How to reflect ESOP for different funding stages in the Cap Table?

ESOPs (Employee Stock Option Plans) have become popular as a startup solution. Including an ESOP in an employee’s compensation package is now a well-known and appealing incentive; it is a win-win situation for startups and their required quality employees. However, it is essential to keep things in perspective because there may be negative consequences for the startup and its chosen employees if not issued with care. This article focuses on employee stock option plans, startup funding stages, ESOP distribution on different funding stages, ownership dilution, ESOP dilution math, ESOP and startup funding stages & more.

Understand startup funding

You have passed stage one if you have an out-of-the-box idea and the determination to succeed. But is that sufficient? As an entrepreneur, you want your business to grow, so you need funding for your startup.

Apple, Amazon, and Google were all once startups. Their business expanded as a result of the funding. For many years, the startup industry will be the driving force behind global innovation and business growth. However, to grow their business, entrepreneurs must learn how to switch to new trends & be more efficient quickly.

Converting an idea into a product or service takes significant time, money, effort, and skill. During the development phase, you would need a solid foundation of resources and expertise as an entrepreneur. If your startup receives funding, you can hire specialists, invest in production costs, and keep operations running.

Benefits of Startup Funding

For swifter operations and avoidance of financial restrictions, start-up funding becomes extremely important in the initial period to give life to the product/service idea; here’s how the funding benefits a startup:

- Funding boosts credibility – When you find investors for a startup & they believe in your idea & are willing to put their money into your startup, your market credibility hits the sky.

- It becomes easier to hire more Employees – Once the cost is not an issue, one can hire more skilled experts in their start-up. More the skill set, the merrier.

- Helps in the investigation of referrals – It’s said that “word of mouth” is one of the most effective marketing tools, & Good investor relationships may result in you receiving referrals from their network. They expose you to the world of the external market. One can find potential customers, clients, talent, and advisors for your company in this manner.

- Following the rules – There is no denying that investors expect you to follow the rules of the law. Hence, your company will be less vulnerable to risks, ensuring business compliance.

- Managing Variable and Fixed Expenses – As a startup founder, you must determine your company’s fixed and variable costs & plan as per that. Funding the business ideas helps in dealing with the expected future expenses.

What is ESOP?

In a nutshell, an ESOP is a type of employee benefit plan. It is intended to provide employees with a unique company ownership interest in the form of allocated stock shares. ESOPs, among other things, give the employees an additional incentive to ensure the company’s success. It also encourages them to implement the most beneficial working practices for shareholders as employees own company stock.

Benefits of having ESOP

If there was ever a case for risk/reward, ESOPs fit the bill perfectly. This article will focus on new business ventures and their permanent employees, typically designed for rapid growth. However, startups can use ESOP leverage to attract other key industry movers and shakers. This relates to obtaining services and advice from highly experienced and successful professionals, generally out of a startup’s financial reach. Advisors, consultants, and internet influencers are some examples.

How does an ESOP work in a cap table?

The ESOP sheet is where all of your employees’ shares are recorded. And to simplify, you should be aware of two types of options:

- ISO/NSO – These are options in American parlance. It makes no difference which country you are in. You can change the names in the Format sheet to whatever you want but don’t change the “RS” name because the model looks for it, and the formulas will complain. These are your standard share options, which you will give to employees.

- Restricted stock – Restricted Stocks are issued from the ESOP pool, so you must deduct them from this sheet and add them to the common street. The simplest way to contemplate this is to look at the double entry in the ESOP sheet and the common sheet and the adjustments and comments made.

Why should companies maintain a cap table for employees and investors?

A Cap table, also known as the capitalization Table, helps better understand the company’s various stakeholders, including its employees, investors, founders, etc.

Following are the reasons why companies should maintain a cap table:

- Financing for Investors – When you pitch it, investors will want to see how your company’s ownership structure is structured. They will want to know the current shareholding composition, previous financing rounds, and the impact of their investment on the shareholding. The cap table will show them where they stand regarding shares and how much they need to invest in improving their position.

- Management of the total shareholders – A Cap table is ideal for managing your company’s shareholders, how many shares they own, and what percentage of the company they own. You will also see the vesting schedule, telling you when more shares will be distributed to your shareholders.

- Legal Document List – The cap table tracks the number of shares and the legal document associated with each transaction. This is useful for keeping track of important legal documents and determining which legal form has been recorded.

- Important Dates and Future Planning – The cap table lists the company’s current shareholders and investors and informs you of key dates on which your options, warrants & convertible bonds can be converted into shares of your company. This could significantly impact your future staffing decisions and business plans.

- Marketing the Company – When the company plans on selling the business, the shareholders will divide the proceeds. The cap table would summarize how much each shareholder would receive and be shown to each shareholder in the event of distribution disagreements.

ESOP in cap table at different funding stages

Undoubtedly, current trends and projections position ESOPs as essential to a solid business plan.

Having said that, any startup intending to go through the ESOP process must begin implementation far sooner than they may think. Other critical factors that startup entrepreneurs must carefully consider include the following:

- Initial funding is anticipated.

- Where additional funding may be obtained.

- Their financial objectives

- A time frame for succession.

- Employees’ ownership stake

Any startup that wants to get their fledgling business off to a good start must first understand the 360-degree requirements of ESOPs.

Understand the ownership dilution

It means you now have a lower relative ownership stake in your startup than you did previously because you have given some ownership to someone else. So if you sell for $100 million, you don’t get the entire $100 million because others want a cut. After all, they own a share. Every time there is a dilutive event, everyone who was previously on your cap table is diluted equally unless they have special rights and something bad happens (like a down round where there are full ratchet anti-dilution).

The earlier someone joins/invests in a company, the more diluted they become because they are diluted at every event. As the company’s founders and first owners, you will bear the most dilution.

