Did You Download Form 3921? Details To Know In It

Have you recently filed Form 3921? Then you might need to download the form.

Options given to employees and shareholders are exercised by them. Form 3921 is filed when options (ISO) issued are exercised by the shareholder. Check out our support guide to learn how to file Form 3921 on Eqvista.

Note: The company must file Form 3921 by the 31st of January.

UNDERSTANDING THE FORM 3921

After filling in the details, you can download the form. The downloaded Form 3921 has four copies namely A, B, C and D.

Here are the key components included in Form 3921:

- Employer and Employee Information: It includes details such as the name, address, and tax identification number (TIN) of the company providing the form (the employer), as well as the employee’s information, including their name, address and account number.

- Date of Grant: the date when the ISOs were granted to the employee.

- Date of Exercise: the date when the employee exercised their ISOs by purchasing the underlying stock.

- Exercise Price per Share: the price per share at which the employee was able to purchase the stock when exercising their ISOs.

- FMV per Share on Exercise Date: the fair market value of the company’s stock on the exercise date.

- Number of Shares Exercised: the number of shares of company stock that the employee purchased when exercising their ISOs.

- Additional Information: If other than the employer, then name, address, and TIN of the company whose stock is being transferred.

- For IRS, Employee, Company: the portion of the form intended for their respective records, providing them with the information they need on their tax return.

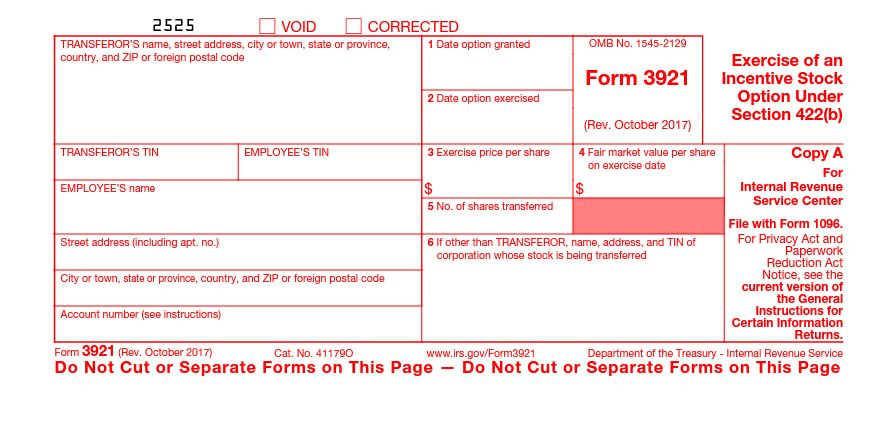

COPY A

A copy of Form 3921 must be sent to the Internal Revenue Service (IRS). You or your company will typically file this copy with the IRS. It is usually filed electronically as part of the employer’s annual return. It may be printed in red ink and is usually scannable for IRS processing.

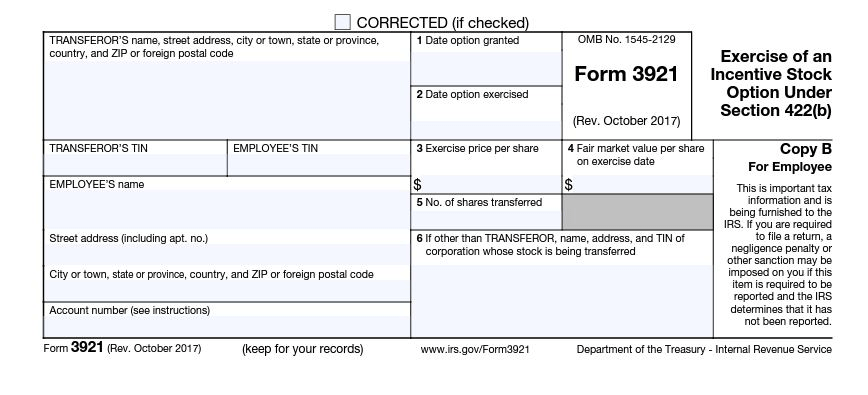

COPY B

The copy is provided to the exercising employee. It is for the employee to keep for their records and use when preparing their tax return.

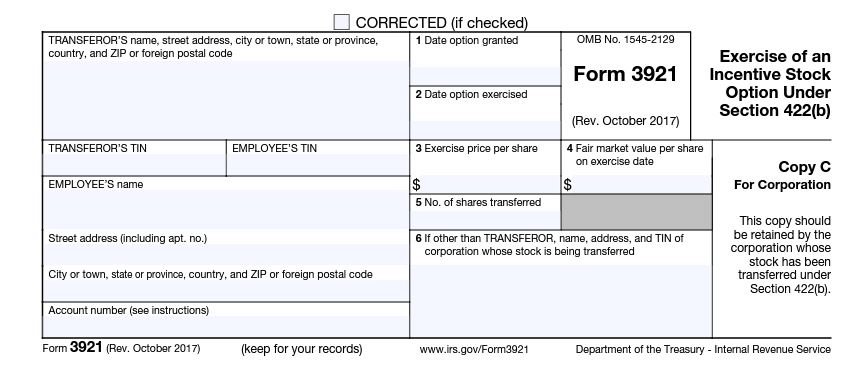

COPY C

The copy is for the company. It is labeled “For Corporation” and should be kept by the company whose stock has been transferred.

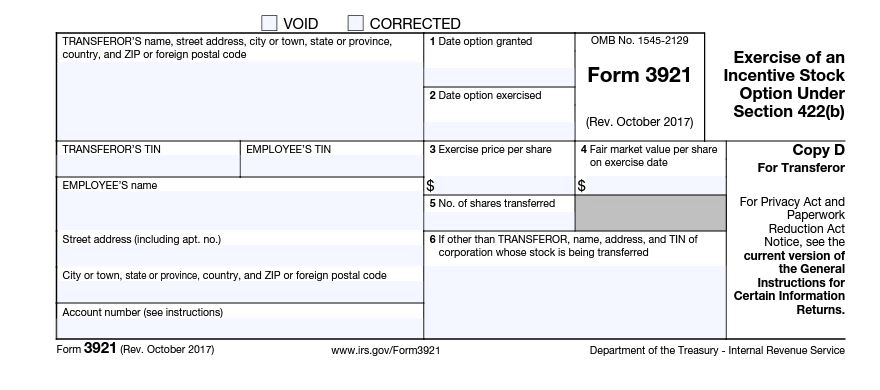

COPY D

The copy is for the transferor. It is typically retained by the company or issuer of the ISOs for their records.

For more information on Eqvista’s other features, check out our support articles and knowledge base. Get in touch with us right away to begin!