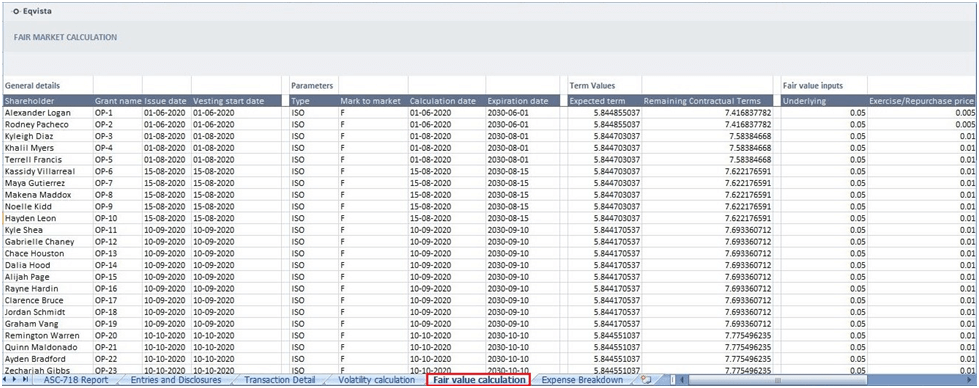

4. Fair Value Calculation

The section involves determining the fair value of stock-based compensation, such as stock options at the grant date. It is determined as of the grant date, which is the date when the stock options are issued or granted to employees or shareholders.

After determining the volatility, the Black Scholes pricing model is used to calculate the fair market value of the options and total expenses.

Check out the support article to learn how to calculate fair value for stock options.

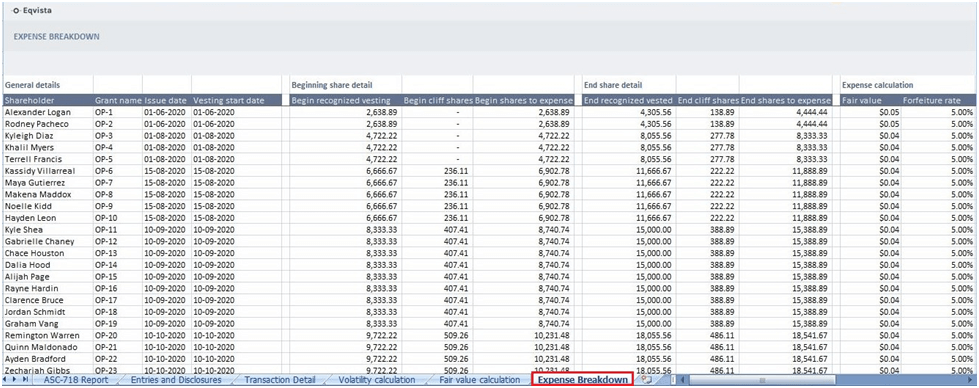

5. Expense Breakdown

The section will typically summarize the total expense associated with stock-based compensation. It provides a detailed breakdown of how expense associated with stock-based compensation is recognized and accounted for.

After calculating the fair market value of each stock option, the total expenses are calculated with the deferred tax asset during the period.

To know more about expense breakdown, check out our support article.

If you want to know about Eqvista’s other features, check out our support articles or get in touch with us today!