Taxes: ISO $100k limits, 83(b) election, Rule 3921, AMT Tax for ISO exercises, NSO tax withholdings for employees

For many years now, employee stock options have become a common way to attract and retain highly skilled employees and offer them a sense of ownership in the company. In fact, as per the National Center for Employee Ownership claimed that the number of workers holding options has grown ten times over the last 30 years.

Let us begin by talking about the various tax rules, starting with the $100k ISO limitation.

What is the $100K ISO limitation?

If you are being offered options, then this is the rule you need to know about. Incentive Stock Options (ISOs), as opposed to Non-Qualified Stock Options (NSOs aka NQSOs), are subject to favorable IRS treatment. The main benefit is that the holder would not have to pay any income tax on the spread between the original exercise strike price and the fair market value (FMV) when exercised. For NSOs, the income tax on the spread is withheld at the point of the exercise.

And even though ISOs have a favorable tax treatment, they are still subjected to the Alternative Minimum Tax (AMT) to prevent people from sheltering all of their income. The $100K limit, also called the $100K ISO limitation, is another IRS rule that is used to prevent the ISO program from being abused as a tax shelter.

This limitation means that the maximum amount of the ISOs an employee can get in a year is $100K. The amount is calculated by taking the FMV of the share at the grant and multiplying it with the number of shares granted. If the grant is subject to vesting such as a 4-year schedule, then the previous product is divided by 4 to determine whether the grant is under the $100K ISO limitation.

If the grant is eligible for early exercise, then you do not divide by 4 since the number of shares is based on the number eligible for exercise that year. This means that the total value of the shares in the year vested has to be equal to or below the value of $100k. Any excess options and subsequent grants above the $100K limit are deemed NSOs and subject to immediate withholding tax at the time of exercise.

What is the 83(b) election?

Another tax rule you need to know about is the 83(b) election. It is a section under the IRC that offers startup founders or employees an option to pay taxes on their total FMV of restricted stock at the time of granting. This election is applied to the equity subject to vesting and it alerts the IRS to tax the elector for the ownership at the time of granting instead of the time of vesting.

With this rule, you can pre-pay your tax on a low valuation before the stocks come completely in your hands. However, if the value of the company declines instead of increasing, this strategy might turn out to be an issue for you. It would mean that you have overpaid your taxes on a much higher equity valuation.

The FMV of the equity upon grant is the value that would be used for assessment of the tax liability. The tax due has to be paid in the year when the stock is being transferred or issued. Nonetheless, there are many cases where the individual gets equity vesting over several years. Employees may earn company shares as they stay with the company for a longer time.

In such a case, the tax on the value of the equity will be due at the time of vesting. If the value of the company increases over the vesting period, the tax paid during each vesting period would also increase accordingly.

Let us take an example to understand this better. A co-founder is offered with 1 million shares subject to vesting and each share has a value of $0.001. At this time, the worth of the shares would be $0.001 x number of shares = $1,000, which is paid by the co-founder.

These shares represent 10% of the ownership of the company and have a vesting period of 5 years. This means that the co-founder will get 200,000 shares every year for five years. And in each of the five years, this person will have to pay tax on the 200,000 shares vested. If the total value of the equity grows to $100,000, then the co-founder’s 10% value increases to $10,000 from $1,000. The person’s tax liability for year 1 will be deducted from ($10,000 – $1,000) x 20% which is in effect, ($100,000 – $10,000) x 10% x 20% = $1,800.

Now, if in year 2, the value of the stock increases to $500,000, the person will pay taxes on ($500,000 – $10,000) x 10% x 20% = $9,800. By the third year, the value goes to $1 million and the tax liability would be ($1 million – $10,000) x 10% x 20% = $19,800. It would continue in the same way if the value keeps increasing. And the taxable income of the co-founder would also increase in the following years. Now, when the co-founder sells all the shares for a profit later on, the profit earned would be subjected to capital gains tax.

What is Form 3921?

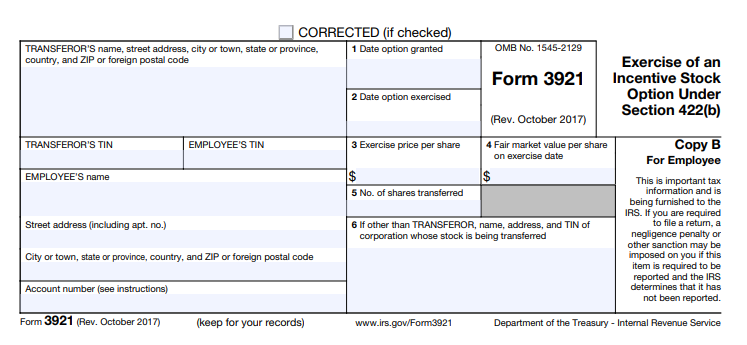

The next thing that you need to know about is form 3921. So, what is it? If the employees in your company (or you as an employee) exercised ISOs last tax year, the company will have to file an IRS form 3921. Companies have to file one form for each employee. And in case the company misses the deadline or ignores the filing, they will have to end up paying a fine for failing to file the form.

