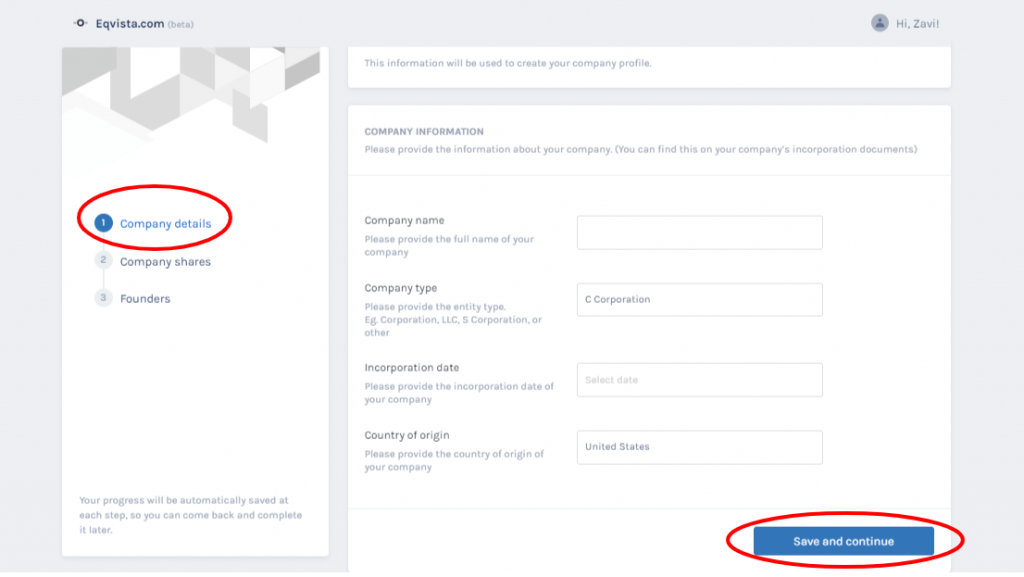

1. Milestone: Fill out company details

Onboarding

File out main information about you, company, authorized shares and Par Value (Initial Price Per Share). Invite your lawyer or simply manage it by yourself. You might also set up a board of directors.

- Client and Contact Information

- Company Information – C Corporation – You may usually set up your company as a C corporation if you plan on issuing shares to investors or employees. Delaware, Nevada California and Wyoming are usually places where people set up their Start-ups. However, we support all states. We will also need the Incorporation date.

- Authorized Shares

What are the authorized or issued shares?

They are the number of Authorized Shares that will be available for issuance. Consider how many shares will be granted to founders and early members of the team. It’s important to note that any subsequent changes to this number will require a filing with the State where your company is incorporated and will also need Shareholders and Directors’ Board approvals. Reserve shares might be considered as semi-authorized as they represent shares which are going to be used, issued or vested in the future therefore you are not able to use them once you book them for future issuance.

- Unissued Shares are calculated as the difference between total authorized shares minus total issued shares. That is, the total number of shares that are authorized to issue, but have not yet been issued to shareholders.

- Fully diluted shares: This refers to all types of shares in our case, common and preferred and issued with options (or warrants, SAFE, KISS, convertible note) as if they have been converted to common stock. It expresses actual ownership in a particular moment under the given conditions.

How do I estimate Par Value of Stocks/Price per Share?

Par value is the minimum price per share that the shares must be issued. Par value is usually set at $0.0001 or $0.00001 (Price per Share (PPS) as stated in the Articles of Association or Articles of Incorporation. Par value is usually set before you start your company so you can inform your incorporator of how much the share price is. If you are issuing shares to founders, investors or employees in later stage, make sure that you authorize shares with the actual price per share. As your company matures, your company PPS can change to reflect market value. You will need 409a valuation to estimate the Market Value. If you already have a 409a, you need to input the value per share as this is your latest price per share.

The FMV is usually set by three options:

- Approved by the Board of Directors (this is usually determined in incorporation documents; many startups choice $0.0001 per share)

- 409a valuation (this is determined by your appraisal company, For a 409A reports, a file of the report is required.)

- Other

If you don’t have a 409A valuation yet, you can use Par Value as “Board determined” FMV and correct values at a later date. This allows exercises without a 409A valuation. Again, the Par Value is just only for new companies.

How do I record my shares?

- Paper Share Certificate – this is an old fashioned record keeping when you issue a physical share certificate directly to the shareholder. He/she will own a paper certificate of your company shares (This is the most traditional way of issuing shares). You can use Eqvista to record all of the shares. You also have to manage the Paper Share Certificates.

- Digitally Signed Share Certificate – It is the same as Paper share certificate, the only difference is that the digital share certificate doesn’t have any physical form so you only use the pdf document or any digital form. The share certificate is signed in e.g. pdf. Document. (This is another option of issuing shares). Meanwhile, “Certificated” shares are recorded with a certificate (paper or electronic). They are hard to track and manage and can be lost or stolen. They are also difficult to audit and have a high probability of administration burden.

- Electronic share (Uncertificated Share) – These shares are issued without a certificate to evidence of ownership. Prior to issuing any share, make sure that your Articles of Association (or by-laws) have allowed it or you can simply file a resolution of directors passing to effect a company change. Public companies have been using uncertificated shares for a very long time, the legality is well established in every state in the U.S. Please make sure that you consult with your lawyer on how you can switch from Paper Share Certificate to an Electronic Share one.

How do I record the Electronic Shares?

To switch from a traditional Certificate to an Electronic Share option you can use for this process:

- Spreadsheet – you can use an excel sheet to manage or issue your shares.

- Third party software – you can use any available capitalization table (cap table) software on the market

- Eqvista – You can equally use Eqvista. It is the cap table integrated system which helps you to minimize costs by using automation, accounting, sharing and compliance tools built into the system. It is all in a cloud-based equity management system so you can login from any device and share your cap table with any shareholder (investor, founder, employee or law firm).

How can I use Eqvista for recording the Electronic Shares?

Just invite your administrator and use their knowledge and experience. If you are wondering, “Why do I need an administrator?” it is because you may need help with your Cap table.

Can I start issuing shares by just using Eqvista?

If you have not issued any of the shares, you are ready to go and can start issuing shares on Eqvista. Eqvista can be your only source of issuing shares. If you have issued paper or digital shares already, you might want to switch but there are certain steps to follow. Please discuss this with your lawyer. You can read these guides to know more on how to Issue Shares on Eqvista.

Does Eqvista offer round modelling and exit analysis?

Yes, Eqvista provides these functions. Eqvista Round Modeling allows our users to view many different round models to see the effect on their share dilution in their cap table. You can learn more about our round modeling features here.

Do you offer employees and investors accessibility?

Yes, we do have different user rights for each company role. Employees can see their shares while Investors are able to see the whole cap table. You can also limit access for each investor.

Does Eqvista offer vesting plans for Employees?

Yes, we do offer vesting plans for Employees (Employees Stock Option Plan (ESO). You can also manually create customized plans for each employee. You can also reserve shares for the employees.