Private Equity

Private equity as the name suggests is capital investments into private firms.

Equity investment is a dynamic market. Despite the risks involved, when done right it has the potential for massive returns. Be it the investor or the company receiving equity funding, the right strategies prove mutually beneficial for both. In this article, we discuss private equity in detail. We try to understand how private equity works through designated firms, and the advantages and disadvantages involved in this form of funding.

Private Equity

From an investor’s point of view, private equity is nothing short of a gold mine. Compared to investments in the public market that vary with market forces, private equity provides investors the opportunity to take ownership of their investments and multiply the initial funds many times over a brief period. But what exactly is private equity? Let’s explore.

What is private equity (PE)?

Private equity as the name suggests is capital investments into private firms. These firms could be originally private establishments, or publicly traded companies that become private on subscribing to these funds. In the latter case, private equity firms strategically buy out public companies resulting in the delisting of their public equity from stock exchanges.

There are many types of private equity funds. Some fund growing startups while others are intended for an established Corporate. These funds are typically used by companies to acquire new businesses, buy new technology, expand the working capital, and strengthen balance sheets. Besides, the vast business experience of PE investors is a definitive value-add to any company. From an investor’s point of view, private equity presents an opportunity for massive returns within a short period. Data indicates that as of 2019, a massive $3.9 trillion were held in assets by private equity firms. This figure was 12.2% higher than the previous year.

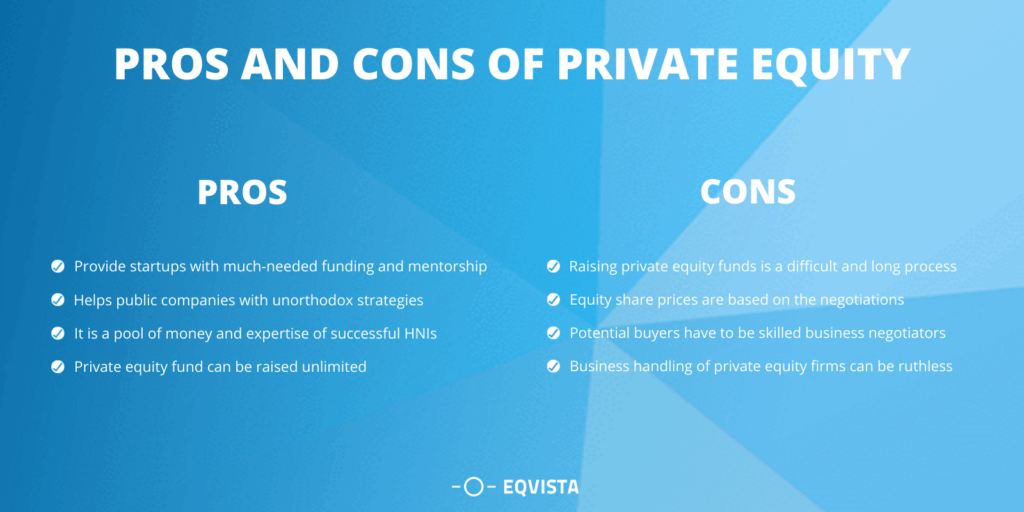

Pros and cons of private equity

Since private equity funds are massive investments, the risk factors are high as well. To avoid failures, PE firms operate on a tight leash and are thus reputed for their ruthless business approach. That being said, it is important to note that PE firms have the machinery to identify strengths in the business structure and take the necessary actions to set in motion the wheels of change. Also, PE firms are accountable to their investors to ensure higher profits. Thus precision is inevitable. Keeping this in mind, let us look at some private equity advantages and disadvantages:

Pros of Private Equity

- Private equity funds in the form of venture capital provide growing startups with much-needed funding and mentorship support. This free reign of expansion might be otherwise difficult with conditional loans from lending institutions. Recurring interest rates become a liability.

- Public companies are always caught up in the grind of reporting periodic earnings. Even if the company needs a breather to catch up with lags, they fail to do so in the ‘public’ structure. An influx of private equity helps them to delist and move away from this cycle and focus on unorthodox strategies needed to boost business.

- A private equity fund is a pool of money and expertise of successful HNIs and business houses. A company at any stage of growth benefits from these inputs.

- There is no limit on how much money can be raised in a private equity fund. Likewise, there is no usage restriction or monthly repayments as well, as long as the business clocks profits.

Cons of Private Equity

- Compared to business loans from lending institutions, raising private equity funds is difficult, time-consuming, and a meticulous process. Investors have to be convinced about the business potential to make huge profits.

- Share prices of public companies are determined by the market. But private equity share prices are based on the negotiations between the buyer and the seller.

- Potential buyers have to be skilled business negotiators to get the best price. Also, the company seller has to choose whom to sell, else their business may lose context.

- Inviting private equity is as good as handing over company ownership during the investment horizon. Since there are no periodic payments involved, founders have high accountability to these investors. Founders must be careful about choosing investors who align with their business and ensure that the majority of shares remains with them.