To help you, each form 3921 would be in three copies (as in, the company has to make three copies of each form):

- Files copy A with the IRS, either electronically or by mail

- Gives copy B to the employee who exercised options

- Keeps copy C for your company’s records

The deadlines to file are as follows:

- January 31st is the deadline to provide copy B to all employees who exercised ISOs in the previous year.

- February 28th is the deadline to file copy A with the IRS on paper.

- March 31st is the deadline to file copy A with the IRS electronically.

If the deadline falls on a legal holiday or the weekend, the next business day would be considered as the deadline. And if the company doesn’t file the right information by the due date, there would be a penalty to pay. The amount of penalty would depend on when you file the correct form.

Here is the timeframe to help you; if you correctly file:

- Within 30 days after the due date, you’ll pay $50/form (i.e. per employee who exercised an ISO). The max penalty here is $547,000 per year or $191,000 for small businesses.

- More than 30 days after the due date, but by August 1st; in such a case you’ll pay $100/form where the max penalty is $1,641,000 per year or $547,000 for small businesses.

- After August 1st, or if you never correctly file, you’ll pay $270/form where the max penalty is $3,282,500 per year or $1,094,000 for small businesses.

So it is always better to stay ahead of things and file all the needed forms on time. Take help from your attorney on this. Being an employee, ensure your company gives you the form on the date as per the IRS guidelines.

What is AMT? (Alternative minimum tax)

You might have seen the mention of AMT before. Well the alternative minimum tax (AMT) is a tax that ensures that taxpayers pay at least a minimum tax. Basically, the AMT recalculates the income tax of a person after adding certain tax preference items back into the adjusted gross income. The rules used for AMT are different than the normal ones for income tax calculations.

Preferential deductions are added back into the taxpayer’s income to calculate his or her alternative minimum taxable income (AMTI), and then the AMT exemption is subtracted to determine the final taxable figure. The difference between a taxpayer’s AMTI and his AMT exemption is taxed using the relevant rate schedule. This yields the tentative minimum tax (TMT).

If the TMT is higher than the taxpayer’s regular tax liability for the year, they pay the regular tax along with the amount by which the TMT exceeds the regular tax. In other words, the taxpayer pays the full TMT. This AMT was created to prevent the taxpayers from escaping their fair share of tax liability through the tax breaks.

NSO Tax Treatment

From above you know how the ISOs are taxed. With this clear, let us now talk about NSO tax treatments. NSOs have different tax treatments based on if they have “readily ascertainable market value” at the time the NSO is granted. If so, then they are taxed when granted. Otherwise, they are taxed when they exercise the NSOs. NSOs have a readily ascertainable market value only if the stock option is actively traded on an established market, or if the NSO meets all of the following four conditions:

- The employee or contractor can exercise the NSO immediately;

- The employee or contractor can transfer the NSO;

- The NSO is not subjected to restrictions or any condition that would have a significant impact on the market value of the NSO; and

- The market value of the option can be readily determined using rules set forth in the regulations.

NSOs rarely meet these requirements. As a result, it is typical for NSOs to be subject to tax when exercised. The taxable amount of the NSO is the FMV on the grant date, minus the amount paid by the worker to exercise the option. If the NSO does not have a readily ascertainable market value when granted, the spread between the FMV on the exercise date minus the exercise price paid by the worker is added to the worker’s compensation.

Tax Treatment of Compensation Income

The spread between the market value of the NSO and the exercise price is treated as compensation income, as shared above. For employees, this compensation income is added to their wage income. The compensation income is subject to federal and state income taxes, Social Security tax, and Medicare tax. The employer will include this amount on the employee’s Form W-2 for the year and indicate the amount of the spread in Box 12 with code V.

For independent contractors, this compensation income is added to their self-employment income. The compensation income is subject to income and self-employment tax at the federal level, plus any state income tax. The company will include this amount on the contractor’s Form 1099-MISC for the year.

Tax Treatment when Stock is Sold

As mentioned for ISOs, when the NSOs are sold, the profits earned would be subjected to capital gains tax. This tax would be on the difference between the gross proceeds from selling the stock minus the adjusted cost basis. The cost basis of the stock acquired by exercising an NSO is the exercise price plus compensation income (the amount included as income when the NSO vested) plus any brokerage fees and commissions.

In case the stock is held for more than a year from the exercise date, the gain from the sale of the stock will be considered as long-term, subject to lower capital gains tax rates. On the other hand, if the stock is held for less than a year, the gain will be considered as short-term and would be subjected to ordinary tax rates.

Wrap Up

With all the details clear for all the various taxes that you will have to handle, you can now be ready to deal with any tax issues that come your way. Being an employee or even an employer, there are some obligations you have to fulfill for the equity taken or given respectively. To learn more about the onboarding of employees, check out the other knowledge-based articles here!