What should a cap table include to reflect ESOP?

Your Investor will be pleased with a well-represented ESOP pool in the Cap Table. When investors invest in your company, they want to ensure that their money isn’t being used for anything other than future funding rounds.

- Vesting – The time span till which the employee must work before receiving a benefit is referred to as vesting. As a result, vesting is the process by which an employee becomes eligible to exercise his or her stock options and become a shareholder in the company.

- Vesting period – The time between the grant date & the date on which all of the ESOP grant’s specified vesting conditions are met.

- Grant date – The date on which ESOPs are distributed to employees.

- Exercise period – After vesting, the employee can purchase company stock. However, the employee has a limited time to buy those shares. This is known as the exercise period.

How does ESOP dilution in a cap table work at different funding stages?

The best way to think of ownership is in terms of shares rather than a high-level percentage. If you start with 100 shares and give away 10%, the total ownership must still be the meaty pie’ and add up to 100%. That 10% is added to the pie as a new filler to make it bigger. Something has to give, which means you, the founder, must be ‘diluted.’ This is accomplished by increasing the number of shares.

If you own 100 shares, your ownership ratio is 100/100 (yours/total). If you give away 10% of your stock, you gain approximately 11 shares. So your stake is now 100/111, or 90%.

As a result, we can see that giving shares to people isn’t free of cost. It also becomes essential to understand that nor are the ESOPs free.

Following are the different stages of funding; let us understand how ESOP delusion happens in a Cap table at these stages:

First hires

It starts here. You start a company and own 100% of the common stock. The entire pie.

Next, you’ll need to add some great engineers to your team to achieve product/market fit and be able to do your seed round. Typically, you will give these early, bright-eyed employees 5-10% of your company. This can be done with options but often with “founder stock”.

If you own 90% of the company and your new engineers own 10%, we will use 10% for dilution.

Seed round

Great work by the team, and now it’s time to raise the seed round. You give yourself six months to complete the round, but it only takes four. You locate and select a suitable seed stage fund. How does mathematics work? So you multiply your previous holding by the investors’ ownership position. So 90% times 90% equals 81%, and 90% times 10% equals 9% for staff. Isn’t it simple?

Series A

Fab. The seed assisted you in scaling up, and now it’s time to add fuel to the fire. It’s time for the legendary Series A. Things are improving, and you’ve defied the odds to arrive here. You had an 18-month runway with your seed, and you planned to start raising after 12 months to get a full year of execution and 6 months to complete the next round.

Your seed investors refer you to Blue Shirt Capital, which specializes in Series A and beyond. They are fond of you. Negotiate for 20% company ownership and demand a 20% ESOP post-raise. You present them with your hiring strategy and negotiate with them. They are now requiring a 10% ESOP.

The ESOP value is deducted from the “pre-money valuation” which means that the dilution from the option pool is deducted before the VC investment. Your effective pre-money valuation is lower than you anticipated, but you need the cash. Before we get into the Series A math, let’s look at what needs to happen with the first ESOP you’ll have to create.

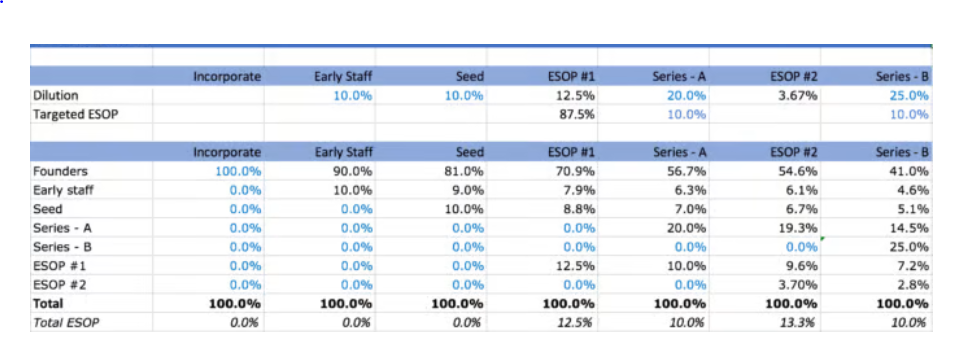

Post series A – ESOP #1

Series A dilution is 20%, while ESOP dilution is 10%. So you divide 20% by 1 and subtract the ESOP required. This brings the total to 12.5% pre-investment amount.

That 12.5% is then diluted proportionally across all shareholders, and another 12.5% is added to the ESOP line. Everything adds up to 100%. So, before the raise but after the ESOP, the founders own 70.9% (81% times 87.5%, which is 1 less the 12.5%), the engineers own 7.9%, and the seed owns 8.8%.

Except for Blue Shirt, who are just getting on your cap table, everyone gets diluted 20% when the Series A investment closes.

The founders now own 56.7% (70.9% times 80%, which is one less than 20%), the engineers own 6.3%, the seed investors own 7%, Blue Shirt owns 20%, and there is a 10% post-raise ESOP. This all adds up to 100% once more.

Series B

You made it to Series B’s promised land, so you must be doing something right! Blue Shirt introduces you to Khaki Co, who decides to do the whole deal for 25% and requires you to contribute to the ESOP pool to keep it at 10%.

Here’s a visual example of the ESOP Dilution Model:

Image source: Inc42

Why choose Eqvista to manage your ESOP?

A simplistic and user-friendly cap table is essential for ESOP administration. Use Eqvista instead of standard Excel sheets when employing Cap tables. The ESOP management software from Eqvista is accessible to all users and offers efficient database administration and analytical features helpful in managing data, making decisions, and other duties. The Eqvista cap tables provide all the data necessary to track your company’s ESOP and individual employee information. To find out more, call us right now.