- Business handling of private equity firms can be ruthless. In some cases, if the investors deem fit, they might come together to replace the management team, or sell their shares to another investor before quitting the business. This becomes a dangerous proposition if the incoming team is not in sync with the business vision. At this point, to buyback investor shares also become difficult and expensive.

With this fair idea about private equity advantages and disadvantages, let us explore how the concept of private equity works for businesses? What is the idea behind these alternate classes of investments? Why do investors prefer private equity over traditional investments?

How Private Equity Works?

Private equity operates on the basic strategy of ‘buy-sell’. Over the years investors realized that compared to traditional investment methods that are dependent on fluctuations in the market, irrespective of the business potential, quick profits could be made by investing in private businesses over a short period. Private equity firms gauge business proposals and choose the one with the highest profit potential.

- Deal origination – Not all business proposals promise profit. To identify the right profit potential in a merger and acquisition (M&A) is what determines the success of a private equity firm. It is now a common practice for PE firms to hire a talented team specializing in sourcing profitable deals. Since M&A markets are highly competitive, to enter the game early, before a business goes into auction, gives a competitive edge to the PE firm.

- Due diligence – When buyers and sellers mutually agree on a proposal, the next step is to verify all documents for authenticity. Private equity firms engage a whole team of consultants ranging from bankers, accountants, lawyers, market researchers, and financial analysts to assess, evaluate, and verify the acquiring company.

- Management – Once the private equity firm is onboard, apart from actively participating in the key decision-making processes, they take on a larger role of mentoring the management for best practices in strategic planning and financial management. Also, since the management’s compensation packages include equity components as well, their contribution to the business directly ties with the profit margins. This keeps the management motivated to deliver their best. Investors gain from this integrated approach and together they take the business to new heights.

- Exit – The exit point of a private equity firm is usually set in the initial stages while deciding the investment horizon. It is typically between 2 to 7 years max. Though the time is set closer to the exit, several considerations are accounted for – such as the exit routes, preparedness of the management, potential buyers, etc. There are three types of exit strategies:

- Wholesale exit – This involves selling the whole business to another buyer, leverage buyout by another private equity firm, or repurchase of the investor shares.

- Partial exit – This involves inviting another private investor to buy a portion of the shares, or a management restructuring where external investors buy a considerable portion of shares.

- Floatation or an IPO – This exit strategy is a hybrid of the previous two. Usually, only a fraction of the business is sold in an IPO. When a maximum of 50% of the business is listed on the open stock exchange, private equity firms gradually start wrapping their operations and exit the firm.

Private Equity Firms

Since private equity funds are quite massive, they seldom operate alone. These funds are pooled together in private equity firms that have a structure in place to turn these investments into massive profits over a short period. Now that we have an idea of how private equity works, let’s explore the structure of a private equity firm.

What is a private equity firm?

A private equity firm comprises money from institutional funds and accredited HNIs. These funds are raised and managed by a team of investment professionals who take responsibility for positive ROIs from these funds. A private equity firm primarily earns from the asset management fee (in the range of 20% of the profits gained from the sale of a company) and a performance fee (usually about 2%).

The structure of a private equity firm has two categories of investment partners. The first one is the Limited Partners (LP), who have limited liability and own 99% of the shares in a fund. The second one is the General Partners (GP), who is responsible for sourcing, operating, and executing the investments and owns only 1% of the shares. But it is the General Partners who have the full liability of the assets. All investors of private equity however have one aspect in common – the willingness to contribute large sums and holding it for a long period. Some firms may even insist on an entry cap of $250K.

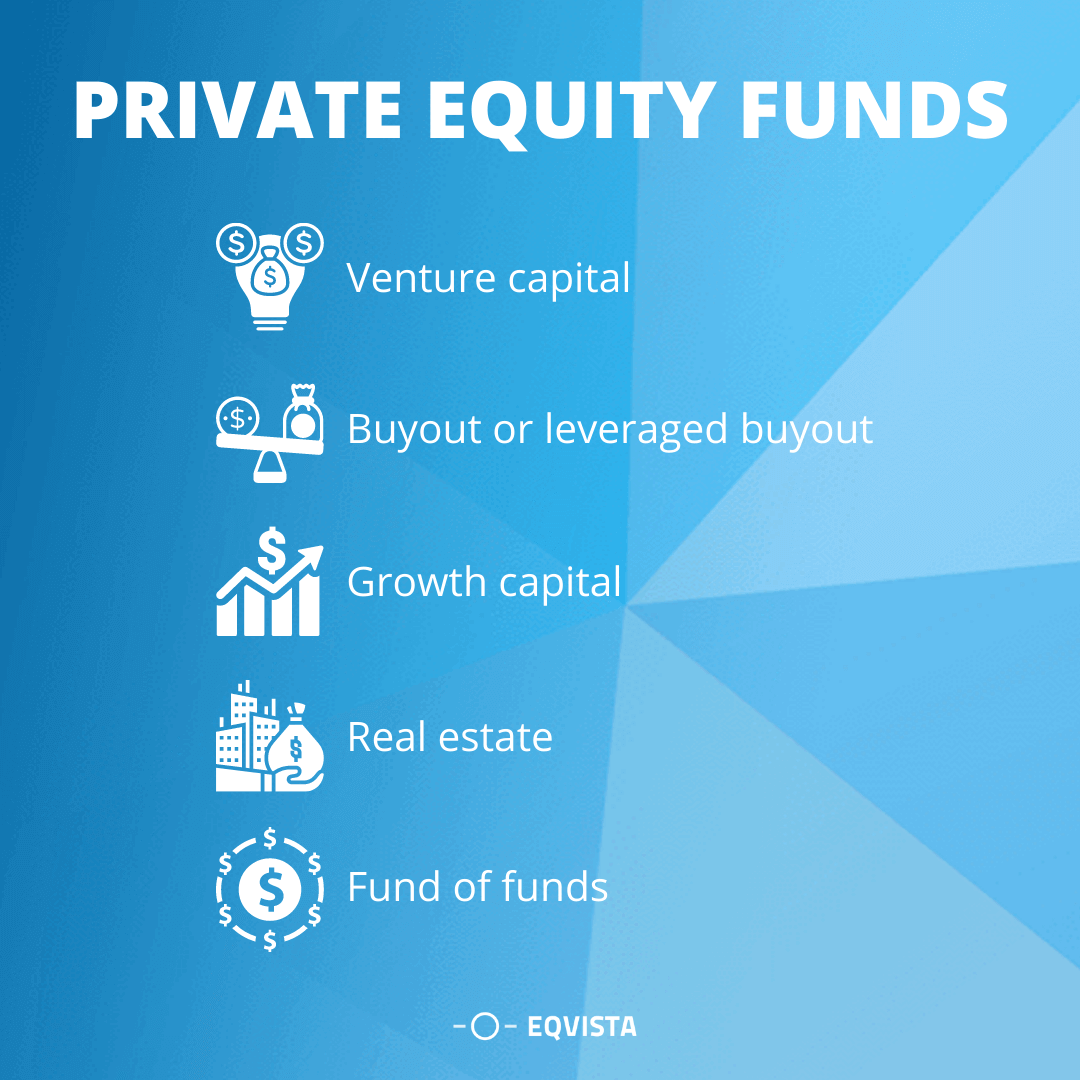

Private equity funds

Based on the size of funds and the extent of business restructuring, private equity firms vary in their approach. Over the years, private equity business has evolved with an entrepreneur-friendly approach where the goal is not just to make quick profits, but to help deserving businesses to grow and thrive. Here are some popular private equity funding models:

- Venture capital – This is a specific format of private equity fund designed to support growing startups. Since this fund is targeted towards the early stages of a business, the stakes are quite high. On the flip side, if everything pans out as planned, the returns are massive. Based on the stage of business, the size of venture capital varies. They normally enter in the Series A round. If the business idea is exceptional, they are known to enter early as micro VC funds, right at the seed stage as well. Venture capital funds range from anywhere between $2 million to tens of millions.

- Buyout or leveraged buyout – A company opts for a leveraged buyout (LBO) when it needs funds to acquire another company. Usually, the firm initiating the LBO pays the least cash as the private equity firm covers 90% of the buyout. However, this fund is lent to the company as a loan in the form of bonds against the company assets as the collateral. The idea is that the returns from the new acquisition will outweigh the interest amounts to be paid against the loan. If the financial forecasts are done right, LBO can be a profitable option to increase returns with a minimum cash investment.

- Growth capital – This type of private equity fund is used by mature businesses to expand, enter new markets, or fund massive acquisitions. Compared to an LBO, the fund requirement is comparatively small as these companies have an established business model. But they do not have a surplus to fund expansion plans. Hence the need for private equity.

- Real estate – This is private equity solely focused on investing in real estate. There are four strategies in this approach – Core (low risk, low return), Core plus (moderate risk, moderate return), Value added (medium to high risk, medium to high returns), Opportunistic (high risk, high return). This range of strategies enables appropriate funding in the real estate sector enabling the growth of assets that have a predictable cash flow to the one that needs substantial funding to purchase land, mortgage notes, etc.

- Fund of funds – Investing solely in one particular funding mechanism increases risk. Fund of funds is a form of private equity that helps diversify these risks. Investors contribute funds to different types of funds, instead of direct investments in one particular equity firm.

Manage Your Company Equity Operations on Eqvista

Irrespective of the stage in a company’s growth curve, equity management is a crucial and integral part of running a business. Eqvista is one of the advanced equity management software in the market that enables you to issue, manage, and track your company equity with ease. Also, our team of experts works along with your business needs to ensure smooth operations. Here are some resources that will help you understand the services we provide. To discuss more, reach us today.

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!